ASML Q4 2024: Moore is Not Dead

Main takes from Conference Calls and Earnings Report with my Personal Touch

Hello readers, welcome back! 🧑🚀

This week, I’m continuing my earnings reviews with ASML’s Q4 2024 earnings report, management video conference and press conference released this morning. (Access to the whole package shared by ASML 👉 here)

I’ve previously covered ASML, and after reviewing their 2024 Investor Presentation last November (link to my article 👉 here), I’m positively surprised by today’s results. They not only reinforce ASML’s long-term growth prospects but also address market concerns and offer some golden nuggets on AI, key growth drivers, recent DeepSeek developments, and industry trends beyond 2025.

These earnings notes are more detailed than usual, as I’ll cover both the management's comments during their "solo" video conference and those from the subsequent press call this morning. I’ll break it down into the following sections:

Q4 2024 Financial Results

Capital Allocation & Shareholder Returns

Technology & Product Updates

2025 Outlook & Key Growth Drivers

Long-Term Vision (Beyond 2025)

ASML and Moore’s Law are alive and well. Let’s see why!

📰 What’s New?

Free Access to 📊 Quarterly Updated Portfolio Composition - by Industry and Geography, plus Valuation Metrics → 📎 Expanse Stocks: Behind-The-Scenes

📌 Free-to-Read Articles (📎 linked below)

🔎 Deep Dives – ⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista

🛒 Amazon (NEW)

💸 General Investing - Latest: Understanding ROIC, ROIIC, and ROCE

💎 Hidden Gems – Latest: Third Edition

🎅 Christmas Special - Top 5 Picks for 2025

💬 Join my Chat! ( 📎 Learn more)

🔐 Paid Subscriber Exclusives

💎 Hidden Gems - Special Editions + exclusive sections from select articles - Latest: 💎 Hidden Gems - Special Edition II

🎁 Bonus Picks - From the 2025 Christmas Special

📊 DCF & Reverse DCF Models + Capital Efficiency Models– Download the models in the 📎 Portfolio section with multiple practical examples (ASML, GOOG, DHR, MEDP, ANET, AMZN and more)

👀 Coming Soon

📊 Quarterly Update to the Portfolio Composition (31-March) - by Industry and Geography, plus Valuation Metrics → 📎 Expanse Stocks: Behind-The-Scenes

A Leap of Faith with Owner-Operators: Why smart capital allocators deserve a big spot in your portfolio (with some examples)

Expanse Stocks x Finchat.io Partnership!

🎁 Get 20% off + 2 months free on any Finchat plan! →📎 Claim Discount

Q4 2024 Financial Results

Notes and Comments

Record Revenue & Growth 🟢

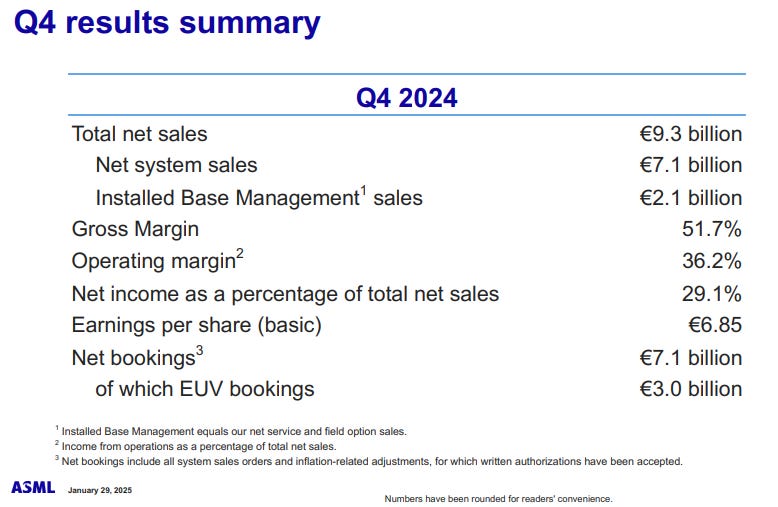

Q4 Revenue: €9.3B (Est €9B), up +28 YoY → primarily driven by Installed Base sales (€2.1B) higher than management estimates.

Full-Year Revenue: €28.3B, +16% YoY slightly above management guide €28B

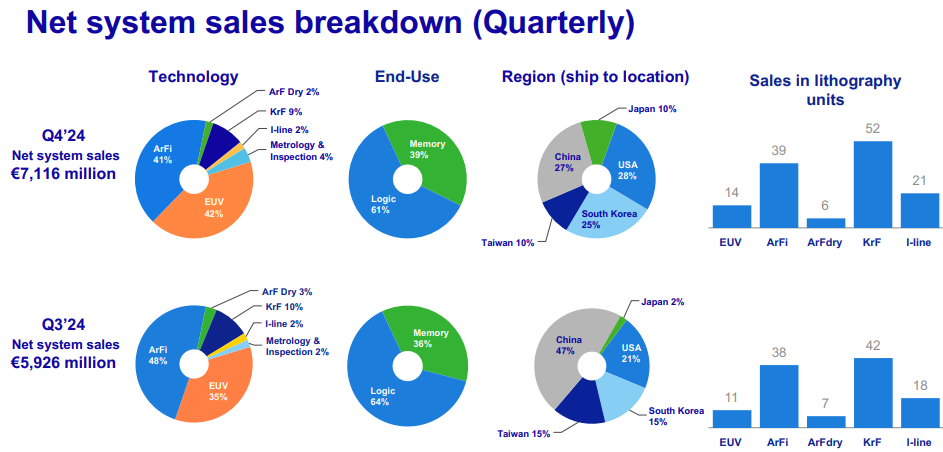

Sales Breakdown (by Technology and Regions) 👀

China-related sales continued to normalize, dropping from 47% of Q3 net sales to 27% in Q4. Management expects this to stabilize at ~20% of net systems sales in 2025.

Total lithography systems sold: 132 units vs. estimated 121 (+6.5% YoY), including 14 EUV systems (vs 11 units in Q3).

Profitability & Margins 🟢

Q4 Gross Margin: 51.7%, benefiting from upgrade sales and early High-NA EUV tool revenue recognition, above estimates of 49.7%.

EPS: €6.84 for Q4 (Est. €6.7), up +31.5% YoY 👌

Net Income: €2.7B for Q4, with Net Margins at 29.1% and €7.6B for FY24

Backlog: Stands at €36 billion → still rock solid 👌

Bookings & Orders 👀

Net System Bookings: €7.1B in Q4, much higher than Est. €3.53B, with €3B only from EUV orders 👌

Management noted they will stop reporting net bookings after 2024, focusing instead on annual backlog updates.

📌 CEO Christophe Fouquet on decision to stop reporting net bookings

“… the way we work with our customers and the way we come up with our expectations for the business, really is based on an ongoing review cycle that we have with customers. So, it's much less influenced by bookings. It's much more based on regular reviews that we have with customers. So, recognizing that PO bookings can be lumpy and are not necessarily a good reflection or an accurate reflection of the business momentum”

→ Personally, I liked the Net Bookings figure, but I agree with ASML’s management that it can create short-term uncertainty for investors who focus too much on QoQ changes. Given ASML’s long lead times, a broader perspective is needed to understand its business trajectory.

📌 CEO Fouquet on financial performance

"We finished 2024 on a strong note, with solid demand across multiple market segments. Despite macroeconomic uncertainties, our long-term fundamentals remain intact."

Capital Allocation & Shareholder Returns

Dividend Growth

2024 Full-Year Dividend: €6.40 per share, a 5% increase YoY.

Final Q4 Dividend: €1.84 per share.

Cash Flows and Share Buybacks

Strong cash flows in Q4, with €7757 million inflows (vs. just €166 million in Q3), providing liquidity to sustain its share buyback program and continue returning value to shareholders. 🚀

📌 CFO Dassen on capital allocation and Cash flows

So, you're right, a lot of cash generation in Q4. Particularly in the last weeks of the quarter, a lot of cash came in… So, I think you see the continuous improvement and increase in dividend right there. Whatever is left can be used for share buybacks. We should continue to see that throughout the planned period.

