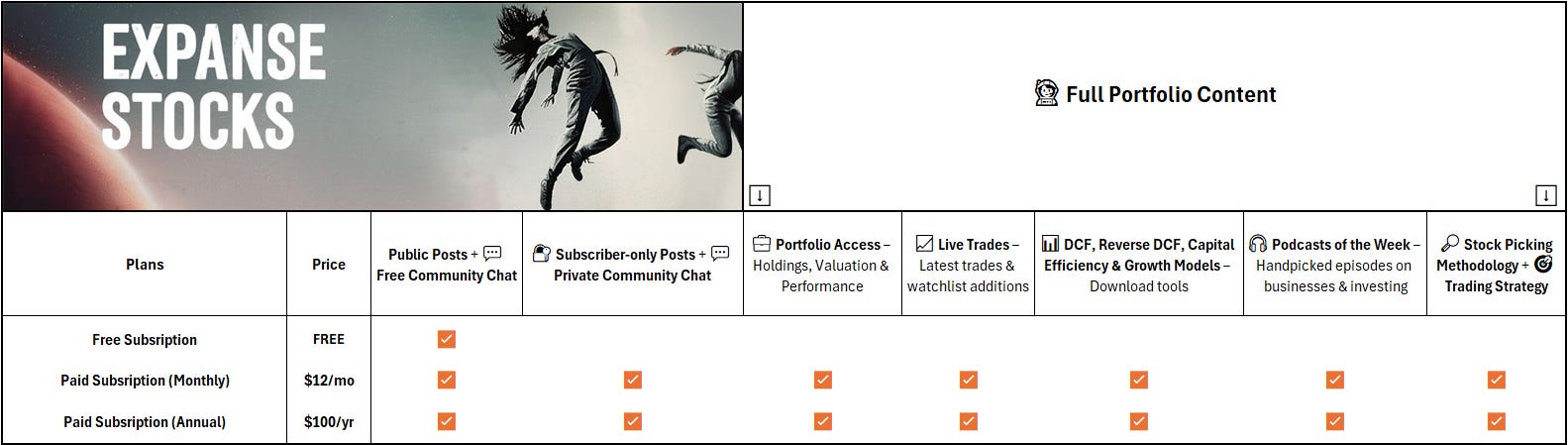

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 11-Sep-2025)

Expanse Stocks x Finchat.io Partnership!

🎁 Get 20% off + 2 months free on any Finchat plan! →📎 Claim Discount

Welcome Explorer!

This is the very first edition of my Deep Dive Briefs, where I break down growth and high-quality businesses.

I'm excited to share my research and insights about Cloudflare (NET), a promising and versatile young company in the cloud infrastructure space.

"We built Cloudflare with the vision of helping to build a better internet—one that is more secure, more reliable, and faster for everyone." - Matthew Prince, CEO and Co-Founder

Topics I’ll cover

🔹 Company Overview – History & leadership insights

🔹 Business Model & Core Offerings

🔹 Economic Moat & Growth Drivers

🔹 Risks & Competitors

🔹 Fundamentals + Technical Analysis

🔹 Final Thoughts

Let’s dive in!

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO | 🧙♂️ CSU Part #1

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy, Industry Write-ups & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

🔐 Paid Subscriber Exclusives

💼 Portfolio Corner – Holdings, valuation models, trades, performance & more!

🤫 Exclusive Sections – From select articles, Deep Dive Briefs & Hidden Gems

👀 Recent Releases!

👀 Coming Soon

💎 Unlocking Japan - Part #1: The Overlooked SaaS goldmine

💎 Unlocking Japan - Part #2: A Hidden Gem

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 11-Sep-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles

Company Overview

Founded in 2009 by Matthew Prince, Michelle Zatlyn, and Lee Holloway, the company was born out of an ambitious decision: rather than relying on big cloud providers like AWS, they built their own infrastructure. This bold move slowed growth in the beginning, but it laid the groundwork for Cloudflare’s current success. Today, they serve everyone from small developers to massive enterprises, helping them create secure, high-performance websites all around the world.

What Makes Cloudflare Stand Out?

Global Edge Network

Cloudflare operates a distributed network of Points of Presence strategically located in over 300 cities. These mini data centers process and route internet traffic closer to end users, reducing latency and improving performance. This network serves 95% of the world's population within 50 milliseconds, offering a competitive edge over other industry players like Akamai and Fastly.But it’s not just about speed. Unlike many companies that outsource their infrastructure, Cloudflare owns theirs, allowing them to launch new services faster and more cost-effectively. Their range of services is impressive, spanning everything from DDoS protection and zero-trust security to enterprise networking. This full-stack approach makes them a “one-stop shop” for businesses looking to secure and scale their digital presence

Pioneers in Serverless Technology

Their platform, Workers, allows developers to run code at the edge of their network—closer to users, meaning faster application response times. This is especially important when compared to traditional cloud infrastructure like AWS, where latency can be higher. With Workers, developers don’t need to worry about managing infrastructure, making it easier to build fast and reliable apps.The Freemium Model

By offering free or low-cost services early on, they created a flywheel effect, attracting millions of users. Today, they have over 174,000 paying customers, and a large chunk of the world’s internet traffic flows through their network.A Culture of Constant Innovation and Creativity

“At Cloudflare, we encourage a culture of experimentation. We have a ‘ship it and see’ mentality where our teams are empowered to innovate and push the boundaries of what’s possible with our technology.” - Matthew Prince, CEO and Co-Founder

Cloudflare is continuously expanding its product lineup, adding services like R2 Object Storage, API management, email security, and now starting to roll up AI support. Their extensive network and proprietary technology enable them to experiment, innovate, and scale as needed, and it seems they are just getting started as they explore future technologies, particularly in real-time applications, AI, and machine learning.

🧐 Fun fact: The lava lamps wall, a trait of Cloudflare’s creativity

Cloudflare has arranged 100 lava lamps on one of the walls in their headquarters' lobby. A camera constantly captures images of the lamps, which are then used to generate random numbers for encryption. The unpredictable movement of the lava provides a reliable source of randomness, ensuring that encryption keys are secure and extremely difficult to crack. These random numbers serve as a starting point for creating secure encryption keys of some of the Cloudflare's security products for their customers.

Cloudflare's Three Acts: Building a Strategic Roadmap

Cloudflare’s business strategy has evolved dramatically, especially since the challenges brought on by the pandemic. In response to struggles with underperforming sales reps, they restructured their team and brought on industry heavyweights like Mark Anderson, former President of Palo Alto Networks. Now, Cloudflare is executing on a strategic roadmap they call their "Three Acts."

Act 1: Application Services

Early on, Cloudflare focused on making the web faster and safer. This led to the development of products like CDN, WAF, DDoS protection, and email security—laying the groundwork for a broad customer base and a vast amount of data.Act 2: Enterprise Networking and Security (SASE)

With solutions like Cloudflare One (their unified security platform) and Magic Transit, they’re challenging traditional networking giants like Cisco and Juniper. Cloudflare’s modern, cloud-first approach allows companies to move away from legacy hardware while providing superior performance and cost savings.Act 3: Developer and AI Services

Cloudflare is positioning itself as the go-to infrastructure platform for developers and AI companies. With services like Workers and R2 Object Storage, they offer the tools developers need to build and deploy fast, scalable applications.

Blending Fundamentals with Technicals

When analyzing Cloudflare’s stock, it’s important to consider both its fundamentals and technical signals. In a market increasingly driven by algorithms and investor sentiment, it’s easy to get lost in short-term noise. Instead, I focus on longer timeframes and broader trends, filtering out the daily volatility.

Cloudflare went public in 2019, so there’s limited historical data. And as a high-growth, unprofitable company (on a GAAP basis), traditional metrics like profitability aren’t as relevant here. Instead, I look at growth efficiency and financial sustainability ratios. Some key metrics I focus on include:

Growth ratios: Revenue Growth, Net Dollar Retention (NDR)

Financial Sustainability & Efficiency: Gross Margin, Free Cash Flow Margin, Rule of 40

For technical analysis, I prefer simplicity, sticking to a few core indicators for weekly timeframes:

50-week MA: To track long-term trends and support/resistance levels

MACD: To gauge momentum and identify buy/sell signals through crossovers and divergences

Volume: To measure the strength of price movements and confirm breakouts

This time, I’ll also incorporate macro-related events and Stan Weinstein’s Stage Analysis, which I find particularly useful for Cloudflare’s chart. So, let’s dive in!

⛅ Cloudflare (NET)

Weekly Technical Analysis

Price Trend: Consolidating within a long-term uptrend.

Price Levels:

Support at $40 and mid-$60s | Resistance at mid-$80s and high $100s.

Price closely tracks its rising 50 MA, with a tightening pattern since June 2024. Upward momentum is building after breaking out of its Stage 1 base, though consolidation continues as it nears resistance, shaped by the 2021 Covid peak and the AI era's first short-term high.

MACD: Tight since June 2024, typically signaling an upcoming strong momentum move. Previous upward momentum was not sustained.

Volume: Steadily declining post-Stage 1 breakout with the sharp increase during the AI peak.

Stage Analysis: Following Stan Weinstein's Stage Analysis, the stock appears to be in an early Stage 2 phase, which has been playing by the book so far, supported by a rising 50MA, a tightening MACD curve, a retest of the previous mid-$60s resistance level now acting as support, and decreasing volume following the transition from Stage 1 to Stage 2.

Valuation & Fundamentals

44.5% Revenue Growth (5Y CAGR)

77.3% Gross Margin | 76.9% Gross Margin (5y Avg)

112% NDR | 116% NDR (5y Avg)

Rule of 40: Revenue Growth + FCF Margin = 43.3%

14.9 EV/Sales | 149 EV/FCF | 78 EV/EBITDA

Stock-Based Compensation Expenses (SBC) at 20% of revenue

Growth and Price Trends

In high-growth software companies, revenue growth typically drives valuation, and Cloudflare is no exception. Comparing its 1Y Revenue Growth with its Price trend since its 2019 IPO shows that the end of its +50% growth coincided with a sharp price drop in late 2021, following the post-Covid market shift and a dip below the 50MA. Covid-era Fed policies fueled inflated valuations, amplifying price swings, with Cloudflare being unfairly compared to hyperscalers and even dubbed the "fourth major public cloud" at its 2021 peak.

Recently, Cloudflare’s revenue growth has stabilized around +30%, supported by a strong NDR of 112%, reflecting its ability to retain and expand revenue. The stock has consolidated in Stage 1 and is now in an early Stage 2 phase as the 50MA flattens and begins to rise. While +30% growth may seem modest compared to its 44.5% 5Y CAGR, and NDR has slightly declined from its +120% peak, other factors could still drive future price expansion, as we’ll explore next.

Sustainability, Efficiency and Valuation

Compared to other SaaS companies with +80% gross margins that don’t operate their own infrastructure, Cloudflare has kept its gross margin stable at around 77%. This is noteworthy, considering the competitive advantage of owning its infrastructure, which enables faster, more cost-effective service rollouts and reflects excellent control over costs.

A key factor supporting Cloudflare’s premium valuation at 149 EV/FCF and 78 EV/EBITDA (NTM) is its rapid FCF margin growth in recent years (Chart 2). For young, high-growth software companies, FCF is a better indicator of cash efficiency than profitability. As Cloudflare's network expands and becomes more efficient, the flywheel effect reduces costs, boosts revenue, and improves cash generation, driving free cash flow higher. Attracting more paying users, especially large enterprise customers, is critical. Notably, both total and >$100K ARR paying customers have been growing steadily, with a recent reacceleration in total paying customers, as shown in the chart.

Cloudflare's ability to maintain its rapid FCF growth against revenue growth will be crucial going forward. Following the volatility of the Covid era, the relative stability in Cloudflare's price trend has allowed FCF per share to improve significantly (Chart 2), supporting its valuation and making the stock more attractive.

The Rule of 40 (Revenue Growth + FCF Margin) is particularly valuable for high-growth companies like Cloudflare, helping to assess their balance between growth, profitability, and valuation. Cloudflare's Rule of 40 stands out at approximately 43.3%.

I’ve included their SBC in my valuation metrics, and I’ll cover it in my final take.

Final Thoughts

As someone who uses Cloudflare’s tools professionally, I’ve grown to admire both their technology and their business strategy. Cloudflare’s unique blend of cloud infrastructure and security solutions gives them the flexibility to work with businesses of all sizes, making them a versatile player in a crowded market.

I love that the company is founder-led and deeply committed to innovation. However, the competitive landscape is tough, with heavyweights like Amazon, Microsoft, and Google in the same space. Cloudflare’s ability to out-innovate and offer cost-effective solutions will be key to their future success.

On the stock side, valuations for high-growth companies were heavily distorted during the COVID era, and we’re still feeling the aftershocks. That said, I see potential in Cloudflare’s future, especially as we enter the AI era and central banks potentially ease monetary policy. While there are risks, Cloudflare’s ability to grow their FCF margin and their expanding customer base, particularly in the enterprise space, offers long-term growth opportunities.

One final note—Stock-Based Compensation is something to watch. It currently makes up 20% of Cloudflare’s revenue, which is a lot. Excessive SBC can dilute shareholders and hurt earnings per share, so it’s definitely a factor to consider.

Thanks for sticking with me! I hope you found this take on Cloudflare as insightful to read as it was for me to write. If you enjoyed this, keep an eye out for more brief deep dives!

Ready to dive deeper?

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 11-Sep-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles