Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 28-Jun-2025)

Welcome Explorer!

This is the second edition of my Deep Dive Briefs, where I break down growth and high-quality businesses.

This time, I’m diving into Parsons (PSN)—an under-the-radar leader in tech-driven solutions, capturing surging demand in defense, intelligence, and critical infrastructure.

Topics I’ll cover

🔹 Company Overview – History & leadership insights

🔹 Business Model & Core Offerings

🔹 Economic Moat & Growth Drivers

🔹 Capital Allocation

🔹 Risks & Competitors

🔹 Fundamentals + Technical Analysis

🔹 Final Thoughts

Let’s dive!

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

👀 Coming Soon

💆♂️ A Reflection on my Investing Mistakes

💸 The Power of Optionality

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 28-June-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles

Company Overview

Making History For 80 Years: From Post-War Innovator to Global Powerhouse

“The secret to hire and retain talent is good luck . . . the proper perception of people . . . and a good feel for the future of business.” — Ralph M. Parsons, Founder of Parsons, answer to a close friend and colleague on they key to attract talent.

Parsons Corporation history is a testament to American ingenuity and resilience. Founded in 1944 by Ralph M. Parsons, the company emerged during the post-WWII boom as a small but key player in the engineering and construction sectors.

Strategically based in Los Angeles in its early days, Parsons quickly secured projects from government agencies and defense contractors. Benefiting from its proximity to key military and aerospace hubs like the Naval Air and Missile Test Center and the Space and Missile Systems Organization, it allowed the company to sink its teeth into cutting-edge developmental projects. From electronics to instrumentation, Parsons was at the forefront of technological innovation, helping to shape the future of aircraft, missiles, and rocket facilities.

By the 1950s, Parsons ventured into the oil and petrochemical industry, collaborating with major clients such as Shell and Gulf Oil, setting the stage for decades of expansion. Yet, Parsons vision extended beyond profit. In 1961, it founded the Ralph M. Parsons Foundation, demonstrating a commitment to philanthropy. The same year, it solidified its industry presence by establishing its Pasadena headquarters.

The 1970s and 80s brought strategic acquisitions, enabling Parsons to work on renowned infrastructure projects, including the Mackinac and Brooklyn Bridges. In 1985, the company introduced an Employee Stock Ownership Program, allowing employees to gain a stake in the business proportional to their salaries and fostering a sense of ownership and loyalty—a tradition that continues to shape its culture.

However, it wasn't all smooth sailing for Parsons. In 1996, the company faced a tragic loss when its CEO, Leonard Pieroni, was killed in a plane crash along with U.S. Commerce Secretary Ron Brown.

Parsons’ adaptability carried it into the XXI century. In 2012, it showcased logistical expertise by managing the move of the Space Shuttle Endeavour from LAX to the California Science Center—at no cost to NASA or the center, proof of its commitment to community service.

Transition from Industrial to Technology Solutions

In 2019, Parsons relocated its headquarters to Centreville, Virginia, strategically aligning itself closer to key clients and growth opportunities. That same year, it returned to public markets as PSN, raising $500 million through an IPO after 35 years of private, employee-owned operations.

Under the leadership of Carey Smith—Chair, President, and CEO—who assumed the role in 2021, Parsons started its transition from an industrial engineering firm into a tech-driven powerhouse.

Historically committed to industrial project management and physical infrastructure, securing government contracts has remained central to Parsons' business model, despite fierce competition and narrow profit margins. However, the increasing focus on digital and technology-based solutions offered Parsons a chance to differentiate itself and capture market share in specialized, higher-margin niches. This strategic pivot is essential as the company recognizes the increasing importance of technology in modern defense and infrastructure.

Key acquisitions have accelerated this shift:

Xator Corporation (2022): Strengthened Parsons' capabilities in cybersecurity, intelligence, and biometrics.

BlackSignal Technologies (2024): Brought expertise in digital signal processing and electronic warfare.

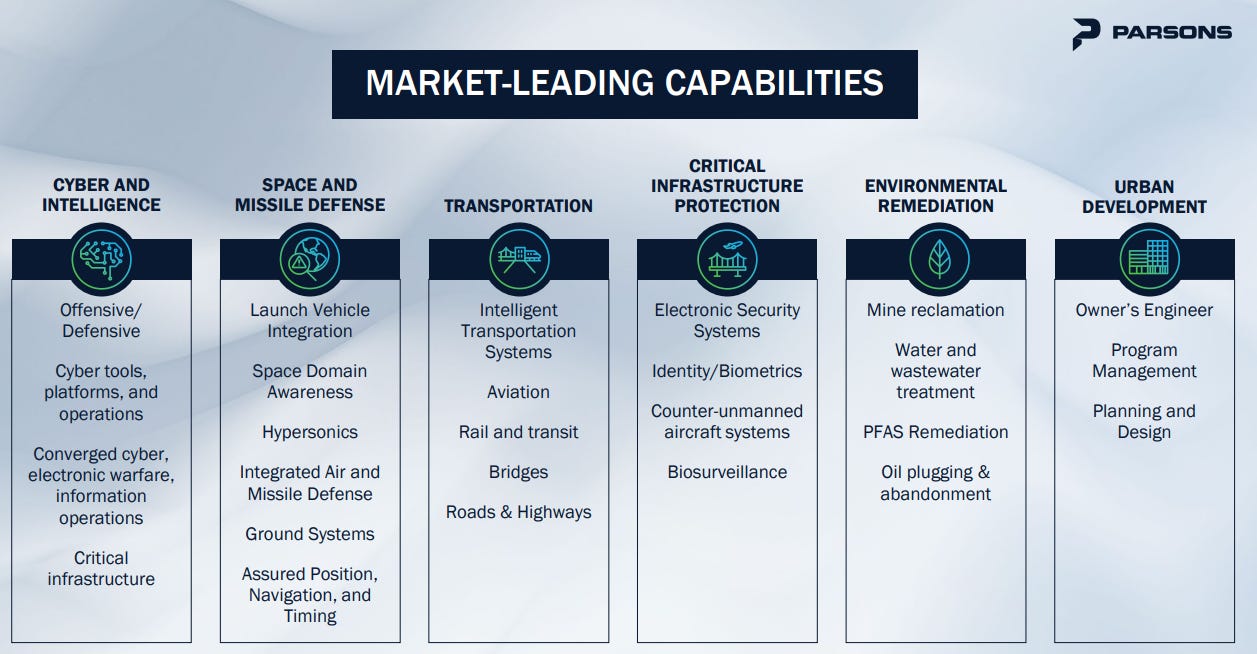

Today, Parsons operates through two primary segments:

Federal Solutions: This unit provides services like cybersecurity, missile defense, and engineering support to U.S. government bodies, including the Department of Defense. The Defense & Intelligence division focuses on command, control, and surveillance, while Engineered Systems delivers infrastructure and environmental monitoring services.

Critical Infrastructure: This segment covers complex infrastructure needs. Mobility Solutions handles essential projects such as roads, bridges, and water systems, while Connected Communities offers smart city solutions to modernize urban infrastructure through advanced technology.

From cybersecurity innovations to efficient water treatment systems, the company functions as the behind-the-scenes architect ensuring vital operations for government and private sector clients in critical industries.

Parsons' legacy is one of adaptability, innovation, and dedication to its mission. From its post-war roots to its current role as a leading provider of technology solutions, the company embodies resilience and a commitment to its people and the communities it serves.

Growth Strategy, Investment Thesis & Competitive Landscape

Enhancing and Optimizing Core Operations—Improve core operations through revenue growth, margin expansion, and strong cash flow by:

Cross-Selling Services: Broadening client offerings with services, including those from acquisitions.

R&D Investments: Advanced cybersecurity, iNET systems, data analytics, and software solutions.

Portfolio Management: Phasing out underperforming sectors.

Working Capital: Maximizing cash flow with disciplined practices.

Expanding into Adjacent Markets—Seek organic growth through strategic market penetration:

Space: Boosting space situational awareness and satellite services.

Smart Cities: Enhancing the iNET platform with AI, cybersecurity, and cloud computing.

Critical Infrastructure Protection: Targeting markets driven by high-threat and regulatory needs.

Energy: Providing security and efficiency solutions to energy sectors.

Health: Applying AI and data analytics to federal health research and care.

M&A and Integrating Disruptive Technologies—Transform business capabilities through acquisitions that bring innovative software and hardware focused on:

Cybersecurity: Protecting large-scale infrastructure with intelligent data analysis.

Intelligence Software: Generating actionable insights from vast data.

IoT Integration: Using sensor data for smart city mobility.

Space Software: Enhancing satellite operations and data analysis with AI.

This multi-growth strategy underscores Parsons' commitment to innovation and expansion while solidifying its market leadership in technology-driven solutions.

Investment Thesis

CEO Carey Smith sums up Parsons’ compelling investment case:

“We have the right portfolio and the right people at the right time, with a distinguished national security profile positioned to outpace near-peer threats and unprecedented infrastructure spend that aligns with Parsons’ strategy.” — Carey Smith, Chair, President, and CEO on Q2 2023 earnings report.

Proven Leadership: An experienced management team with a track record of meeting commitments.

People-First Culture: A mission-driven approach and commitment to its people that attracts top talent.

National Security Expertise: Unique portfolio poised to outpace evolving threats.

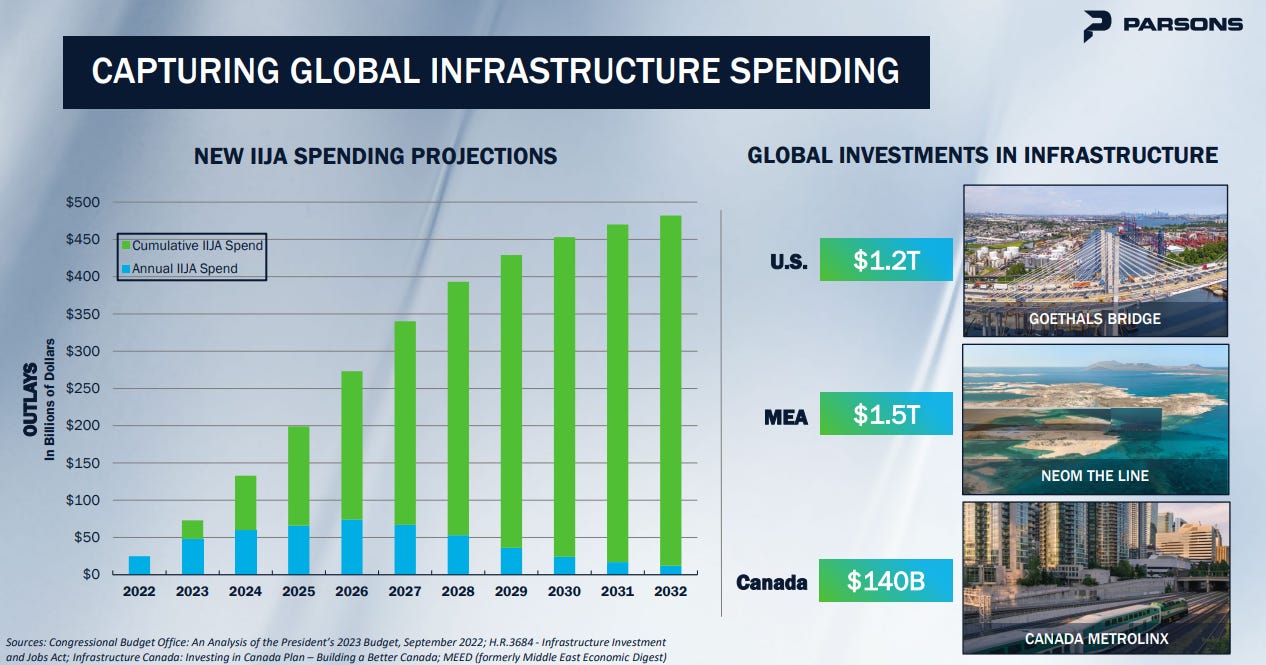

Infrastructure Boom: Positioned to capitalize on record global infrastructure investment this decade.

Robust Market Presence: Strong growth and profitability across all six core end-markets.

Strong Financials: Positive outlook with a solid history of effective capital deployment.

Competitive Landscape

Parsons operates in an industry marked by high-level competition:

In its Federal Solutions segment, it contends with major defense contractors and service providers such as Booz Allen Hamilton, Leidos, CACI International, Science Applications International Corporation, and defense giants like Lockheed Martin and Northrop Grumman. These competitors have significant resources and established government relationships, challenging Parsons to leverage its superior technological expertise to stand out.

In the Critical Infrastructure sector, Parsons competes with engineering and consultancy firms like AECOM, Jacobs Engineering, Stantec, and WSP Global. These firms offer comprehensive engineering services but are increasingly incorporating technology into their solutions to keep pace with evolving industry trends.

Despite being surrounded by larger peers, Parsons holds its own competitive advantage by maintaining a healthy backlog and consistent contract wins. This is demonstrated by new orders consistently outpacing current revenue. Moreover, its ability to integrate acquisitions positions Parsons as an adaptable contender capable of securing government contracts and expanding its influence.

Blending Fundamentals with Technical Analysis

When evaluating Parsons' stock, it's important to balance fundamentals with technical signals. In a market molded by algorithms and sentiment, it's easy to be distracted by short-term fluctuations. My focus remains on long-term trends, filtering out daily noise to get a clearer picture.

Since Parsons only went public in late 2019, historical data is limited. The company’s transition from traditional infrastructure to tech-driven, high-margin solutions complicates valuation. Thus, blending traditional infrastructure metrics with those aligned with tech and service companies will be more suitable.

Some key metrics I’ll focus on include:

Growth metrics: Revenue Growth, Federal Solutions Revenue (higher-margins services) vs Critical Infrastructure Revenue (lower-margins services), Total Backlog and New Awards

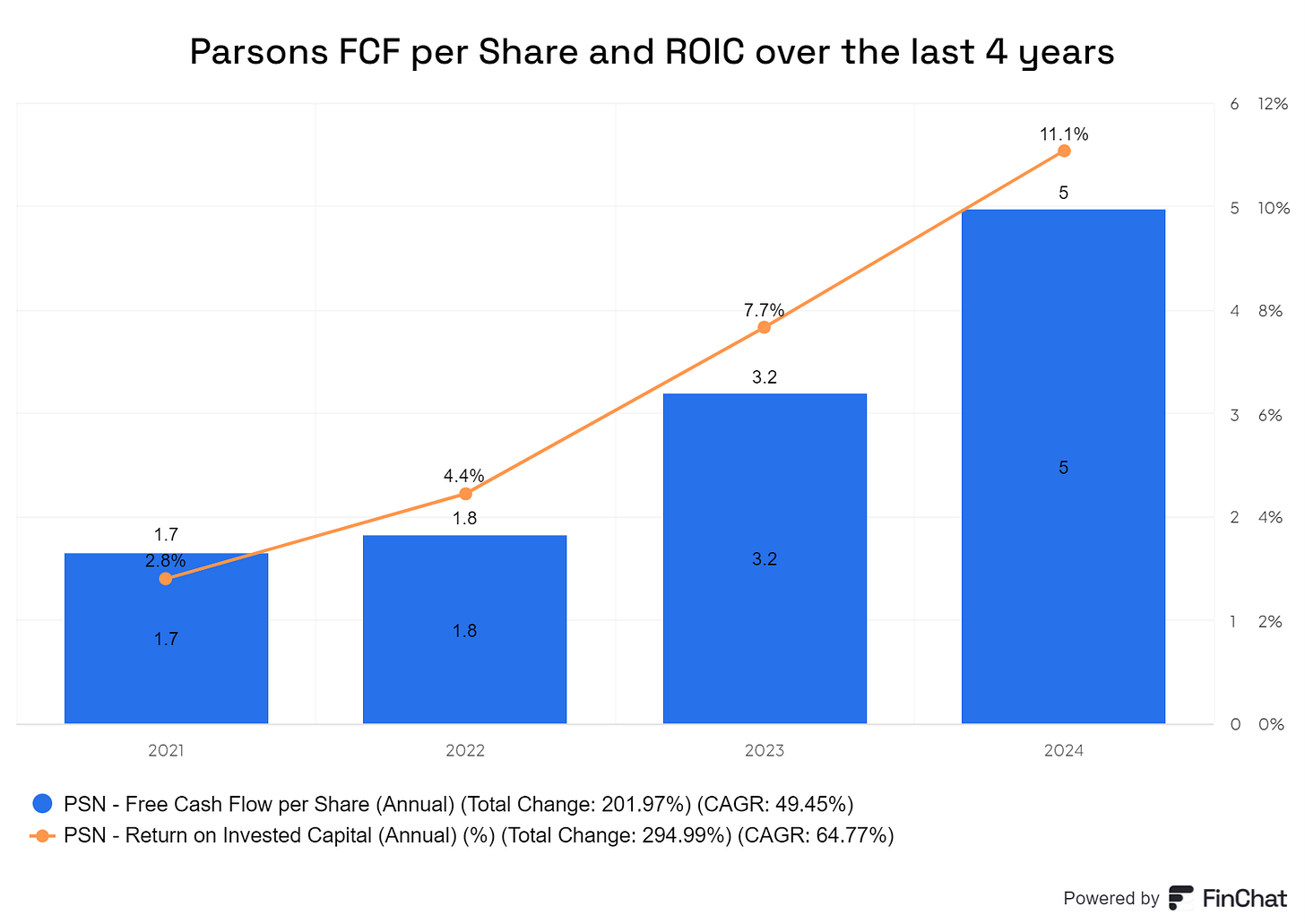

Financial Sustainability & Efficiency: Return on Invested Capital (ROIC), Operating Margin, Free Cash Flow (FCF), Debt-to-Equity

Profitability: EBITDA Margin, EV/EBITDA vs key competitors

For technical analysis, I prefer simplicity, sticking to a few core indicators for weekly timeframes:

20-week MA: To track trends and support/resistance levels

MACD: To gauge momentum and identify buy/sell signals through crossovers and divergences

Volume: To measure the strength of price movements and confirm breakouts

👷♂️ Parsons (PSN)

Weekly Technical Analysis

Price Trend: Parsons has seen a parabolic rise since its Q2 2023 earnings report, where it raised full-year revenue, EBITDA, and cash flow guidance. Their CEO highlighted the company’s ideal position on “capitalizing on unprecedented global infrastructure spending and the increasing demand for national security solutions”. This optimism has sparked a rerating, resulting in a breakout from its Stage 1 base in August 2023 and riding up the 20-week MA.

Price Levels: Support at $85 and low-$90s | Resistance at 110$.

MACD: Currently on a slowing upward momentum.

Volume: The rally’s been supported by strong buying pressure and high volume, though recent volume has dipped despite record-breaking earnings (again) last week.

Commentary: Parsons’ fundamentals continue to improve quarterly, but the stock may have priced in these gains for now. Slowing MACD and lower volume suggest a potential consolidation period to digest recent moves.

Growth Trends

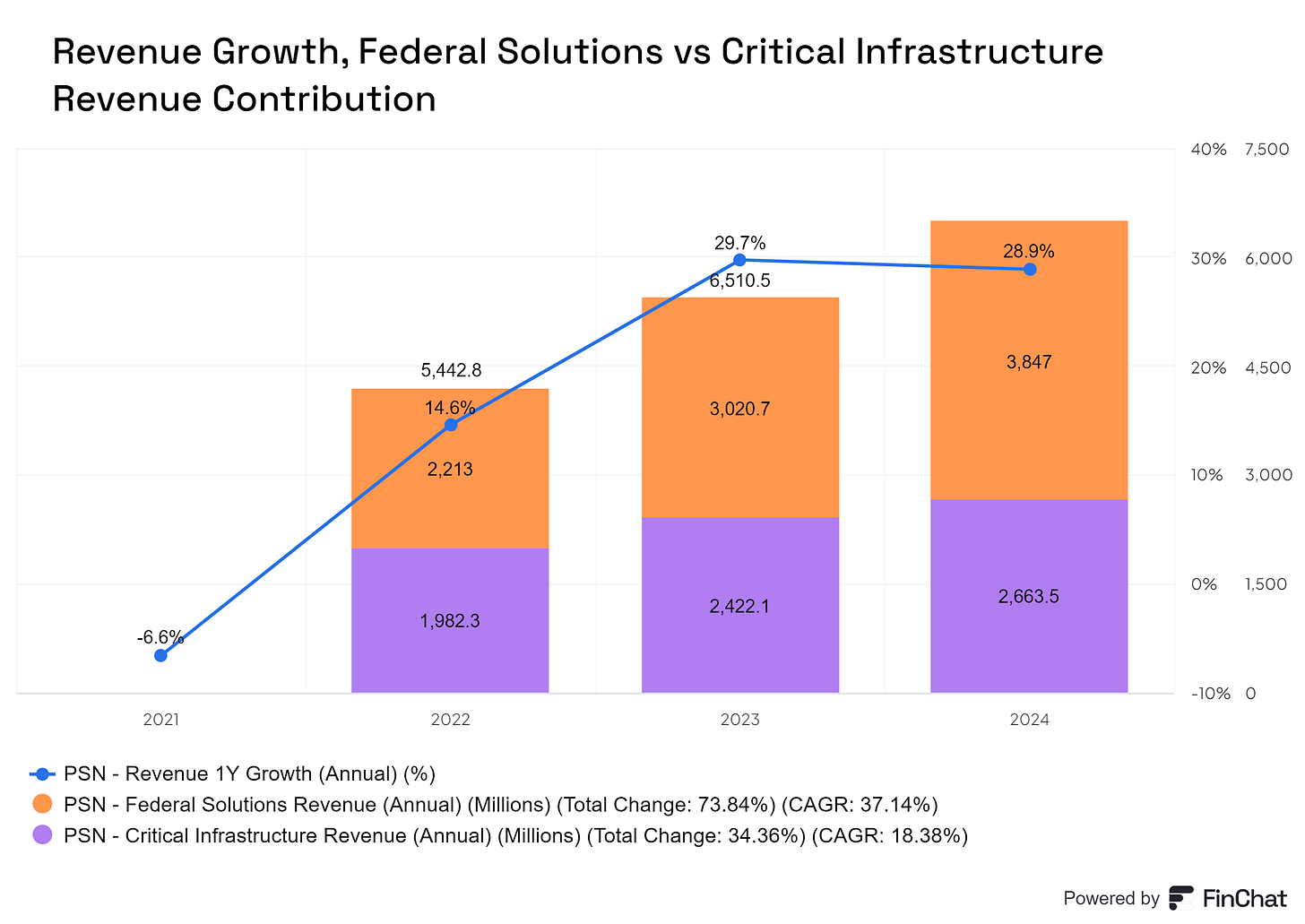

The Federal Solutions segment provides high-margin services like cybersecurity and missile defense, whereas Critical Infrastructure projects, such as roads and water systems, tend to yield lower margins.

Parsons’ strategic pivot toward tech-driven solutions has been crucial, enabling it to tap into high demand from government and major private clients. This shift has fueled revenue growth, which has accelerated to +29%, driven by a 3-year CAGR of +37% in Federal Solutions revenue and a move away from lower-margin infrastructure work.

Parsons is capitalizing on secular trends, including unprecedented infrastructure spending and surging demand for national security solutions. These tailwinds have boosted their backlog to $8.8B, up from $7.8B at the start of the pandemic.

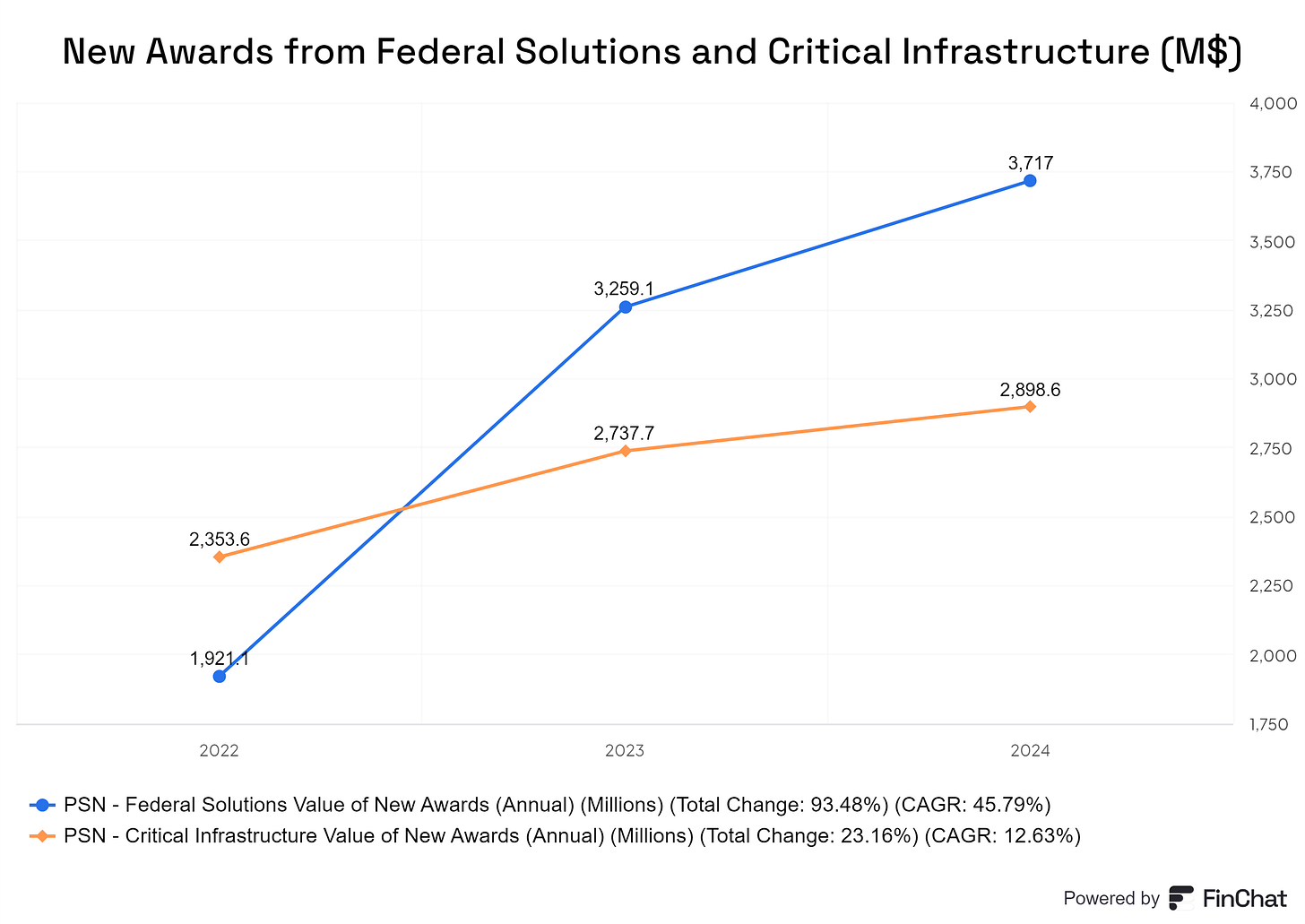

As shown in the chart below, new awards in both Federal Solutions and Critical Infrastructure have risen, with Federal Solutions achieving an impressive 3-year CAGR of 46%.

Profitability and Valuation

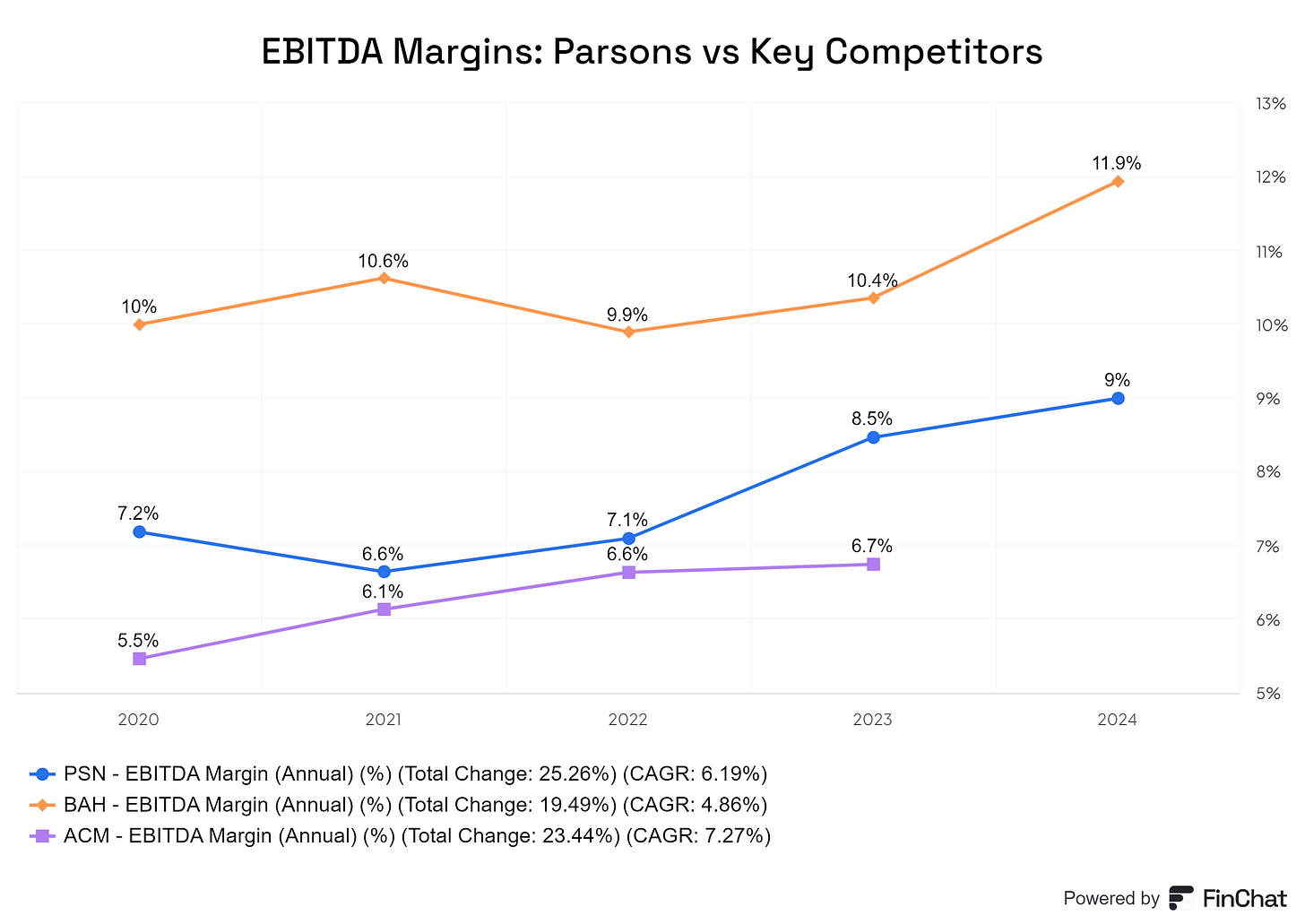

Over the past four years, Parsons has expanded its EBITDA margins from mid- to high-single digits. The chart above shows this progress, comparing Parsons with key competitors like Booz Allen Hamilton (BAH) in federal services and AECOM (ACM) in critical infrastructure. This reflects Parsons' strategic pivot toward higher-margin federal services over lower-margin infrastructure projects.

The market currently values Parsons at EV/EBITDA of 18.7%, aligning with peers in the Federal Services segment such as BAH. Long-term, Parsons is expected to approach EBITDA margins closer to those of top defense firms like Lockheed Martin, which stand at around 15%.

Sustainability and Efficiency

While revenue growth and higher margins have contributed to stock price expansion in recent years, I believe the real drivers are Parsons’ ROIC and free cash flow. As shown in the chart above, Parsons has impressively increased ROIC from 1.7% to 11.1% over four years, reflecting the benefits of its focus on higher-margin tech solutions. Free cash flow per share has also grown at a 50% CAGR during this period, supporting growth and R&D expenses.

What makes this even more remarkable is that Parsons has maintained a healthy 0.6 debt-to-equity ratio while pursuing strategic acquisitions to accelerate its shift toward tech-driven, higher-margin offerings.

Final Thoughts

Parsons Corporation is a testament to American ingenuity and resilience, transforming from its post-WWII roots in engineering and construction to a forward-thinking leader in tech-driven solutions.

