Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Portfolio Corner - 🗓️ Monthly Updates (Last Update: 8-Oct-2025)

Expanse Stocks x Finchat.io Partnership!

🎁 Get 20% off + 2 months free on any Finchat plan! →📎 Claim Discount

Welcome Explorer!

This is the seventh edition of Deep Dive Briefs, where I break down growth and high-quality businesses.

This time, I’m diving into:

If you’ve been following Expanse Stocks for a while, you’ll know I’ve written plenty about this company, one of my 📎 bonus picks for 2025, 📎 ASML Investor Day 2024 or 📎 ASML’s earnings digests —but until now, I hadn’t done a full deep dive. With markets in turmoil and ASML popping up in every investor’s “shenanigans book” over the past few years, I figured it was the perfect time to spotlight this incredible Dutch innovator once again.

Let’s rewind to ASML’s origins and explore how a long-standing culture of ingenuity, perseverance, and world-changing innovation helped build the company we see today. We’ll also break down the business model, its biggest growth drivers, and perform a complete fundamental analysis of the company including DCF and Reversed DCF proprietary models and Capital Efficiency Models (with ROIC, ROIIC and ROCE).

Topics I’ll Cover

🔹 Company’s History & Curiosities

🔹 Business Model & Product Ecoystem

🔹 Economic Moat & Growth Drivers

🔹 Capital Allocation

🔹 Risks & Competitors

🔹 Fundamentals + Technical Analysis

🔹 Earnings Growth Model – A quick mental framework to estimate ASML’s returns

🔐 For Paid Subscribers:

🔹 Traditional DCF Model – Intrinsic value & implied share price

🔹 Reverse-Engineered DCF – Expected returns using my proprietary models

🔹 Capital Efficiency - ROIC, ROCE and ROIIC and What’s to be expected

🔹 Final Thoughts – My stance on ASML as a long-term investment

Let’s dive in!

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO | 🧙♂️ CSU Part #1, Part #2, Part #3 | 🤖 Intuitive

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy, Industry Write-ups & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

🔐 Paid Subscriber Exclusives

💼 Portfolio Corner – Holdings, valuation models, trades, performance & more!

🤫 Exclusive Sections – From select articles, Deep Dive Briefs & Hidden Gems

👀 Recent Releases!

👀 Coming Soon

✨ The Rareness of Moaty Industrials: A Selection of 6 Gems

💎 Hidden Gem: Special Edition III

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 8-Oct-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles

Company Overview

From Shed to Technological Superpower

ASML’s story begins in Veldhoven, a modest Dutch town nestled near Eindhoven, where Philips helped create a thriving hub of industrial innovation. Founded in 1984 as a joint venture between Philips and ASM International, ASML was initially a division viewed with skepticism. The company had no profit, little respect, and barely any viable product. It inherited underwhelming technology and was housed in a leaky shed, more a hopeful experiment than a real contender in the semiconductor equipment world.

The first lithography system it launched, the PAS 2000 wafer stepper, was an inherited relic from Philips, powered by oil hydraulics—an immediate red flag in the chip industry, where contamination is catastrophic. Sales flopped, morale plummeted, and ASML appeared destined for the scrapyard.

But then came a streak of luck.. and resilience.

Turning Point: The TSMC Fire

In 1987, the new-born TSMC placed a crucial order with an equally young ASML. Then disaster struck—a fire destroyed the newly delivered machines. For most startups, that could’ve been the end of the road. But fate had other plans: insurance covered the damage, TSMC doubled down on its order, and ASML got a second chance. That moment not only saved the company—it gave ASML its first meaningful customer and a much-needed foothold in the semiconductor world.

The PAS 5500 Breakthrough

In the early 1990s, ASML introduced the PAS 5500 stepper, designed by a young and relatively unknown engineer: Martin van den Brink. It marked the first real commercial breakthrough. Fast-forward to today, and some PAS 5500s are still in use after more than 30 years. This machine, humble as it may seem, laid the foundation for a lithography empire.

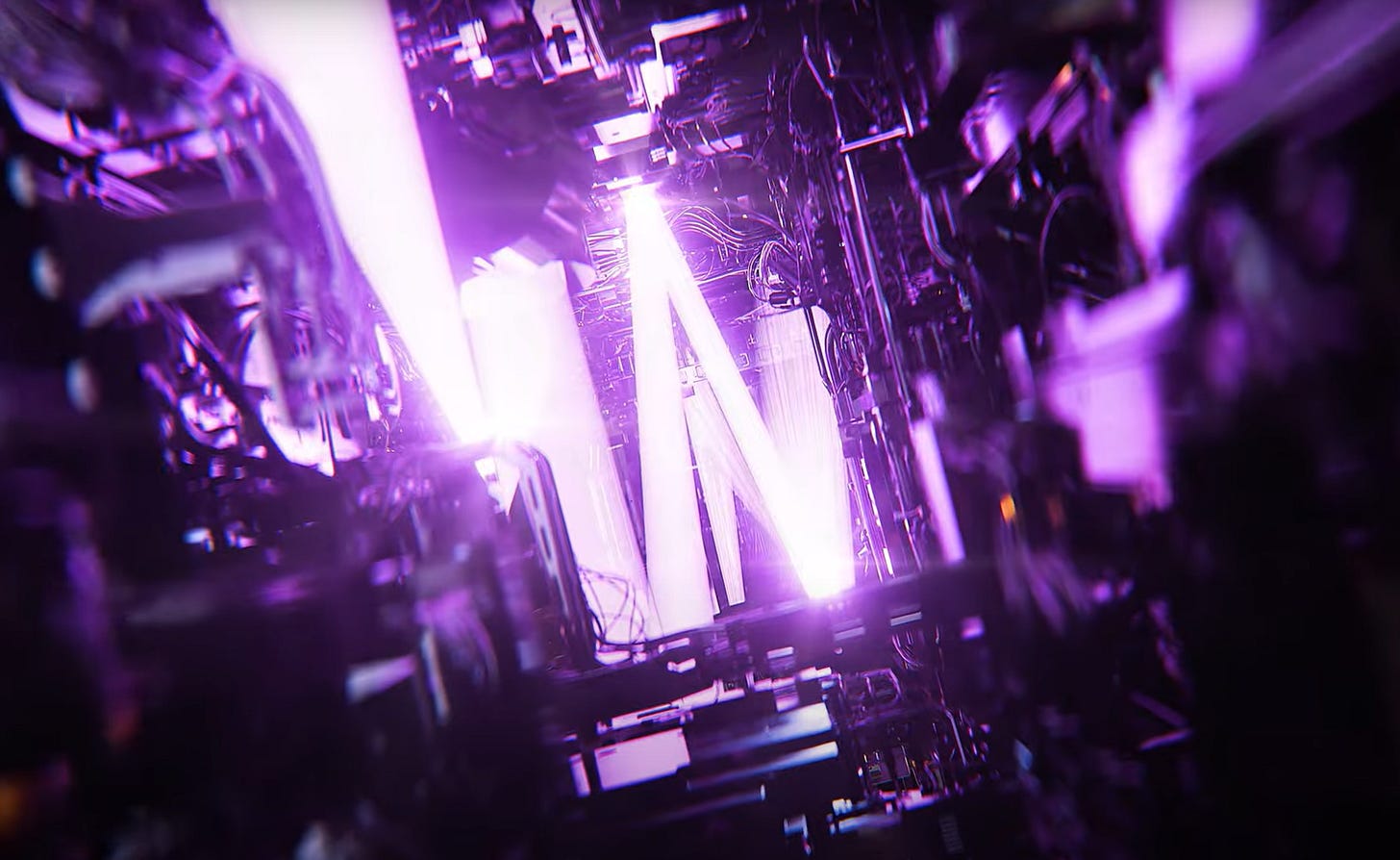

The EUV Revolution

By the mid-1990s, it was clear that existing photolithography technology—then based on deep ultraviolet (DUV)—would eventually hit physical limits. If Moore’s Law was to continue, chips would need to shrink beyond what DUV could manage. This led to the development of extreme ultraviolet (EUV), a concept that sounded more like science fiction than practical engineering.

The process involved blasting tin droplets 50,000 times per second with a laser to create plasma hotter than the surface of the Sun. And that’s the easy part. EUV light has to be bounced off hyper-flat mirrors—some of the flattest surfaces ever made by humans—before it can etch microscopic patterns on silicon wafers.

Despite the sheer absurdity of the task, ASML pressed on.

In 2001, ASML acquired Silicon Valley Group (SVG), gaining critical IP and engineering talent. In 2012, TSMC, Intel, and Samsung collectively invested €1.4 billion in ASML to fund final R&D on EUV. In 2019, EUV finally entered commercial use—nearly 40 years after the theoretical groundwork was first laid.

The Architects of ASML’s revolution

Two names are etched into ASML’s incredible rise: Peter Wennink and Martin van den Brink.

Wennink, a former Deloitte accountant, first crossed paths with ASML during its IPO in the mid-90s. He was so impressed that he jumped ship and joined as CFO in 1999, later stepping into the CEO role in 2013. Known for his steady hand and sharp financial mind, he steered ASML through industry booms and busts, geopolitical turbulence, and game-changing acquisitions.

Martin van den Brink, the designer of the game-changer PAS 5500 stepper and ASML’s former CTO and President, joined the company at its founding. A tireless innovator and arguably one of the most influential engineers in semiconductor history, he led product development for decades. He was instrumental in pushing EUV across the finish line and retired in 2024 after four decades of leadership.

In 2024, both men stepped down, marking the end of an era. Their successor, Christophe Fouquet, has been with the company for 17 years since 2008. Fouquet’s seen as a strong internal candidate, having led both product and customer operations in the past and is expected to continue their legacy of excellence and pragmatism.

Culture: Innovation, Collaboration and Transparency

ASML’s internal culture is unlike most industrial giants. Engineers are encouraged to file patents in their own names—a rare gesture that fosters both pride and innovation. Top contributors are immortalized every year, literally: their faces are etched into a silicon wafer and displayed at HQ.

In an industry often cloaked in secrecy, ASML champions transparency, collaboration, and long-term thinking. Employees are not just cogs—they’re architects in one of the most sophisticated engineering efforts in human history.

Learnings, Facts & Curiosities

Here are some impressive facts about ASML that reveal just how unique this company really is.

As you’ll notice, at the end of some bullet points below, I’ve included links to ASML’s official learning hub—one of the best (and most underrated) resources out there for diving into the fascinating world of semiconductor technology.

🔹 Name Origins

Contrary to popular belief, ASML is no longer an acronym. It once stood for Advanced Semiconductor Materials Lithography, a nod to its founding by Philips and ASM International. Today, it’s just ASML—an iconic brand on its own.

🔹 Global Footprint

While its roots are Dutch, ASML is truly global. With more than 60 locations across 16 countries, the company operates R&D, manufacturing, and support centers in Europe, Asia, and North America.

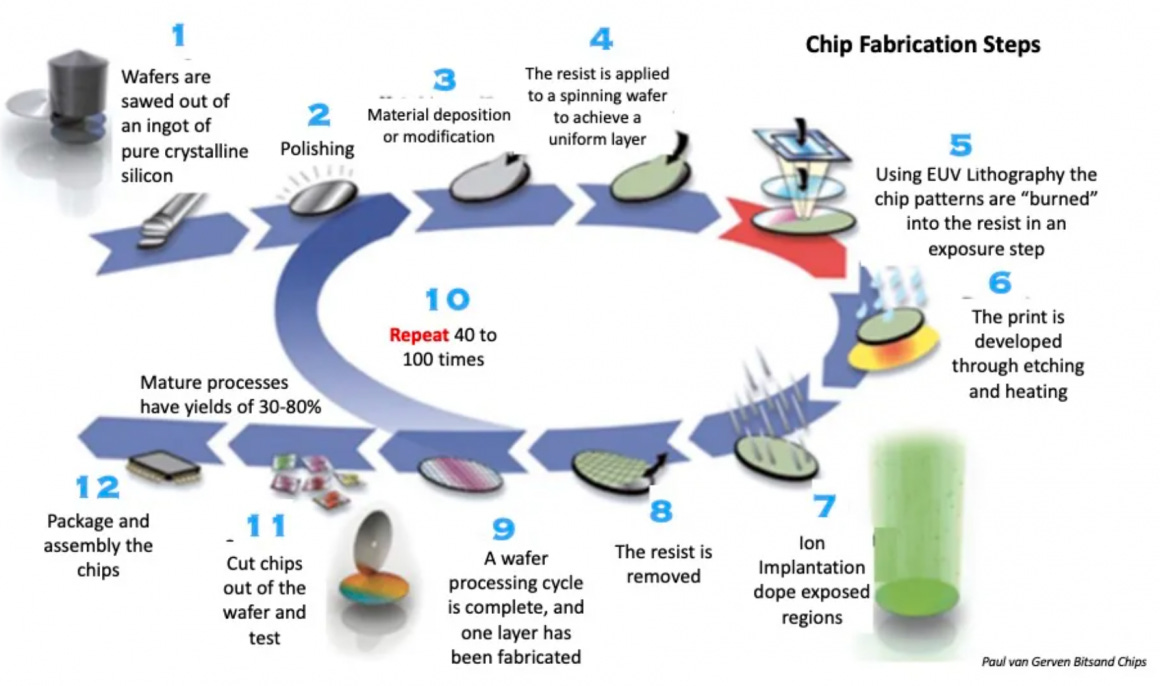

🔹 Not a Chipmaker

Despite powering the chip industry, ASML doesn’t make chips or wafers. Instead, it builds the lithography systems used by companies like Intel, Samsung, and TSMC to etch circuits onto silicon.📎 Link: Learn how microchips are made

🔹 Gigantic Machines, Gigantic Shipments

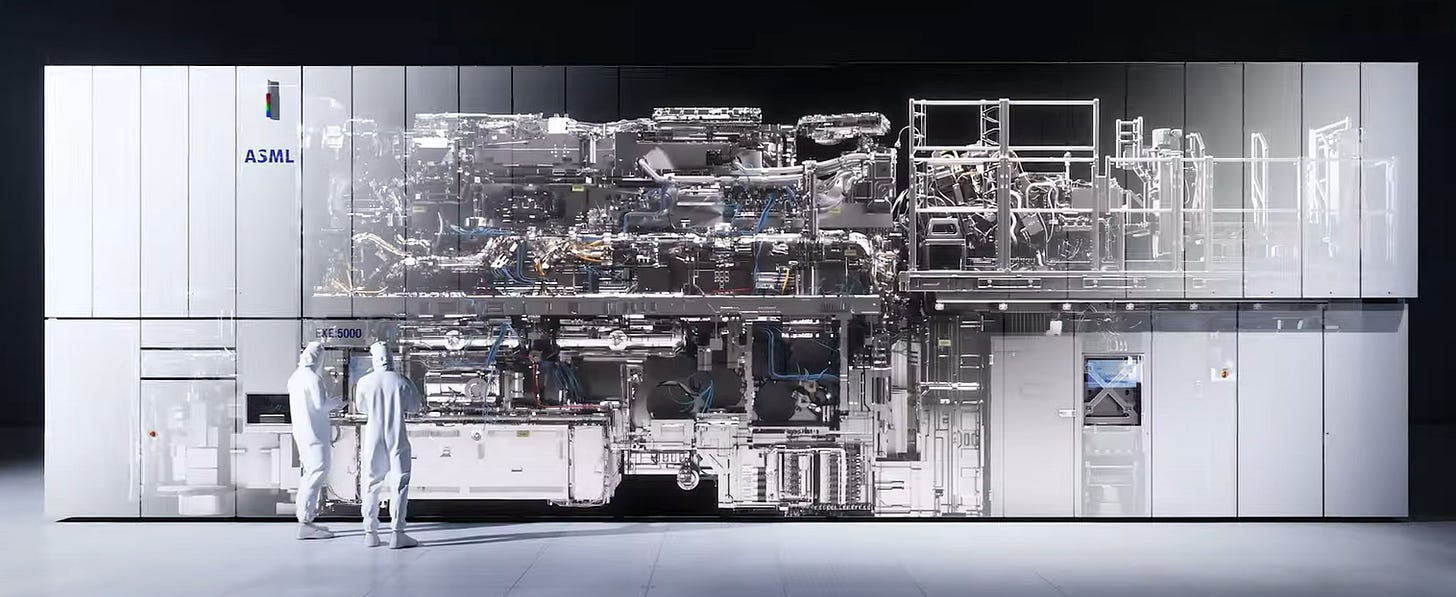

Each EUV machine is so large and sensitive it requires:

40 freight containers

3 cargo planes

20 trucks

And careful handling to prevent temperature shifts during transit.

📎 Link: Learn about our EUV lithography systems

🔹 True Engineering Marvels

The optics in ASML’s EUV machines are made by 📎 Zeiss SMT and include mirrors that reflect light 40 times with perfect precision. These mirrors are considered the flattest surfaces ever created by humans—some with variations of less than a few atoms.📎 Link: Learn how EUV light is created

🔹 Despite its technological prowess, ASML alone can’t make a microchip.

Chips are born from a long, complex, and capital-intensive process. Sure, ASML’s lithography systems play a crucial role—printing the nanoscale patterns that define chip circuits—but they’re just one piece of the puzzle. Chipmakers invest billions into building fabs, buying a range of specialized equipment, and training talent to master the intricate world of semiconductor manufacturing. ASML’s tech is essential—but it’s part of a highly orchestrated symphony.📎 Link: Read about the main steps in semiconductor manufacturing

🔹 Long-Term Thinking in Action

Some companies think in quarters, ASML thinks in decades. Their EUV technology took 20+ years to commercialize. Their High-NA platform is expected to run well into the 2030s.

Business Model & Product Ecosystem

ASML does not manufacture chips. It builds the machines that enable companies like TSMC, Samsung, and Intel to create the world's most advanced semiconductors. Lithography—the process of printing nanometer-scale patterns on silicon wafers—is its domain.

Deep and Extreme Ultraviolet Lithography

ASML’s systems come in two major categories: Deep Ultraviolet (DUV), the workhorse of the industry, and Extreme Ultraviolet (EUV), the cutting-edge technology needed for advanced chips:

DUV remains profitable and is widely used for mature nodes— i.e. manufacturing processes using older technologies, typically 28 nm or larger.

While EUV machines are essential for "cutting-edge" or advanced nodes— i.e. chip manufacturing processes with transistor sizes below 5nm, with 10nm and 7nm nodes also considered highly advanced — making the smallest, most powerful chips in smartphones, AI processors, and data centers. ASML is the only company in the world capable of producing EUV machines, giving it a monopoly on one of the most vital processes in chipmaking.

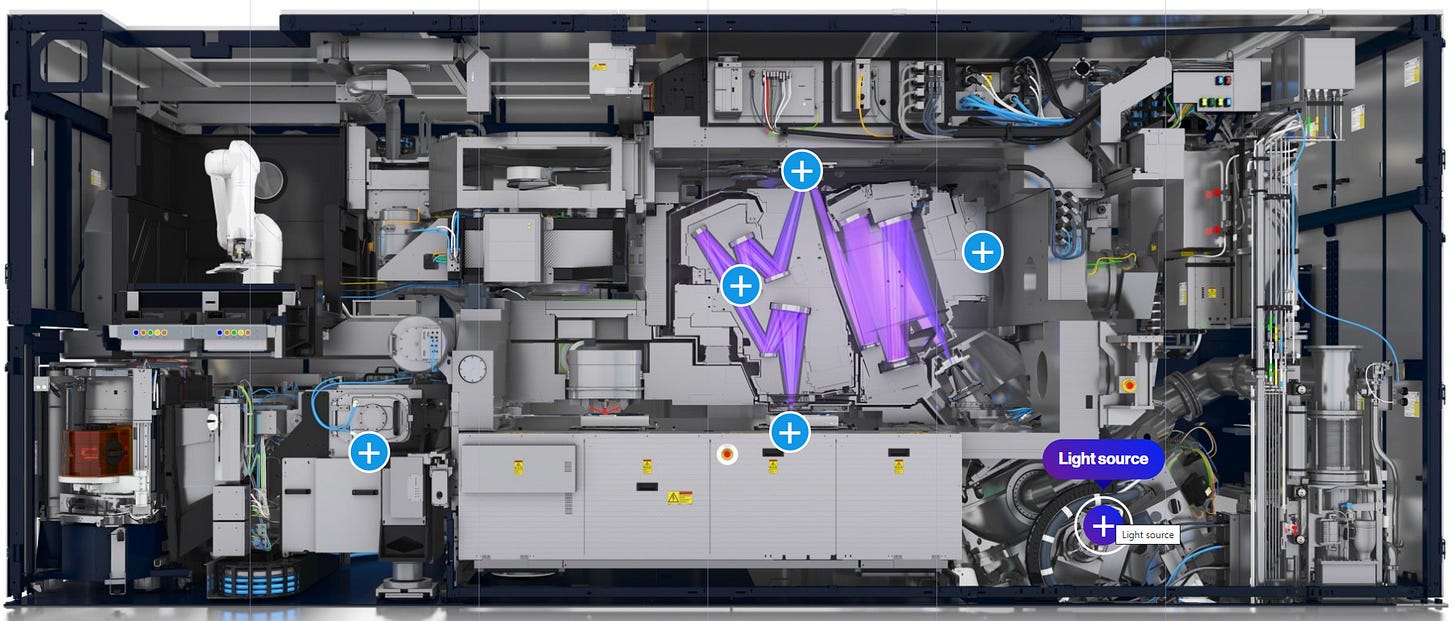

Each EUV system contains more than 700,000 components and requires around 40 containers and several aircraft to transport. They cost up to $350 million and are often considered the most complex machines ever built.

I highly recommend to go through this interactive 2D model of the insides of an EUV system, shared by ASML on their website (link’s below).

Holistic Lithography & Services

ASML's approach extends beyond selling machines. Its Holistic Lithography strategy integrates metrology, inspection tools, and software, such as YieldStar and Brion tools, to optimize the chip production process. This creates long-term value and recurring service revenue:

Equipment Sales (75% of revenue): Each machine can cost between €150–350 million.

Recurring Revenue (25%): Comes from upgrades, maintenance, and software updates—that extend the life of its machines. Their systems last decades—some dating back 30 years are still operational and generating revenue.

This model creates a razor-and-blade effect: once a customer installs a lithography system, they become embedded with ASML through service agreements and upgrade cycles.

Economic Moat

ASML holds a moat built on four key pillars:

Technological Monopoly

Holding over 90% of the global lithography market, it’s the only company capable of mass-producing EUV systems. Rivals like Nikon, Canon, or China’s SMIC and Huawei haven’t cracked the EUV code—and likely never will get close to ASML technological standards. Catching up would take not just tens of billions in R&D, but decades of compounded expertise. The moat here isn’t just wide, it’s generational.

Intangible Assets

Over the years, ASML has built strategic relationships with key players like Zeiss SMT, which supplies the optics (mirrors flatter than anything else ever made), and chips manufacturers: TSMC, Intel, and Samsung, who invested have invested billions of dollars in ASML over the last decade. Decades of R&D, partnerships— as critical as the hardware itself— and a complex intricate ecosystem that would take decades to replicate.

Switching Costs

Once installed, ASML machines are nearly impossible to replace. Fabs are optimized around them. Switching would cost billions and halt production for months. And it’s not just the equipment—ASML embeds its service staff inside customer sites, ensuring uptime and long-term loyalty.

Cost Advantages

ASML modular, outsourced supply chain is both scalable and flexible, while competitors like Nikon and Canon are generations behind in R&D intensity.

ASML’s machines are indispensable. They are the bottleneck of the semiconductor fabs. Any downtime is costly, which is why customers prefer to stick with ASML for the long haul. In short, if you want to manufacture cutting-edge chips, ASML is not just the best option—it’s the only option.

Growth Drivers

High-NA EUV Machines

ASML is preparing to launch its next-generation EUV tools with a 0.55 numerical aperture, an increase from the 0.33 NA of previous systems. These machines are expected to enter high-volume production by 2025–2026 with Intel first in line— although this is yet to be confirmed given the “existential crisis” the American chip manufacturer is going through. These €350M systems will allow even greater transistor density, finer resolution and performance at better economics for chipmakers.

Installed Base Management

With over 90% of machines still operational, ASML can continue to earn from services, upgrades, and software enhancements—especially on its increasingly complex EUV machines.

Demand from AI, HPC, and IoT

The surge in demand for AI chips, high-performance computing, and edge devices means more fabs will need ASML equipment. Each new chip generation requires finer lithography. The next generation of AI chips from NVIDIA, AMD, and others will demand ever-smaller transistors—only possible with EUV and soon, High-NA EUV.

Demand for chips in EVs, industrial systems, and edge devices is also driving long-term volume needs which represent another tailwind for ASML.

Global Fab Expansion

With governments investing billions into domestic semiconductor production (e.g., CHIPS Act in the U.S., and European Chips Act), ASML is set to benefit from a broader base of fab customers beyond Asia.

Capital Allocation

ASML has been a disciplined allocator of capital:

Investments: The 2012 sale of a 23% stake to customers (TSMC, Samsung, Intel) helped fund EUV development. Acquisitions like Cymer (EUV light sources) and Hermes Microvision (e-beam tools) bolstered its strategic position.

Cash Flow Powerhouse: Operating margins exceed 30%, and service revenue is set to rise with more complex machines, boosting their margins and cash flows.

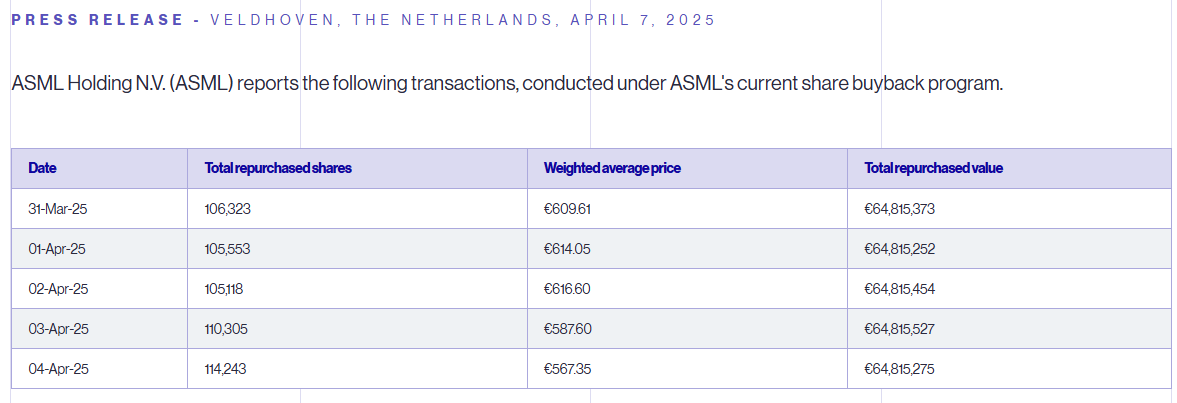

Shareholder Returns: ASML balances dividends with share buybacks, having repurchased over 13% of shares since 2013. Recently, it announced a new €12B buyback program running through 2025.

R&D Commitment: Spending more than €4B annually, around 15% of total revenue, ASML's R&D is fully focused on lithography, in contrast to diversified competitors.

Risks & Challenges

Being a monopoly, in the most critical industry in the world, is not without uncertainty:

Customer Concentration: Roughly 60% of ASML’s revenue comes from just two customers—TSMC and Samsung. And the trend is becoming even more concentrated, with TSMC increasingly dominating the leading-edge manufacturing space. As Intel and Samsung continue to face internal setbacks, TSMC is steadily gaining share, tightening its grip as ASML’s most critical client.

Geopolitical Tensions: Export restrictions and trade tensions—particularly between the U.S. and China—are intensifying. While this adds uncertainty, ASML's systems are so critical and irreplaceable to advanced chip production that the impact may be partially mitigated.

Semiconductor Cyclicality: The industry’s inherent booms and busts could delay orders or reduce capex. Although more than a risk, I personally see this as an opportunity to get in cyclical names with secular tailwinds.

Supply Chain Reliance: Key components are single-sourced; disruptions at suppliers like Zeiss SMT could be catastrophic.

Blending Fundamentals with Technical Analysis

When evaluating a business, it's important to balance fundamentals with technical signals. In a market molded by algorithms and sentiment, it's easy to be distracted by short-term fluctuations. My focus remains on long-term trends, filtering out daily noise to get a clearer picture.

Some key valuation metrics I’ll focus on when evaluating ASML include:

Growth metrics: Net Sales and Services Revenue, New Lithography System Sales, Net Backlog, Average Price per EUV system.

Profitability: Gross Margin and Net Operating Profit After Tax (NOPAT)

Capital Allocation & Capital Efficiency: Return on Capital Employed (ROCE) vs peers, Share Repurchases

For technical analysis, I prefer simplicity, sticking to a few core indicators for weekly timeframes:

200-week MA: To track long-term trends and support/resistance levels

MACD: To gauge momentum and identify buy/sell signals through crossovers and divergences

Volume: To measure the strength of price movements and confirm breakouts

Price levels: Important historical price levels acting as long-term support or as resistance.

🤖 ASML

Weekly Technical Analysis

When you zoom out on ASML’s weekly chart, despite the stock’s known cyclical swings, its current long-term trend is, frankly, hard to get excited about.

⚠️ Breaking Down Through Support Like Butter: ASML has sliced through multiple moving averages and support levels with unusual speed. Historically, the stock has rarely dipped below its weekly 200MA—not even during most downturns—except for 2008, when it was a far smaller and very different company. This time, a cocktail of geopolitical tensions and customer order delays concerns seems to be weighing heavy on investor sentiment.

✅ But here’s the thing: When a stock moves like this, it’s crucial to step back and refocus on the fundamentals. Is this breakdown a real shift in ASML’s long-term story—or just a market overreaction? As I’ll outline later in the Fundamental Analysis and DCF sections, I believe it’s the latter.

👀 Near-Term Uncertainty: With markets swinging wildly (±10% days on the Nasdaq and S&P 500 aren’t uncommon these days), it’s hard to call near-term moves. After briefly piercing a key long-term support (~€550), ASML has shown some signs of stabilization above this level. But if that doesn't hold, the next major support rests around the low-€400s range, formed during its 2021–2023 base.

Key Indicators:

🔹 MACD: Deep in negative territory, firmly in “bear market” mode since July 2024. Watch for potential positive divergence as an early sign of momentum turning.

🔹 Volume: Volatility has brought big volume—but encouragingly, recent selling has been met with stronger buying pressure. That’s a hint some investors are seeing value here.

🔹 Support Levels:

📌 Low-€400s – Strong long-term support from ASML’s 2021–2023 multi-year base.

📌 Mid-€500 – Already breached but showing a fast rebound on high volume.

Fundamental Analysis

🔹 Growth Trends

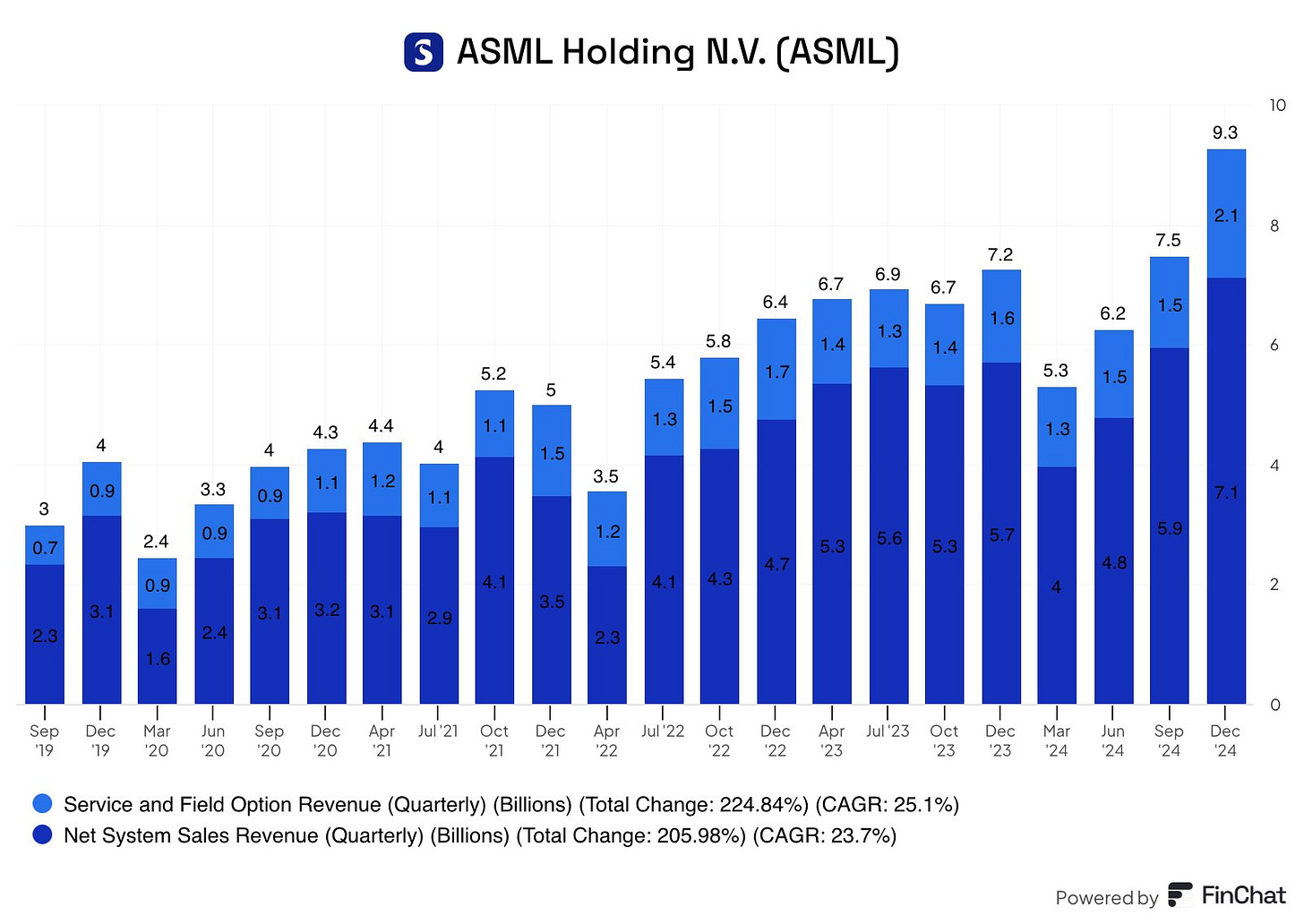

Let’s start with the obvious: revenue is the main growth driver. As mentioned in the “Business Model” section earlier, ASML’s growth engines are pretty clear: ~75% of revenue comes from Net System sales (hardware), with the remainder from Services (maintenance, software upgrades, etc.).

Looking at the last four quarters in 2024, both net system sales and services have been climbing again. But—and this is important—that growth hasn’t been linear. That’s not a red flag, though. It’s just the nature of the beast.

ASML operates in a cyclical industry. What you’re seeing here is a recovery phase following a typical industry cooldown post-Q4 2023. Only recently has ASML started beating those previous sales highs again.

“Pro tip”: For evaluating semicaps like ASML, forget quarter-to-quarter noise and zoom out. Focus on multiyear trends, from 2-year to 5-year. Also worth noting: ASML has one of the longest lead times in the industry—just under a year. That means once an order is placed, it takes ~12 months to deliver the equipment, thanks to the sheer complexity of their lithography systems.

If you look at the chart above, over the past 5 years, ASML’s total sales have grown 2.5x. That's no fluke—it’s a signal of sustained structural demand, not just cyclical waves like commodities.

But what about future growth?

Despite the macro drama and semiconductor sector-specific noise, the road ahead still looks very promising… watch the backlog! ASML currently sits on a €36 billion backlog. If fulfilled in 2025, that translates to a potential +27% YoY revenue growth—which would beat their own midpoint guidance of €32.5B. This backlog alone suggests demand is intact and (potentially) accelerating despite the lumpiness of quarterly net bookings.

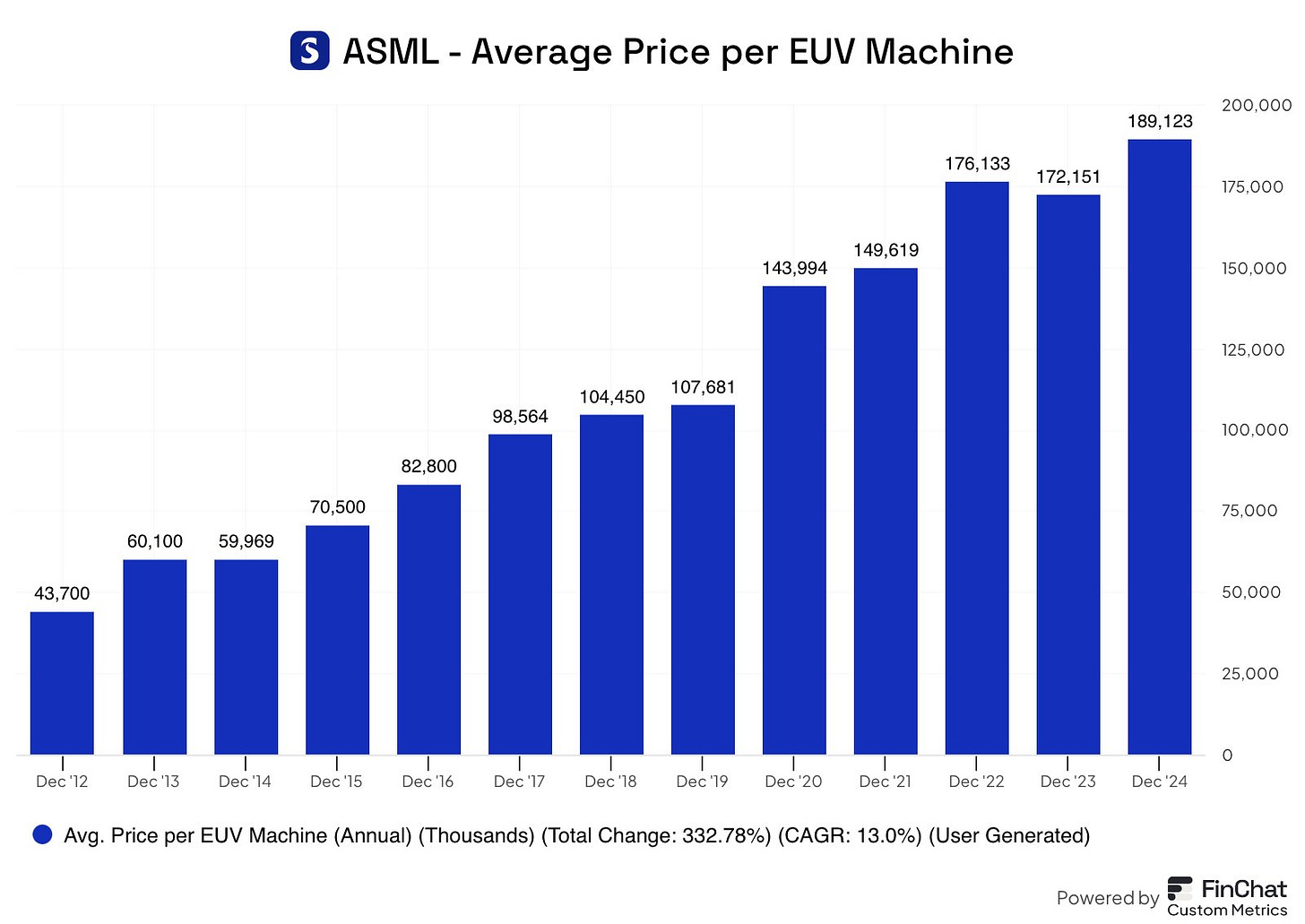

What else is driving revenues besides demand?

You guessed it—EUV system pricing.

Over the past decade, ASML has steadily raised the average price of its EUV machines at a +13% CAGR. And customers? They’re still lining up.

Why? Because with every iteration, ASML’s machines get better, faster, and more precise—delivering major improvements in transistor density, resolution, and energy efficiency. In short: chipmakers like, TSMC or Samsung, make better chips, faster, and with better economics.

The good news is: expect the uptrend to continue. ASML’s current average EUV price is ~€189M. Next-gen machines will be priced at €350M. That’s big leap, but it's justified. These are the most advanced tools on Earth for leading-edge chipmaking.

So, if you are an investor and you are holding the ASML bag, don’t get lost in the quarterly wiggles. This is a long-term compounding machine operating in a structurally critical industry. If you're betting on the future of tech, you're (likely) betting on ASML—whether you realize it or not.

🔹 Profitability

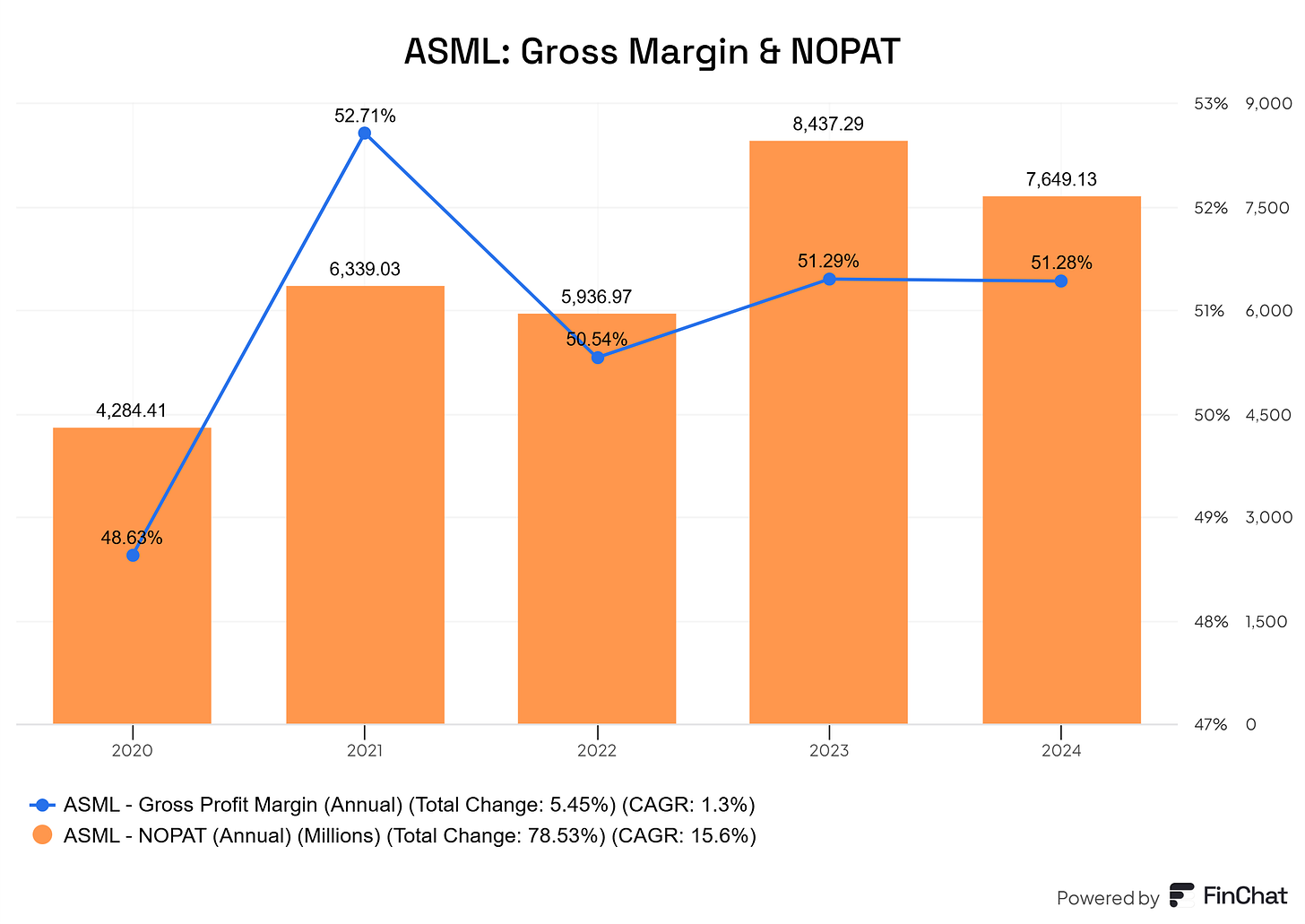

Just like the top line, ASML’s bottom line can look deceptively bumpy—especially if you're zoomed in on quarterly Free Cash Flow or EPS. Semiconductor cycles are lumpy by nature, and short-term fluctuations often mask the bigger picture.

So how do you cut through the noise? I prefer to focus on: Gross Margins and NOPAT (Net Operating Profit After Tax)

While FCF is crucial, it can be skewed by swings in CapEx and working capital—things like inventory builds or delayed payments (which happen often in ASML’s world). NOPAT strips that out and zeroes in on true operating efficiency, making it a better gauge for long-term profitability in cyclical businesses like semicaps.

This chart above is very telling of ASML’s recent price action.

Indeed, while gross margins have stayed stable around low-50s%, operating profits have dipped in 2024 vs. 2023—largely due to the semicap downcycle in mature nodes (aka non-AI chip production). And let’s not overthink it: as profits goes, stock prices usually follow.

In ASML’s case, the stock price drawdown has been amplified by external noise—geopolitical tensions, export bans, and customer-specific concerns.

But—and I can’t stress this enough— don’t fall into the trap of focusing on a single year. If you zoom out, the 5-year profit trend tells a much stronger story, as NOPAT grew from €4.28B in 2020 to €7.65B in 2024, a solid 15.6% CAGR. That’s the kind of long-term trajectory you want to see in a high-quality compounder like ASML.

🔹 Capital Allocation and Capital Efficiency

One thing I pay attention to when evaluating a company—especially management’s skill as capital allocators—is the timing of the share repurchase programs.

It’s simple: buying back shares when your stock is trading at sky-high valuations isn’t smart. The goal of a repurchase program is to enhance shareholder value, not dilute it.

Buybacks are most effective when done at lower valuations, as they reduce the number of outstanding shares, thereby boosting each remaining shareholder’s ownership stake and earnings per share (EPS). On the other hand, buying back shares at elevated prices diminishes that impact and can even be value-destructive.

In ASML’s case, their capital allocation strategy is usually impeccable. With the stock trading near the bottom of its historical valuation range, the company has been aggressively buying back shares, as part of its already announced €12.0 billion share buyback program and as recently shown on their Investor Relations site:

Now, to evaluate capital efficiency, I’ll use one of my favorite metrics: Return on Capital Employed (ROCE) — which tells us how effectively a company generates profits from all the capital it uses (both equity and debt). The formula is simple:

ROCE = EBIT / Capital Employed

Where:

✅ EBIT (Earnings Before Interest and Taxes) measures pre-tax operating profit.

✅ Capital Employed = Total Assets - Current Liabilities or Equity + Non-current Liabilities (both from the Balance Sheet).

If you’re curious to dig deeper into capital efficiency metrics like ROCE, ROIC, and ROIIC, I recently published a free-to-read guide walking through each one, including how to calculate them step by step. Check it out here: 📎 Understanding ROIC, ROIIC, and ROCE: Measuring Capital Efficiency

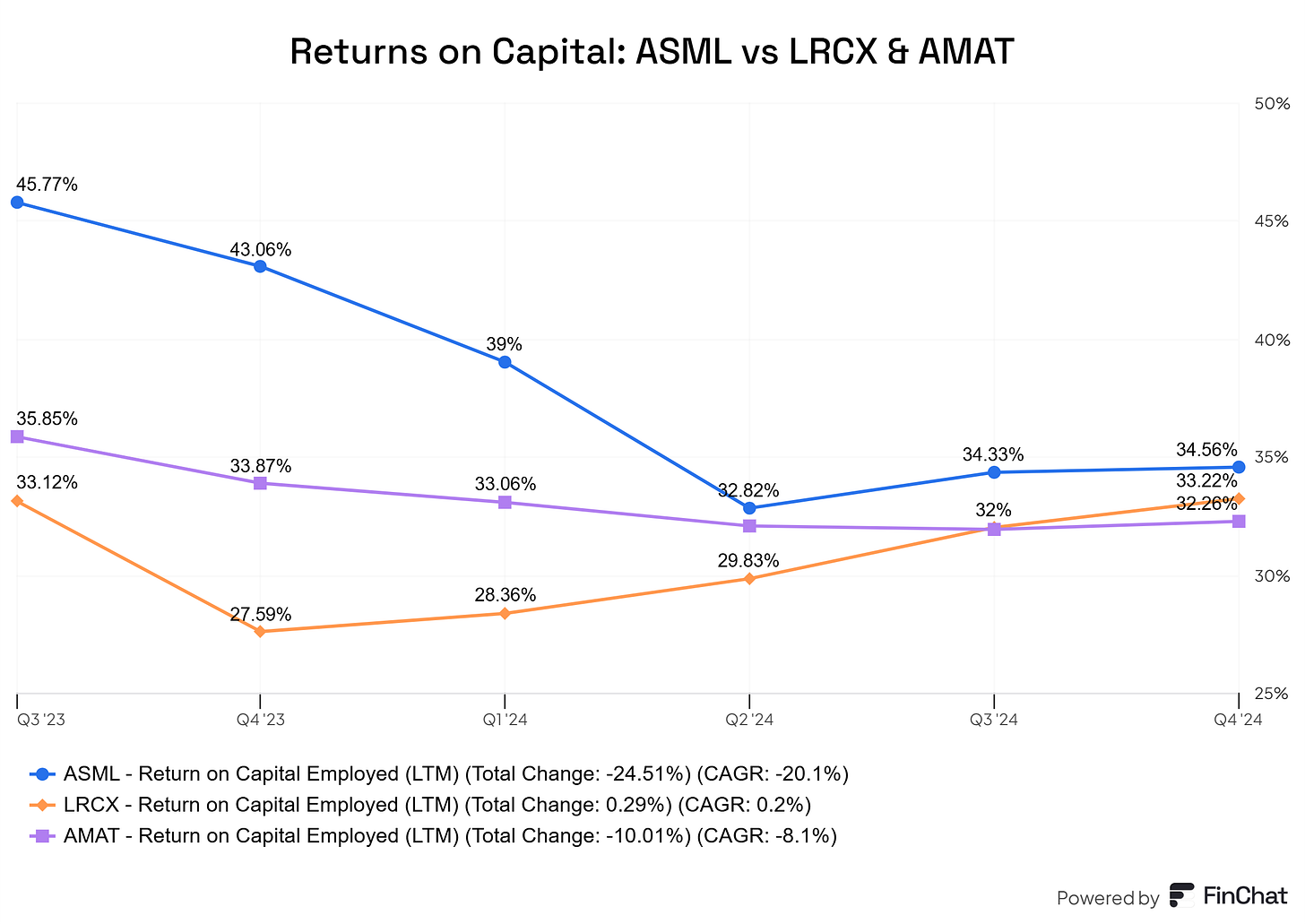

To provide further context to this metric. I’ll be comparing ASML’s returns to other heavy weighted in the semicap arena, AMAT and LRCX:

As you might expect, ROCE—like most capital efficiency metrics—is influenced by cyclicality. Fluctuations in the operating profits (EBIT) impact the numerator of the ROCE formula, while capital employed (the denominator) can also swing depending on how a company manages its balance sheet through the cycle.

This is where great management shines: by adjusting working capital and investment levels, they can soften the impact of downturns and even show counter-cyclicality in tough times.

If you look at the chart above comparing ASML’s ROCE with peers like AMAT and LRCX, you’ll see ASML’s clear edge in capital efficiency.

🔒 In next sections (for paid subscribers), we’ll break down ASML’s capital efficiency using ROIC, ROCE, and ROIIC, with Expanse Stocks’ proprietary models. But first, let’s try to do a quick mental exercise to estimate ASML stock potential returns.

Earnings Growth Model: A Quick Mental Framework to Estimate Potential Returns

A simple way to approximate long-term stock returns is using this formula:

📌 Expected Return ≈ Earnings Growth + Dividend Yield ± Valuation Change

This model helps investors quickly assess if a stock’s projected growth aligns with their return expectations—without diving into more complex DCF calculations.

1️⃣ Earnings Growth (EPS Growth Rate)

Earnings growth is calculated using the EPS Growth Rate. To estimate this rate, consider:

Historical EPS growth: My starting point is typically over 5 to 10 years.

Analyst estimates: Useful but often optimistic, so take them with a grain of salt.

Management forecasts & industry trends: Help refine assumptions.

ASML’s case:

EPS has grown at a 25.6% CAGR over the last 5 years.

Analysts project 20% annual Normalized EPS growth for the next 3+ years.

ASML management’s insights suggest 15 to 20% EPS CAGR ahead.

To stay conservative, let’s assume a 17.5% EPS growth rate over the next 5 years.

2️⃣ Dividend Yield

ASML’s current dividend yield is 1%.

3️⃣ Valuation Change: Multiple Expansion/Contraction (Change in P/E ratio)

To estimate the impact of valuation changes:

Where:

Ending P/E = Fair P/E at the end of the holding period.

Current P/E = P/E at the start.

N = Holding period in years.

Amazon’s case:

Current P/E = 28.8x, well below its 5-year normalized average of 35x.

To stay conservative and assuming a 5-year holding period, a reasonable fair P/E might be 30x (considering its high quality and historically high multiple).

Using the formula above, this results in a valuation boost of +0.8% per year

3️⃣ Earnings Growth Model Results

So, ASML Expected Returns over 5 Years is:

📌 Earnings Growth + Dividend Yield ± Valuation Change ≈ 17.5% + 1% + 0.8% = +19.3% CAGR

🔑 Key Takeaways

The Earnings Growth Model offers a quick way to estimate returns.

Three factors—EPS growth, (dividends), and valuation shifts.

Margin of safety is key—Wall Street projections can be overly optimistic.

ASML’s estimated 19.3% annual return suggests overperformance ahead vs overall market.

Of course, this approach —although straightforward— doesn’t capture intrinsic value fully and it’s oversimplified, so I like to complement it with my DCF and reversed-engineered DCF models.

Next content is reserved for Paid Subscribers and includes:

1️⃣ Traditional DCF Model – ASML’s intrinsic value & implied share price

2️⃣ Reverse-Engineered DCF – ASML’s expected returns using proprietary models

3️⃣ Capital Efficiency - ROIC, ROCE and ROIIC using proprietary models

4️⃣ Final Thoughts – My stance on ASML as a long-term investment

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 11-Sep-2025)