Deep Dive Brief: Amazon

Jeff B. and the Take-It-All, Win-It-All Customer-Obsessed Juggernaut

Expanse Stocks x Finchat.io (now Fiscal.ai) Partnership!

🎁 Get 20% off + 2 months free on any Fiscal.ai plan! → 🔗 Claim Discount

Welcome Explorer!

This is the sixth edition of Deep Dive Briefs, where I break down growth and high-quality businesses.

This time, I’m diving into:

You might wonder—what else is there to say about this tech giant? Well, plenty.

Amazon has been reinventing itself into a more operationally efficient, cost-effective juggernaut, primed to capitalize on high-margin opportunities in AI, robotics, advertising, (maybe) space telecom, and its continued cloud dominance through AWS.

Like its Big Tech counterparts Microsoft and Alphabet, Amazon doesn’t just get old —it evolves, leveraging its deep pockets, industry influence, and massive network to stay at the forefront of innovation. The goal? Take it all, win it all.

Let’s dive into Amazon’s origins with its legendary founder, Jeff Bezos, and explore how his "customer first" philosophy shaped the company. We’ll break down Amazon’s business model, key growth drivers, and why it’s still primed to keep the flywheel spinning.

Topics I’ll Cover

🔹 Jeff Bezos - The Architect of Modern Commerce

🔹 Company Overview

🔹 Business Model & Core Offerings

🔹 Economic Moat & Growth Drivers

🔹 Capital Allocation

🔹 Risks & Competitors

🔹 Fundamentals + Technical Analysis

🔹 Earnings Growth Model – A quick mental framework to estimate AMZN’s returns

🔐 For Paid Subscribers:

🔹 Traditional DCF Model – Intrinsic value & implied share price

🔹 Reverse-Engineered DCF – Expected returns using my proprietary models

🔹 Capital Efficiency - ROIC, ROCE and ROIIC and What’s to be expected

🔹 Final Thoughts – My stance on Amazon as a long-term investment

Let’s dive in!

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO | 🧙♂️ CSU Part #1, Part #2, Part #3 | 🤖 Intuitive

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy, Industry Write-ups & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

🔐 Paid Subscriber Exclusives

💼 Portfolio Corner – Holdings, valuation models, trades, performance & more!

🤫 Exclusive Sections – From select articles, Deep Dive Briefs & Hidden Gems

👀 Recent Releases!

👀 Coming Soon

✨ The Rareness of Moaty Industrials: A Selection of 6 Gems

💎 Hidden Gem: Special Edition III

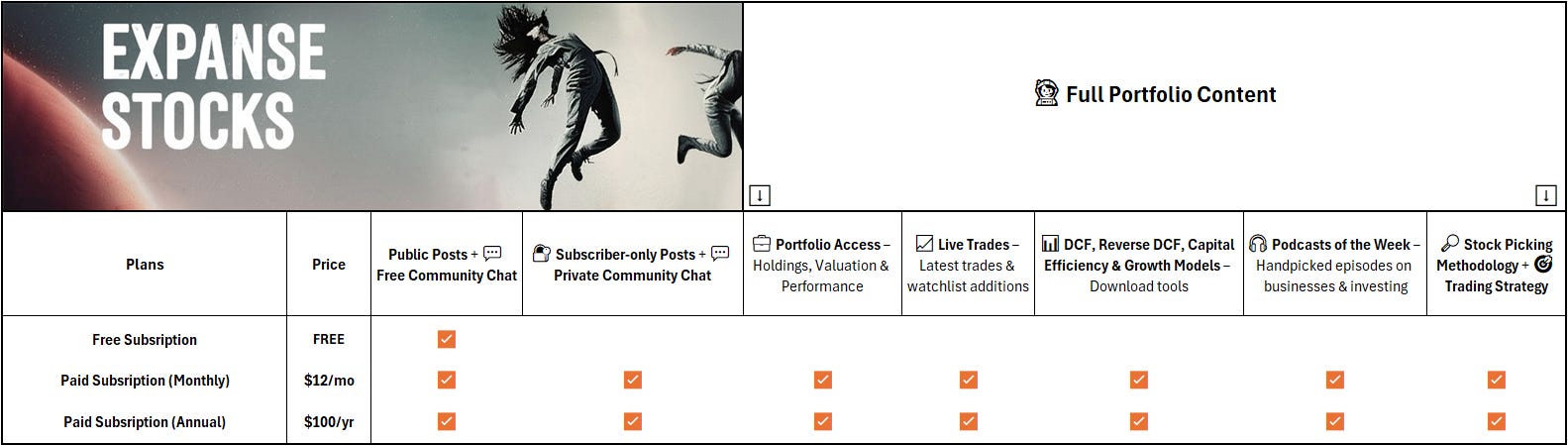

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 8-Oct-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles

Jeff Bezos: The Architect of Modern Commerce

If life was all about bicep size, this would be the ultimate zero-to-hero saga. Fortunately, his business game is almost as pumped as his arms.

Few entrepreneurs have shaped the global economic landscape as profoundly as Jeffrey Preston Bezos. His journey from a science-loving, intellectually curious child to the mastermind behind one of the world's most powerful companies, his story is one of ambition, sharp strategy, and an almost fanatical devotion to customer satisfaction.

Early Years: A Mind Wired for Innovation

Born in 1964 in Albuquerque, New Mexico, Bezos displayed an early fascination with science and mechanics… no, not chemistry 🧪

Enough with the jokes. Onwards.

As a child, he would play with household gadgets, dismantling and rebuilding them just to understand their inner workings. Summers spent on his grandfather’s ranch in Texas reinforced his self-reliant and problem-solving mindset.

Later on, his academic brilliance led him to Princeton University, where he majored in electrical engineering and computer science. After graduating in 1986, Bezos embarked on a successful career in finance, joining investment firm D. E. Shaw & Co. He quickly rose through the ranks, becoming one of the firm’s youngest senior vice presidents.

But despite his lucrative career, Bezos was captivated by the rapid expansion of the internet, which was growing at an astonishing rate of 2,300% per year in the early 1990s. Recognizing an unprecedented opportunity, he made the decision—the one that would change his life and the world forever.

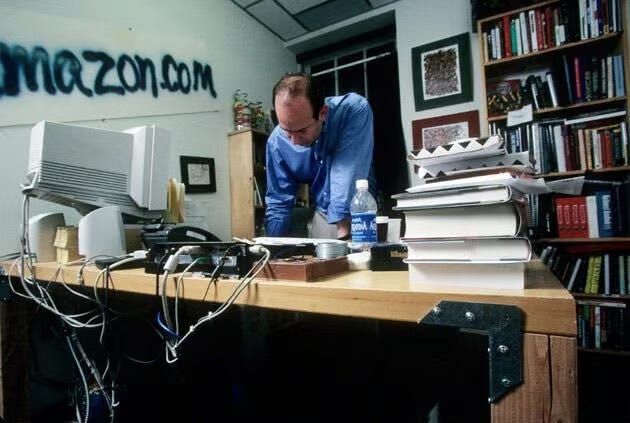

The Birth of Amazon: A Calculated Leap of Faith

In 1994, Bezos left his high-paying job, packed up his belongings, and set off on a cross-country drive to Seattle. During this journey, he sketched out the business plan for what would eventually become Amazon. Initially, the company was conceived as an online bookstore, a strategic entry point given books' universal demand and ease of shipping.

Operating from a garage with a few employees and a door-turned-desk, Bezos launched Amazon.com in July 1995. The site was rudimentary, but its potential was vast. Unlike traditional bookstores, Amazon offered an almost limitless selection, lower prices, and the convenience of home delivery. The company’s tagline, "Earth’s Biggest Bookstore," reflected Bezos’ early ambitions, but in reality, books were just the beginning.

Amazon’s Meteoric Rise: Obsession with Customers and Innovation

From day one (literally), Bezos built Amazon’s culture around customer obsession, ruthless efficiency, and long-term thinking. His infamous 'Day 1' philosophy insisted that the company should always operate like a hungry startup—nimble, relentless, and constantly innovating. He warned against slipping into ‘Day 2’ which he described as stagnation and eventual decline.

Amazon's relentless focus on innovation transformed online shopping. In 1997, the company went public at $18 per share, raising $54 million. Skeptics doubted its profitability, but Bezos remained focused on reinvesting revenues into infrastructure, technology, and customer service enhancements.

Jeff had his sights set on a much bigger game from the start. Those early baby steps—first books, then CDs, then electronics—weren’t just random expansions; they were the building blocks of the Amazon empire we know today. I highly recommend to watch this 5min video interview with Jeff Bezos back in 1997 to better understand his revolutionary mindset:

He introduced key innovations that would later become industry standards:

User Reviews (1995): Bold move at the time, allowing customers to rate and review products, fostering trust and transparency.

One-Click Ordering (1999): A game-changing feature that streamlined online purchases.

Amazon Marketplace (2000): Opening the platform to third-party sellers, turning competitors into partners and expanding product variety.

Amazon Prime (2005): A subscription service offering free two-day shipping, exclusive content, and other benefits, dramatically increasing customer retention and loyalty.

Bezos' ability to think long-term also led to Amazon Web Services (AWS) in 2006. Initially built to support Amazon's internal operations, AWS evolved into the world’s leading cloud computing platform, generating billions in annual revenue, powering companies like Netflix, Airbnb, or NASA.

Calculated Risks, Infinite Resilience

Bezos’ leadership wasn’t without failures. The Fire Phone (2014) was a spectacular flop, losing Amazon over $170 million. Attempts to enter the travel booking industry with Amazon Destinations also fell flat. But rather than dwell on missteps, Bezos embraced failure as an essential part of innovation.

"Failure and invention are inseparable twins," he once said.

His willingness to experiment allowed Amazon to continuously push boundaries, pivot when necessary, and double down on emerging opportunities.

Bezos Beyond Amazon: Space and Philanthropy

In 2000, Bezos founded Blue Origin, a private aerospace company with a vision to make space travel accessible. He often spoke of his dream of enabling humanity to become a spacefaring civilization (Is that you Elon?), believing that Earth's resources were finite and that space exploration was necessary for long-term survival.

Under Bezos, Blue Origin is developing reusable rocket technology, rivaling Elon Musk’s SpaceX. The company made headlines in 2021 when Bezos himself embarked on a suborbital space flight aboard the New Shepard rocket, fulfilling a lifelong dream.

As one of the world’s richest individuals, Bezos has also expanded his philanthropic efforts. He established the Bezos Earth Fund, pledging $10 billion to combat climate change, and launched the Day One Fund, focused on education and homelessness.

A Lasting Legacy: From CEO to Executive Chairman

In 2021, Bezos stepped down as CEO, handing the reins to AWS chief Andy Jassy while transitioning to Executive Chairman. Though it marked the end of an era, his fingerprints remain all over Amazon—customer obsession, relentless innovation, and long-term thinking still drive the company forward.

Bezos didn’t just build a company; he rewrote the playbook on modern commerce, technology, and logistics. His journey is a masterclass in calculated risks, perseverance, and vision—proof that the right mindset can create a legacy far bigger than its founder.

Last but not least, if you want a firsthand look at Bezos’ thoughts on the future of Amazon, space, and innovation, I highly recommend his 2024 New York Times DealBook Summit interview:

🎧 Spotify Podcast 📎 Jeff Bezos talks Innovation, Progress and What’s Next

Or, if you prefer reading, check out my notes from the interview, published on Expanse Stocks back in December 2024:

📎 Jeff Bezos DealBook Summit Interview: Highlights & Takeaways

Easily one of the most insightful discussions from Bezos—so many “golden nuggets” that I lost count!

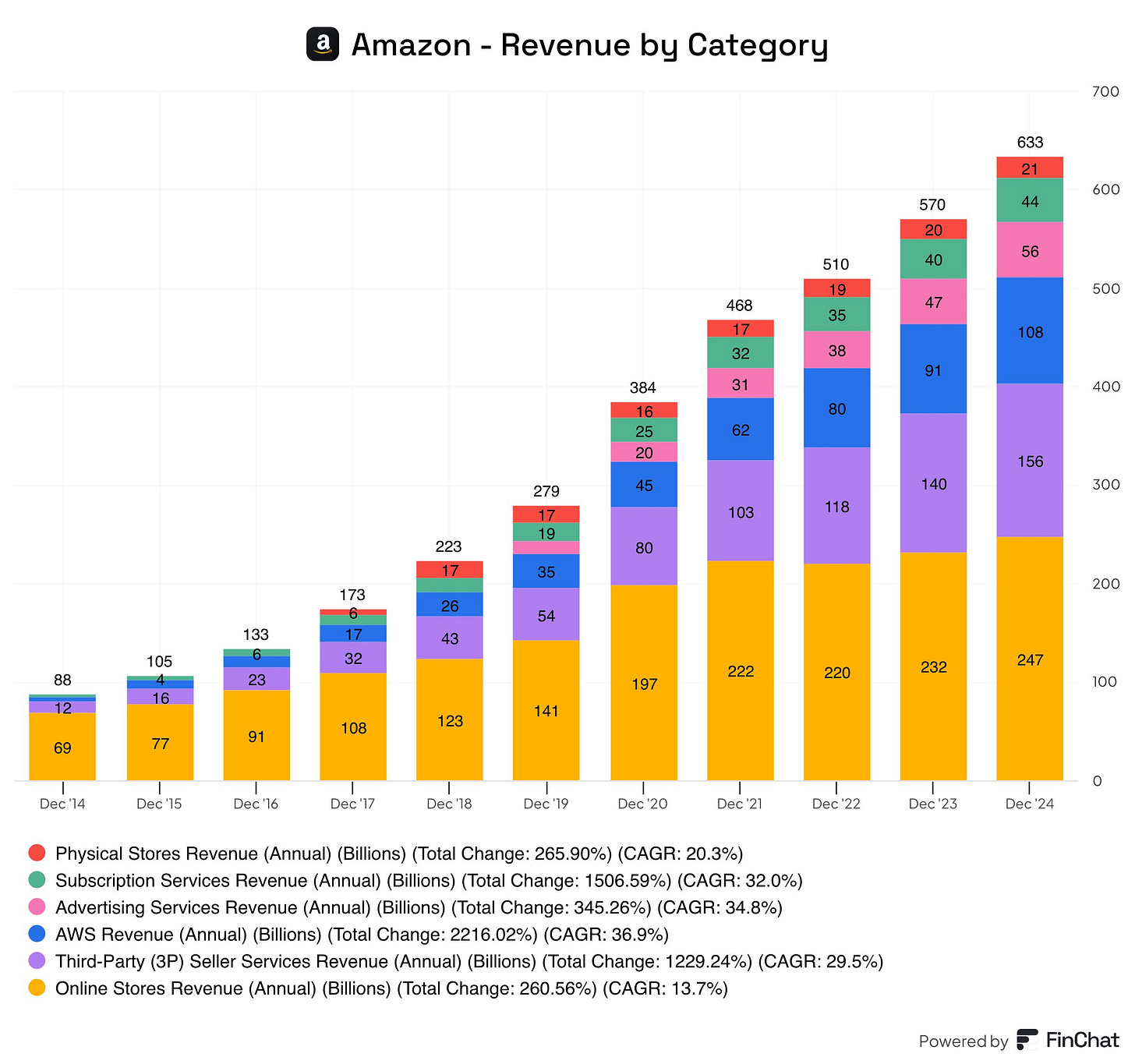

Company Overview

What began as an online bookstore in 1994 has evolved into an empire spanning e-commerce, cloud computing, artificial intelligence, entertainment, and logistics.

With operations in over 20 countries and a market capitalization that routinely hovers above $2 trillion, Amazon isn’t just a company; it’s a global juggernaut. Whether through Prime deliveries, Alexa-powered smart homes, or AWS servers running the internet’s backbone, Amazon has woven itself into the fabric of everyday existence.

Amazon’s mission statement:

"To be Earth's most customer-centric company, where customers can find and discover anything they might want to buy online."

Business Model & Core Offerings: The Amazon Ecosystem

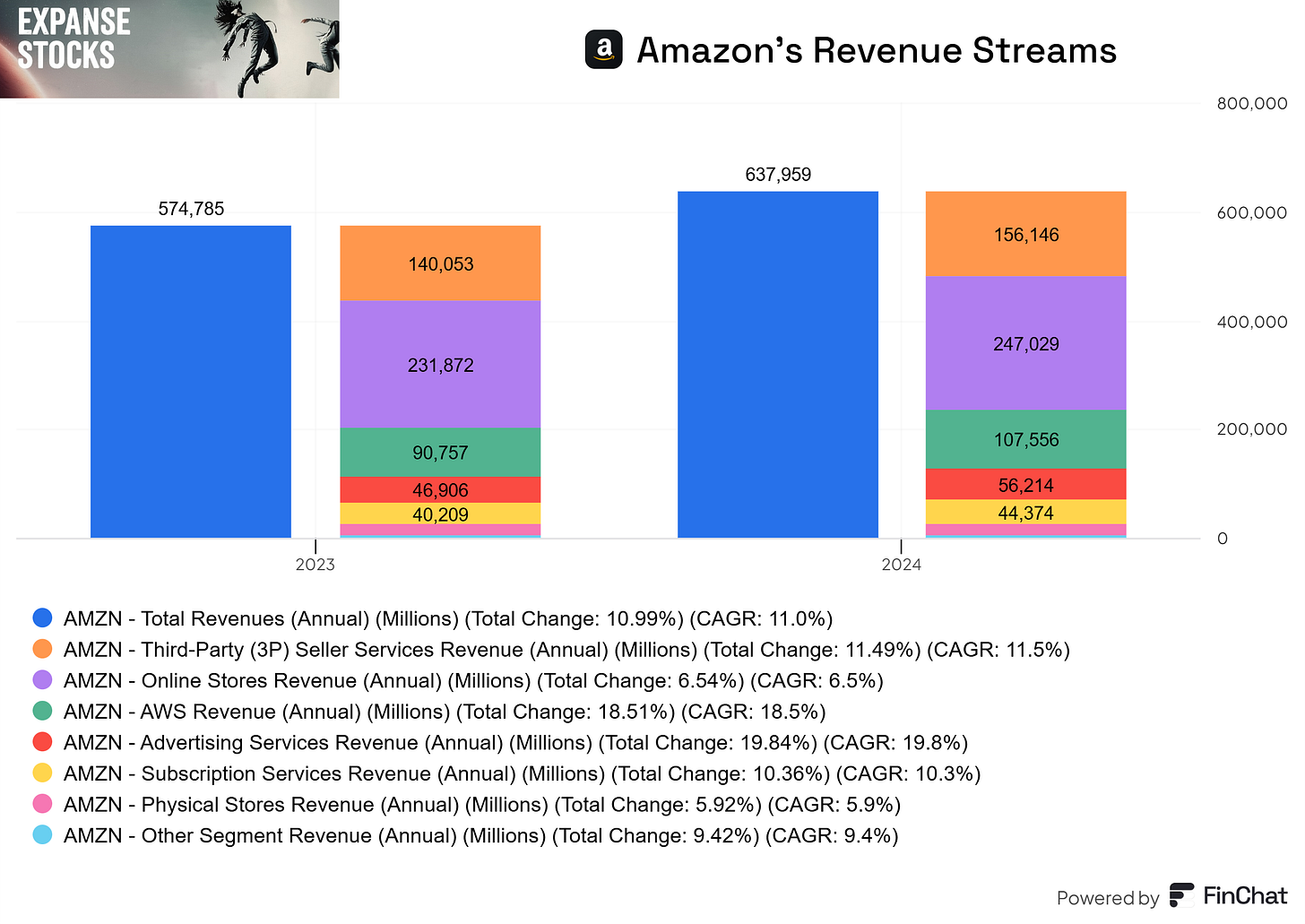

Amazon’s business model isn’t just about selling products, it’s also about creating a self-sustaining ecosystem that keeps customers, sellers, and businesses coming back. The company operates through multiple revenue streams:

🔹 E-commerce & Retail

Online Stores: The traditional retail arm, generating 40% of total revenue, includes direct sales of everything from books to groceries.

Third-Party Seller Services: A rapidly growing segment, contributing for over 24% of total revenue. Amazon earns commissions and fulfillment fees from third-party merchants, who now account for over 60% of all products sold on the platform.

Subscription Services: Amazon Prime, with over 200 million subscribers, providing fast shipping, exclusive content, and perks, driving customer loyalty and higher spending per user.

🔹 Amazon Web Services (AWS)

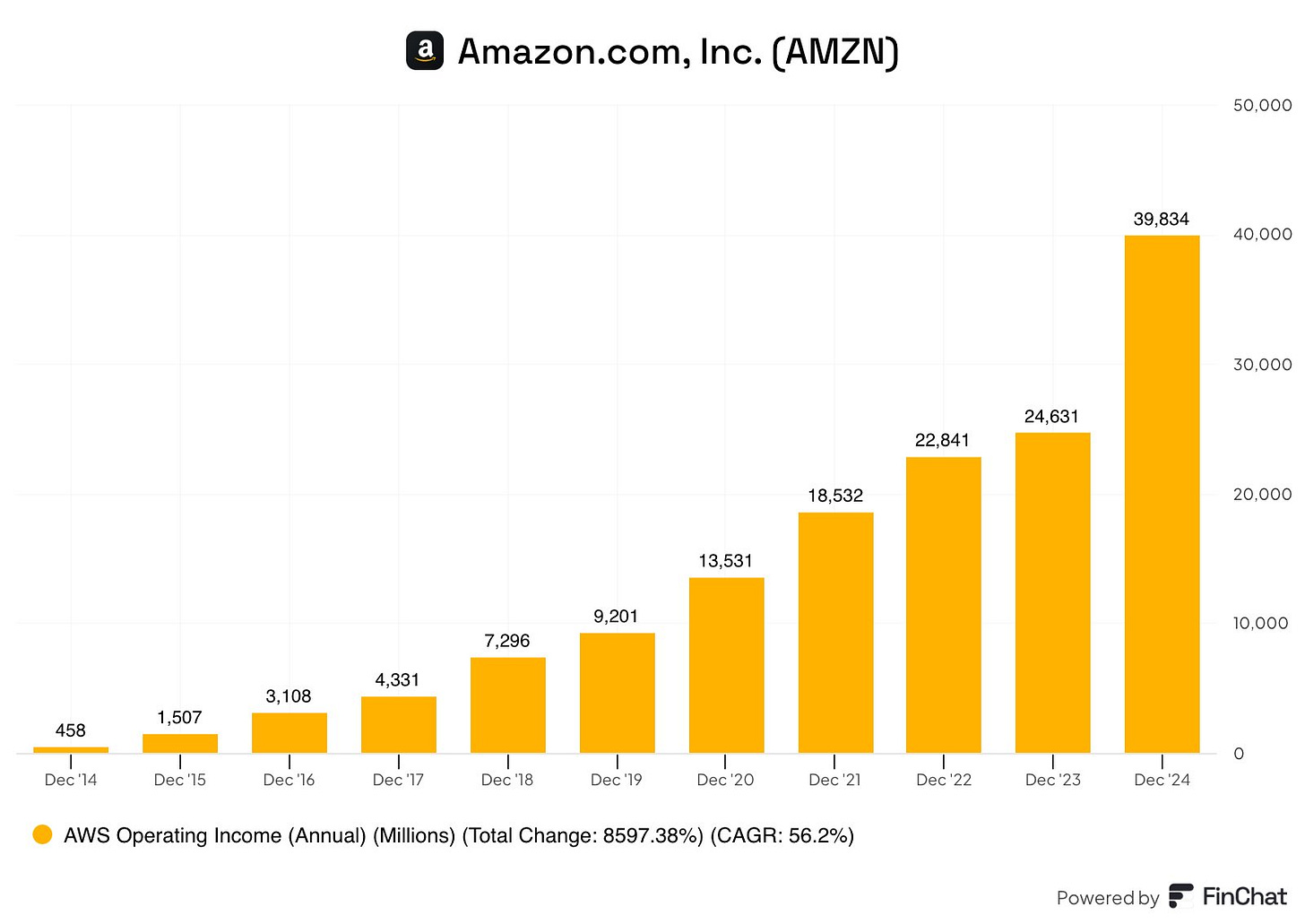

AWS is generating over $100 billion in annual revenue, accounting for over 15% of total revenue, and contributing significantly to overall profits. It isn’t just Amazon’s most profitable, high-margin segment, it’s become the backbone of the modern internet. With over 30% market share in cloud computing, AWS powers everything from startups to Fortune 500 companies, providing computing, storage, and AI solutions.

🔹 Digital Advertising

Amazon has quietly built a digital advertising empire, now accounting for 9% of revenue. With precise data on consumer habits, Amazon’s ad platform rivals Google and Meta in profitability.

🔹 Logistics & Physical Stores

Amazon’s logistics network, from drone deliveries to cashier-less stores, is starting to reshape, once again, the retail industry. Whole Foods, Amazon Fresh, and Fulfillment by Amazon (FBA) bolster its presence in both physical and digital commerce.

Economic Moat

Amazon’s enduring dominance is built on several competitive advantages:

1️⃣ Network Effects: The more customers shop, the more sellers join. The more sellers join, the greater the selection and competition, creating a flywheel effect that reinforces Amazon’s supremacy.

2️⃣ Cost Advantages: Economies of scale enable Amazon to negotiate better prices, provide free shipping and streamline logistics, lowering costs. Competitors struggle to match this advantage.

3️⃣ Intangible Assets: : Proprietary data, AI-driven recommendations, and exclusive Prime Video content enhance Amazon’s brand and stickiness.

4️⃣ Switching Costs: AWS customers, deeply integrated into Amazon’s ecosystem, face significant challenges in moving to another cloud provider.

Amazon’s strength isn’t just about selling more, it’s about making it nearly impossible for consumers and businesses to leave. All in all, one of the strongest “moaty” businesses in existence.

Growth Drivers

Several megatrends are propelling its next phase of expansion:

🔹 AI & Cloud Expansion

The rise of generative AI is a major tailwind for AWS, with services like Bedrock and proprietary ASIC chips (Trainium & Inferentia) positioning Amazon as a leader in AI infrastructure.

🔹 Logistics & Fulfillment Innovation

Amazon’s multi-hub strategy and increased use of robotics are lowering costs while improving delivery speeds, enhancing the customer experience.

Surprisingly, this is one of the areas most overlooked by investors but it may probably be one of the main drivers for higher profitability and margins expansion in the future.

🔹 Digital Advertising

Amazon’s growing dominance in digital advertising presents a lucrative opportunity, leveraging consumer purchase intent data for targeted ads.

🔹 Entertainment & Media

Investments in Prime Video, Twitch, and MGM Studios show Amazon’s commitment to competing with Netflix and Disney in the content streaming space.

🔹 Physical Retail Expansion

Amazon is deepening its presence in physical retail with Amazon Fresh, cashier-less Amazon Go stores, and its acquisition of Whole Foods.

🔹 Healthcare

With initiatives like Amazon Pharmacy and One Medical, Amazon is positioning itself as a potential major player in the healthcare distribution industry.

🔹 New Verticals

Amazon is betting on other long shots like EVs through its Rivian’s partnership but also in Fintech, widening its market reach.

Pulling the strings behind the scenes, Jeff Bezos has been actively seeking to develop 📎 Project Kuiper, an initiative to increase global broadband access through a constellation of more than 3,000 satellites in low Earth orbit. How this satellite based communication services may contribute to create synergies with the current business is yet to be seen.

Capital Allocation

The company prioritizes reinvestment into the business as the primary driver of shareholder returns, favoring internal growth over dividends or stock buybacks.

🔹 Reinvestments while keeping a Solid Balance Sheet

Amazon maintains a substantial net cash position, with strong free cash flow from AWS and advertising as main contributors. Historically, Amazon has generated immense liquidity, enabling the company to fund its aggressive expansion without compromising financial stability. The company is consistently reinvesting in high-growth areas like cloud computing, logistics, and AI.

🔹 Strategic Acquisitions

Amazon regularly pursues small, strategic acquisitions, but these tend to be immaterial to its financials. Instead of focusing on large-scale mergers, Amazon integrates niche innovations that enhance its existing operations. Examples include the purchase of MGM Studios for $8.5B to improve Prime Video’s content library and the acquisition of One Medical to expand into healthcare.

🔹 Leadership and the Track Record of Innovation

Amazon has a knack for turning skeptics into believers—again and again. From AWS to Prime, its history of bold bets evolving into industry dominance is no accident. Jeff Bezos built the blueprint, but since stepping down as CEO in 2021, he’s left the execution to Andy Jassy, the former AWS chief who proved himself navigating both the COVID-19 storm and the AI boom but who’s still under the large shadow of his predecessor.

Jassy faces fresh challenges, from the rise of generative AI to growing competition. But with deep cloud expertise and his strategic eye, I believe he’s well-equipped to lead Amazon through its next evolution. Time will tell.

🔹 Management Incentives Plan

Amazon plays the long game—not just in business but in how it pays its top execs. Unlike many large corporations that offer annual bonuses, Amazon hands out stock awards that vest over several years, keeping leadership focused on sustainable growth rather than short-term gains. Current CEO Andy Jassy, for example, received a significant stock package upon his promotion, structured to align his incentives with Amazon's long-term success.

By tying compensation to stock performance, Amazon reinforces its obsession with innovation, efficiency, and expansion into new growth frontiers. In short, when Amazon wins, so do its leaders because they’re in it for the long haul.

Risks & Challenges

Despite all the strengths, Amazon also faces some challenges:

⚠️ Regulatory Scrutiny (Never Gets Old): Increasing antitrust concerns could lead to legal battles and potential breakups.

⚠️ E-commerce Competition: Walmart, Shopify, and emerging platforms may erode Amazon’s retail dominance.

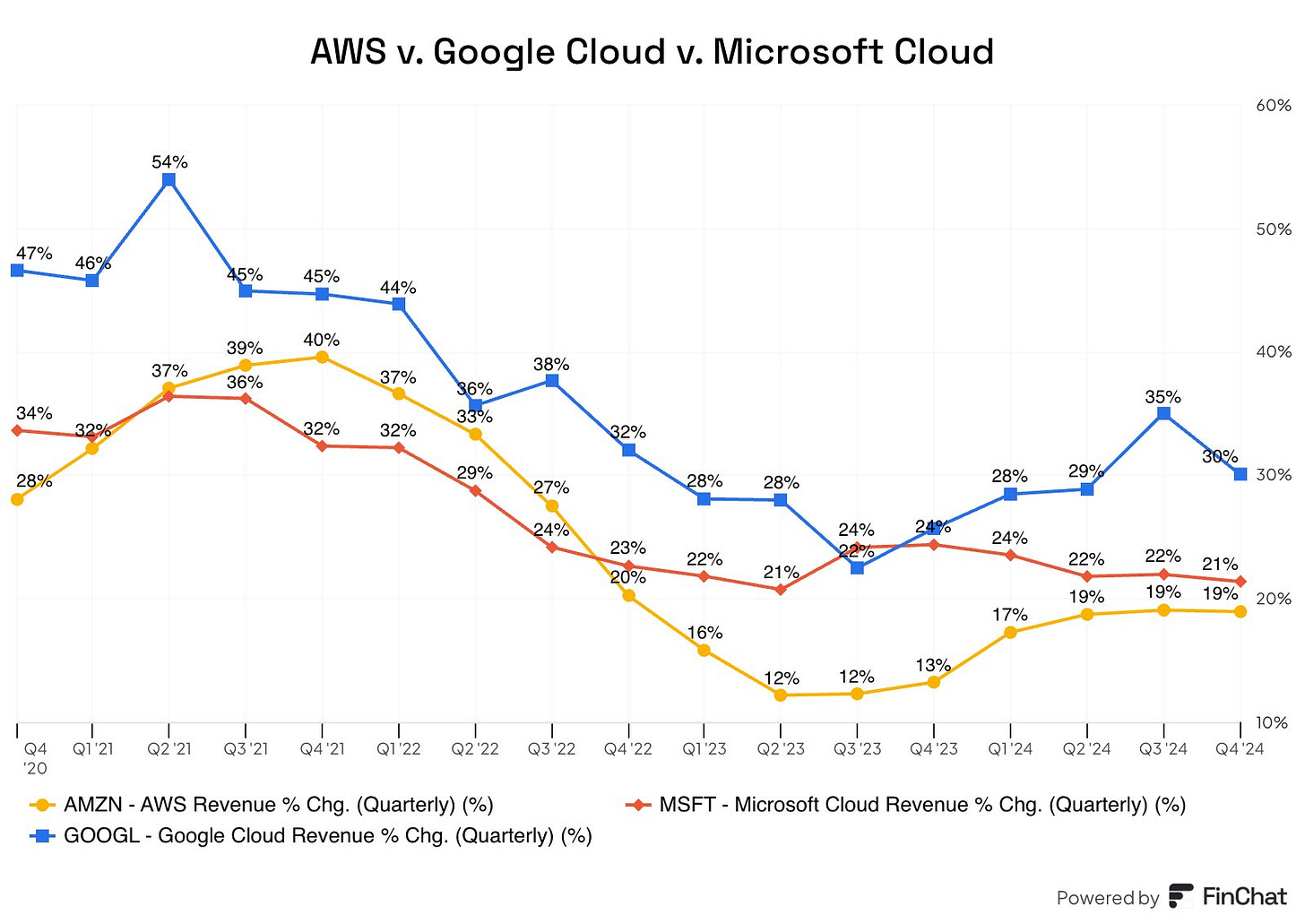

⚠️ Cloud Competition: Microsoft Azure and Google Cloud are trying to close the gap on AWS.

⚠️ High Costs: Rising labor, logistics, and infrastructure costs could squeeze margins.

⚠️ Changing Consumer Behavior: Inflation and economic shifts remain the wildcard that may impact discretionary spending.

Blending Fundamentals with Technical Analysis

When evaluating a business, it's important to balance fundamentals with technical signals. In a market molded by algorithms and sentiment, it's easy to be distracted by short-term fluctuations. My focus remains on long-term trends, filtering out daily noise to get a clearer picture.

Some key valuation metrics I’ll focus on when evaluating Amazon include:

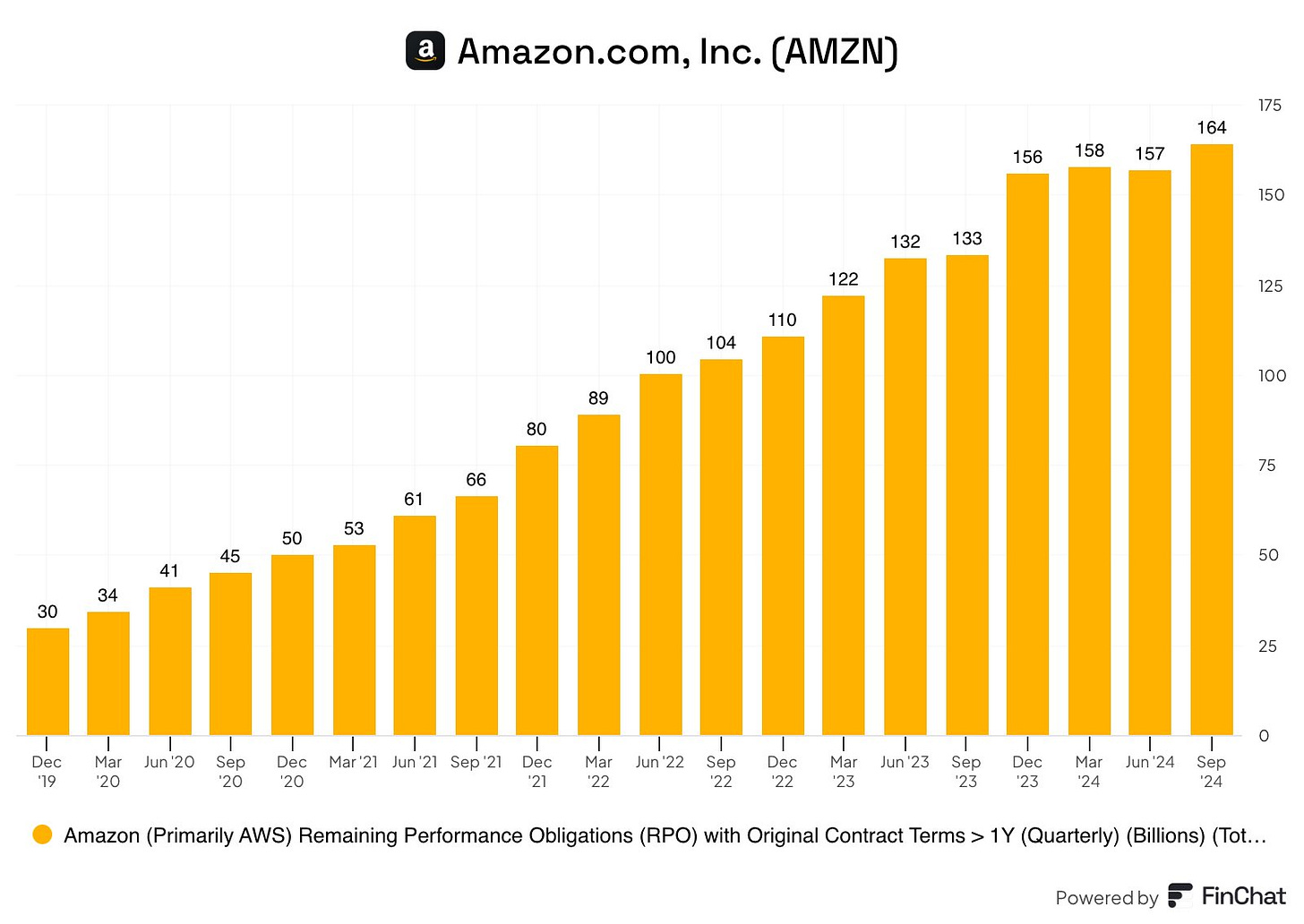

Growth metrics: Revenue Growth (by Category) and AWS Remaining Performance Obligations (RPO)

Profitability: Operating Profits & Operating Margin

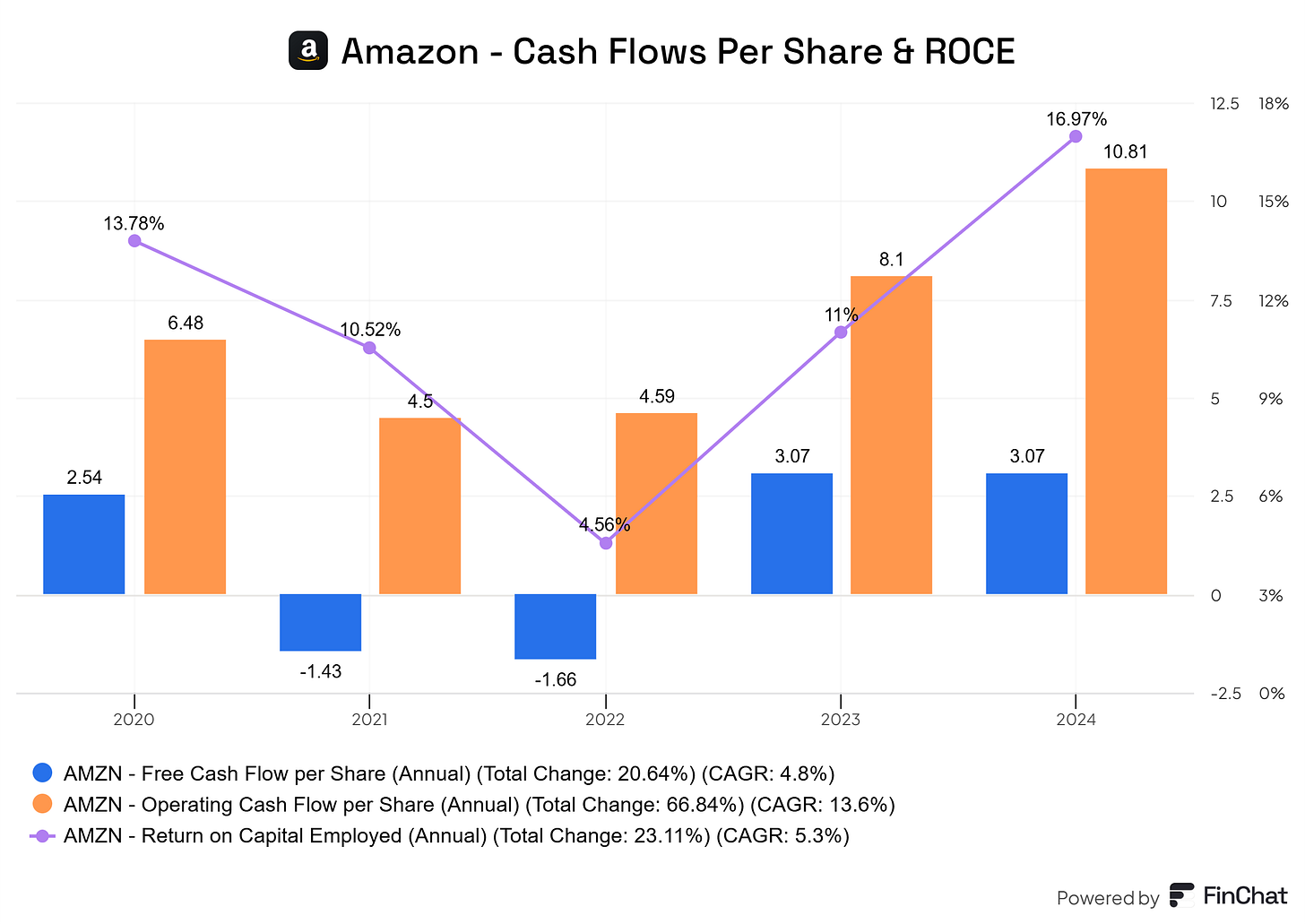

Financial Sustainability & Capital Efficiency: Return on Capital Employed (ROCE), Operating Cash Flow per Share, Free Cash Flow per Share

For technical analysis, I prefer simplicity, sticking to a few core indicators for weekly timeframes:

100-week and 50-week MA: To track trends and support/resistance levels

MACD: To gauge momentum and identify buy/sell signals through crossovers and divergences

Volume: To measure the strength of price movements and confirm breakouts

Price levels: Important historical price levels acting as long-term support or as resistance.

🛒 Amazon (AMZN)

Weekly Technical Analysis

✅ Amazon is retesting its key breakout level around $190-200, continuing its climb from its multi-year base (2022–2024)

✅ In the midst of this market “turmoil”, the price has dropped from ATHs to land on the 50-week MA, which initially held but gave way to a second support level around $190, aligning with its previous breakout. The stock is now attempting to stabilize.

✅ Looking stronger than other Big Tech peers—GOOG and MSFT have fallen further below their 50MA and are struggling to reclaim their bullish stance.

⚠️ Important moment ahead: This $190-200 zone is key for keeping the bullish setup intact (at least in the short term). A breakdown could open the door to more downside, with momentum indicators flashing a "make or break" signal, as we’ll see next.

Key Indicators:

🔹 MACD: Still above the zero line, but the MACD (blue line) crossed-down and momentum has weakened with the recent market pullback. Watch for signs of stabilization (flattening MACD) in the coming days.

🔹 Volume: First above-average persistent selling volume in months—not alarming yet, but something to monitor.

🔹 Support Levels:

📌 $190 – Key long-term support from the multi-year base (2022–2024).

📌 $160–$170 – Next major support zone if the breakdown continues.

Fundamental Analysis

🔹 Growth Trends

Amazon might be a $2T behemoth, but its revenue growth has been anything but sluggish. Over the past decade, the company has continued expanding at an impressive pace. Sure, the COVID years (2020–2022) threw some curveballs—supply chain chaos, shifting demand, and massive CapEx investments—but 2023 and 2024 have marked a strong rebound.

This time, the growth story isn’t just about scale—it’s about profitability. High-growth, high-margin segments like AWS, Advertising, and Subscription Services now account for a third of total revenue, fueling Amazon’s next wave of expansion. The retail juggernaut is getting bigger but also getting smarter about where the real money is.

AWS growing and showing Resilience vs Hyperscalers

Even with over $100B in revenue and a commanding 30%+ share of the cloud market, AWS isn’t slowing down—still growing at a solid 19% with one of Amazon’s key KPIs, Remaining Performance Obligations (second chart below), still perking up too.

More impressively, it’s holding its ground better than competitors like Azure (first chart below), proving its resilience in an increasingly crowded space.

The real fun? Watching how this cloud battle unfolds in 2025 and beyond, as AI innovations shake up the landscape. With new disruptions and opportunities on the horizon, the next chapter of the AWS vs. Azure rivalry may be just restarting (again).

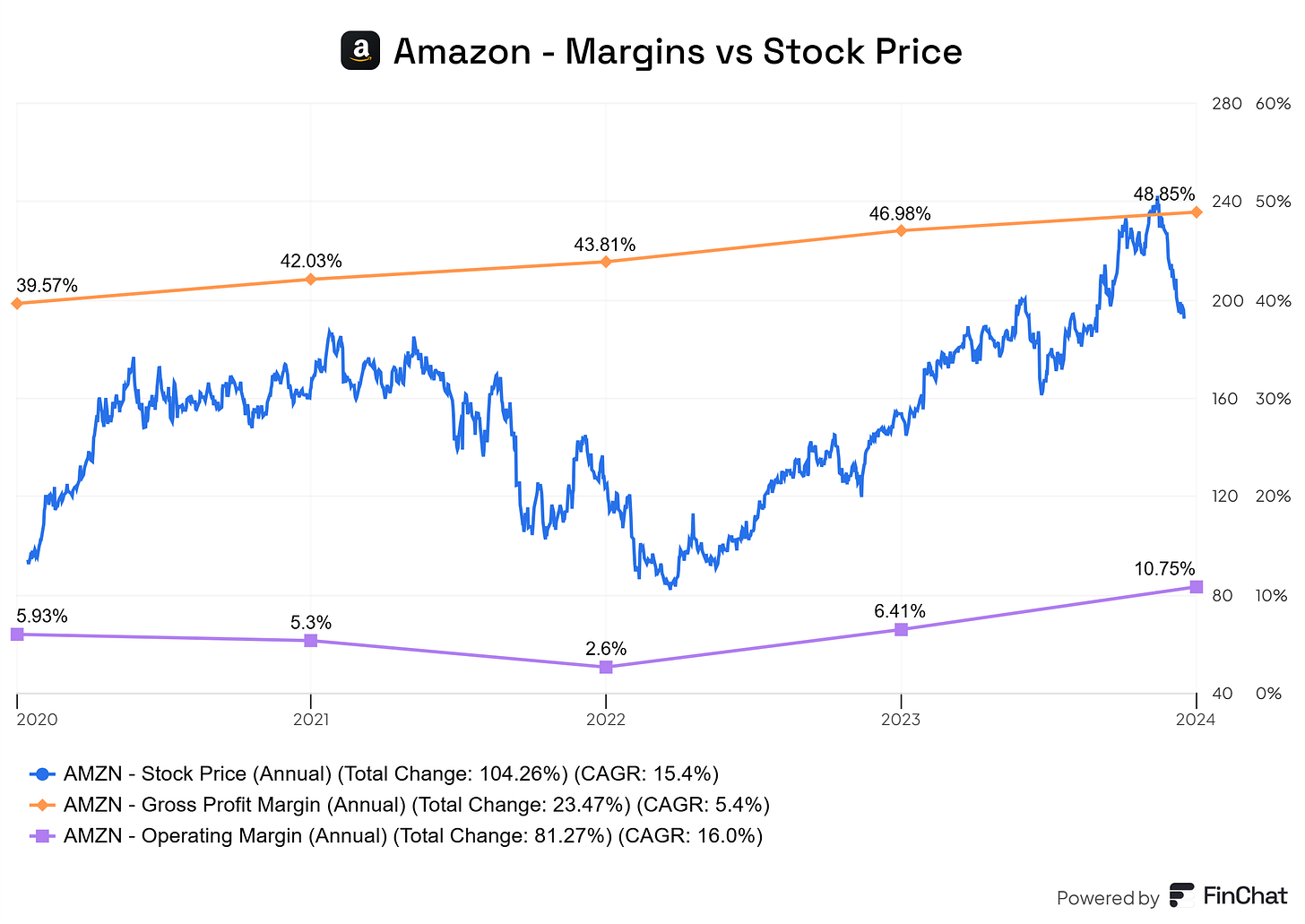

🔹 Profitability

Amazon’s stock has been on a strong run lately, and for good reason. Even with the recent market-wide turbulence, the company’s focus on driving operational efficiencies—especially after its heavy Covid-era investments in logistics & fulfillment and higher-margin venues (like AWS and Ads)—is paying off in a big way.

The results? Gross margins approaching 50% and, more impressively, operating margins and operating profits reaccelerating at scale like never before. In short, Amazon’s becoming a leaner profit machine. Spectacular, to say the least.

🔹 Sustainability and Capital Efficiency

Cash flow and returns on investments are two key financial metrics for assessing a company’s intrinsic value and future shareholder returns. The good news? Amazon’s operating cash flows (OCF) and return on capital (ROCE) are trending in the right direction. The not-so-good news? Free cash flow (FCF) is stagnating year-over-year, and that’s raising some eyebrows in the market.

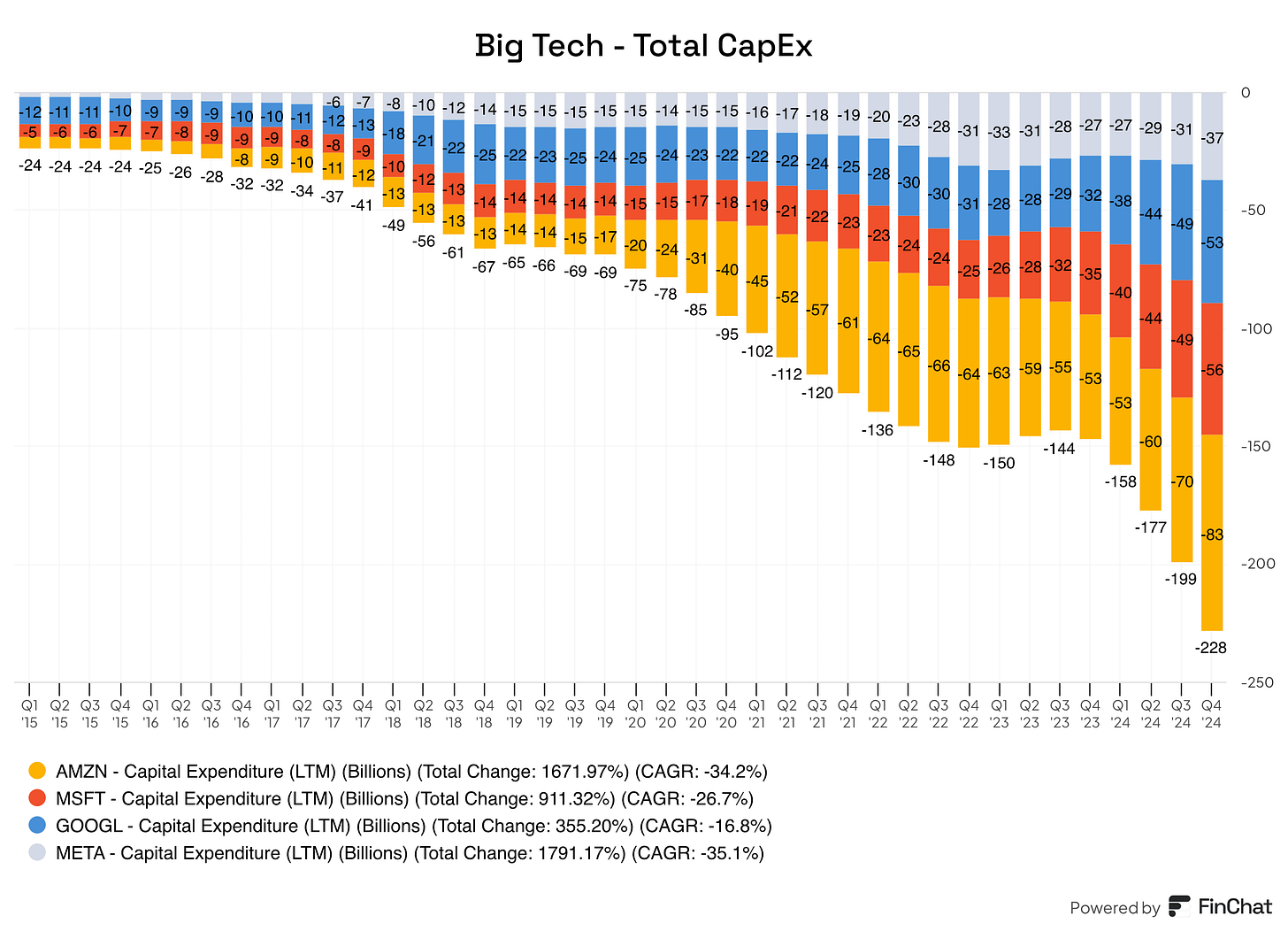

Why? As Amazon exits its Covid-driven investment cycle, it’s diving headfirst into another high CapEx cycle—this time for AI infrastructure. This is putting pressure on FCF (since FCF = OCF - CapEx). While these investments are unlikely to yield immediate returns, hyperscalers like Amazon are going ‘all-in’ on AI, betting big on its long-term potential (see chart below).

Short term, this adds uncertainty, which explains the market’s hesitation in pushing Amazon’s stock even higher.

What about long term? If history is any guide, Amazon’s strategic investments tend to pay off in a big way. We will know in due time.

Earnings Growth Model: A Quick Mental Framework to Estimate Potential Returns

A simple way to approximate long-term stock returns is using this formula:

📌 Expected Return ≈ Earnings Growth + Dividend Yield ± Valuation Change

For a growth-focused stock with minimal or no dividends like Amazon, this other formula may be more suitable:

📌 Expected Return ≈ Earnings Growth ± Valuation Multiple Expansion/Contraction

This model helps investors quickly assess if a stock’s projected growth aligns with their return expectations—without diving into more complex DCF calculations.

1️⃣ Earnings Growth (EPS Growth Rate)

Earnings growth is calculated using the EPS Growth Rate. To estimate this rate, consider:

Historical EPS growth: My starting point is typically over 5 to 10 years.

Analyst estimates: Useful but often optimistic, so take them with a grain of salt.

Management forecasts & industry trends: Help refine assumptions.

Amazon’s case:

EPS has grown at a 30% CAGR over the last 5 years.

Analysts project 20+% annual Normalized EPS growth for the next 3+ years.

Amazon management’s insights suggest over 20+% EPS CAGR ahead.

To stay conservative, let’s assume a 18% EPS growth rate.

2️⃣ Valuation Multiple Expansion/Contraction (Change in P/E ratio)

To estimate the impact of valuation changes:

Where:

Ending P/E = Fair P/E at the end of the holding period.

Current P/E = P/E at the start.

N = Holding period in years.

Amazon’s case:

Current P/E = 35x, well below its 5-year normalized average of 45x.

To stay conservative and assuming a 5-year holding period, a reasonable fair P/E might be 30x (considering its high quality and historically high multiple).

Using the formula above, this results in a valuation drag of -3% per year

3️⃣ Earnings Growth Model Results

So, Amazon’s Expected Returns over 5 Years is:

📌 Earnings Growth ± Valuation Change ≈ 18% − 3% = +15% CAGR

🔑 Key Takeaways

The Earnings Growth Model offers a quick way to estimate returns.

Three factors—EPS growth, (dividends), and valuation shifts.

Margin of safety is key—Wall Street projections can be overly optimistic.

Amazon’s estimated 15% annual return suggests overperformance ahead vs overall market.

Of course, this approach —although straightforward— doesn’t capture intrinsic value fully and it’s oversimplified, so I like to complement it with my DCF and reversed-engineered DCF models.

Next content is reserved for Paid Subscribers and includes:

1️⃣ Traditional DCF Model – Amazon’s intrinsic value & implied share price

2️⃣ Reverse-Engineered DCF – Amazon’s expected returns using proprietary models

3️⃣ Capital Efficiency - ROIC, ROCE and ROIIC using proprietary models

4️⃣ Final Thoughts – My stance on Amazon as a long-term investment

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 8-Oct-2025)