Remember that Expanse Stocks and Finchat.io Partnership! Enjoy a 20% discount (+ 2 months free) on any Finchat plan 👉 Claim Your Discount Here

Not a free member yet? Join Expanse Stocks for free if you’d like to receive more content like this and get access to some of my free research (Deep dives, “Monthly Specials” Picks, Hidden Gems Screeners, Stock News and more)

Hello, reader!

Yesterday, Medpace (MEDP)—a leading CRO for small and mid-sized biopharma—released its Q3 2024 earnings. After last quarter's warning about a slowdown due to unexpected cancellations, how did things shape up this time?

In this post, I’ll break down the key takeaways from the earnings report, highlight both the positives and negatives, and provide my analysis of their technical chart. Finally, I’ll share whether I think this is a good opportunity for long-term investors to jump in.

📰 What’s New?

Free Access to 📊 Quarterly Updated Portfolio Composition - by Industry and Geography, plus Valuation Metrics → 📎 Expanse Stocks: Behind-The-Scenes

📌 Free-to-Read Articles (📎 linked below)

🔎 Deep Dives – ⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista

🛒 Amazon (NEW)

💸 General Investing - Latest: Understanding ROIC, ROIIC, and ROCE

💎 Hidden Gems – Latest: Third Edition

🎅 Christmas Special - Top 5 Picks for 2025

💬 Join my Chat! ( 📎 Learn more)

🔐 Paid Subscriber Exclusives

💎 Hidden Gems - Special Editions + exclusive sections from select articles - Latest: 💎 Hidden Gems - Special Edition II

🎁 Bonus Picks - From the 2025 Christmas Special

📊 DCF & Reverse DCF Models + Capital Efficiency Models– Download the models in the 📎 Portfolio section with multiple practical examples (ASML, GOOG, DHR, MEDP, ANET, AMZN and more)

👀 Coming Soon

📊 Quarterly Update to the Portfolio Composition (31-March) - by Industry and Geography, plus Valuation Metrics → 📎 Expanse Stocks: Behind-The-Scenes

A Leap of Faith with Owner-Operators: Why smart capital allocators deserve a big spot in your portfolio (with some examples)

Expanse Stocks x Finchat.io Partnership!

🎁 Get 20% off + 2 months free on any Finchat plan! →📎 Claim Discount

Q3 2024 Earnings Recap

Net Sales: +8.3% Y/Y to $533.3M 🟠

👉 Slightly below expectations, with deceleration in growth.Backlog: +8.8% to $2.93B | Backlog Conversion: +18.2% 🟡

👉 Growth is slowing, but conversion rates remain stable and high.Net New Business: -12.7% | Book-to-Bill: 1.0x 🔴

👉 Significant slowdown from FY23’s >1.2 ratio due to cancellations and tough funding conditions for small biopharma clients. More on this in my Call notes and Final Take sections below.GAAP Net Income: +36.5% Y/Y to $96.4M | EBITDA: +31.7% to $118.8M (22.3% margin, up from 18.3%) 🟢

👉 Solid bottom-line growth despite slowing revenue. Cost management and a shift to higher-margin services are paying off. Although they benefitted from one-time gains, they were also impacted by tax provisions.FCF: +31% Y/Y to $138.5M | Cash on Hand: +28.5% Q/Q to $656.9M | FCF Conversion: 116.6% 🟢

👉 Strong cash flow efficiency, even in a cyclical downturn—exactly what you'd expect from a high-quality business.Buyback Program: No repurchases yet in Q3, they still have $308.8M to repurchase shares 👀

2024 Guidance:

Net Sales: +10.8% to +12.9% (revised down from +12.7% to +15.3%) 🟠

GAAP Net Income: +33.0% to +37.2% (revised up from +27.6% to +35.4%) 🟢

EBITDA: +24.1% to +29.7% (revised up from +18.6% to +26.9%) 🟢

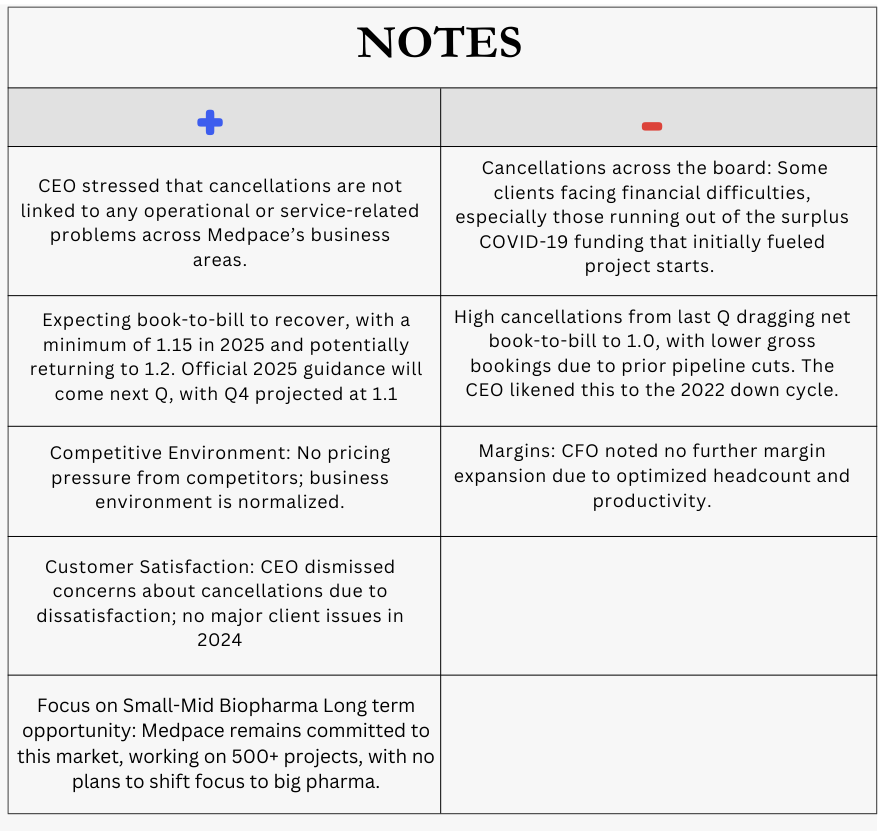

Earnings Conference Call

Medpace - MEDP 0.00%↑

Technical Setup

Before today's earnings report, the stock was retesting its 50-day MA and attempting to break out of a falling wedge pattern.

Post-earnings, selling pressure intensified, pushing the stock back into the wedge and breaking its first support level in the $320s, moving closer to the next support at $280.

However, following ER call, the price is recovering some losses. A positive MACD divergence is forming, suggesting that selling momentum might be getting to an end.

Commentary:

It's common to see sharp volatility in low-float stocks like MEDP. The market is reacting with a "shoot-first-ask-questions-later" approach, concerned that the revenue slowdown and decline in new business awards could signal competitive or operational issues.

While the chart shows weakness with a declining 50-day MA and broken support, the panic-driven selling paired with the positive MACD divergence could present a good entry point for long-term investors.

🧠 FINAL TAKE

High-quality leader in the CRO space for small and mid-sized biopharma, facing a short-term downturn due to the challenging biotech funding environment. Many of its clients are running out of the COVID-19 surplus funds that initially fueled projects, with some even filing for bankruptcy.

In my view, these cyclical issues, similar to those seen in 2022, are temporary within a longer-term growth trend. Medpace’s strong position in the underpenetrated $28B small-to-mid biotech CRO market puts it in a good spot to benefit as biotechs increasingly rely on CROs for clinical trials.

As the Fed starts to ease its policies and the tight financial environment begins to relax over the next year, I think we might see biotech funding bounce back. How fast that happens, though, is still up in the air.

Medpace also has $308.8M left in their share buyback program, and I wouldn’t be surprised if they start putting it to use at these prices. For long-term investors, this sell-off might be a chance to buy in, but I’d expect a slower U-shaped recovery, rather than a quick rebound.

Ready to dive deeper? Here’s what I can offer you and how I can help you

For Free Subscribers, you now have access to:

📊 Quarterly Updated Portfolio Composition by Industry and Geography, plus Valuation Metrics.

👉 Expanse Stocks: Behind-The-Scenes (Last Update: 23-Dec-2024)

&

For Premium Subscribers, with full access to all my articles, private Community Chat, and the Portfolio section of the Expanse Stocks blog, you’ll get:

🗓️ Biweekly Updates (Last Update: 14-Jan-2025)

🔎 Stock Picking Methodology: Learn my long-term investment strategy.

💼 Full Portfolio Access: View long-term holdings with valuation metrics and performance tracking.

📈 Live Trades: Stay updated on my latest trades and watchlist additions.

📊 DCF & Reverse-Engineered DCF Models: Download proprietary models with calculations and evaluation guides.

🎯 Swing Trading Strategy: Learn my short-term trading technique for quick gains