Under current CEO Carey Smith, Parsons has strategically pivoted toward high-value services, capturing surging demand in defense, intelligence, and critical infrastructure.

The company’s growth strategy is focused on enhancing core operations, expanding into adjacent markets like space and smart cities, and integrating disruptive technologies such as AI-powered cybersecurity and IoT solutions.

With strong secular tailwinds in infrastructure and national security, Parsons has achieved this year +29% revenue growth, supported by a 3-year CAGR of +37% in its Federal Solutions segment. A $8.8B backlog and rising new awards in Federal Solutions and Critical Infrastructure support a sustained revenue visibility.

Valued at a forward EV/EBITDA of 18.7%, Parsons valuation is in line with peers in the Federal Services sector. The market anticipates low double-digit EBITDA margins, inching closer to industry leaders like Lockheed Martin at 15%. While some growth is priced in, Parsons’ strategic position, improved FCF and ROIC, and proven execution give the stock potential for further price expansion.

CEO Carey Smith summed it up best:

Parsons is equipped with “the right portfolio and the right people at the right time,” ready to lead in an evolving global landscape.

Thank you for being here! I hope you found this take on Parsons as insightful to read as it was for me to write. If you enjoyed this, keep an eye out for more deep dives!

Ready to dive deeper?

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 28-Jun-2025)