Hidden Gems: Fourth Edition

A Primer on Constellation Software: The Capital Allocation Machine

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-Jul-2025)

Expanse Stocks x Finchat (now Fiscal AI) Partnership!

🎁 Get 20% off + 2 months free on any plan! →🔗 Claim Discount

Welcome to the fourth edition of Hidden Gems!

In this series, we uncover small- and mid-cap companies that often fly under the radar but hold unique advantages—whether it’s exceptional business quality, underrated fundamentals, or sustainable growth potential.

If you’re new here, start by checking out the earlier editions (most of content is free to read):

For this Fourth Edition, we’re heading to Canada, one of those rare wonderlands. Not just for its landscapes, open-minded people, and multicultural friendly environment (though I might be biased, having lived, studied and worked there for almost 3 years as a European)… but also for its incredible pool of world-class yet often overlooked businesses: Shopify, Brookfield, Thomson Reuters, etc.

But the company we’re diving into this time is, in my view, one of the wonders of the investing world: Constellation Software (CSU).

Led by its already legendary founder and still-owner-operator, Mark Leonard who has earned his place in the hall of fame as one of the best capital allocators of the 21st century.

Let’s dive in! But before, let’s take a look at what Expanse Stocks has to offer 👀

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

👀 Recent Releases!

👀 Coming Soon

💎 Hidden Gem - Fifth Edition

💸 Why Equities Win Against Other Assets

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-Jul-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles

Founding and Origins: The Unconventional Capitalist Legend

The story of Constellation Software (CSU) starts in 1995 with its enigmatic, private and eccentric founder: Mark Leonard—a man who is equal parts capital allocator, systems thinker, contrarian philosopher and Santa Claus in disguise.

Before entering business, Leonard’s secretive life was anything but conventional. He worked as a gravedigger, bouncer, furniture mover, …—an unusual résumé for someone who would go on to build one of the world’s most successful software holding companies. Eventually, Leonard earned an MBA and entered the world of venture capital (VC).

But he grew disillusioned. VC culture in the 1980s and 1990s was increasingly focused on chasing unicorns, short-term growth stories, and quick exits. Inspired by Warren Buffett and Berkshire Hathaway, Leonard envisioned a decentralized conglomerate that would buy boring, profitable software companies that no one else wanted and hold them forever.

In 1995, with $25 million from OMERS (Ontario Municipal Employees Retirement System), Leonard founded Constellation Software with a unique vision: a decentralized acquirer of Vertical Market Software (VMS) companies, focused not on flipping businesses but on compounding capital through permanent ownership.

The company’s first acquisition was Trapeze Software, a provider of public transit scheduling software. Niche, unsexy, but mission-critical—exactly Leonard’s kind of business. The acquisition proved that small vertical markets could deliver high recurring revenue, loyal customers, and defensible moats.

Leonard structured CSU from the ground up as a learning machine, designed to scale not just software, but also knowledge, culture, and capital discipline across geographies and industries.

When CSU IPO’d in 2006, it wasn’t to raise capital, but to transition away from OMERS, which had a more short-term focus. That year, revenue was around $150M. Today, CSU generates over $8 billion and still hasn’t issued new shares…

“Hello there, Silicon Valley SaaS darlings dishing out 20%+ of revenue in stock-based comp, livin’ the dilution dream, huh? How you doin’?” 👋 — Nikotes

What is Vertical Market Software (VMS)?

Think software that’s focused on niche, often quirky industries. Think: municipal transit systems, bowling alley operators, poultry farms, regulatory-heavy funeral homes... you name it.

These industries:

✅ Have tiny TAMs—so tiny they scare off VC-backed competitors.

✅ Need deep customization, tight integration, and reliability, aka “sticky” software.

✅ See near-zero churn (unless the customer literally goes out of business).

✅ Offer high-margins, recurring revenue, upfront payments, and barely any CapEx.

Here’s the kicker: Constellation doesn’t build these software tools. They acquire the best operators in these niche spaces—usually small, under-the-radar businesses with durable cash flows and great returns on capital.

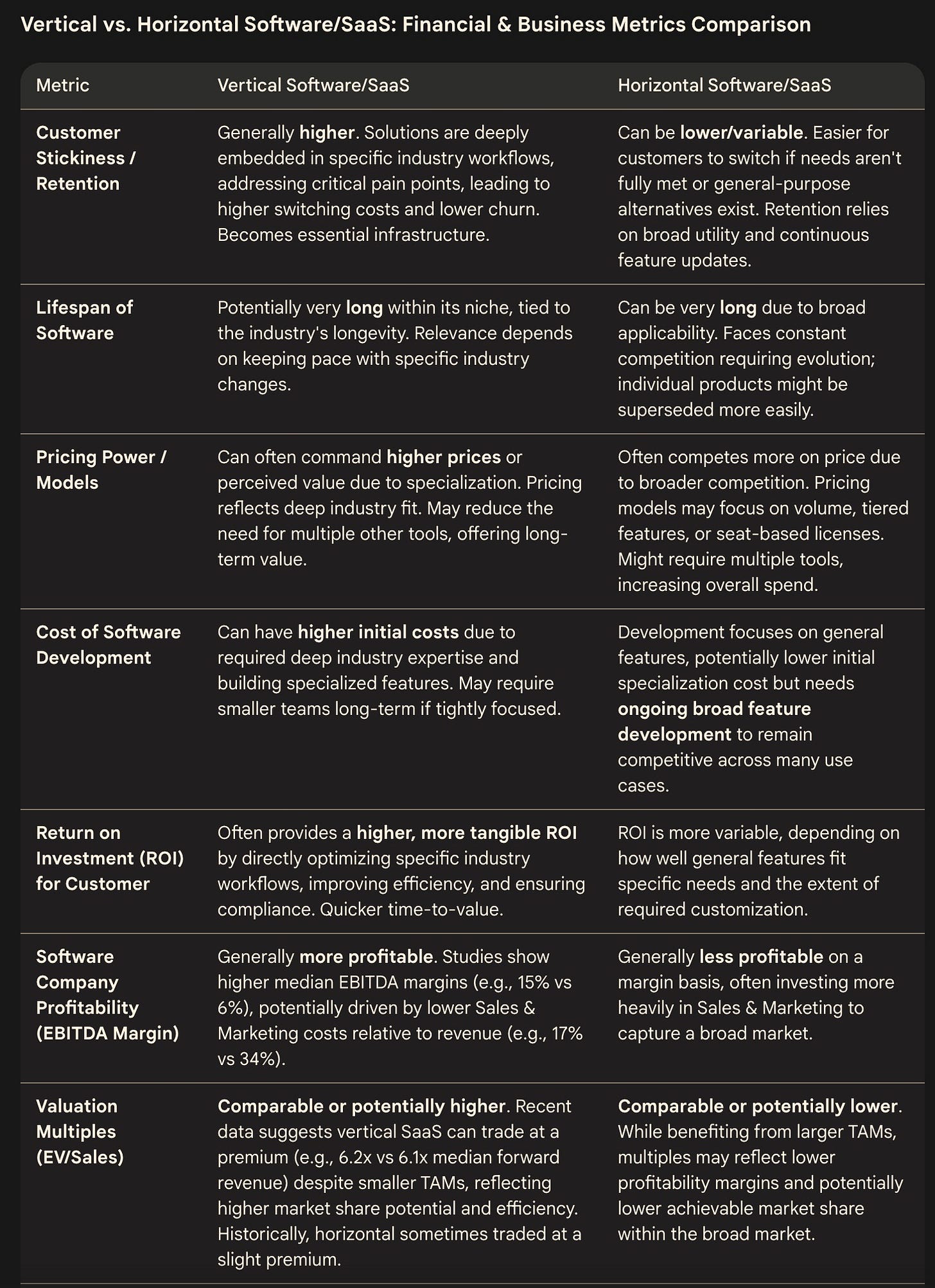

For context, here's a great comparison between VMS and your usual big-name horizontal SaaS (credit @zeroxpectation on X for the table):

Growth Drivers

1️⃣ Disciplined M&A Engine

CSU is a deal machine—acquiring 100+ small VMS businesses a year. Most are:

<$25M in size

Founder- or family-owned

Bootstrapped, with high ROIC potential

Acquired at reasonable multiples

No VC hype here. These deals are too small (and “boring”) for private equity or Silicon Valley to bother with.

2️⃣ Internal Deal Sourcing & Delegation

With 1,000+ software businesses under its belt, CSU doesn’t rely on bankers. It builds from within:

Internal referral pipelines

Capital allocation embedded down the org chart

Local managers trained to source and execute deals

Focused on Returns on Invested Capital (ROIC)—not top-line revenue or “vanity” metrics

3️⃣ Decentralization at Scale

CSU is split into 6 autonomous operating groups: Jonas, Harris, Vela, Volaris, Perseus, Topicus (plus newcomer Lumine). Each runs like a mini-CSU:

Full control over M&A, operations, budgeting

Their own target markets and KPI dashboards

Capital allocation tailored to their niche

4️⃣ Organic Growth Perking Up

For years, CSU's growth came solely via M&A. But lately? That’s changing:

Organic growth has ticked up to 5–6%

Inspired by CSU’s spin-off Topicus’ approach in Europe and driven by:

Upsells & cross-sells

Targeted price increases

Better R&D and product upgrades

Value-added feature modules

5️⃣ Capital Discipline as Religion

Marc Leonard’s gospel: Don’t chase bad deals.

CSU sticks to 20%+ IRR hurdles

Will happily walk away if the math doesn’t work

Doesn’t hoard cash either and excess capital gets:

Spun out (Topicus, Lumine)

Returned (e.g. $420M special dividend in 2019)

Financed wisely via non-recourse debt

Their model boils down to one key metric: Returns on Invested Capital (ROIC). If the ROIC’s not there, the deal doesn’t happen. Simple as that.

Future Outlook: A Runway That Could Last Decades

In my view, even at a $60B+ market cap, CSU’s growth is far from over:

1️⃣ Big Untapped TAM

The global VMS market is vast and fragmented. CSU estimates that there are over 50,000 VMS companies globally and growing each year. Even with 100+ acquisitions a year, CSU sees only ~30% of available deals—a fraction of its potential universe.

2️⃣ Platform Creation for Global Scaling

Spin-outs like Topicus (Europe) and Lumine (telecom) allow CSU to tap into sectors or geographies that require local identity or talent retention. These platforms act as growth accelerators, enabling CSU to:

Access deals it couldn’t buy outright

Retain founders via equity incentives

Decentralize even further without overburdening the parent

Expect more spin-outs and platform launches as CSU scales into new verticals and emerging markets.

3️⃣ Increasing Use of Retained Earnings

With $1B+ in annual free cash flow, CSU has firepower to:

Fund larger platform acquisitions

Invest in internal R&D

Allocate capital to newly formed platforms at scale

Its challenge now is not access to capital, but where to deploy it smartly—a problem Leonard has structured CSU to solve through rigorous, distributed capital allocation.

4️⃣ Emerging Market Opportunity

While North America and Western Europe are well-tapped, CSU has barely scratched the surface in:

Eastern Europe

Latin America

Southeast Asia

These regions have thousands of VMS businesses but lower deal competition, creating a clear arbitrage opportunity for a global acquirer with CSU’s playbook.

5️⃣ Learning Organization = Compounding at Scale

As CSU continues to refine its internal knowledge sharing and post-mortem practices, its acquisition engine becomes smarter over time. This creates a feedback loop that helps:

Reduce integration risk

Increase ROI per acquisition

Improve capital deployment accuracy

The Spin-Out Strategy: Topicus, Lumine & the Rise of “Constellation Juniors”

CSU has mastered the art of deploying capital in tough-to-access verticals via spin-outs:

Topicus: A pan-European VMS platform with higher organic growth and tighter regulation-induced moats.

Lumine Group: Focused on telecom/media verticals, born out of CSU’s Valeris group.

Both structures retain partial CSU ownership (~30% Topicus and 60% Lumine) and allow original management teams to stay aligned via shareholding.

Spin-outs serve two goals:

Retain talent and founder equity alignment

Access platform-level M&A where outright acquisitions weren’t possible

This strategy allows CSU to continue compounding capital without breaking its culture and structural model.

There is much to say about these two spin-outs gems, but I reserve them the spotlight for my next Hidden Gems articles for paid subscribers coming later this year.

Leadership & Culture: The Learning Machine

Almost invisible to the public, Mark Leonard has quietly built CSU into a capital allocator’s cult—fueled by intellectual honesty, frugality, and autonomy.

Forget the typical corporate playbook:

❌ No centralized innovation team

❌ No all-hands or flashy slide decks

❌ No “corporate” in the pejorative sense

Instead, CSU thrives on a set of cultural hallmarks:

🔹 Extreme decentralization – Each group (and subgroup) runs its own P&L, M&A, and budget.

🔹 Skin in the game – Bonuses aren’t handed out as stock options; employees buy CSU shares with their own money.

🔹 Continuous learning – Post-mortems, pre-mortems, internal forums, and playbook sharing drive institutional knowledge across the organization.

🔹 Pragmatism over perfection – Experiments like Keep Your Capital let teams deploy at lower hurdle rates if the strategic value is high.

Over time, CSU has become more than a company: it’s a training ground for the next generation of capital allocators.

Competitive Edge in a Crowded Field

At first glance, CSU’s model looks copy-pasteable. As Marc Leonard once quipped, all you need is “a checkbook and a phonebook.” But the real moat runs deeper. Here’s what keeps CSU in a league of its own:

✅ The “Good Home” Reputation

CSU is founder-friendly. No gutting teams. No wrecking culture. No alienating loyal customers. Sellers trust they’ll be cared for.

✅ Internal Sourcing Engine

Many deals come from within—referrals via portfolio companies who’ve already walked the path.

✅ Massive CRM database

CSU has built a proprietary database of niche software businesses—who they are, what they’re worth, and when to strike.

✅ Pattern Recognition at Scale

With 20+ years of micro-deals under its belt, CSU uses internal forums, playbooks, and cohort-based training to spread wisdom across its empire and compounding experience.

✅ No Flipping. Ever.

They buy and hold. Long-term value creation > exit multiples.

✅ Everyone Has Skin in the Game

Incentives are aligned from the top down. Operating group heads, deal-makers, and even junior managers think like owners.

✅ Low Leverage Dependency

Historically, CSU didn’t rely on debt to juice returns—just disciplined execution and smart capital allocation. But that’s starting to evolve. As the company scales and chases larger M&A deals, it has begun tapping into long-term debt to fund more substantial acquisitions. Still, the ethos remains: capital discipline first, leverage second.

Even with a wave of new imitators trying to mimic the playbook, Constellation remains the undisputed heavyweight in small-cap vertical market software.

Golden Nuggets and Curiosities

Leonard’s letters are widely studied across finance and tech—despite not being published in recent years. Feeling curious about them? Feel free to check this fantastic 📎 Collection: Mark Leonard's Shareholder Letters grouped by Quartr. Definitely worth a read!

CSU has returned 35% CAGR since IPO in 2006.

CSU has never issued new equity—21.2M shares outstanding since IPO.

All employees buy stock on the open market as part of their bonus plans, aligning incentives deeply.

70%+ of revenue is recurring maintenance/SaaS revenue, the heartbeat of CSU’s P&L.

CSU has invested in 1,000+ VMS companies across 50+ countries, the widest portfolio of businesses in the world.

Most acquired software serves ultra-niche sectors like cemeteries, school buses, ski lodges, or wind farms.

Often referred to as “Berkshire Hathaway for Software”.

A classic Mark Leonard quote:

“To compete with us, all you need is a checkbook and a phone book… but it turns out culture, reps, and reputation are hard to replicate.”

Why It’s a Hidden Gem (Even at $60B)

Even with its size and cult following, CSU remains oddly underappreciated by many traditional investors. Why?

It doesn’t fit the classic SaaS or platform narratives.

It’s deliberately hard to model—designed not to optimize for short-term metrics.

It skips flashy conferences and doesn’t issue forward guidance.

Yet beneath that quiet exterior lies one of the most consistent and capital-efficient compounders on the planet:

✅ Still deploying capital at 20%+ ROICs

✅ Huge TAM: 50,000+ VMS companies globally. CSU only sees 30% of the deal flow

✅ Spin-outs like Topicus and Lumine unlock growth beyond CSU’s scale constraints

If you appreciate relentless execution, decentralization, and culture-first compounders, then CSU might just be the ultimate long-term vehicle. A business built to endure, adapt, and win—quietly.

As Mark Leonard once said:

“We are in the business of discovering the rare, the obscure, and the underappreciated—and then letting them compound.”

Two years ago, I stumbled across his legendary investor letters, thanks to this 📎 Compilation of Mark Leonard’s Letters grouped by Quartr, and I’ve been hooked ever since.

I boarded the obscure ship and haven’t looked back. Today, CSU is my largest position.

Stay tuned: In my next Hidden Gems – Special Edition (for paid subscribers), I’ll take a deeper look into the CSU universe—including its spin-offs, Topicus and Lumine.

If you are ready to dive deeper, here’s what I can offer you as a Paid Subscriber

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year) with the annual plan!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-Jul-2025)