Deep Dive Brief: Intuitive Surgical

The Surgical Robot Venture That Became a Monopoly

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 8-Oct-2025)

Expanse Stocks x Finchat (now Fiscal AI) Partnership!

🎁 Get 20% off + 2 months free on any Finchat plan! →🔗 Claim Discount

Welcome back Explorer!

In this fourteenth edition of my Deep Dive Briefs series, I’m continuing my research journey on the healthcare sector, this time exploring:

When I look for great businesses, I don’t just want companies that compete in a market, but also those that create and define it (think ASML). I hunt for multi-layered moats, predictable business models, and long runways for growth. Few companies check those boxes as clearly as Intuitive Surgical (ISRG).

When I first looked at Intuitive, I’ll admit I was skeptical. A $170B med tech giant at 55x earnings? It screamed ‘bubble.’ But the deeper I went, the more it became clear why the market assigns such a premium. Intuitive has become a full-stack surgical platform that has redefined the operating room.

For long-term investors, the combination of moat + model + growth runway may justify paying up. But are you willing to pay up that much?

Topics I’ll Cover

🔹 Company Overview

🔹 The Da Vinci Solution & A Brilliant Razor-Blade Business Model

🔹 Economic Moat

🔹 Capital Allocation Strategy

🔹 Addressable Market, Growth Drivers and Optionality

🔹 Risks & Challenges

🔹 Financials & Valuation - Includes a 30-year DCF Model

🔹 Investment Case – My stance on Intuitive as a long-term investment

Let’s take a closer look and dig into one of the most exciting businesses in the healthcare industry.

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO | 🧙♂️ CSU Part #1, Part #2, Part #3 | 🤖 Intuitive | 🛒 💳 MELI Part #1

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy, Industry Write-ups & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

🔐 Paid Subscriber Exclusives

💼 Portfolio Corner – Holdings, valuation models, trades, performance & more!

🤫 Exclusive Sections – From select articles, Deep Dive Briefs & Hidden Gems

👀 Recent Releases!

👀 Coming Soon

🔎 Deep Dive Brief: Mercado Libre’s Flywheel - Part II

💎 Hidden Gem: Special Edition III

Company Overview

The Problem Intuitive Solved: The Limits of the Human Hand

To understand the genius of Intuitive, we first have to appreciate the history of surgery. For centuries, open surgery was the only option: a large incision giving surgeons direct access and visibility. The trade-off was immense trauma for the patient, long and painful recoveries, and a high risk of infection.

The first major evolution was laparoscopic surgery in the late 20th century. By using small "keyhole" incisions to insert long instruments and a camera, surgeons could perform procedures in a minimally invasive way. This was a big leap forward, drastically reducing recovery times and complications. However, it came with its own significant drawbacks:

The Fulcrum Effect: Manipulating 18-inch steel rods through a tiny pivot point is incredibly difficult. The surgeon’s hand movements are reversed and amplified, making precise actions unintuitive.

Limited Dexterity: The rigid, straight tools of laparoscopic surgery simply cannot replicate the full range of motion of the human wrist.

Surgeon Fatigue: Standing hunched over a patient for hours is physically grueling. As one surgeon noted in our research, performing two major laparoscopic procedures in a day is enough to require a visit to a physiotherapist.

2D Vision: The standard camera provides a flat, 2D image, robbing the surgeon of crucial depth perception.

It was in solving these exact problems that Intuitive Surgical was born.

From DARPA Project to Surgical Standard

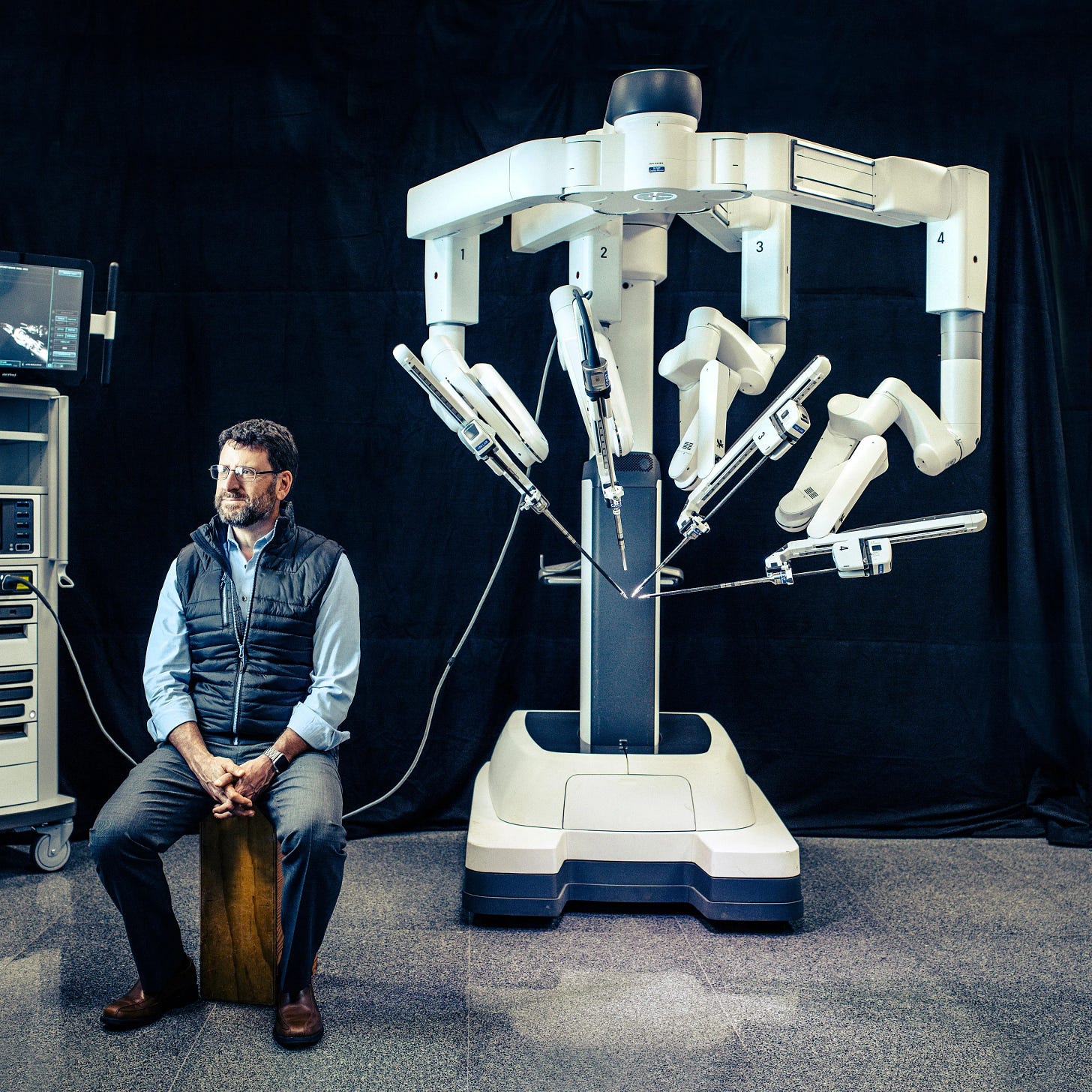

The da Vinci system origin story began in the 90s. The DARPA research aimed at enabling remote battlefield surgery. Intuitive acquired the technology rights in 1997 and spent years adapting it for hospital use, facing a lot of skepticism along the way.

Robots in surgery? Seemed like an expensive solution looking for a problem.

But management was methodical and determined. They started with urology (particularly prostatectomies) where the value proposition was clearest: less blood loss, faster recovery, fewer complications.

From there, they systematically expanded into gynecology, thoracic, general, and now cardiac procedures. Today, with over 9900 systems installed worldwide and 16+ million cumulative procedures performed, they've essentially redefined how complex surgery is taught and performed.

The Da Vinci Solution & A Brilliant Razor-Blade Business Model

The da Vinci system is a masterclass in robotics engineering and ergonomics. It places the surgeon at a comfortable console a few feet from the patient. From there, the surgeon looks into a high-definition 3D viewfinder and controls several robotic arms with robotic precision. The system translates the surgeon’s natural hand movements into steady, scaled-down movements inside the patient, completely eliminating hand tremors and the dreaded fulcrum effect. The instruments are "wristed," mimicking and even exceeding the dexterity of the human hand.

This technological superiority is matched by a brilliant business model. Intuitive generates revenue from three synergistic streams, creating a unique razor-and-blade structure:

Systems: The initial capital sale or lease of the da Vinci robot ($500k - $2.5M per unit). This accounts for ~27% of revenue.

Instruments & Accessories: The high-margin, single-use, or limited-use tools required for each procedure. This is the recurring "blade" revenue and the largest contributor at ~56% of sales.

Services: The recurring maintenance and training contracts on the installed base of over 8,000 systems. This makes up the remaining ~17%.

The genius of this model is in the unit economics. Once a hospital commits to da Vinci, every additional procedure drives high-margin consumable revenue with minimal incremental cost. Here's how it works:

Hospitals purchase (or lease) da Vinci systems for $500k to $2.5M per unit.

Every procedure requires specialized instruments and accessories that must be replaced every 10-20 uses, plus ongoing service contracts for maintenance and training.

The result? Instruments & Accessories (I&A) + Maintenance & Training now represent 73% of total revenue, creating a recurring revenue stream tied directly to procedure volumes. This provides tremendous visibility and stability. Gross margins are highest in the I&A segment (estimated >75%), followed by Services (~65%), and lowest for Systems (~50%). A shift in mix towards more system sales, as seen during a new product launch, can temporarily depress corporate gross margins, which is something to watch during the current da Vinci 5 rollout. The price meter that best aligns with value is procedure volume, which directly drives the I&A revenue.

This model is a compounding machine by nature currently generating almost $8B of revenues. Each new system placed in a hospital expands the installed base, which in turn drives a predictable and growing stream of high-margin revenue from instruments and services for years to come.

The Multi-Layered Economic Moat

Intuitive’s dominance is protected by one of the biggest moats I’ve ever analyzed in the healthcare industry. It is not one single advantage, but a series of interconnected barriers that make it incredibly difficult for competitors to challenge them.

Switching Costs: A hospital invests millions in the da Vinci system. But the true cost of switching is far higher. It means retraining entire surgical teams, redesigning operating room workflows, and disrupting established processes. It’s a logistical and financial nightmare that few hospital administrators would willingly undertake.

Network Effects That Accelerate Adoption: The moat here is self-reinforcing. More da Vinci systems lead to more surgeons being trained on the platform. As the pool of trained surgeons grows, hospitals are incentivized to buy more systems to attract top talent. This drives higher procedure adoption, improving hospital ROI and leading to even more system orders.

A Mountain of Regulatory & Data Advantage: Intuitive has spent over two decades doing the hard work of securing regulatory clearances for specific procedures in geographies around the world. A new competitor starts from scratch. More importantly, with over 13 million cumulative procedures performed, Intuitive sits on an unparalleled dataset. This data has fueled over 38000 peer-reviewed academic articles, creating a body of clinical evidence that a new entrant would take decades to replicate.

Unmatched Brand & Trust: For many surgeons and patients, "robotic surgery" is practically shorthand for "da Vinci." Surgeons rely on its precision and reliability, while patients increasingly choose hospitals that advertise it by name.

I may be biased, but I saw this firsthand earlier this year. A family member needed surgery in my hometown of Madrid, Spain. To my surprise, the local public hospital had the latest da Vinci system ready — operated by a 50-year-old Spanish surgeon who smiled and reassured us: “Don’t worry, this beast doesn’t leave a scar.”

Morningstar classifies this as a "wide moat," and I'd argue it's only getting wider as the installed base grows.

Capital Allocation: Patient and Disciplined

One thing I particularly like about Intuitive's management is their capital allocation discipline. With over $5B in cash and zero debt, they have tremendous financial flexibility, yet they've resisted the urge to make expensive acquisitions or aggressive share repurchases. Instead, they have been reinvesting methodically:

R&D (~15% of revenue): Continuous system upgrades and platform development

Surgeon Training: Over 70 training centers globally. This is moat-building disguised as an expense

Manufacturing Capacity: Ensuring they can meet growing demand without quality compromises

Execution has also been key and world-class level for two decades. The company essentially created the field of robotic surgery and has managed its growth with a rare sustainable discipline. Customer sentiment, judged by the platform's adoption and surgeon loyalty, is very high. The organizational design, which separates R&D, capital sales, and clinical sales, appears highly effective at both innovating and driving this adoption.

Ex-CEO Gary Guthart, who joined in 1996 and became CEO in 2010, and now sits as executive chair of the Board of Directors at Intuitive, embodies the long-term thinking required to build this “moaty” machine with a decades-long strategy to reshape global surgery.

I highly recommend watching this 47 min video where Gary shared insights on the problems that the Medtech sector is still facing as well as the problems that have been solved with the help of Intuitive surgical robotic platforms:

🔗 Video: Keynote w/ Gary S. Guthart, PhD, CEO and Member of the Board of Directors at Intuitive | LSI USA '25

Addressable Market, Growth Drivers and Optionality

With Intuitive Surgical trading at premium valuations, many investors question whether the growth runway justifies the price. After digging into the numbers, I think the market is significantly underestimating both the size of the opportunity and Intuitive's positioning to capture it. Let me walk you through why.