A Hidden Gem Deep Dive Brief: Lumine Group

Constellation’s Telecom Powerhouse in the Making

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 8-Oct-2025)

Expanse Stocks x Finchat (now Fiscal AI) Partnership!

🎁 Get 20% off + 2 months free on any Finchat plan! →🔗 Claim Discount

Welcome back Explorer!

In this ninth edition of my Deep Dive Briefs series, I’m continuing my research journey on serial acquirers—this time exploring the second spin-off from Constellation Software:

A few weeks ago, I published a Hidden Gems Deep Dive Brief on Topicus (the first of CSU’s spin-offs), and prior to that, a broader primer on Constellation Software itself—the parent of both Topicus and Lumine. If you haven’t had a chance to read them yet, I highly recommend starting there:

🔗 Hidden Gems: Fourth Edition - A Constellation Software Primer

🔗 Hidden Gems Deep Dive Brief: Topicus

They provide the perfect backdrop for what’s ahead and will help you better understand the CSU family of companies. 😉

In this edition, we’ll rewind to Lumine’s origin and its complex spin-off process, then dive into its business model, key growth drivers, competitive advantages, and finish with a fundamental analysis—including a DCF model and estimated shareholder return potential.

Topics I’ll Cover

🔹 Origins and Constellation Roots

🔹 Leadership & Culture

🔹 Business Model

🔹 Capital Allocation Strategy

🔹 Capital Structure

🔐 For Paid Subscribers:

🔹 Growth Drivers

🔹 Future Growth Outlook

🔹 Cash Profitability and Organic Growth

🔹 Valuation Model - Quick mental framework and DCF model to estimate intrinsic value and shareholders returns

🔹 Final Thoughts – My stance on Lumine as a long-term investment and why it’s still a hidden gem

Let’s dive in!

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO | 🧙♂️ CSU Part #1, Part #2, Part #3 | 🤖 Intuitive

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy, Industry Write-ups & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

🔐 Paid Subscriber Exclusives

💼 Portfolio Corner – Holdings, valuation models, trades, performance & more!

🤫 Exclusive Sections – From select articles, Deep Dive Briefs & Hidden Gems

👀 Recent Releases!

👀 Coming Soon

✨ The Rareness of Moaty Industrials: A Selection of 6 Gems

💎 Hidden Gem: Special Edition III

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 8-Oct-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles

Origins & Constellation Roots: A Volaris Vertical That Grew Up

Lumine Group started as a specialized unit within Volaris Group, one of Constellation Software’s six operating groups. Its mission: acquire and scale vertical market software (VMS) businesses serving communications and media sectors.

Founded and led by David Nyland, a telecom industry operator and entrepreneur (more on him in next section), Lumine was officially branded in 2020 and evolved from a small M&A outpost into a full-fledged operating group, acquiring 28 companies by 2022.

Its incubation under Constellation gave it three main advantages:

The Constellation Playbook: Decentralization, capital discipline, post-acquisition review (PAR) process, and ROIC-based performance evaluation.

Acquisition Engine in Training: While still part of Volaris, Lumine built up a portfolio of 28 businesses with an average age of 21 years.

2023 Spin-off: Like Topicus before it, Lumine matured within the Constellation ecosystem until it was ready to stand on its own. It was spun out in early 2023 and now trades independently on the TSX-V Canadian exchange.

Though now publicly traded, Lumine is still deeply tied to its roots:

Constellation Software retains a ~60% equity stake and Super Voting shares

The board is dominated by Constellation appointees, ensuring cultural and capital allocation continuity

Leadership & Culture: A Constellation-Made Team

CEO David Nyland brings a rare skill set: he’s an ex-developer, founder of two telecom software startups, and a long-time operator within Constellation (joined Volaris in 2014).

Under his leadership, Lumine has maintained Constellation strategic discipline while accelerating its acquisition strategy. What makes Nyland’s style special and valuable for the company is his understanding of both, code and capital allocation, someone able to speak the language of engineers and allocators alike.

Key cultural traits carried over from Constellation:

No stock-based comp: Management buys shares with their after-tax bonus.

3–5 year lockups on insider purchases: Long-term skin in the game.

ROIC-based incentives: Bonuses tied to exceeding hurdle rates, not revenue or vanity metrics.

Minimalist HQ: Central team is lean and most decisions are decentralized.

Structured knowledge sharing: 250+ documented best practices flow between Constellation’s business units.

Zero dilution model: Preferred and special shares were recently converted into common shares, eliminating non-cash expense noise.

Board oversight: 6 of 7 directors are appointed by Constellation (e.g. Mark Miller, Constellation COO and Chairman of Lumine), ensuring alignment—especially on $100M+ M&A deals.

Business Model: Vertical Market for Communications & Media

Lumine acquires and builds mission-critical software used by telecoms, broadcasters, and media companies. These are high-stakes industries where downtime isn’t tolerated.

Typical use cases:

Telecom OSS/BSS platforms (billing, roaming, network monitoring)

Ad-tech and broadcast scheduling

Regulatory compliance software

Enterprise IoT platforms

These businesses offer:

Mission-critical software (billing, scheduling, network roaming, etc.)

Long-tenured enterprise customers

High recurring revenue (~94% at WideOrbit —> more on this in next section)

Strong customer retention due to high switching costs, most customers stay for 10–20+ years, just like at Constellation.

Lumine operations are split across three operating groups, all decentralized and acquisition-driven:

Two in communications (network management, mobile services, IoT, BSS/OSS)

One in media (ad sales, inventory optimization, content scheduling—anchored by WideOrbit)

All business units are managed independently but share access to 250+ best practices for sales, operations, customer success, and finance.

Capital Allocation Strategy: Small Team, Big Ambitions

Lumine’s capital allocation mirrors Constellation’s, but with a different taste:

Focus on carve-outs: Orphaned software divisions from larger telecom/media companies, like WideOrbit or Nokia assets.

Average deal size: ~$12M historically but increasing with maturity

Deals size approval thresholds:

<$20M: Lumine board approval

$100M: Requires Constellation board approval

The company reinvests 100%+ of its cash flow into M&A, aiming for hurdle rates of 20–25% ROIC.

With thousands of target companies mapped, and hundreds already in the funnel, growth runway is substantial. Lumine’s vertical—despite being focus on telecom and media—is global and spreading with acquisition targets across North America, Europe, and Asia.

WideOrbit: The Big Bet That Changed the Game

WideOrbit is a turning point for Lumine. Acquired for ~$490M in December 2022 (far above their historical average deal size of ~$12M). It’s still Lumine’s largest acquisition to date and it was the catalyst for Lumine’s spin-off decision by Constellation later in 2023.

What makes it so special?

The largest TV & radio ad-sales platform in the U.S.

Renewal rates of ~99.99% and recurring revenue of ~94%

Boasting 70% gross margin and 26% operating margin

Adding ~$165M in revenue at time of acquisition

Lumine paid ~10x EBITDA / ~2.9x sales, in line with Constellation norms for strategic deals. Despite early GAAP losses due to amortization and derivative noise, true cash profitability is strong, with sustainable growth driven by long-term contracts and minimal churn.

WideOrbit’s platform is embedded in broadcaster workflows. Some clients include:

Major U.S. media houses (Fox, Hearst, Sinclair)

Regional radio networks

National cable operators

WideOrbit’s impact on Lumine’s operations and financials:

Added scale overnight

Diversified Lumine into media (previously telecom-heavy)

Instantly introduced robust U.S. cash flows

Provided a playbook for future large-scale, high-quality carve-outs

The integration still in-progress, but going well:

Sales team rationalization has been completed

Price uplift campaigns are still underway

Their R&D spending’s been reprioritized toward high-margin modules

If some people were worried about the potential ROIC of larger acquisitions at Constellation, Lumine’s the perfect proof of concept that the Constellation playbook can also work at scale.

Capital Structure

With time since the IPO, Lumine’s capital structure has become cleaner and more conservative, reflecting the Constellation Software philosophy of self-funded growth, non-dilutive financing, and aligned incentives.

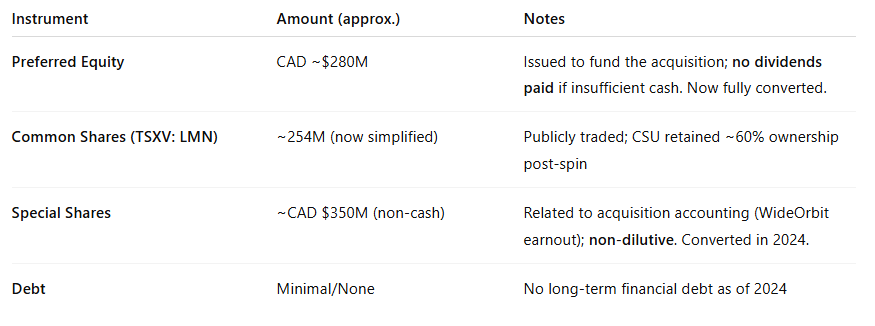

🔹 Post-WideOrbit Consolidated Capitalization (2023–2024)

The acquisition of WideOrbit for ~USD $490M (CAD ~$650M) in early 2023 was Lumine’s largest acquisition ever, and it was financed using a unique multi-layer capital stack—which has since been largely cleaned up for simplicity and transparency.

Here's how the capitalization looked immediately after the WideOrbit deal:

🔹 As of 2024: A Much Simpler Capital Base

Following the April 2024 conversion of all preferred and special shares into common shares, Lumine now has:

Only one class of equity: common shares

~253.3 million common shares outstanding

No preferred equity, no special shares, and no debt

Constellation Software still holds ~60% equity and controls via Super Voting shares

This simplification has removed all GAAP distortion related to non-cash amortization and fair value accounting for derivatives. Investors can now track performance using Free Cash Flow Available to Shareholders (FCFA2S) and Adjusted Net Income, without noise from legacy structures.

🔹 Balance Sheet Health

No financial leverage

Net cash position post-WideOrbit integration

Ample free cash flow from operations to fund M&A

No need for dilution, secondary raises, or debt issuance in the near term

🔒 The following sections are reserved for paid subscribers

🔹 Growth Drivers

🔹 Future Growth Outlook

🔹 Cash Profitability and Organic Growth

🔹 Valuation Model - Quick mental framework and DCF model to estimate intrinsic value and shareholders returns

🔹 Final Thoughts – My stance on Lumine as a long-term investment and why it’s still a hidden gem