"We remain committed to disciplined capital deployment, balancing strategic R&D investments with attractive shareholder returns."

Technology & Product Updates

EUV & High-NA Progress 👌

First High-NA EUV tools were shipped and accepted by customers in Q4

Demand remains strong, with customer discussions focused on scaling up production.

📌 CEO Fouquet on High-NA EUV adoption 👀

"We’re still in the early innings of High-NA, but initial customer adoption is progressing well. The transition from R&D to volume manufacturing will be gradual, but we’re confident in the long-term opportunity."

DUV Advancements

The new NXT:2150i immersion tool and NXT:870B KrF tool increased wafer throughput to 400 wafers per hour (WPH), further improving efficiency.

📌 CFO Dassen on DUV shipments:

"While EUV gets much of the attention, DUV continues to be a key part of our portfolio, especially for mature and mid-node semiconductor manufacturing."

E-Beam & Metrology

ASML delivered its first four multi-beam e-beam systems, validating its push into semiconductor inspection

📌 CEO Fouquet on metrology innovation

"As chips get more complex, the need for precise metrology increases. Our multi-beam e-beam solutions will play a critical role in yield improvement for advanced nodes."

2025 Outlook: AI as a Key Growth Driver

Notes and Comments

Q1 2025 Guidance 🟢

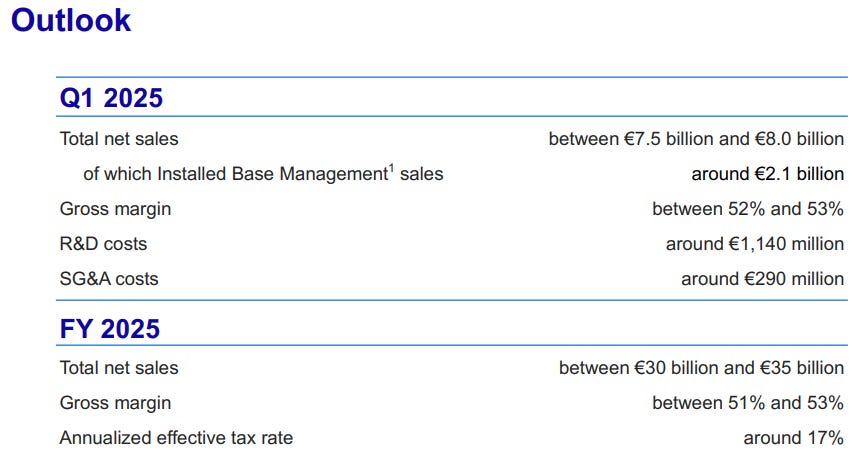

Revenue: €7.5B–€8B, up +46.5% YoY, with Installed Base sales contributing €2.1B.

Gross Margin: 52%–53% (Est. 51.2%), reflecting a shift in product mix.

📌 CFO Roger Dassen on short-term visibility

"Q1 bookings might appear volatile, but our backlog of €36 billion provides a strong foundation for sustained revenue growth in 2025 and beyond."

FY2025 Guidance 🟡

ASML forecasts FY25 revenue between €30 billion and €35 billion with a gross margin of 51%–53% → Reiterating their FY25 guidance issued in Q3 and during their Investor presentation. Management is keeping a conservative and cautious stance.

AI’s Impact on Semiconductor Demand 👀

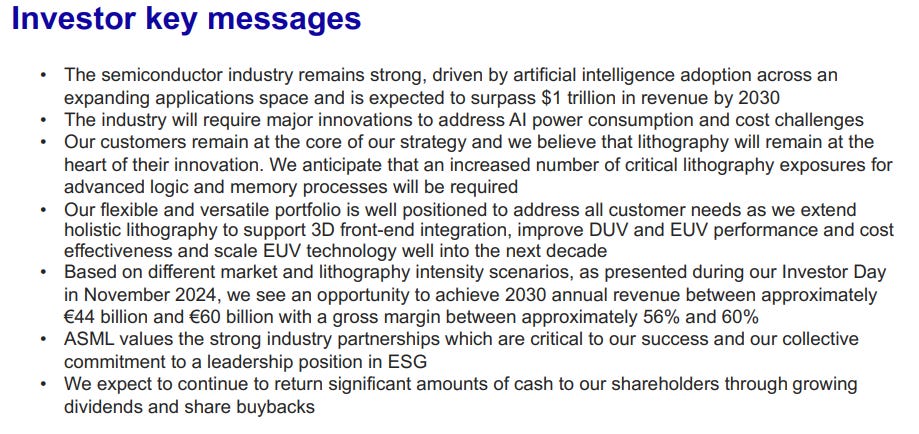

AI-related logic demand is rising, particularly for high-performance computing (HPC) and data centers.

Memory demand remains stable after a strong recovery in 2024.

📌 CEO Fouquet on AI demand 👀

"We see AI transforming semiconductor demand. More AI workloads mean higher transistor density, which requires more advanced lithography layers—exactly what ASML specializes in."

“We believe that widespread AI adoption will be driven by the development of compelling applications across various sectors, such as robotics and personal computing. Once these applications become mainstream, AI will become more accessible to the masses, driving substantial volume growth. This mass adoption will be a tailwind for ASML's business."

📌 CEO Fouquet on DeepSeek and AI innovation 👀

“Today, we don’t know how AI will evolve or which players will emerge as leaders. The landscape is still unfolding. But one thing is certain—these advancements will drive opportunities and fuel innovation, which ultimately serves as a strong tailwind for us.”

📌 CFO Dassen on DeepSeek

"These advancements [DeepSeek’s] could lead to the democratization of AI, driving broader adoption. As AI becomes more accessible, lower costs will fuel higher demand, ultimately increasing volumes."

“For AI to be everywhere, we need to see major progress on costs and power consumption. Lowering costs also leads to more volume...So I will say any technology, whatever it is, that will contribute to cost reduction will increase the opportunity.”

China Market Normalization 🟢

Revenue from China surged in 2023–2024 due to backlog fulfillment but is expected to return to historical levels in 2025.

📌 CEO Fouquet on China’s contribution

"China played a significant role in our 2024 results, but we expect it to normalize in 2025 as shipments shift toward leading-edge customers in other regions."

→ Positive move to de-risk from China, given the ongoing geopolitical tensions 👌

📌 CFO Dassen on Chips Export Controls

"We are not going to speculate; we have been living with this for a very long time."

Long-Term Vision (Beyond 2025)

Notes and Comments

ASML reaffirmed its 2030 revenue target of €44–€60 billion, with a gross margin of 56%–60% 🟢

AI and Semiconductor Expansion

AI, HPC, and automotive semiconductors will drive demand for advanced lithography tools.

📌 CEO Fouquet on ASML’s long-term positioning ⭐

"We are not just following industry trends; we are enabling them. The increasing complexity of semiconductor devices means lithography will remain a critical bottleneck—and an opportunity—for years to come."

Lithography Layer Growth

More advanced chips require higher lithography layer counts, reinforcing ASML’s market leadership.

📌 CEO Fouquet on lithography scaling 🦾

"Our customers need more layers to push Moore’s Law forward. This trend plays directly into ASML’s strengths, ensuring our technology remains at the center of semiconductor innovation."

Ready to dive deeper? Here’s what I offer and how I can help you

Free Access to 📊 Quarterly Updated Portfolio Composition - by Industry and Geography, plus Valuation Metrics → 📎 Expanse Stocks: Behind-The-Scenes

➕ Unlock Premium Content – $12/month or $100/year

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-Feb-2025)

🔎 Stock Picking Methodology – Learn my long-term strategy

💼 Full Portfolio Access – Holdings, Valuation metrics & Performance tracking

📈 Live Trade Updates – My latest trades & watchlist additions

📊 DCF & Reverse-Engineered DCF Models – Proprietary models & valuation guides

🎯 Swing Trading Strategy – My short-term trading approach

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles