For years, investing in Japan has felt challenging, to say the least. It’s a nation at the forefront of high-tech manufacturing and robotics, yet many of its corporate processes remain stubbornly analog. This, combined with the infamous ‘lost decades’ of economic stagnation which started in the 90s and a corporate culture that historically prioritized stakeholders over shareholders, led many to underweight or even ignore Japanese equities entirely. The narrative was simple and, for a long time, correct: capital was trapped on balance sheets (see Nintendo), and shareholder value was not a priority.

After digging deeper through podcasts, Japan business literature, Japanese companies’ IR websites, and some wonderful information shared by great investors experts on X (e.g. 🔗 Made In Japan), my view is also that this time really looks different.

A confluence of structural reforms, demographic necessity, and a massive technological catch-up is creating what I believe to be one of the most compelling, under-the-radar investment opportunities for the next decade, particularly within the country's (still) nascent Software-as-a-Service (SaaS) sector.

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO | 🧙♂️ CSU Part #1, Part #2, Part #3 | 🤖 Intuitive

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy, Industry Write-ups & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

🔐 Paid Subscriber Exclusives

💼 Portfolio Corner – Holdings, valuation models, trades, performance & more!

🤫 Exclusive Sections – From select articles, Deep Dive Briefs & Hidden Gems

👀 Recent Releases!

👀 Coming Soon

✨ The Rareness of Moaty Industrials: A Selection of 6 Gems

💎 Hidden Gem: Special Edition III

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 8-Oct-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles

The Multi-Billion Digital Gap Creates Generational Opportunity

While Warren Buffett continues doubling down on Japanese trading houses with "no plans to sell" for the next 50 years (true story, source: 🔗 Investopedia), there's a better story unfolding behind the scenes of Japan's massive economy.

The other day I read a piece on Japanese software business culture, that made me laugh. Picture this: “Taro, a mid-level manager in Tokyo, starts his morning paying with his phone at a modern POS system, then walks past a cash-only stationery shop, arrives at work to input data from faxed orders into a cloud accounting platform, and ends his day at a government office where digital ID cards coexist with paper forms.”

This isn't contradictory, it is Japan's reality, and it potentially represents one of the most undervalued investment opportunities in global tech today.

The Numbers Don't Lie

Japan ranks 31st globally in digital competitiveness. For the world's fourth-largest economy, I’d would call it embarrassing but I prefer seeing it as an opportunity.

Consider the scale: Japan's 99.7% Small and Medium Enterprise (SME) market has only 30-ish% SaaS adoption. Around 70% of manufacturing orders still arrive by fax. The Japanese SaaS market sits at roughly $11 billion, representing just 4% of total IT spending versus 15-18% in the US. That's a $200+ billion addressable market sitting there, waiting.

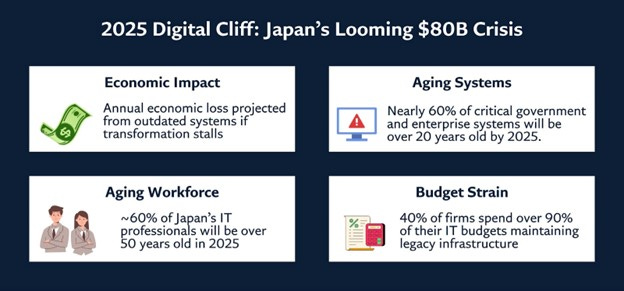

But here's where it gets interesting (and urgent): Japan's Ministry of Economy projects an $80 billion annual economic loss by 2025, dubbed the "2025 Digital Cliff", if legacy systems aren't modernized. Nearly 60% of critical systems will be over 20 years old by then, with the expertise to maintain them retiring en masse.

The government is concerned and throwing money at the problem. The Digital Agency launched with a $660 million grant program, 130 cloud migrations completed, and aggressive “My Number” card adoption (71% increase in cardholders in a single year). This isn't gradual change – it's systematic transformation.

The Small-Cap SaaS Goldmine

While true that Berkshire and other big financial institutions can't touch small caps due to size constraints, this creates a structural advantage for everyone else. Japanese small-cap SaaS companies are trading at steep discounts versus US counterparts, despite comparable growth rates and superior retention metrics.

The recurring revenue model works differently in Japan. That consensus-driven decision-making process that seems slow? It creates customer stickiness that US SaaS companies can only dream of. Once adopted, these solutions become deeply integrated into workflows, generating extraordinarily low churn rates and high lifetime values.

The financial dynamics looks compelling:

Overall SaaS market growing 10-13% CAGR through 2032

High-growth segments (cloud integrations, accounting) hitting 35-45% CAGR

Operating leverage accelerating as fixed costs spread across growing subscriber bases

200% increase in companies achieving 20%+ ROIC over the past decade

Framework for Success: The Localization Moat

Foreign investors, like me, have consistently underestimated that getting into Japanese SaaS and making it right isn't just about translation. It's about deep localization: understanding nemawashi (consensus-building), integrating with legacy hanko stamp workflows, and building solutions that align with monozukuri (craftsmanship) principles. 🔗 Source: Podobas

Companies like Money Forward (3994.T) and Freee (4478.T) are more than accounting platforms as they provide a cultural Japenese bridge between analog business practices and digital efficiency. This creates defensive moats that global competitors struggle to breach.

The thing is that this localization creates both opportunity and limitation. While domestic focus limits international expansion potential, it also means these companies are perfectly positioned to capture Japan's massive digital transformation without foreign competition.

The Counterargument (And Why It's Wrong)

"But Japan's been promising digital transformation for decades"

While true, this doesn't change the fact that three catalysts make this time different:

Demographic crisis: 30% of the population is over 65, creating 11 million worker shortfall projections

Government mandate: Digital Agency is encouraging change but also mandating it

Economic necessity: The $80 billion Digital Cliff is a present reality

"Cultural resistance will slow adoption!"

Yes, initial adoption might take longer; but once implemented, and it is already underway, software solutions achieve retention rates that could make the competitive US SaaS sector weep with envy.

The Active Catalyst: M&A Acceleration

The Kaonavi acquisition by U.S.-based private equity firm Carlyle Group (🔗 Source) for $325 million in December 2023 wasn't just a one-time thing, but a preview of what’s coming. Large Japanese and International corporations with business in the country are racing to acquire digital capabilities, while private equity recognizes the undervaluation gap.

This creates multiple exit pathways for investors: strategic acquisitions by domestic giants, private equity buyouts, or international expansion as these companies scale their localized advantages.

Investment Framework: What to Look For

Quality indicators:

Vertical specialization (healthcare, construction, logistics)

High customer retention rates (>95%)

Recurring revenue models with predictable cash flows

Strong balance sheets with low debt

Management teams with both technical and cultural expertise

Red flags:

Heavy dependence on project-based revenue

Aggressive international expansion without domestic scale

Underinvestment in cybersecurity (critical as threats increase)

Weak pricing power in the SME segment

The Reality Check

I’d argue finding these opportunities is not without risks. Talent scarcity remains severe (2.3 million digital worker gap by 2026), integration with legacy systems creates implementation complexity, and the SME market's price sensitivity limits monetization potential.

But the thing is these challenges create the very inefficiencies that generate outsized returns for patient capital and the market has been pricing in all these problems (with pretty low multiples) while ignoring the solutions.

The Takeaway

Japan's SaaS transformation is a multi-year structural shift backed by government mandate, demographic necessity, and a multi-billion cliff in economic urgency. The small-cap segment offers exposure to this transformation at valuations that make little sense relative to fundamentals.

The real opportunity lies in the digital infrastructure enabling Japan's next economic phase. The analog world is ending, and some of the companies building the digital bridge are trading like it's still 2008.

I would even go as far as to say that missing Japan's SaaS revolution might be this decade's equivalent of missing China's manufacturing boom or India's IT services explosion. The only difference? This time, you're getting it at a discount.

In the second part of this series, I will uncover one case study on one of the most successful pure-play SaaS companies in Japan I’ve recently added to the Watchlist, available in the 🔗 Portfolio Corner.

Thanks for following along,

—Nikotes

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 8-Oct-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles