TOP 5 Picks 2025: 🎅 Christmas Specials

A list of 5 names + 2 extras for long-term investing and swing trading going into 2025.

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 28-Jun-2025)

Expanse Stocks x Finchat.io Partnership!

🎁 Get 20% off + 2 months free on any Finchat plan! →📎 Claim Discount

Welcome back and Happy Holidays!

Thank you for joining me on this Christmas Specials.

This year has been a rewarding one for investors, particularly those investing in US equities, with the SPY and QQQ delivering impressive back-to-back +20% annual returns. Incredible, right?

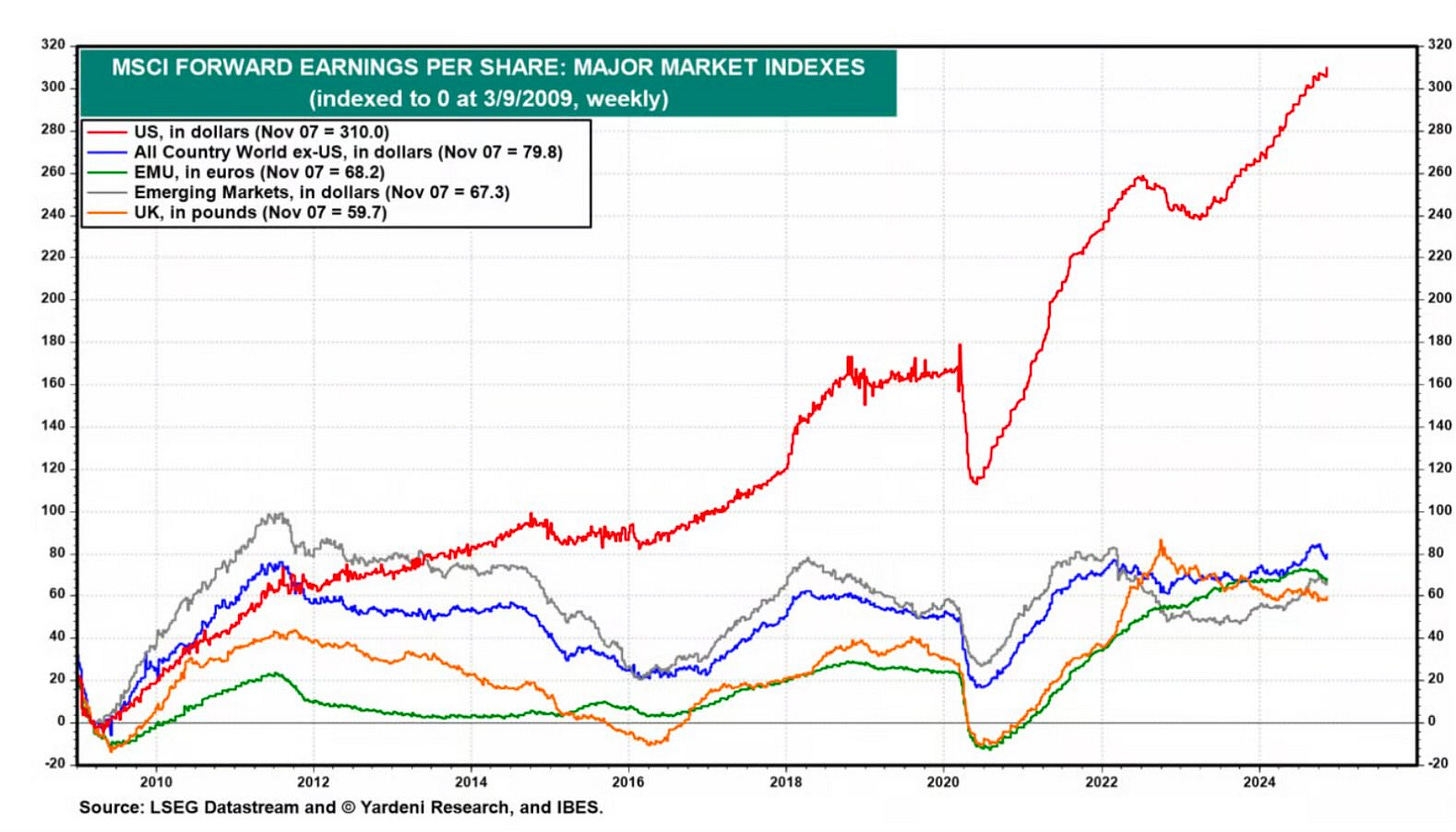

Well, maybe not so surprising when you take a closer look. The underlying driver behind this stellar performance has been strong EPS growth, which US markets have consistently outpaced compared to global counterparts like Europe, China, and the rest of the world 👇

As simple as it may seem, EPS Growth is a one of the main drivers of market returns, and the U.S. has dominated this metric for years (especially since the start of the Covid pandemy back in 2020).

What lies ahead in 2025?

While historical data can be fascinating, it offers limited predictive power. Some sources, like the one presented by Carson Investment Research, point to double digits SPY returns since 1950 after two consecutive +20% years:

But the reality is that markets are inherently unpredictable, and past performance isn't a blueprint for the future.

For long-term investors, the focus should be on multi-year horizons and underlying fundamentals. Meanwhile, swing traders should stick to technical setups, market momentum, and sentiment.

The takeaway? Avoid relying on 1-year market predictions based on historical data. This approach is flawed and can lead to misplaced confidence.

So, any Picks for 2025?

I can't predict what next year holds, but I can share my preferences. These are grounded in a blend of fundamentals, market context, and technical analysis.

So, let’s dive into my Top 5 Picks for 2025! 🎅

…and two extras:

Swing Pick: I’ve added a 6th pick—a high-beta small-cap stock for swing traders. It’s backed by an exceptional chart setup and comes highly recommended by a trusted friend in the Stocktwits community.

Bonus - “Trifecta” Pick: At the end of the article, you’ll find my 7th pick for Premium Subscribers—a trifecta of three stocks, similar yet distinct, operating in the same industry with strong secular tailwinds. Among them, I uncover a small-to-mid-cap hidden gem for long-term investors. This promising name has recently earned a spot in my portfolio. It’s also featured in my Hidden Gems - Special Edition (exclusive to Paid Subscribers)—don’t miss it!

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

👀 Recent Releases!

👀 Coming Soon

💎 Hidden Gem - Fifth Edition

💸 Why Equities Win Against Other Assets

🎮 Nintendo (NTDOY)

Nintendo made my October Monthly Specials edition earlier this year, and although the stock has already started to break out from its multi-year base and still believe there is plenty of fuel left going into 2025. Let’s see why.

Technical setup

Breaking out from its large Cup & Handle pattern, similar to past setups.

Price above the rising 50-week MA as the stock breaks out from its mature base.

MACD is setting up for a momentum boost just like in past cycles, pending upcoming news—which I’ll discuss later.

Fundamentals: Key Valuation metrics (LTM)

28% ROIC | 27% Operating Margin | 26.7% FCF Margin | 27.6 OCF/Sales

No debt, with ¥2,163.13B in Cash and a ¥9,415.2B MC

These metrics are impressive, especially considering that Nintendo is in the final phase of its console cycle. The Switch, now 8 years old, has sold over 145 million units, far surpassing its predecessors, and achieving a longer and more profitable sales cycle.

Market Context and Thoughts

On Nintendo’s Moat:

This legendary entertainment firm has one of the strongest "IP franchise" moats alongside Disney, and it’s gearing up to launch its new Switch 2 console in Q1 2025.

On Nintendo’s cyclicality and Business Model transition:

Often seen as a cyclical video game/console business with low recurring revenues, leadership has been steadily shifting the model toward more reliable, recurring revenue streams with their Nintendo Account system, supporting cross-platform customers, and subscription-based Nintendo Switch Online service (Source: Medium).

Additionally, leadership has ambitious plans to further capitalize on their IP franchises through new film releases and amusement parks.

🧠 FINAL TAKE:

Quality company, undervalued, with strong margins, high ROIC, and plenty of cash on hand. Their business model is shifting toward increasing recurring revenue from video game franchises and consoles, with some of the strongest IP franchises still under-monetized.

Good opportunity for both, swing trading going into 2025 and long term investment, supported by the technical setup, fundamentals and the upcoming console release.

🐶 Zoetis (ZTS)

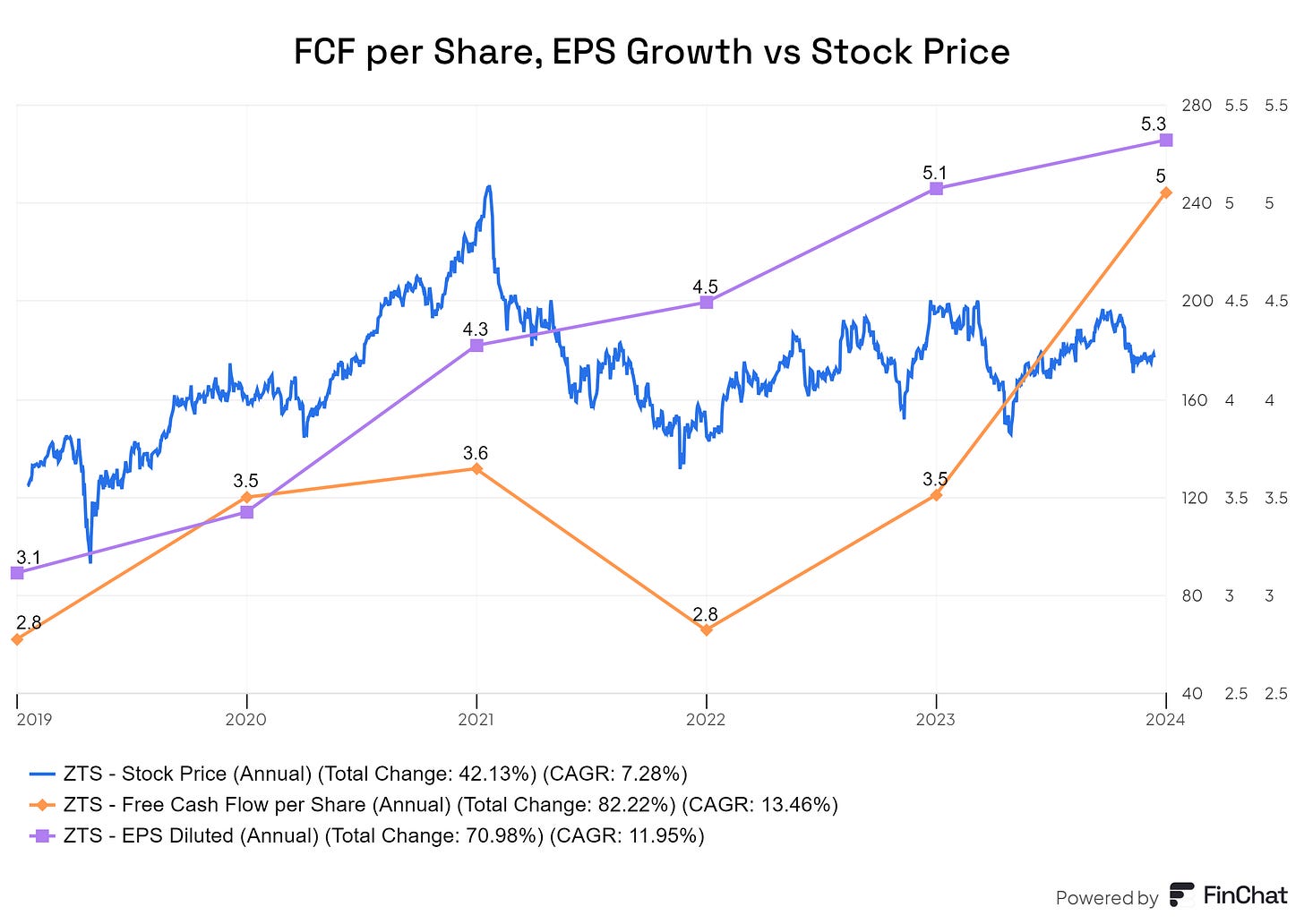

Another name that made it to my October Monthly Specials edition earlier this year. The stock has been 'dead money' for over three and a half years, but this is shaping up to be a 'golden opportunity' heading into 2025. The stock is nearing the end of building a solid multi-year base, while the business continues to grow its EPS at a low double-digits rate and has successfully reaccelerated its FCF/Share growth over the past three years, all while the stock price remains stuck. Let’s dig deeper.

Technical setup

50-week MA and 200-week MA flattening out as price is moving sideways and comfortably sitting on both MAs.

Stock price has been attempting to break a strong multi-year resistance level, 195$-200$, while forming a solid rounded base (blue curve) which started to form right after the downfall of the Covid-2021 peak.

MACD with the positive divergence from 2022 and now going above the zero line as it keeps building upward momentum.

Fundamentals

8.8 EV/Sales (NTM) vs 10.1 EV/Sales (5Yr Avg)

21.8 EV/EBITDA (NTM) vs 23.5 EV/EBITDA (5Yr Avg)

24% ROIC vs 23.3% ROIC (5Yr Avg)

EPS continue to grow at a steady 12% CAGR and FCF/Share reaccelerating substantially since the 2022 bottom while price continue to consolidate

Source: Finchat.io. Get 15% discount on any plan with this link

Market Context and Thoughts

On market fears:

With Trump’s election, many investors have panic-sold pharma stocks, fearing changes to pro-pharma regulations and government spending. However, not all campaign promises are realized, and changing the status quo is harder than it seems. With just four years in office, Trump’s remaining term is unlikely to bring drastic changes, potentially creating opportunities for long-term investors as markets often stabilize over time.

On Zoetis’ Business Opportunities and Moat:

Animal health market is expected to grow at 5% CAGR for the next 10 years, and new potential multi-billion markets (renal, cardiology, allergies) are emerging for this pharmaceutical leader with pricing power and a moat in intangible assets (Patents, Brand, Scale).

Source: Zoetis Investors Presentation (September 2024)

🧠FINAL TAKE:

Quality stock trading below its 5-year average valuation, nearing the end of its multi-year consolidation phase, while key metrics for future price appreciation like FCF/share or EPS Growth keep improving.

Good opportunity for both, long investment or swing trade, at these levels based on fundamentals and technical setup.

💻 Synopsys (SNPS)

Although it may seem surprising, given the stock's poor performance this year compared to its peers in the semiconductor and software sectors, this pick is driven by its technical pattern, the underlying fundamentals, and the secular tailwinds ahead. The company operates in a critical market dominated by an oligopoly, with Synopsys and Cadence Design Systems at the helm. Let’s take a closer look 👀

Technical Setup

At first glance, the current setup may not seem ideal, but with a proven compounder that rarely dips below its 50-week MA, recoveries often come quicker than expected. Here’s a closer look at why this might be another promising opportunity 👇

Price Action

The stock has been consolidating, and the 50-week MA has flattened as it has struggled to reclaim this level for several months.

MACD

While the MACD has been trending downward and lingering below the zero line, there are early signs of momentum beginning to turn upward with some parallels from H2 2023 chart pattern (circled in orange).

Volume

Selling pressure has been gradually declining since the July peak, with the major exception being the post-Q3 2024 earnings release, which triggered an overreaction in volume.

Historical Patterns

Highlighted in violet, the pattern from H2 2023 offers interesting parallels. When the price dipped below the 50-week MA previously, it didn’t stay there for long. The stock recovered support, reclaimed the 50-week MA, and resumed its upward trajectory. Back in H2 2023, after consolidating for about two years, this pattern preceded a +68% yearly rally once the MACD crossed above the zero line.

Market Environment and Commentary

SNPS sold off after a decent Q3 2024 report and a prudent FY2025 outlook due to a mix of factors as explained by their management team: “impact of a shorter fiscal period for FY2025 (1 week shorter), market uncertainty and pragmatic view of China, readying our company for the largest acquisition in our history (ANSS acquisition expected for H1 2025)”

Although the stock is not specially cheap, it’s trading below its 5-year average P/E ratio and the opportunities ahead, despite the above factors, are as bright as ever with the rise of AI and the need of custom ASIC chips design.

Their competitor, Cadence Design Systems recently highlighted some interesting trends for the semiconductor industry and chips design on their investor call. Their CEO noted:

“Generational trends such as hyperscale computing, autonomous driving, and 5G, are all accelerated by the AI super cycle…”

“… executing to our intelligent system design strategy that triples our TAM opportunity while significantly expanding our portfolio across core EDA, IP, and system design and analysis. I'm excited about AI's incredible promise and how rapidly it is becoming an integral part of the design workflow, with customers steadily increasing their investments in AI-driven automation.”

🧠FINAL TAKE:

EDA, IP, and system design and analysis are dominated by an oligopoly, with Synopsys as a key player. Their solutions are essential to chip manufacturing, and their market and applications are expanding, accelerated by the AI super cycle and major growth trends in computing, autonomous driving, and 5G.

The potential acquisition of Ansys is Synopsys’ wild card. If approved, it would further expand their moat and TAM, though it can create short-term stock price pressures.

Solid opportunity for a long-term investment, backed by secular trends and a critical role within an oligopoly essential to the semiconductor industry. Technical setup has potential for a swing trade too, showing signs of repair and preparing to gain momentum once again.

💸 Adyen (ADYEN)

Another name that featured in my Monthly Specials series for December, this one is an “easy” pick. Not much has changed in terms of its technical setup and fundamentals since I highlighted it last month—except for one key development: the stock has moved higher recently and is now on the verge of breaking out from a bullish multi-year inverse head-and-shoulders pattern. Here’s why it’s a Top Pick:

Technical Setup

Adyen’s stock collapsed in August 2023 following its H1 2023 earnings release, driven by disappointing sales growth and compressing margins. This decline pushed the stock back to pre-pandemic levels. However, over time, this has created a very interesting technical setup, as explained below:

Inverse Head and Shoulders (Weekly Timeframe):

Left Shoulder: Formed after the end of 2021, establishing a key support level around the €1200 range.

Head: Developed during the 2023 collapse, where the stock bottomed out at long-term support near €600.

Right Shoulder: Recently formed above the crucial €1200 support zone, with the stock now approaching a breakout level near €1500.

Smaller Inverse Head and Shoulders (Highlighted in purple):

Over the past few months, a smaller inverse head-and-shoulders pattern has emerged, reinforcing the bullish potential.

50-week MA

Price jumped above the 50 MA recently which is perking up as the stock prepares for the breakout.

MACD

The MACD line is gaining momentum above the zero line and points to a potential bullish reversal.

Volume:

Selling volume has steadily declined, with dips being consistently bought on spiking volume—a positive indicator of accumulating demand.

A breakout from the bullish pattern would be further validated by a spike in buying volume.

Fundamentals

There’s a lot to like about Adyen as it continues to carve out a significant niche in the global payments landscape. Here are the key reasons:

Simplifying Payment Complexity: Adyen addresses the headaches of managing multiple local payment providers by offering seamless payment routing, lowering merchant costs, and boosting authorization rates.

Capital Efficiency: Its capital-light model helps to achieve sustainable growth, on Adyen’s CEO words: “We aim to maintain a sustainable capital expenditure level up to 5% of our net revenue”

Scalable Growth: Targeting net revenue growth in the low-to-high 20% range annually through 2026, demonstrating its ability to scale fast.

Margin Strength: With inherent operating leverage, the company aims to achieve EBITDA margins above 50% by 2026. This is industry-leading profitability.

Solid Balance Sheet: Adyen remains net cash-positive with minimal debt, providing both stability and flexibility for reinvestment.

Market Share Upside: Operating in a highly fragmented market, Adyen is just getting started, with significant runway to expand its market share:

"We are still the minority player across our customer base on average... There is a lot of volume for us to still win in our existing base. The business will be much bigger in the years ahead than it is today. And in doing that, we want to be sure that we have the right flexibility to invest where we can accelerate growth." — CEO comments, H1 2024 Conference Call, on the vast untapped volume within the company’s existing customer base

Price will Catch Up to Fundamentals

Since the revenue growth slowdown from the Covid-era bubble in 2021—declining from the mid-40% range to the low-20% range by H1 2023—Adyen's growth has stabilized around the mid-20% level. Meanwhile, EPS growth has maintained an impressive +33% CAGR over the past four years, even as the stock price remains stuck.

They say, “technicals follow fundamentals.” Well, Adyen might just be a prime example of what could happen… soon.

FINAL TAKE

Adyen’s stock has been building a solid multi-year base, supported by the inverse head and shoulders pattern. With fundamentals showing gradual improvement since the H1 2023 pullback, the stock is on the cusp of a breakout. I think this could be a great opportunity for long-term investors and swing traders going into 2025.

🔎 Google (GOOG)

For Google, I won’t dive into a detailed analysis because the fundamentals, technical indicators, and chart patterns speak for themselves. However, I do want to share my personal thoughts on this still underappreciated (and sometimes hated) innovation powerhouse.

While many focus on concerns about competitors stealing Google’s search market share and the DOJ's break-up potential, Google is positioning itself for a potential run into 2025. Its transformation beyond search is surprisingly underappreciated with its rapidly growing and profitable cloud services, leading video platform, and ventures into more than exciting fields like:

AI, where Google is ahead of competition, with their proprietary TPUs powering most of their services

Automotive autonomy, where Waymo is already the only approved vehicle with a fully autonomous system and is just starting its expansion

Quantum computing: Google unveiled Willow earlier this week, a quantum chip that could transform industries. More details on this release here. While it's still in its early stages, the potential for real-world applications—like revolutionizing drug discovery or powering highly efficient systems—is immense in the long-term and it’s the kind of innovation that could make anyone dream.

So, my question to the fear mongers is: What’s there to fear and not be excited about? I still don’t get it.

🎢 Swing Pick: Magnite (MGNI)

High-beta Tech Play

One of the pandemic-era high flyers, this $2.2B small-cap technology company has seen a dramatic fall from its $60s heights to the single-digit range. Despite what seems like a risky or bold choice, there are some good reasons to take a closer look, specially for swing traders.

MGNI operates a global, independent sell-side advertising platform for Connected TV (CTV) channels and has recently made significant strides improvement on its fundamentals:

Turned profitable in the last quarter after years of sluggishness in negative territory.

Trades at a forward P/E of 19 and EV/FCF of 17.

Achieving a 31.52% 5-year CAGR improvement in its now-positive ROIC.

However, the real appeal lies in its technical setup, which bears a striking resemblance to Cloudflare (NET), one my favorite high-growth names I highlighted in my deep dive a few months ago (link), that recently broke out from its early Stan Weinstein's Stage 2 phase. Let’s break down MGNI’s technicals.

Technical Setup

Weekly Moving Averages (MAs):

The 50-week MA is gradually trending upward, signaling building momentum, though the stock continues consolidating near resistance.

The price has also reclaimed its 200-week MA and is now holding steady around it.

MACD Momentum:

After tightening since early 2024, the MACD line has turned upward above the zero line—a classic signal of a potential strong upward move.

Volume:

Buying pressure spikes over recent months (highlighted by grey arrows) helped MGNI break out of its multi-year base and cross the key resistance at $15s, transitioning from Stage 1 to an early Stage 2 phase.

Volume has since declined in a healthy consolidation pattern, suggesting preparation for further movement within Stage 2.

Stage Analysis:

According to Stan Weinstein’s Stage Analysis (link), MGNI is in an early Stage 2 phase (see image attached to the chart).

This phase is confirmed by a rising 50-week MA, a tightening MACD curve, a successful retest of the previous mid-$15s resistance as potential support, and declining volume after the transition.

These features align with the "playbook" for Stage 2 transitions, setting the stage for future upside.

Although I don’t anticipate the wild price swings of the COVID era, if MGNI's fundamentals keep improving and market conditions—such as lower interest rates—align, 2025 could be a fantastic year for Magnite.

The next pick is a trifecta of stocks. Among them, I uncover for the first time a small-cap gem which comes straight from my 📎 Hidden Gems - Special Edition. I’ve recently added it to my long-term portfolio, recognizing its exceptional potential. The next details about the trifecta pick and the small-cap gem are reserved to Paid Subscribers.

Ready to dive deeper? Here’s what I offer and how I can help you

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 28-June-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles