Deep Dive Brief: Monolithic Power Systems

Growth and Quality in One Often Overlooked Semiconductor Name

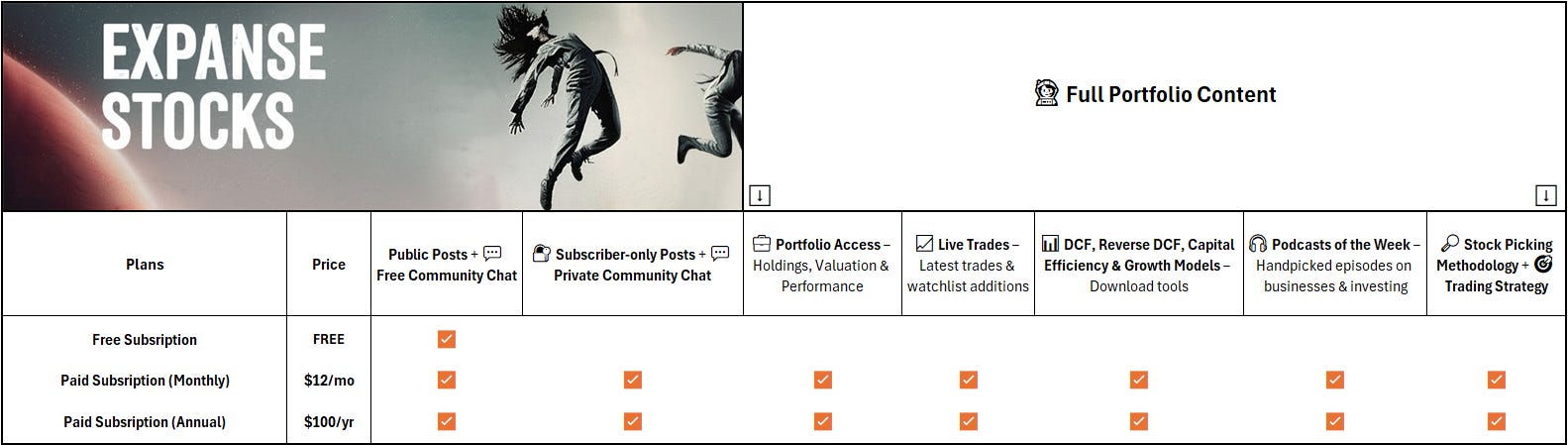

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 11-Sep-2025)

Expanse Stocks x Finchat.io Partnership!

🎁 Get 20% off + 2 months free on any Finchat plan! →📎 Claim Discount

Welcome Explorer!

This is the third edition of my Deep Dive Briefs, where I break down growth and high-quality businesses.

I'm excited to share my research and insights about Monolithic Power Systems (MPS), a standout innovative player in the power management chip industry.

Recently, the stock price has taken a hit after some market drama, which makes the stock even more interesting and worth a closer look in my opinion.

Topics I’ll cover

🔹 Company Overview – History & leadership insights

🔹 Business Model & Core Offerings

🔹 Economic Moat & Growth Drivers

🔹 Capital Allocation

🔹 Risks & Competitors

🔹 Fundamentals + Technical Analysis

🔹 Final Thoughts

Let’s dive in!

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO | 🧙♂️ CSU Part #1

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy, Industry Write-ups & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

🔐 Paid Subscriber Exclusives

💼 Portfolio Corner – Holdings, valuation models, trades, performance & more!

🤫 Exclusive Sections – From select articles, Deep Dive Briefs & Hidden Gems

👀 Recent Releases!

👀 Coming Soon

💎 Unlocking Japan - Part #1: The Overlooked SaaS goldmine

💎 Unlocking Japan - Part #2: A Hidden Gem

Company Overview

This business story began as a bold vision. In 1997, Michael Hsing set out to revolutionize power management technology.

His idea was ambitious: integrate an entire power system onto a single chip. What seemed improbable at the time became the foundation of Monolithic Power Systems, Inc (MPS). Under Hsing's leadership, MPS has not only realized this vision with its innovative monolithic power modules but has consistently broken industry norms with its patented technologies.

A bit of History

Drawing from his experience as a Senior Silicon Technology Developer Engineer, Hsing launched MPS in 1997 and introduced innovative products like a single-chip CCFL backlighting solution that captured 80% of the laptop market by 2005 (Source, link).

Following this success, MPS diversified into DC/DC products, went public in 2004, and expanded into six product lines with over 1,000 products, serving thousands of customers worldwide. In 2013, MPS debuted the world’s first Monolithic Power Module, redefining power management with fully integrated, efficient, and compact solutions.

Known for his creativity and ingenuity, Hsing has grown MPS into a global leader that continues to lead the industry, pushing boundaries with cutting-edge technologies and redefining what’s possible in power management.

Understanding the Industry Landscape

Semiconductors form the backbone of modern technology, powering everything from smartphones to industrial machinery. These components fall into three main categories: digital integrated circuits (ICs), analog ICs, and mixed-signal ICs, with MPS specializing in the high-performance analog and mixed-signal segments.

What are analog and mixed-signal ICs?

Analog ICs process continuous, real-world signals like voltage, temperature, or sound, often used for amplifying, regulating, or converting electrical signals in devices.

Mixed-Signal ICs combine analog and digital functions on a single chip, bridging real-world signals with digital systems for applications like audio processing, communication, and power management.

What makes analog and mixed-signal ICs unique?

Longer Product Cycles: Unlike fast-evolving digital ICs, analog products have lifespans that often span decades.

High Design Complexity: Analog ICs are challenging to design and manufacture, creating barriers to entry for competitors.

Diverse Markets: Analog and mixed-signal ICs serve a broad range of industries, reducing reliance on any single market.

Efficiency Focus: These chips bridge the gap between real-world signals (e.g., temperature, sound) and digital systems, with a focus on precision and power efficiency.

What sets MPS Apart?

MPS stands out in the semiconductor industry through a combination of deep system-level knowledge, semiconductor design expertise, and innovative proprietary technologies.

These strengths have allowed the company to create monolithic solutions that are smaller, more energy-efficient, and cost-effective than competing products. For instance, its chips excel in markets that demand high integration, such as AI-powered data centers, electric vehicles, and 5G infrastructure.

Here’s how MPS differentiates itself:

By integrating digital and analog functions onto a single chip, MPS delivers products with greater power density, reduced heat output, and improved precision.

MPS aims to create solutions that consume less energy and materials, aligning with sustainability goals.

The company regularly expands its product portfolio, introducing new offerings with a focus on emerging markets like cloud computing, autonomous driving, and smart appliances.

Key Markets and Revenue drivers

MPS serves six major markets, each contributing to its revenue providing balance and diversification — Source: Latest Annual Report on Form 10-K

Storage and Computing (27.0% of Revenue)

Applications: Storage devices, laptops, notebooks, GPUs, etc.

Growth Driver: Rising demand for AI-enabled GPUs and data-driven applications.

Automotive (21.7%)

Applications: Advanced driver-assistance systems (ADAS), infotainment, USB connectors, and EV battery management.

Opportunity: Electrification and autonomy are driving demand for compact, reliable chips in vehicles.

Enterprise Data Servers (17.7%)

Applications: Cloud servers, AI server CPUs and GPUs.

Competitive Edge: MPS precision power management chips support the processing needs of AI and cloud computing.

Consumer (12.9%)

Applications: Smart TVs, gaming consoles, home appliances, and monitors.

Challenge: Cyclicality in consumer demand creates revenue volatility.

Communications (11.3%)

Applications: 4G/5G infrastructure, satellite systems, and wireless networks.

Driver: The ongoing 5G rollout and satellite expansion.

Industrial (9.4%)

Applications: Power sources, security systems, and industrial meters.

Potential: Despite the ongoing industry’s downcycle, growth in IoT and smart manufacturing is expected to pick up and boost demand for low-power chips.

This diverse market exposure enables MPS to remain resilient against fluctuations in any one sector, while ensuring sustained growth in high-potential areas like AI-driven enterprise data and electric mobility.

Business Strategy

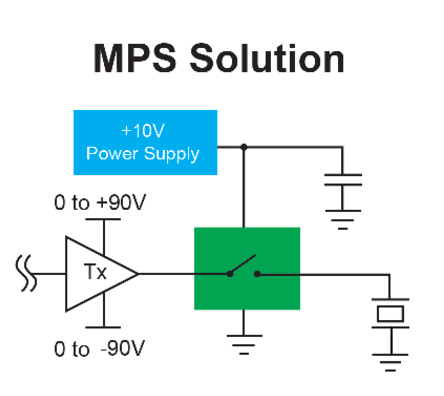

MPS has established itself as a disruptor in the power management chip industry, leveraging innovation and efficiency through its proprietary bipolar-CMOS-DMOS (BCD) process. This pivotal technology enables the integration of specialized transistors, optimized for power management and mixed-signal applications, on a single chip. For a deeper dive into BCD technology, check out this excellent resource on AnySilicon, referred to as the 'Google of the Semiconductor Industry': 📎 The Ultimate Guide to: BCDMOS.

While power management chips often come from well-established giants like Texas Instruments or Analog Devices, MPS has carved its niche by offering something different: chips that are smaller, smarter, and lighter, providing a competitive edge.

Key strategies include:

Differentiation through advanced manufacturing techniques that combine analog, digital, and memory functions into a single chip.

Focus on high-growth markets, such as data centers (AI-driven demand) and automotive applications (advanced driver-assist systems and EV batteries).

An asset-light fabless model that enables high returns on invested capital and adaptability to changing market needs.

Economic Moat

MPS’ moat is built on two pillars.

Intangible assets: Innovative design and Proprietary Technology

Take its sixth-generation BCD technology, for instance. By achieving a 55-nanometer manufacturing process—ahead of main competitors stuck at 90-110 nm—MPS can deliver chips with greater power density, a smaller form factor, and better energy efficiency.

Integrated solutions with its "monolithic" approach replaces multiple discrete components, offering customers cost-effective and reliable designs. Consider its Quantum State Modulation (QSMod) controller, which fine-tunes power delivery for GPUs and other processors (FPGAs and ASICs), slashing power loss and allowing for even smaller designs.

Imagine replacing a bulky three-piece system with a smoother, smaller and more power efficient all-in-one chip. That’s MPS value proposition in a nutshell. This isn’t just a better technology, it’s real-world impact, enabling longer battery life in EVs and cooler, more efficient data centers.

Switching costs

When customers integrate MPS’ chips into their products, they effectively manage to “lock” customers into long-term relationships due to the complexity and expense of system redesigns.

This is especially true in industries with long product cycles, like automotive and industrial equipment. For example, automakers often work with suppliers years in advance of launching a new model. Switching to a different chip mid-cycle would require a full redesign, driving up costs and delaying production. For many clients, sticking with MPS is not just easier; it’s smarter.