Deep Dive Brief: Medpace

High Quality CRO riding Secular Tailwinds by Serving Small to Midsize Biotechs

Expanse Stocks x Finchat.io Partnership!

🎁 Get 20% off + 2 months free on any Finchat plan! →📎 Claim Discount

Welcome Explorer!

This is the fourth edition of my Deep Dive Briefs, where I break down growth and high-quality businesses.

I’m excited to share my research and insights about Medpace (MEDP), a global contract research organization (CRO) that specializes in providing full-service drug development and clinical trial management for small and midsize biotech firms.

Recently, Medpace's stock price has taken a hit over the past few months due to higher-than-usual customer cancellations, as the company is facing a short-term downturn driven by the challenging biotech funding environment—something I covered in detail in my 📎 Medpace Q3 2024 Earnings Review.

While these challenges have pressured the stock in the near term, they’re also creating an interesting setup for long-term investors, in my opinion. This situation makes Medpace worth a closer look.

Topics I’ll cover

🔹 Company Overview – History & leadership insights

🔹 Business Model & Core Offerings

🔹 Economic Moat & Growth Drivers

🔹 Capital Allocation

🔹 Risks & Competitors

🔹 Fundamentals + Technical Analysis

🔹 Reverse-Engineered DCF – Expected returns using my proprietary models

🔹 Final Thoughts – My stance on Medpace as a long-term investment

Let’s dive in!

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO | 🧙♂️ CSU Part #1

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy, Industry Write-ups & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

🔐 Paid Subscriber Exclusives

💼 Portfolio Corner – Holdings, valuation models, trades, performance & more!

🤫 Exclusive Sections – From select articles, Deep Dive Briefs & Hidden Gems

👀 Recent Releases!

👀 Coming Soon

💎 Unlocking Japan - Part #1: The Overlooked SaaS goldmine

💎 Unlocking Japan - Part #2: A Hidden Gem

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 11-Sep-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles

Company Overview

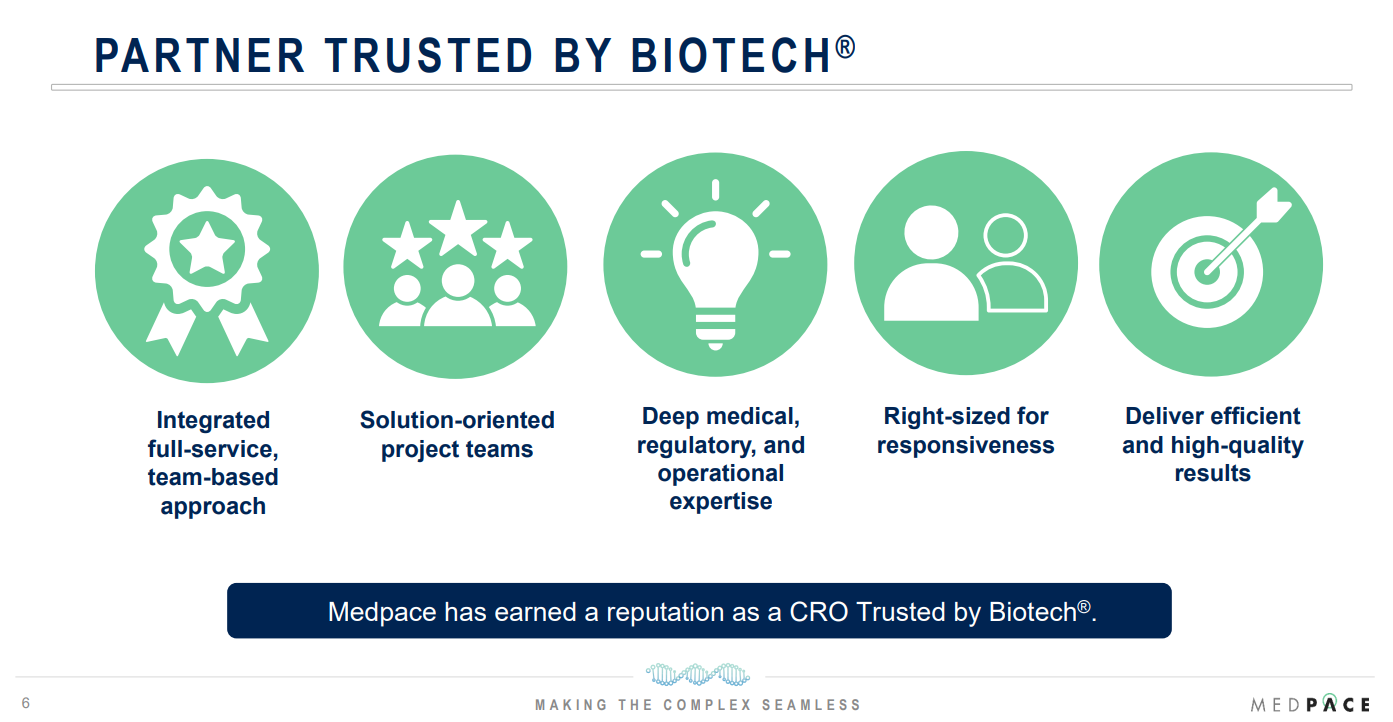

Medpace was founded by Dr. August Troendle in 1992 and has established itself as a global contract research organization (CRO). The company provides end-to-end drug development and clinical trial management services, primarily tailored to small and midsize biotech, pharmaceutical, and medical device companies.

Headquartered in Cincinnati, Ohio, Medpace operates in 42 countries and manages a workforce of >5,900 employees, delivering services on a global scale.

Dr. August Troendle: A Career of Excellence driving Medpace Success

With a rare combination of medical expertise and business acumen, Dr. August Troendle’s career exemplifies leadership deeply rooted in industry knowledge and experience.

Before founding Medpace, Dr. Troendle polished his medical skills at Sandoz (now Novartis), where he managed the clinical development of lipid-altering agents. His earlier role at the FDA as a Medical Review Officer provided him with valuable insights into regulatory processes—knowledge that later influenced Medpace’s focus on compliance and precision in clinical trials.

Dr. Troendle has also served on boards of important biopharmaceutical companies such as Coherus BioSciences and Xenon Pharmaceuticals. His educational achievements, including an M.D. from the University of Maryland and an MBA from Boston University, reflect his dedication to excellence, a principle he has successfully instilled in Medpace’s culture.

From Humble Beginnings to Best-In-Class Services

From modest origins to its current $11B market cap, Medpace has followed an extraordinary trajectory. The company’s mission is deeply rooted in its commitment to clinical research, ethical integrity, and best-in-class service—core values instilled by its founder and CEO, Dr. August Troendle.

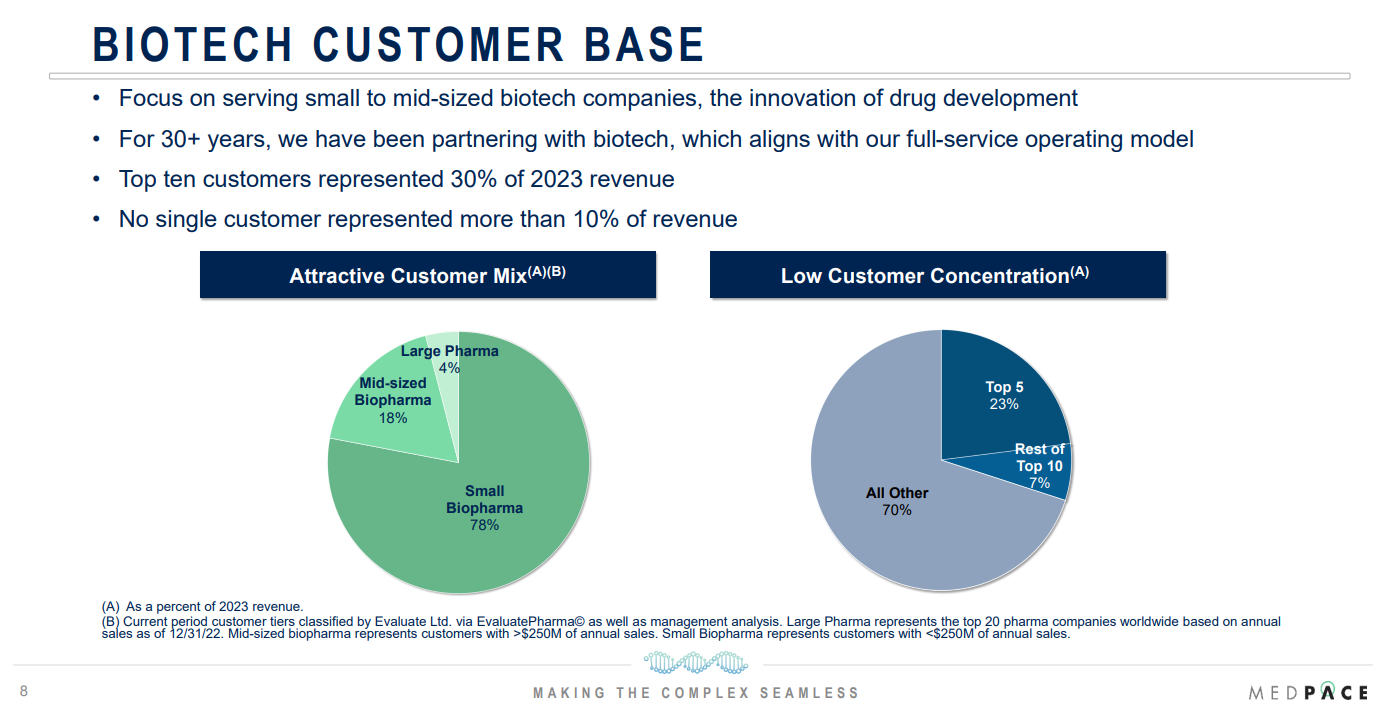

What sets the company apart is its laser-focused strategy of targeting small and midsize biopharma companies, a niche often overlooked by larger CROs. In this underserved space, Medpace acts as a trusted partner, providing critical expertise and infrastructure that many of its clients lack.

This differentiated approach has delivered exceptional results, both to its clients and shareholders (34.8% (!) CAGR annually since its IPO in 2016), cementing Medpace as a clear leader in its field.

Business Model

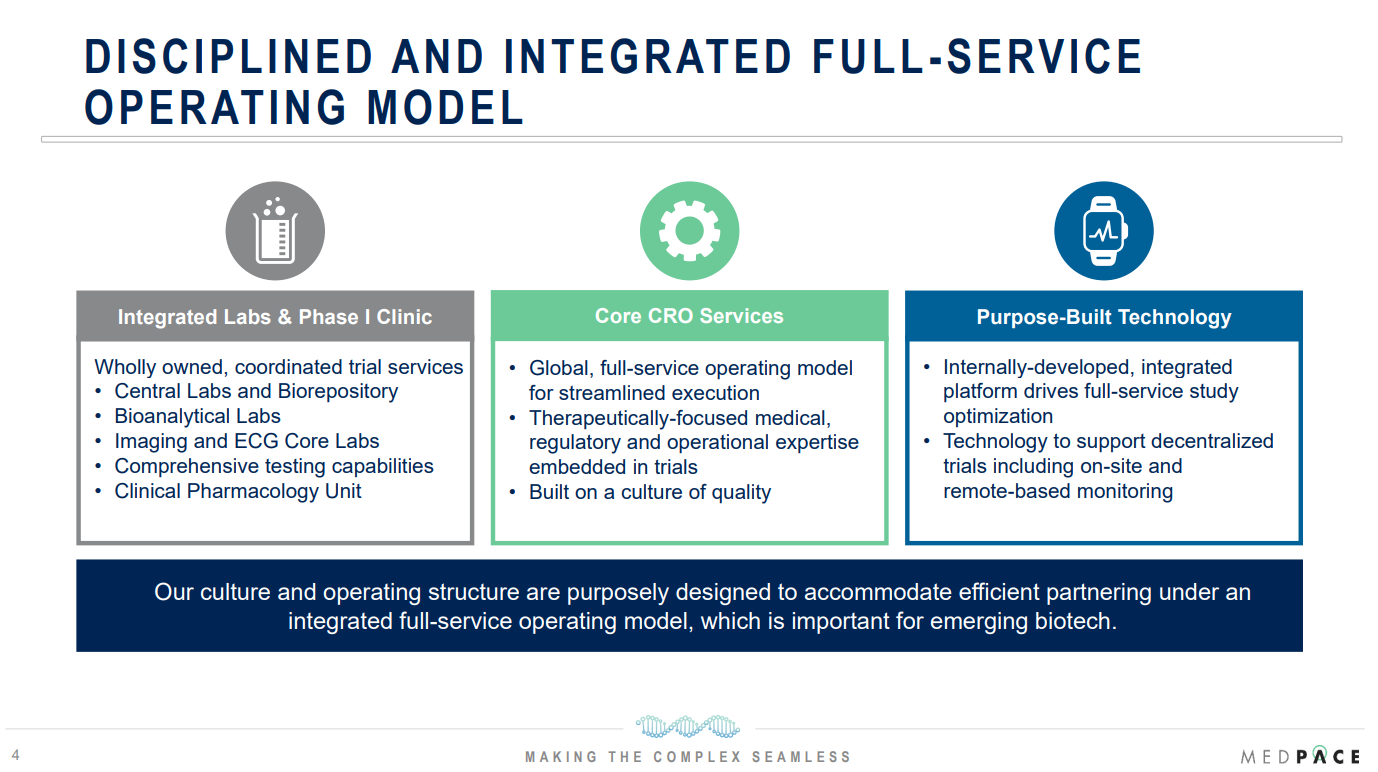

Its business model is built around full-service outsourcing solutions, managing every stage of the clinical trial process. This contrasts with the fragmentary outsourcing favored by large pharmaceutical firms.

By offering an end-to-end approach, Medpace has established itself as a dependable partner that simplifies and accelerates clinical development for its clients.

Core Business Segments:

Clinical Development Services

The backbone of Medpace’s operations, this segment handles everything from trial design to patient recruitment, regulatory compliance, and more. For example, a small biotech developing a novel cancer therapy might rely on Medpace to navigate complex multinational trials while ensuring regulatory alignment across the U.S., EU, and Asia.Laboratory Services

Medpace’s labs support trials by analyzing biological samples, ensuring data accuracy, and maintaining strict adherence to regulatory standards. For instance, in the case of a groundbreaking Alzheimer’s drug, Medpace’s labs would manage critical biomarker testing to ensure the success of the trial.

Regulatory Affairs and Consulting

Regulatory challenges can be a nightmare for biotech firms. Medpace helps clients secure timely FDA or EMA approvals, reducing the risk of costly delays.

Post-Marketing Services

Medpace extends its support beyond the initial approval phase, offering post-marketing surveillance and conducting Phase IV trials to monitor long-term efficacy and safety after a drug reaches the market.

Medpace has carved out specialized expertise in therapeutic areas like oncology, cardiology, and neuroscience, making it an industry leader in tackling complex diseases. Its global presence spans 60 regulatory jurisdictions allowing them to deliver clinical trial management across the world.

Economic Moat

What sets Medpace apart from its competitors? Two words: switching costs.

Once clients engage Medpace for a late-stage trial, switching to another CRO mid-project is like changing horses midstream—a decision that is not only costly and risky but also unnecessarily stressful. Late-stage trials require a lot of resources, intricate coordination, and precision execution. Transitioning to a new CRO would disrupt timelines, potentially delaying the drug’s launch by months and cutting into the client’s valuable patent-protected market time.

Additionally, Medpace’s efficiency is a financial lifeline for its clients. CRO-managed trials are completed 30% faster than in-house efforts, on average. Faster completion means drugs reach the market sooner, earning the “so much wanted” patent-protected revenue.

But Medpace’s moat not only rests on switching costs and efficiency. The company’s competitive edge is further reinforced by its intangible assets, including:

Therapeutic Knowledge: Medpace excels in specialized therapeutic areas, such as oncology, cardiology, and neuroscience, offering unmatched depth in these critical fields.

Global Regulatory Expertise: With operations in over 60 regulatory jurisdictions, Medpace is able to tackle effectively complexities of global compliance, a critical capability for multinational trials.

A Reputation for Excellence and Differentiation: Built on decades of success, Medpace’s reputation ensures trust from clients and differentiates it from competitors.

A good example of Medpace differentiated capabilities lies in its pioneering work with decentralized trials, a model that gained more traction during the COVID-19 pandemic. Its ability to adapt to emerging trends while maintaining precision and efficiency is a trait of its leadership in the CRO space.

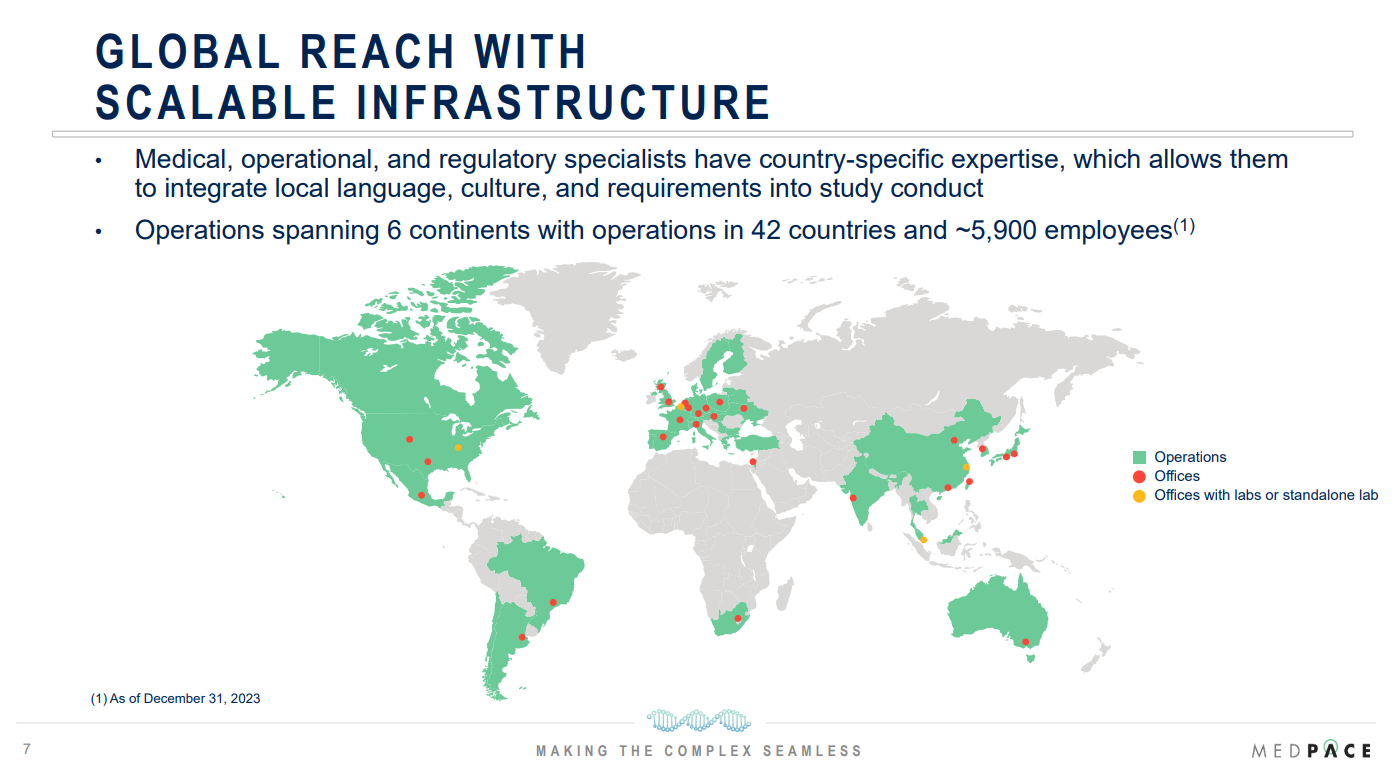

Source: Medpace IR website, Investor 2024 Presentation, Slide 6. Link.

Growth Drivers

With revenue expected to grow at an average annual rate of 14% over the next five years, the company is capitalizing on a number of key trends and strategic opportunities:

Rising Outsourcing Trends

The outsourcing of clinical trials has seen a significant uptick, increasing from 37% in 2007 to over 51% in 2022, and it shows no signs of slowing.

Why the surge in outsourcing?

Increasing Complexity of Clinical Trials: Today’s trials demand specialized expertise, vast infrastructure, and significant resources, all of which CROs like Medpace are better equipped to handle.

Cost Efficiency: For many small and midsize biotechs, outsourcing reduces the financial burden associated with in-house trial management.

Speed and Precision: CROs complete trials faster, ensuring quicker market entry and earlier revenue generation for their clients.

Medpace is perfectly positioned to ride this wave with its large and diversified customer base, offering full-service solutions tailored to the needs of small and midsize biotech firms that often lack the infrastructure to conduct trials independently.

Focus on Complex Therapeutics

Medpace aligns its services with highly innovative fields like gene therapy, biologics, and precision medicine—areas that demand advanced therapeutic expertise and are expected to dominate future drug pipelines.

Gene Therapy: As biotech innovation accelerates, gene therapy represents a significant growth area. Medpace’s expertise in tackling the complexities of trials in this space is a major competitive advantage.

Biologics: With biologics comprising a growing percentage of FDA approvals, Medpace’s specialized capabilities ensure it remains indispensable to its clients.

By focusing on these complex therapeutic areas, Medpace not only maintains its relevance in a rapidly evolving industry but also positions itself as a key enabler of innovation for its biotech clients.