Deep Dive Brief: Arista Networks

Building the Ethernet in the Era of AI with the "Arista Advantage"

Expanse Stocks x Finchat.io Partnership!

🎁 Get 20% off + 2 months free on any Finchat plan! →🔗 Claim Discount

Welcome Explorer!

This is the fifth edition of my Deep Dive Briefs, where I break down growth and high-quality businesses.

This time, I’m diving into:

Arista Networks (ANET) is a leader in networking equipment, specializing in Ethernet switches and software for data centers. The stock has been on a tear in recent years—and for good reason. Despite the sharp upward move, the company operates in a “no-so-sexy” market and remains relatively under-followed compared to AI darlings like Nvidia or Big Tech peers. In the stock market, flying under the radar can be an advantage.

What truly sets Arista apart, in my view, is its technological superiority in networking, outstanding financial strength, and its rock-solid management team.

Topics I’ll cover

🔹 Company Overview – History & leadership insights

🔹 Business Model & Core Offerings

🔹 Economic Moat & Growth Drivers

🔹 Capital Allocation

🔹 Risks & Competitors

🔹 Fundamentals + Technical Analysis

💡 Earnings Growth Model – A quick mental framework to estimate returns

🔐 For Paid Subscribers:

🔹 Traditional DCF Model – Intrinsic value & implied share price

🔹 Reverse-Engineered DCF – Expected returns using my proprietary models

🔹 Final Thoughts – My stance on Arista as a long-term investment

Let’s dive in!

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO | 🧙♂️ CSU Part #1

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy, Industry Write-ups & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

🔐 Paid Subscriber Exclusives

💼 Portfolio Corner – Holdings, valuation models, trades, performance & more!

🤫 Exclusive Sections – From select articles, Deep Dive Briefs & Hidden Gems

👀 Recent Releases!

👀 Coming Soon

💎 Unlocking Japan - Part #1: The Overlooked SaaS goldmine

💎 Unlocking Japan - Part #2: A Hidden Gem

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 11-Sep-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles

Company Overview

Arista Networks has carved a unique niche in the fast-evolving networking industry, setting new standards in high-speed data communication. Founded in 2004, the company has become a synonymous with innovation, offering state-of-the-art Ethernet switches and software solutions.

With a focus on data centers, cloud providers, and enterprises, Arista attends the critical needs of modern connectivity, scaling performance to meet the demands of an increasingly digital world.

A Bit of History: Building Blocks of Success

Arista’s journey started with the vision of three industry luminaries—Andy Bechtolsheim, Ken Duda, and David Cheriton.

Each brought his piece of experience to the table, having developed technical skills at top companies like Sun Microsystems and Cisco. Together, they set out to revolutionize networking with a software-first philosophy.

The pivotal moment came in 2008 with the launch of EOS, the industry’s first fully programmable and Linux-based network operating system.

Unlike its competitors, EOS was designed to be resilient and highly modular, enabling organizations to fine-tune their networks with precision. Initially, financial institutions adopted EOS for high-frequency trading due to its low latency. However, its versatility soon captured the attention of big data clients across diverse industries.

By 2010, Arista introduced its 7500 Spine switch, a game-changer in data center architecture. This product replaced the traditional three-tiered network design with a more efficient two-tiered spine-leaf configuration. The result? Faster performance, lower costs, and scalability.

Leadership: Perfect Blend of Execution & Tech Innovation

In October 2008, Arista’s co-founders Andy Bechtolsheim and David Cheriton, took another bold decision and appointed Jayshree Ullal as CEO and President.

This former Cisco executive had an impressive track record of transforming Cisco's business, from its early days in 1993 to a $5 billion operation by 2000, and subsequently growing it to over $10 billion by 2010, all while managing more than 20 mergers and acquisitions in the enterprise sector.

Under Ullal’s leadership, Arista has skyrocketed from a startup to a global networking powerhouse. Her ability to execute has earned her accolades like Fortune’s "Top 20 Business Persons" in 2019 and Barron’s "World’s Best CEOs" in 2018.

On the technological front, Andy Bechtolsheim stepped into the role of Chief Architect, while Ken Duda took on the role of Chief Technology Officer. Today, they continue to drive Arista’s technological innovations, ensuring the company remains at the forefront of the networking industry.

Business Model

Their business model revolves around providing high-end, scalable networking solutions adapted for data centers, cloud computing environments, and large-scale internet companies like Microsoft. Instead of focusing on the "compute" side of technology, Arista is a master at delivering networking systems that enable high-speed communication between computing resources.

Revenue generation comes from two primary streams:

Product Revenue: This forms the lion’s share (80%) of Arista’s total revenue and includes the sale of specialized high-performance networking hardware such as switches and routers. These products integrate the company’s proprietary EOS software, delivering flexibility and customization for customers.

Service Revenue: This includes post-contract support and renewals (20%), which customers typically purchase alongside hardware on a recurring basis. Service revenue has outgrown product, and Arista wants to further increase recurring revs sources by expanding its Software-as-a-Service offerings.

Geographies and Diversification

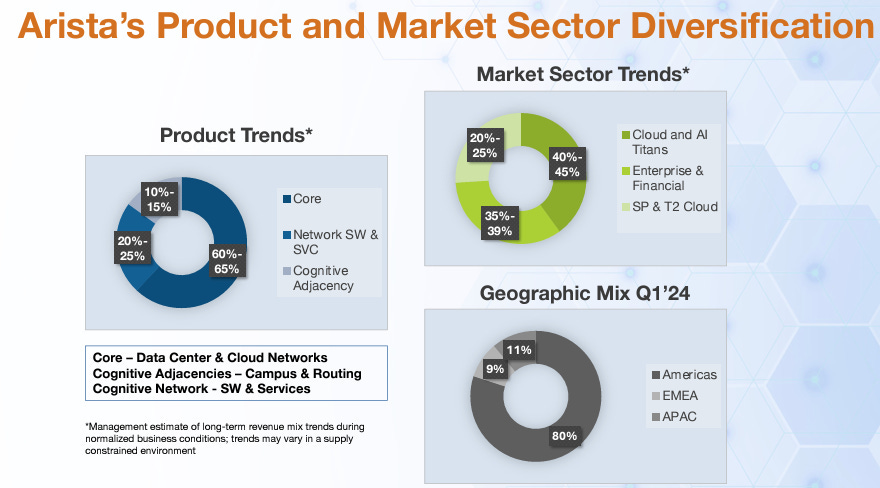

Geographically, Arista’s biggest market is North America, which contributes approximately 80% of its revenue. The remaining share comes from Europe, the Middle East, and Africa (~11%) and the Asia-Pacific region (~9%).

Core Offerings: The “Arista Advantage”

Arista’s product portfolio is built to address high-speed data demands while simplifying network management.

As an engineer working in the field of data infrastructure and software, I understand how complex and technical Arista’s networking solutions can be. To avoid overwhelming this article, I won’t delve too deeply into the details here. However, I came across a well-crafted white paper, the Arista Advantage, published on their investor site. It provides an in-depth explanation of the evolution of the internet and networking over the years, highlighting Arista’s deep understanding of modern organizational challenges and how their software-driven cloud networking architecture and —the “Five A’s” framework—addresses these needs.

If you’d like to explore it, here’s the link to the full PDF 📎 Arista_Advantage.pdf

That said, I’ll share a lighter content and key insights into their core offerings and advantages:

🔹High-Speed Switches

Arista dominates the market for switches operating at speeds of 200 gigabits or more. These devices form the backbone of data centers, ensuring seamless communication between servers.

📍 Example: The 7500 Spine switch (first version launched in 2010) remains the standard for hyperscale clients, delivering reliability and high performance.

🔹Extensible Operating System (EOS)

The crown jewel of Arista’s offerings, EOS is a modular, programmable operating system designed for scalability and efficiency. Its decentralized architecture reduces downtime and facilitates easier network upgrades.

Arista’s website is packed with excellent introductory videos on their core technologies. And who better to explain EOS than Ken Duda, one of Arista’s tech-savvy co-founders? I highly recommend checking out the Arista EOS products section, 📎 here, to gain a clearer understanding.

🔹CloudVision

This workload orchestration platform extends EOS’ capabilities to analyze, automate and optimize operations across multi-cloud and enterprise environments. It’s like having a virtual orchestra conductor ensuring every piece of your network orchestra plays in harmony.

Here is a nice 12min CloudVision overview shared by Arista 📎 Video

🔹 Emerging Markets

Arista’s innovative Network-as-a-Service strategy has allowed the company to expand beyond traditional data centers into new areas:

Cognitive Campus Networking: Supporting localized networks within limited geographic areas while implementing Zero-Trust Network Security. Learn more 📎 here

Cognitive Unified Edge (CUE) & WiFi Networking: "Networking at the edge" delivers secure and compliant connectivity for IoT devices and remote/hybrid work environments.

Economic Moat

Arista’s competitive advantage come from its intangible assets, high barriers to entry created by switching costs, but also its relentless focus and commitment to technological innovation.

🔹Intangible Assets

EOS represents nearly two decades of development, incorporating feedback from hyperscalers and enterprises. Its API-rich ecosystem and modular design address diverse customer needs, from large-scale cloud providers to smaller enterprises deploying private clouds. EOS’ decentralized architecture offers reliability and flexibility, providing customers with a significant edge in network performance.

📍 Example: By leveraging EOS, Microsoft integrates programmability and efficiency into its hyperscale cloud infrastructures.

🔹Switching Costs

Transitioning away from Arista involves big operational hurdles. Customers face high costs related to retraining staff, redesigning workflows, and implementing new systems. Moreover, Arista’s proprietary configurations often require years of optimization, further embedding their solutions within its clients’ ecosystems.

📍 Example: Meta has relied for years on Arista’s high-speed switches, demonstrating the difficulty of replacing such critical components in its ever-growing complex infrastructure.

🔹Focus on Ethernet Innovation and AI

Arista is a founding member of the 25 Gigabit Ethernet consortium which continues to lead the industry with advancements in future 400 Gbps deployments and the development of higher data rates for network spines and Data Center Interconnects.

Furthermore, Arista’s Ethernet technology continues to challenge InfiniBand (Nvidia’s) in AI networking. Its flexibility, scalability, and cutting-edge speeds make Ethernet a preferred choice for AI workloads, securing Arista’s place as one of the leaders in the AI networking market.

Growth Drivers

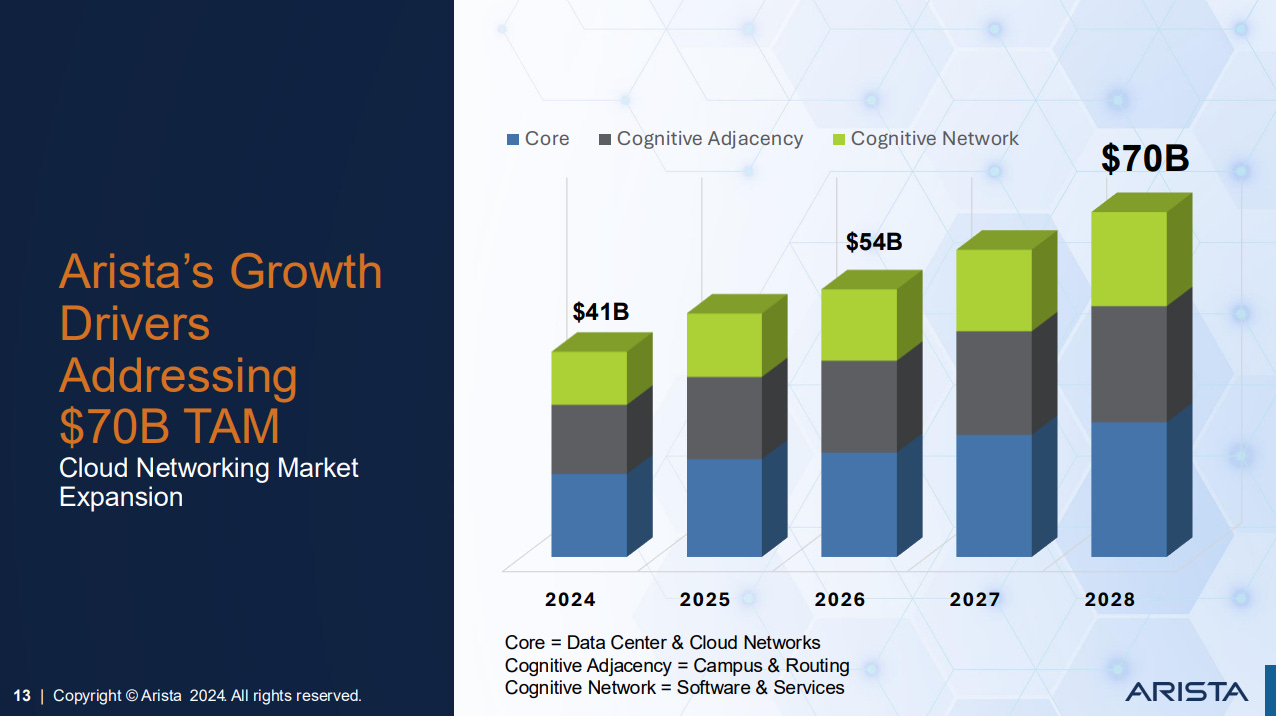

AI and advanced networking standards like 400G represent transformative opportunities for Arista, but there is more to it. The key drivers are:

🔹Cloud Migration and Consistent Market Share Gains

Enterprises continue to embrace digital transformation, increasingly rely on cloud environments, demanding high-speed and programmable networks. Arista’s solutions align perfectly with these requirements, offering both performance and cost efficiency.

Arista’s superior products have allowed it to consistently capture market share from its main competitor, Cisco, in the high-speed data center switching market, further amplifying these trends.

🔹AI Networking

The surge in AI workloads requires ultra-high-speed networks to manage massive data demands. With Ethernet becoming the preferred choice over InfiniBand — which current holds over 80% market share — Arista is primed to capture a significant share of the $25 billion AI data center market.

🧐 Why Ethernet Wins? State of the art technology supports speeds up to 800G, Ethernet outpaces InfiniBand in scalability and troubleshooting flexibility, making it the preferred choice of next-gen AI infrastructure.

🔹400G and 800G Transition

As the shift to 400G (and eventually 800G) networks gains momentum, Arista’s advanced switches are well-positioned to accommodate growing data traffic. This standard is vital for high-bandwidth applications like virtual reality and cloud gaming, providing Arista good chances to remain a market leader.

🔹Enterprise Expansion

Arista’s venture into enterprise and campus markets—including innovations like Wi-Fi 6, “Networking at the Edge” and AI-driven network management— diversify its revenue streams and boosts market penetration.

Total Addressable Market (TAM)

Overall, this positions Arista to tap into a growing TAM of approximately $70 billion (estimated for 2028).

Capital Allocation

Arista’s approach to capital allocation is quite straightforward as explained on their latest 2024 investor presentation:

Risks and Competitors

While I reckon Arista’s strengths are significant, it faces several risks (including the recent DeepSeek developments):

Customer Concentration:

Microsoft and Meta account for approximately 40% of Arista’s revenue. This reliance creates vulnerability to shifts in spending by these key clients. A reduced infrastructure buildout from either customer could impact growth.

Product Concentration:

Arista’s revenue is still heavily reliant on its switch products. While diversification into other segments seems to be underway, as noted before, it remains a critical area for long-term success.

800G Transition:

As the networking industry moves toward the 800G standard, Arista will need to invest heavily in R&D to remain competitive. As always in tech innovations, costs and potential delays could pose challenges.

Manufacturing Dependence:

Arista relies on third-party manufacturers for its products. This limits its control over pricing, production timelines, and quality assurance, leaving it vulnerable to supply chain disruptions and cost fluctuations.

AI Networking Evolution:

To build AI networks, Ethernet technology must evolve further. This process will require years of development and capital investment, during which competitors may close the gap.

⚠️ Recent Market Drama: DeepSeek

DeepSeek, a Chinese AI upstart, claims it can train GPT-4-level models at a fraction of the typical cost—just $5–6M compared to $100M+—using innovations like Mixture of Experts, multi-token steps, compression, and chain-of-thought enhancements. These advancements reduce GPU requirements for both training and inference.

For those interested in a deeper dive into DeepSeek’s claims and implications, I recommend an excellent FAQ from Stratechery by a respected tech analyst in the Fintwit community. While some explanations are technical, I’ve found them insightful and worth exploring 📎 DeepSeek FAQ

What are the implications for Arista’s Business?

In my opinion, it’s too early to determine the full impact. If DeepSeek’s methods significantly cut AI’s GPU requirements, hyperscalers like Meta or Microsoft might reduce their CapEx, potentially impacting Arista’s growth tied to AI infrastructure. However, in Arista’s most recent guidance, management estimated around 10% of FY25 sales to be AI-related, with general data center build-outs still critical for high-speed networking needs.

On the flip side, some argue DeepSeek’s efficiency gains could align with Jevons Paradox (read more 📎 here): as AI becomes cheaper, adoption broadens, leading to greater demand for GPUs and networking infrastructure. This could benefit companies like Nvidia and Arista in the mid-to-long term.

All in all, I don’t have a strong opinion on this yet and I think it’s essential to listen to what Arista’s management got to say about this.

Competitor Landscape

Arista’s success puts it in direct competition with established industry players like Cisco. Cisco’s expansive portfolio, including cybersecurity and collaboration tools, appeals to a broader customer base, particularly smaller enterprises and campus networks.

Other players, such as Juniper Networks and Huawei, are also competing for market share, investing in similar high-speed technologies and emerging markets.

Arista’s ability to maintain its innovative edge will be crucial in defending its market position.

Blending Fundamentals with Technical Analysis

When evaluating a business, it's important to balance fundamentals with technical signals. In a market molded by algorithms and sentiment, it's easy to be distracted by short-term fluctuations. My focus remains on long-term trends, filtering out daily noise to get a clearer picture.

Some key valuation metrics I’ll focus on when evaluating Arista include:

Growth metrics: Revenue Growth (by segment Product and Service Revenue)

Profitability: Gross Profit, Earnings Per Share (EPS) Growth, R&D-to-Revenue and SG&A-to-Revenue

Financial Sustainability & Capital Efficiency: Return on Invested Capital (ROIC), Cash Reserves, Free Cash Flow per Share, Cash Flow Conversion, Debt

Valuation: P/E, EV/FCF

For technical analysis, I prefer simplicity, sticking to a few core indicators for weekly timeframes:

100-week and 50-week MA: To track trends and support/resistance levels

MACD: To gauge momentum and identify buy/sell signals through crossovers and divergences

Volume: To measure the strength of price movements and confirm breakouts

Price levels: Important historical price levels acting as long-term support or as resistance.

🔌 Arista Networks (ANET)

Weekly Technical Analysis

📈 Price Trend:

ANET has been a compounding beast, delivering +260% returns over the past 2 years as hyperscalers ramped up CapEx. The stock has consistently ridden its 50-week MA since early 2023. While valuation multiples have expanded, Arista has simultaneously improved profitability and capital efficiency—a key factor in sustaining its strength.

🔹 Price Levels & Support:

Support: Strong at low-$90s (near 50-week MA).

Resistance: $110, $120, $130 (breakdown gaps).

📊 Key Indicators:

✔ Ascending 50-week MA (orange): Longstanding launchpad for bullish momentum.

✔ 100-week MA: Well below current price, last tested in early 2023.

✔ MACD: Positive momentum intact, although showing signs of “wanting” a pause

✔ Volume: Decreasing overall but with accumulation spikes on dips—a classic bullish sign of a strong stock benefiting from favorable momentum and industry tailwinds.

But…

🧐 21-Feb Update: DeepSeek-Driven Drawdown & Post-Earnings Dip

Recent volatility from the DeepSeek narrative and recent Q4 earnings has triggered higher selling volume and a potential momentum pause. A breather here wouldn't be surprising—more thoughts at the end of this Deep Dive.

Growth Trends

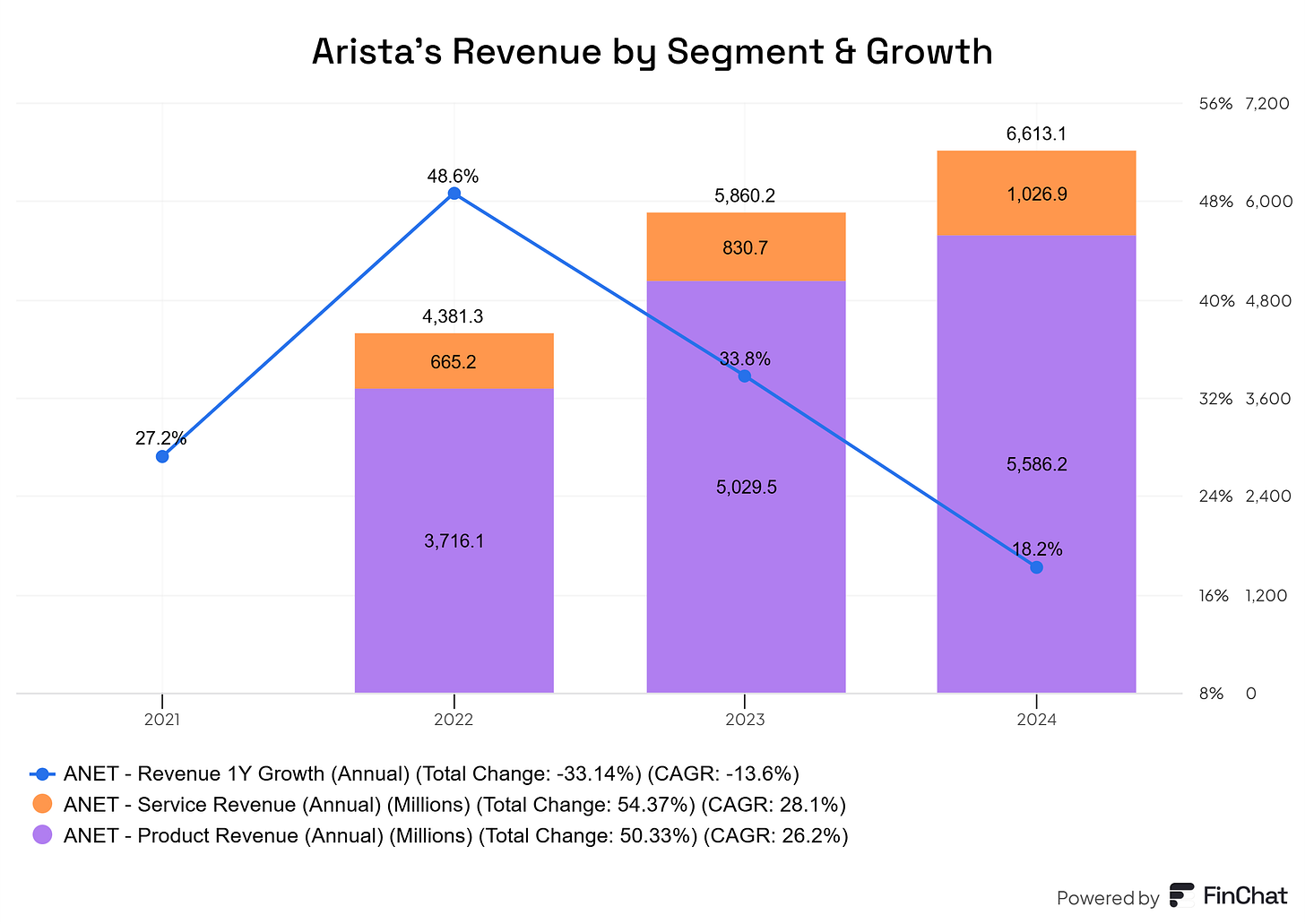

Arista’s impressive performance over the past few years has been in part due to its strong top-line growth. The Product revenue segment, its largest, has compounded at an impressive 26.2% CAGR over three years, while its smaller but rapidly expanding Service revenue has grown at a 28.1% CAGR during the same period.

However, overall YoY revenue growth has notably decelerated from a peak of +48.6% in FY2022 to 18% in FY2024. This slowdown raises an important question for FY2025: Will growth stabilize, accelerate, or decline further?

Management has provided a FY2025 guidance of 15–17% revenue growth in their most recent Investor Presentation. Given Arista's reputation for giving conservative guidance, it wouldn’t surprise me to see them exceed these estimates and achieve 20% growth next year.

Profitability

While top-line growth has been impressive, the key factor driving Arista’s stock performance has been its ability to manage the bottom line even better 👇

As you may already know, EPS growth is one of the primary drivers of stock returns, and Arista has delivered on this front with exceptional performance—posting a 46% CAGR over the last four years.

This impressive growth wasn’t just a result of rising revenues, but also, from Arista’s ability to optimize operating expenses relative to revenues. As shown in the chart above, both R&D-to-revenue and SG&A-to-revenue ratios have steadily declined, showcasing Arista’s operational efficiency.

At the same time, the company has maintained gross profit margins in the mid-60% range—higher than ever. Simply perfect execution.

Sustainability and Capital Efficiency

If profitability was impressive, their capital efficiency is out of this world 👇

Over the past four years, Arista Networks has elevated its Return on Invested Capital (ROIC) from an already stellar low-40% range to a world-class mid-50% range. At the same time, the company has compounded its Free Cash Flow (FCF) per share at an impressive high-40% CAGR.

The icing on the cake? $7.5 billion in cash on hand, a FCF-to-EBIT conversion ratio over 100%, and zero debt. These are financials that few companies can rival.

But the big question for investors is clear: Can this level of performance and growth be sustained long-term? Hard to tell but their combination of top management, superior product offerings, competitive advantages, and favorable industry tailwinds position them well for continued success.

Now, let’s turn to the valuation side!

Valuation: Reset Post-DeepSeek related Dip

With the recent pullback in stocks tied to AI CapEx narratives, such as ANET, valuations have eased from the "very high" multiples seen in recent years to "high but not overly expensive" levels.

Currently, the stock still trades at the upper end of its historical range for NTM P/E, P/FCF, and EV/Sales multiples. While it may still seem priced to perfection, high-quality companies like Arista often expand their multiples leading to higher premium valuations.

If the industry tailwinds continue blowing in its favor, it's likely the market will reward Arista accordingly, as it has in the past.

We will get to see more on valuation and expected returns on the next section.

Earnings Growth Model: A Quick Mental Framework to Estimate Potential Returns

A simple way to approximate long-term stock returns is using this formula:

📌 Expected Return ≈ Earnings Growth + Dividend Yield ± Valuation Change

For a growth-focused stock with minimal or no dividends like Arista Networks, this may be more suitable:

📌 Expected Return ≈ Earnings Growth ± Valuation Multiple Expansion/Contraction

This model helps investors quickly assess if a stock’s projected growth aligns with their return expectations—without diving into more complex DCF calculations.

1️⃣ Earnings Growth (EPS Growth Rate)

Earnings growth is calculated using the EPS Growth Rate. To estimate this rate, consider:

Historical EPS growth: My starting point is typically over 5 to 10 years.

Analyst estimates: Useful but often optimistic, so take them with a grain of salt.

Management forecasts & industry trends: Help refine assumptions.

Arista’s case:

EPS has grown at a 27.2% CAGR over the last five years.

Analysts project 19% annual EPS growth for the next 3+ years.

Management’s Investor Day insights suggest 20+% EPS CAGR ahead.

To stay conservative, let’s assume an 18% EPS growth rate.

2️⃣ Valuation Multiple Expansion/Contraction (Change in P/E ratio)

To estimate the impact of valuation changes:

Where:

Ending P/E = Fair P/E at the end of the holding period.

Current P/E = P/E at the start.

N = Holding period in years.

Arista’s case:

Current P/E = 54x, well above its 5-year average of 37x.

Assuming a 5-year holding period, a reasonable fair P/E might be 35x (considering its high quality).

This results in a valuation drag of -8.3% per year.

3️⃣ Earnings Growth Model Results

So, Arista’s Expected Returns over 5 Years is:

📌 Earnings Growth ± Valuation Change ≈ 18% − 8.3% = +9.7% CAGR

🔑 Key Takeaways

The Earnings Growth Model offers a quick way to estimate returns.

Three factors—EPS growth, (dividends), and valuation shifts.

Margin of safety is key—Wall Street projections can be overly optimistic.

Arista’s estimated 9.7% annual return suggests market-like performance.

Of course, this approach —although straightforward— doesn’t capture intrinsic value fully and it’s oversimplified, so I like to complement it with my DCF and reversed-engineered DCF models.

Next content is reserved for Paid Subscribers and includes:

1️⃣ Traditional DCF Model – Intrinsic value & implied share price

2️⃣ Reverse-Engineered DCF – Expected returns using my proprietary models

3️⃣ Final Thoughts – My stance on Arista as a long-term investment

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 11-Sep-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles