The Serial Acquirers Playbook: A Primer

Underappreciated Quality Traits of Serial Acquirers with Real-World Examples from the Nordics and Globally

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-Jul-2025)

Expanse Stocks x Finchat (now Fiscal AI) Partnership!

🎁 Get 20% off + 2 months free on any plan! →🔗 Claim Discount

Welcome Explorer!

With the Constellation Software primer released a few weeks ago 🔗 Hidden Gem: Fourth Edition, and upcoming Deep Dive Briefs on its hidden gem spin-offs—Topicus and Lumine Group—I figured there’s no better time to drop a primer on Serial Acquirers and their playbook.

Whether you’re a long-time subscriber or a new reader of Expanse Stocks, this piece is designed to help you understand how these businesses, when executed right, can deliver great returns to long-term investors.

At first glance, the term “serial acquirer” might sound like corporate gibberish. But look closer, and you’ll find something deeper inside: a well-defined strategy for long-term compounding that has “quietly” outperformed the market for decades.

Serial acquirers are companies that repeatedly buy and integrate businesses. Over time and consistent execution, they’ve proven to be among the most durable value creators in public markets. From the Nordics to America, these firms combine smart capital allocation, decentralized operating models, and people-first philosophies to build powerful growth flywheels.

In this primer, we’ll explore why high-quality serial acquirers often win, and what lessons investors can draw from their playbook.

But before we dive in, I want to give credit where it’s due: much of the inspiration for this primer comes from the fantastic research published by Sweden-based REQ Capital, an investment firm with deep expertise in this space. I’ll share more about them throughout this primer content and their work in the final thoughts of this article.

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

👀 Recent Releases!

👀 Coming Soon

💎 Hidden Gem - Fifth Edition

💸 Why Equities Win Against Other Assets

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-Jul-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles

Introduction to The Traits of Serial Acquirers Quality

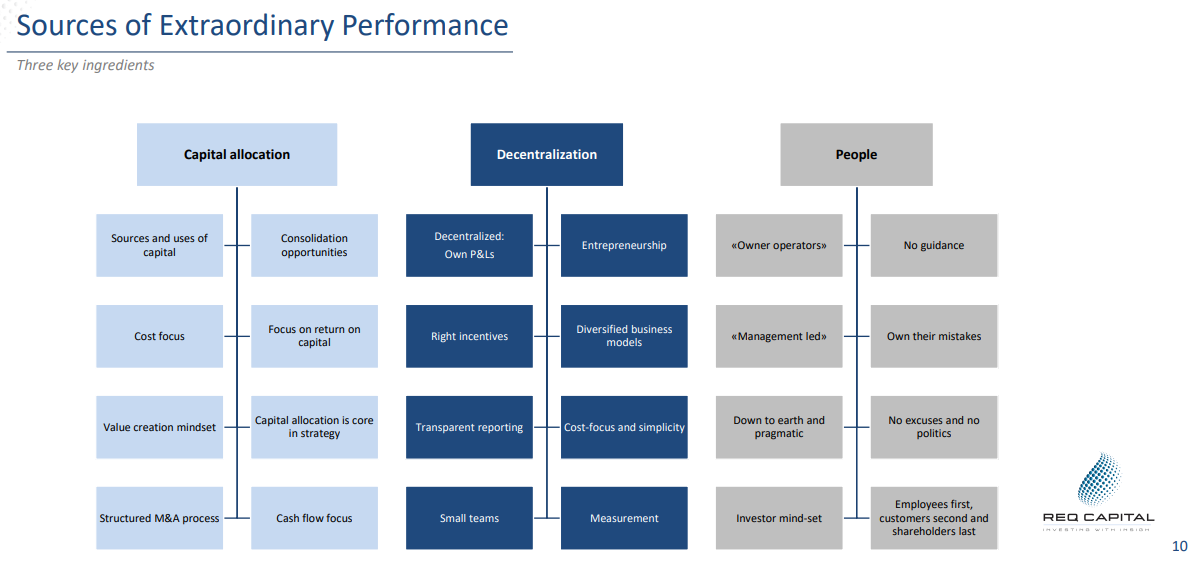

When studying serial acquirers, three defining traits consistently emerge that explain both their enduring business success and their outstanding long-term stock performance:

Capital Allocation

"The first rule of capital allocation — whether it’s in running a business or managing your personal finances — is to think about opportunity cost. Every dollar you spend is a dollar that could have been used better somewhere else."

— Warren Buffett

This quote, by one of the greatest, captures the essence of great capital allocation.

For serial acquirers, success doesn’t come from empire-building for its own sake. It comes from deploying capital efficiently, making every dollar work harder over time.

These companies prioritize small, frequent, and disciplined acquisitions. They avoid chasing flashy targets or overpaying for synergies. Instead, they buy high-cash-generative businesses, often founder-led and under the radar, and integrate them thoughtfully.

Take Constellation Software, for example. Mark Leonard’s firm has long avoided high-multiple acquisitions, instead favoring smaller “tuck-ins” across a wide variety of software verticals. Its discipline has led to spectacular returns, +35% CAGR over the last two decades, proving that patient, thoughtful capital allocation pays off.

Then there's Danaher, a US-based generalist acquirer, which builds its businesses through a structured approach known as the 📎 Danaher Business System (DBS) which has propagated and impregnated throughout the company’s culture (attached above, a very nice summary to understand this approach by Quartr). Among other traits, the DBS strategy ensures integration of acquisitions by focusing on lean operations, long-term value creation, and return on invested capital.

As Warren Buffett once again said in his 1987 shareholder letter:

“After ten years on the job, a CEO whose company annually retains earnings equal to 10% of net worth will have been responsible for the deployment of more than 60% of all the capital at work in the business.”

Capital allocation is not a side job, it is the Job of a CEO.

People & Relationships

At the end of the day, businesses are built by people and thrive on lasting relationships, not just spreadsheets or strategies. The best serial acquirers understand this better than most.

In REQ Capital’s deep dive, they found that most successful serial acquirers are founder-led or family-owned, with long-tenured leadership and long-term relationships with their employees. These aren’t fly-by-night operators, they see building their business and relationships within the organization and, externally, with their customers as a passion that provides meaning and direction to their life.

Take Sweden-based Indutrade, which has had just three CEOs in its 50-year history. Its leadership puts a premium on alignment with the entrepreneurs they acquire—emphasizing cultural fit, autonomy, and a long-term mindset over short-term gains.

Or look at HEICO, a family-owned U.S. aerospace company that’s thrived for decades on trust, continuity, and values. As Chairman Larry Mendelson once put it:

“We know the people, not only running them, but we know the people in charge of departments, all the way down to people on the shop floor.”

This echoes one of my favorite quotes from William Thorndike’s The Outsiders—a must-read for any investor (check out the 📚 Resources section on Expanse Stocks if you're curious about more book recs and many other resources for investors):

“There is a fundamental humility to decentralization—an admission that headquarters does not have all the answers and that much of the real value is created by local managers in the field.”

The best serial acquirers don’t just buy businesses but they honor them. They keep the name, the people, the processes, the leadership and their autonomy. Choosing continuity over restructuring, and trust in the teams who built something valuable and giving them the tools to keep doing it.

Decentralization

One of the most recent distinctive traits of modern successful serial acquirers is a deeply decentralized operating model. They trust local managers to run the businesses they know best. Headquarters stays small, agile, and focused on coaching rather than controlling.

As Mark Leonard wrote in one of his Constellation Software shareholder letter:

“We count on the fact that with each new acquisition will come general managers who are steeped in their verticals… veterans who have built industry-leading (albeit small) vertical market software businesses.”

Similarly, Addtech, a Nordic acquirer in the industrial space, gives its country heads and subsidiary managers autonomy over operations. This encourages responsiveness to local market dynamics and boosts morale across the board.

HEICO Corporation also exemplifies this. With roughly 100 independently run businesses, its management has famously avoided central bureaucracy. As Co-President Eric Mendelson explains:

“We give tremendous authority and responsibility to the operating person. We believe the person running the business knows more than someone 2,000 miles away at HQ.”

This model speeds up decision-making and creates a culture of ownership; exactly what you want when managing a vast portfolio of companies.

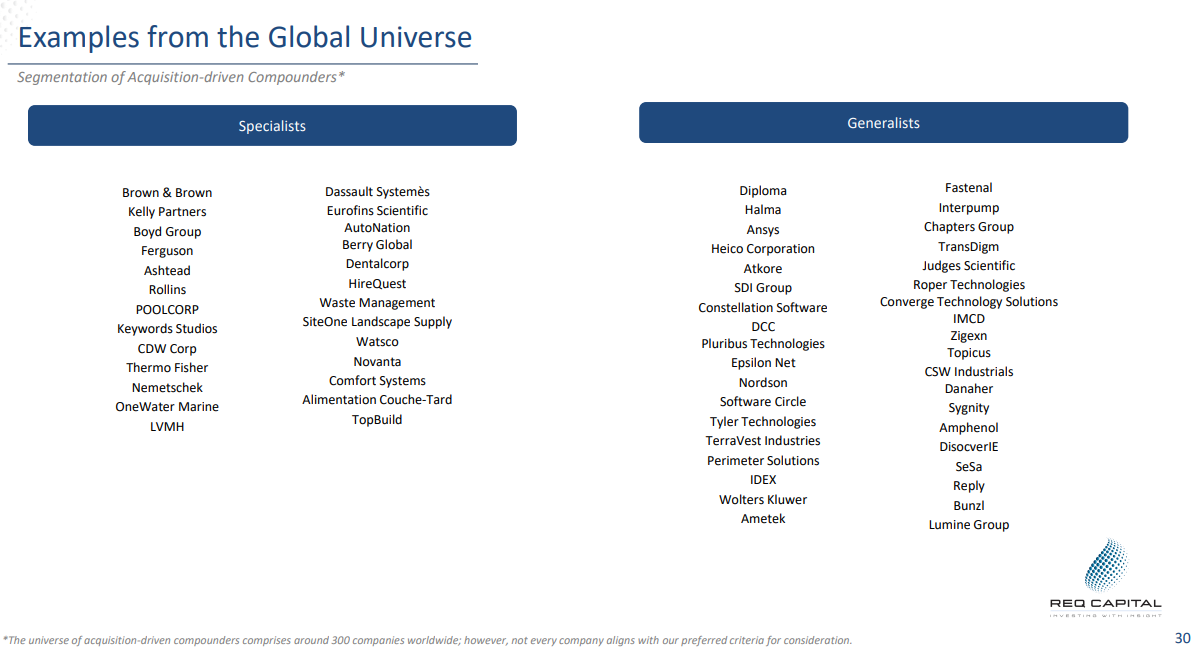

Specialist or Generalist? Just Different Ways of Compounding

Successful serial acquirers come in two broad flavors:

Generalists (Lifco, Constellation Software or HEICO): They acquire across industries, applying consistent principles but leaving room for diversity and complexity.

Specialists (Watsco, LVMHor Brown & Brown): They dominate one or a few verticals, leveraging deep domain expertise and becoming the “buyer of choice” in their niche.

Each model has trade-offs:

🔹 Generalists gain flexibility and wider acquisition pipelines.

🔹 Specialists often achieve better integration, branding, and customer trust within focused verticals.

Both can win if they follow the core principles outlined above.

Final Thoughts: What Investors Can Learn

Roughly 70% of acquisitions end up destroying value—so it’s no surprise investors tend to be skeptical of companies that grow mainly through merge-and-acquisitions (M&A). But if you can find those outsiders who truly understands what separates the other 30%, chances are you’ve found a high-quality company the market is underestimating.

The high-quality serial acquirers are financial engineers but, most importantly, they are builders. Builders of organizations, teams, and enduring systems of growth.

Their playbook relies on:

✅ Disciplined capital allocation

✅ Trust in people, local leadership and building lasting relationships

✅ Autonomy & a Culture of humility, patience, and respect

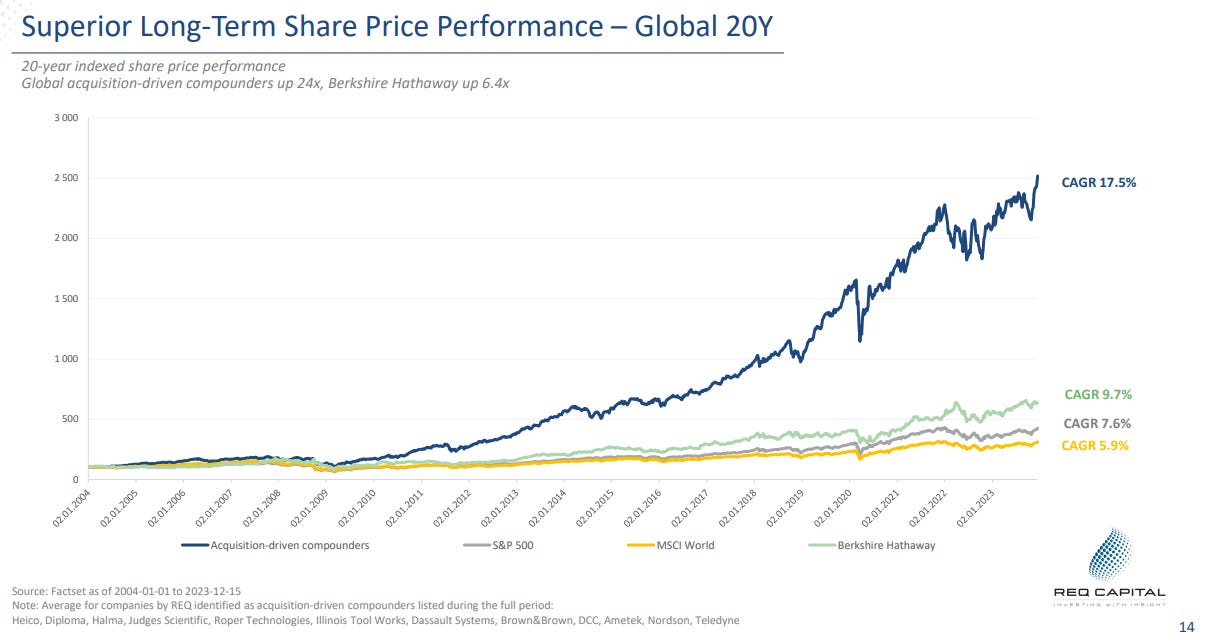

Their track record speaks volumes. Over the past two decades, many unknown high-quality Nordic serial acquirers—like Addtech, Lagercrantz, and Atlas Copco— or Global ones— like Ametek, Amphenol and Transdigm— have outperformed even Berkshire Hathaway and global indices.

As investors, there’s a lot to learn from studying serial acquirers. Even if you never end up owning shares in one, understanding how these businesses operate can sharpen your ability to evaluate capital efficiency, leadership culture, and long-term value creation.

A fantastic starting point is the research done by 📎 REQ Capital, a Sweden-based investment firm with some of the most comprehensive insights on serial acquirers. Many of their pieces are free to read on their website. I highly recommend starting with their 📎 Deep Dive into Shareholder Value Creation by Acquisition-Driven Compounders —a goldmine of insights and data on serial acquirers around the globe.

I’ll admit, I fell hard for this type of business (and their leaders) midway through my investing journey. Today, about 50% of my long-term portfolio is made up of serial acquirers.

In a world where growth often comes with a lot of noise, for me, the quiet compounding of high-quality, proven serial acquirers speaks the loudest.

Stay tuned—my research report on Topicus drops at the end of this week. It’s the first of Constellation Software’s spin-offs I’m covering, and in my view, it’s an exceptional hidden gem with serious long-term potential. Don’t miss it!

Ready to dive deeper? Here’s what I offer and how I can help you

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-Jul-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles