ASML Investor Day 2024: Highlights & Takeaways

Semiconductor Industry Trends, ASML Financial Projections, AI and EUV Technology Growth drivers, Final Thoughts

Remember that Expanse Stocks and Finchat.io Partnership! Enjoy a 20% discount (+ 2 months free) on any Finchat plan 👉 Claim Your Discount Here

Not a free member yet? Join Expanse Stocks for free if you’d like to receive more content like this and get access to some of my free research (Deep dives, “Monthly Specials” Picks, Hidden Gems Screeners, Stock News and more)

Hello, reader!

Last week, ASML, the semiconductor powerhouse, hosted its much-anticipated annual Investor Day. This year’s event was particularly awaited, coming on the heels of their Q3 2024 earnings, where a lowered 2025 guidance induced some fears and uncertainty among investors and the broader market.

As we’ve come to expect from ASML investors' day, the company delivered a comprehensive dive into its financial and technological roadmaps, showcasing its pivotal role in shaping the future of the semiconductor industry. In this article, I’ll break down the most important takeaways from what was a dense yet highly educational presentation. And if you feel like taking a look at the Full presentation with all the slides here is the link.

Here are the topics I’ll cover:

Overall Semiconductor Industry Trends

ASML Financial Projections and Market Focus

AI and EUV Technology

Final Thoughts

Let’s dive in!

📰 What’s new?

Several articles (most are FREE to read):

Brief Deep Dives: ⛅ Cloudflare, 👷♂️ Parsons, 𓇲 MPS, 🥼 Medpace

🎅 Christmas Special: TOP 5 Picks for 2025

💸 General Investing Articles

👀 Coming up:

💎 Hidden Gems - Third Edition: Featuring 2 British treasures—one free to read and the second for paid subscribers.

Deep Dive Brief: 🔌Arista Networks

Summaries of several earnings and conference calls for Q1 earnings season

Articles exclusive for Premium Subscribers:

Bonus picks at the end of the 🎅 Christmas Special

📊 DCF & Reverse DCF Models: Available for download in my Portfolio section

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year) with the annual plan!

🗓️ Biweekly Updates (Last Update: 28-Feb-2025)

🔎 Stock Picking Methodology: Learn my long-term investment strategy.

💼 Full Portfolio Access: View long-term holdings with valuation metrics and performance tracking.

📈 Live Trades: Stay updated on my latest trades and watchlist additions.

📊 DCF & Reverse-Engineered DCF Models: Download proprietary models with calculations and evaluation guides.

🎯 Swing Trading Strategy: Learn my short-term trading technique for quick gains

👉 Access Full Portfolio Content

Overall Semiconductor Industry Trends

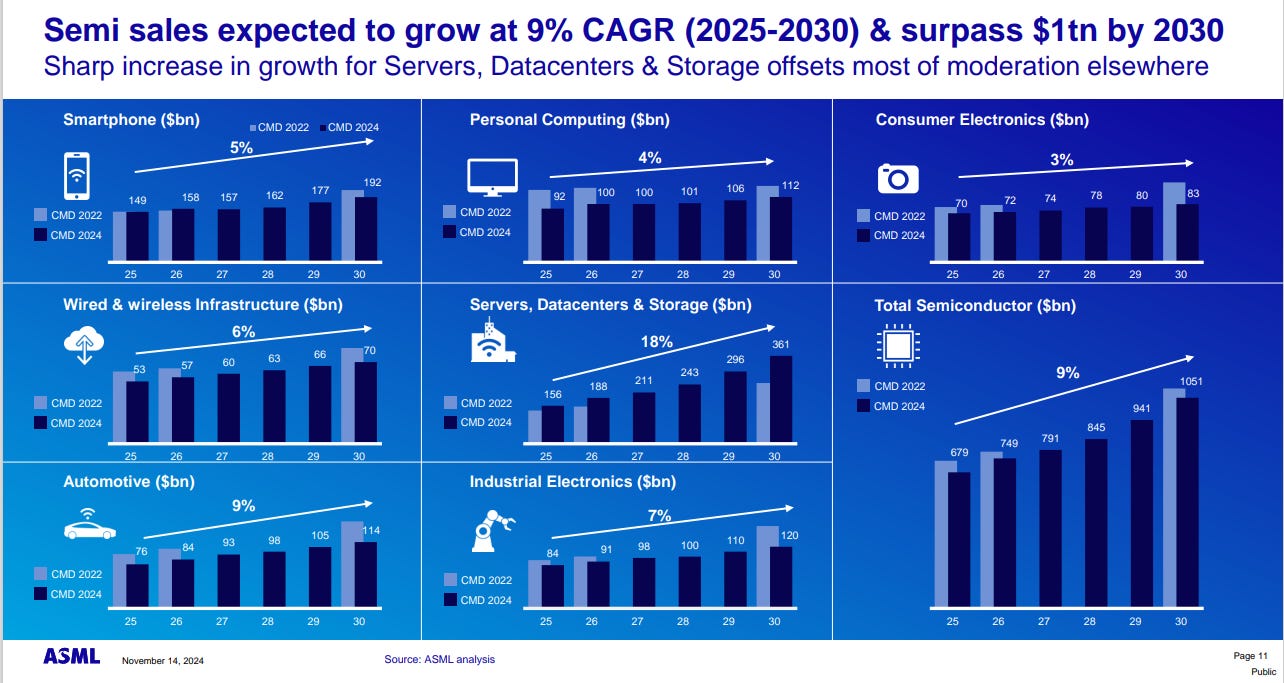

ASML expects the semi industry sales will surpass $1tn by 2030 and will grow at 9% CAGR. 🟢

However, they lowered its 2030 end-market forecast across all segments except servers and datacenter where higher growth projections offset most of moderation elsewhere. (🔴 Non-server, 🟢 Server & Data Center market)

Non-server markets —Personal Computing, Automotive, Consumer and Industrial Electronics— seeing the steepest forecast declines.

If these projections hold true, it suggests notable challenges ahead for non-server segments, potentially reshaping demand dynamics across the semiconductor industry.

Moore’s law is alive and well

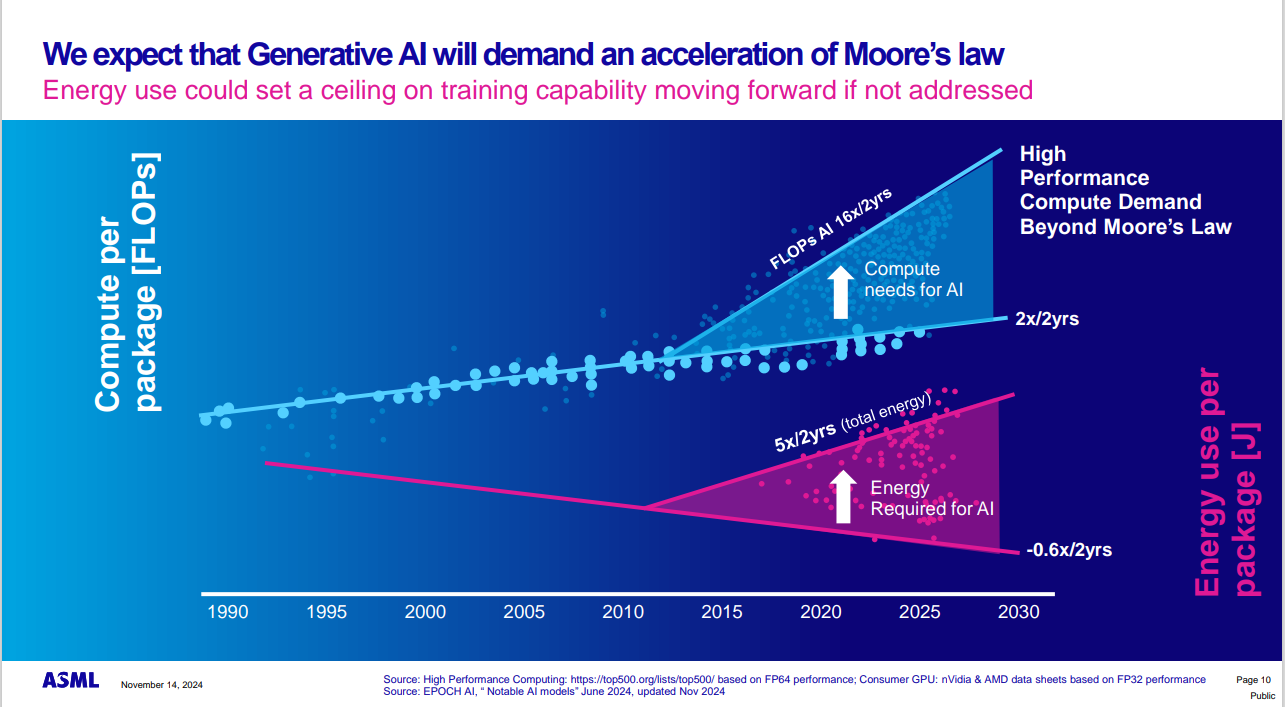

According to ASML, transistors per package continue to double every two years enabling >1tn by 2030.

Furthermore, they expect that AI will demand a further acceleration of Moore’s law, but warned that this growth may be limited by energy capacity 👀

ASML Financial Projections and Market Focus

Revenue Targets: ASML reaffirmed its 2030 revenue targets of €44–€60 billion, with a gross margin of 56–60%. This equates to a CAGR of 7.8–13.5% from 2024. 🟢

This outlook relies on the sustained success of its flagship EUV and DUV lithography systems. Breaking it down:

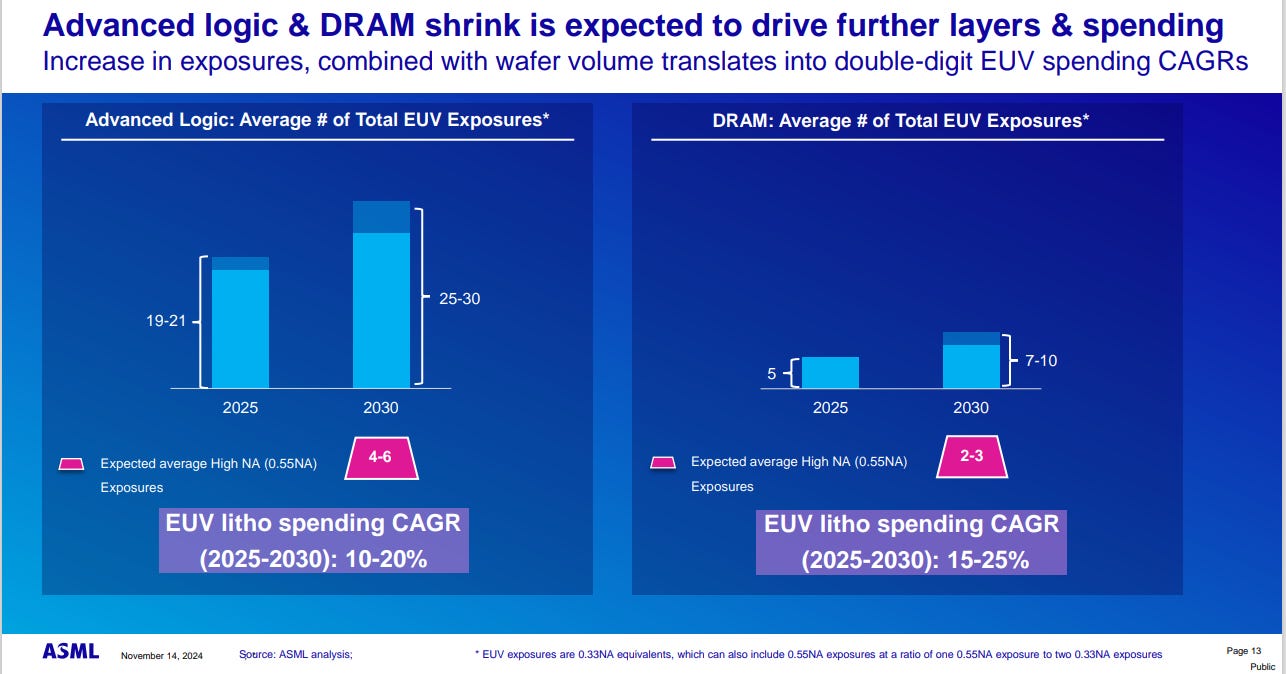

EUV Lithography: Expected to grow at an impressive 10-20% CAGR driven by demand for cutting-edge logic chips (≤7nm) and 15–25% CAGR, driven by DRAM memory solutions. 🟢

DUV Lithography: A more mature segment, growth is more subdued (flattish CAGR), reflecting its established status as the industry’s “workhorse.” ASML is clearly leaning into EUV as its rising star, but it’s not letting go of its DUV cash cow just yet. 🟡:

“EUV is our future, but DUV is our anchor. Together, they create a portfolio that’s both innovative and resilient.” —CEO, Christophe Fouquet, highlighted the strategic importance of balancing these segments.

Shift in Memory Dynamics

NAND demand significantly downgraded (-60% vs. 2022 forecast) 🔴, while DRAM expectations saw a substantial upgrade (+67% vs 2022 forecast) 🟢

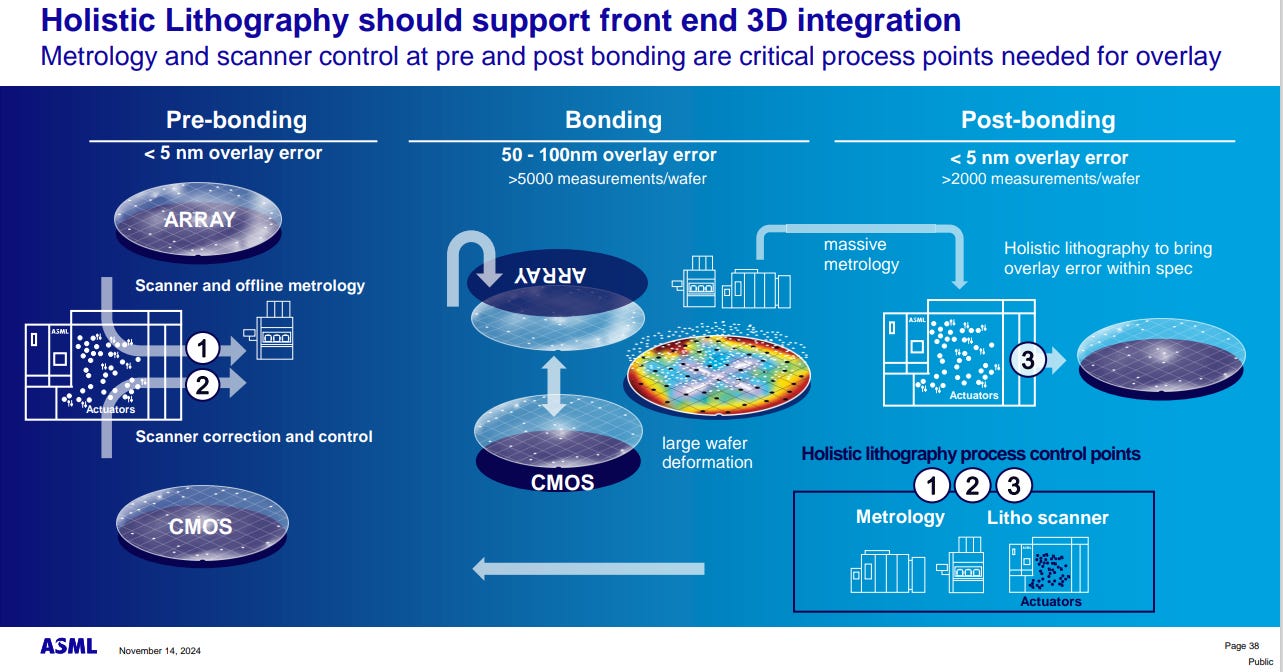

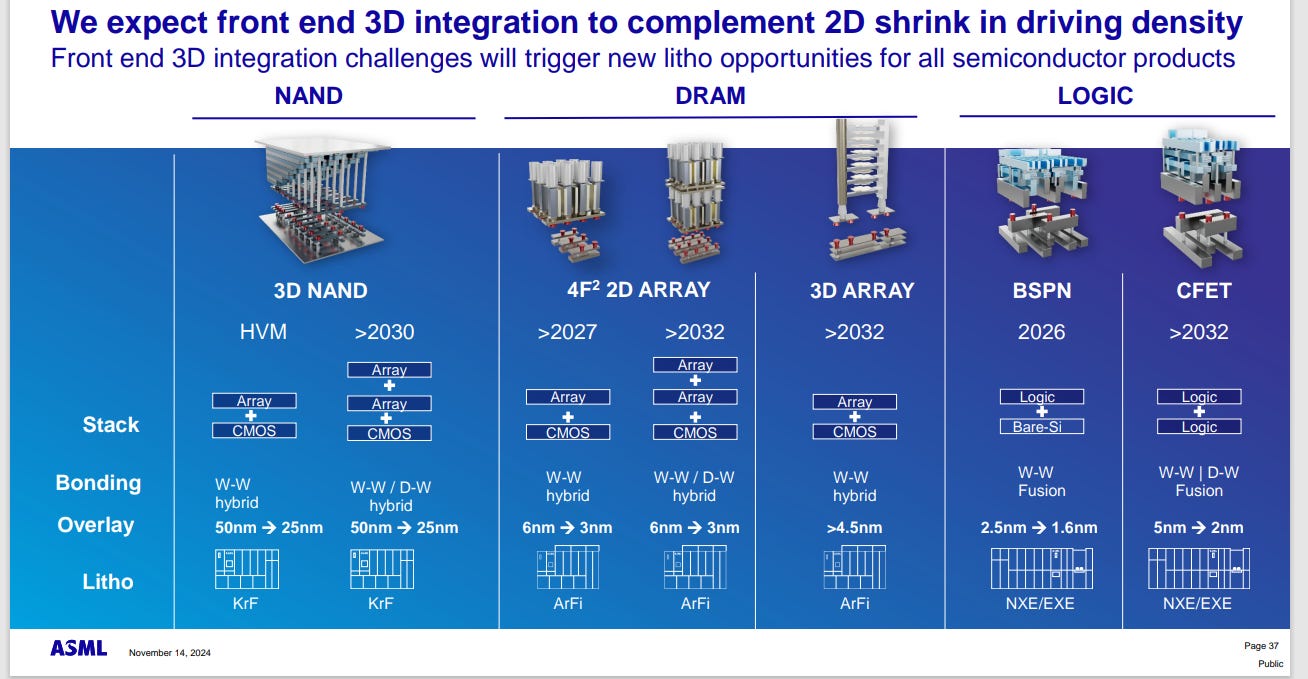

3D DRAM evolution remains a potential disruptor for ASML as it involves stacking memory layers vertically, but 2D DRAM remains dominant due to its cost-efficiency, reflecting a longer-term transition to 3D structures.

However, the company hinted that front end 3D integration challenges may trigger new lithography opportunities for all semiconductor products, thanks to their holistic lithography supporting both approaches to maintain its relevance across the spectrum 👀

“Holistic Lithography should support front end 3D integration. Our system is the only tool that can provide major corrections” —CEO on 3D integration

Source: Investor Day Presentation, slide 37. Link

Global and Geopolitical Positioning

The elephant in the room was the export restrictions on advanced immersion tools to China. With China accounting for a significant slice of ASML’s revenue, >20%, these limitations are a concern.

China Restrictions: Focus on overlay specifications, preventing China from mass-producing chips at advanced nodes <7nm for logic or 18nm for DRAM.

Opportunities Amid Restrictions: ASML is exploring China-specific configurations to maintain market presence without breaching regulatory boundaries. 👀

AI and EUV Technology: Key Growth Drivers

ASML recognizes the expanding role of AI in shaping semiconductor demand. The company predicts the AI-related chip market could reach $400B by 2030, with a significant share requiring advanced lithography solutions. This seems conservative compared to other projections made by other semiconductors players like AMD forecasting +$500B by 2030.

AI accelerates demand for powerful processors and memory technologies, which depend on precision lithography to create increasingly complex designs. The revised estimate for server chip revenues, now expected to reach $360B vs $250B previously forecasted 🟢

“The AI revolution represents an opportunity not just for chipmakers but for ASML as well. Our tools are essential for enabling the technology that powers AI advancements.” — CEO comments on AI

EUV, the Crown Jewel of Lithography

EUV lithography, especially the advanced High-NA (Numerical Aperture) EUV systems, is a technological marvel and the most promising growth driver, pushing the boundaries of precision and performance in semiconductor manufacturing.

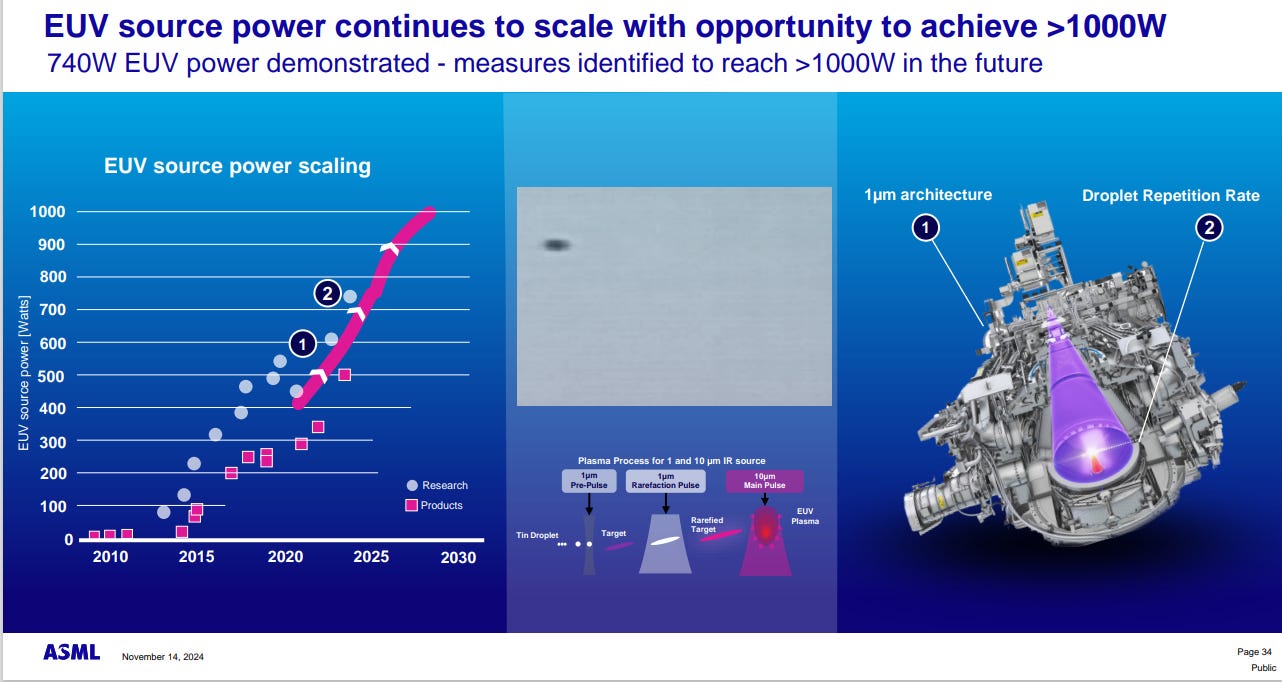

The lenses in EUV systems are capable of achieving tolerances measured in picometers (subatomic magnitude), smaller than a silicon atom. Meanwhile, EUV source power has increased from 200W in 2018 to 500W today, with a goal of reaching 1000W by 2030.

By 2030, the company anticipates a surge in EUV adoption, with 25–30 EUV exposures per chip in advanced logic and 7–10 in DRAM. These figures highlight how crucial ASML’s tools are to advancing Moore’s Law in an era when many thought its limits had been reached.

ASML’s projections highlight the game-changing potential of High-NA systems:

Higher Throughput: Capable of processing 280 wafers per hour, these systems enable more EUV exposures per chip, improving manufacturing efficiency.

Cost Efficiency: Increased throughput translates to lower costs per wafer, making it more attractive to customers and eventually driving revenue growth.

Sustainability: Energy use per wafer could be reduced by 80%, addressing the critical demand for cost-effective and environmentally sustainable manufacturing solutions.

“High-NA isn’t just about sharper imaging; it’s about delivering unprecedented value—speed, precision, and sustainability all in one.” —CEO comments on High-NA systems

🧠 Final Thoughts

ASML’s 2024 Investors Day reflected a well-thought-out strategy that connects its technological achievements with sustainable financial growth. By pushing the boundaries of EUV lithography, adapting to evolving memory markets, addressing AI-driven demands, and navigating geopolitical challenges, ASML continues to position itself for double-digit growth through 2030 and beyond.

At the heart of its strategy, ASML message is clear: its innovations don’t just follow industry trends—they drive them. Their CEO, Christophe Fouquet, emphasized this pivotal role in enabling future semiconductor megatrends:

“We are not just building tools; we are shaping the future of the semiconductor industry. And as the world’s reliance on technology grows, so does our responsibility to deliver.”

That’s all, I hope you enjoyed these notes!

Ready to dive deeper? Here’s what I can offer you and how I can help you

For Free Subscribers, you now have access to:

📊 Quarterly Updated Portfolio Composition by Industry and Geography, plus Valuation Metrics.

👉 Expanse Stocks: Behind-The-Scenes (Last Update: 23-Dec-2024)

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year) with the annual plan!

🗓️ Biweekly Updates (Last Update: 28-Feb-2025)

🔎 Stock Picking Methodology: Learn my long-term investment strategy.

💼 Full Portfolio Access: View long-term holdings with valuation metrics and performance tracking.

📈 Live Trades: Stay updated on my latest trades and watchlist additions.

📊 DCF & Reverse-Engineered DCF Models: Download proprietary models with calculations and evaluation guides.

🎯 Swing Trading Strategy: Learn my short-term trading technique for quick gains