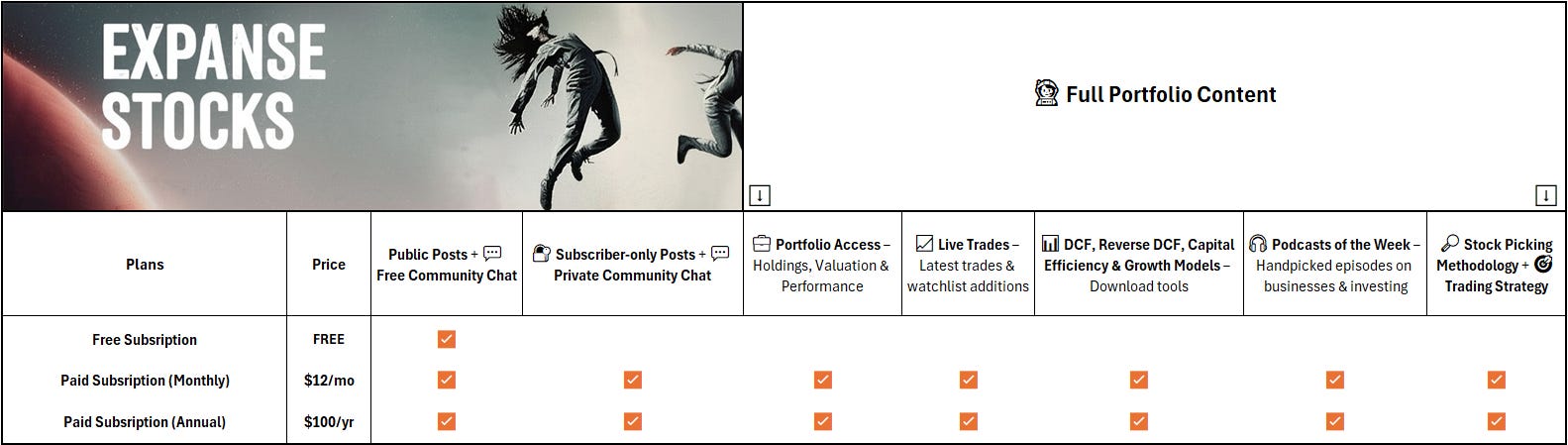

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-May-2025)

Expanse Stocks x Finchat.io Partnership!

🎁 Get 20% off + 2 months free on any Finchat plan! →📎 Claim Discount

Welcome to the third edition of Hidden Gems!

In this series, we uncover small- and mid-cap companies that often fly under the radar but possess unique advantages—whether it’s exceptional business quality, underrated fundamentals, or strong growth potential supported by compelling technical setups.

If you’re new here, check out the earlier editions (free to read):

And for Paid Subscribers: 👉 Hidden Gems -Special Edition

For this third edition, we’re heading to the rainy Great Britain islands to explore two small-cap gems. Despite operating in vastly different industries, these companies share exceptional management, a commitment to shareholder returns, and a genuine passion for their craft.

1️⃣ A Legendary Miniature and Fantasy Board Game Maker (Free to read)

Known as the House of Warhammer, this iconic British brand has a market cap of £4.4B. (Yes, I was a big fan back in the day! 🤓). Topics, I cover:

Founding & Origins

Leadership & Vision

Growth Drivers

Fun Facts & Golden Nuggets

Final Thoughts: What makes it a Hidden Gem

2️⃣ A Young Serial Acquirer (for Paid Subscribers)

With a £500M market cap, this small-cap “cash generation machine”, that I’ve recently added to my portfolio, specializes in acquiring and scaling scientific instrument businesses, enjoying a surprising high ROIC and a big runway for growth. Topics, I cover:

Same Topics as for the first gem

➕

Summary of FY 2024 results and FY 2025 Outlook

Final Thoughts: What makes it a Hidden Gem and a rare opportunity for (new) shareholders at current levels

I’m especially excited to share these two 💎s —not just because one brings back nostalgic memories from my childhood, but because both are truly high-quality, hidden businesses amidst a sea of more hyped investment options. Let’s dive in!

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 📎 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

🔐 Paid Subscriber Exclusives

💼 Full Portfolio Content – Positions, valuation, trades, performance [Details below]

💎 Hidden Gems - Special Editions

🎁 Bonus Picks – From the 2025 Christmas Special

🤫 Exclusive Sections – From select Deep Dive Briefs & Hidden Gems

👀 Coming Soon

✈ Deep Dive Brief: HEICO

💸 A Reflection on my Investing Mistakes

🎲 Games Workshop (GAW): The House of Warhammer

Founding and Origins: The Punk-rock Group of Gaming Companies

Games Workshop’s journey feels like an independent punk-rock group hitting it big. Founded in 1975 by three friends—Steve Jackson, John Peake, and Ian Livingstone—the company began in a shared London flat. Driven by their love of board games, the trio initially treated the venture as a fun side hustle, aiming to make a bit of beer money rather than build an empire.

Operating out of a London Peake's bedroom, the founders handcrafted versions of classic games and even launched their own magazine, Owl & Weasel. The enlightening moment? Discovering an early version of Dungeons & Dragons (D&D) at a gaming convention. They fell in love, became Europe’s exclusive distributor for D&D, and started opening doors to a world of opportunity.

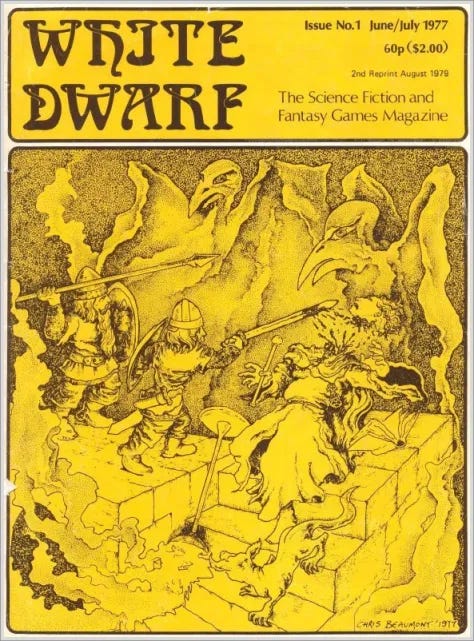

But it wasn’t all smooth. By 1976, John Peake, less enamored with roleplaying games stepped away. This left Jackson and Livingstone free to focus on their growing obsession with fantasy miniatures, eventually founding the mythic White Dwarf magazine in 1977 and the legendary Citadel Miniatures in 1978.

This was the birth of Games Workshop as we know it—a company that combined a love for games with a touch for craftsmanship.

Pivotal Moment: “The Great Master Plan” by Sir. Kirby

Games Workshop’s stock returns and business growth took off after what is often referred to as The Great Master Plan. In the late 2000s, under the leadership of then-Chairman Tom Kirby and then-CFO Kevin Rountree, the company streamlined operations, cut unnecessary costs, and refocused entirely on its core strengths: making the best miniatures in the world and building Warhammer into a dominant niche brand.

They stopped trying to be a broader game company and doubled down on Warhammer.

They closed unprofitable retail stores and prioritized markets where demand was strong.

Licensing deals, previously a side thought, became a strategic pillar for long-term growth.

The result? Leaner operations, higher profit margins, and a focus that allowed Games Workshop to excel in what they do best. This strategy laid the groundwork for the company’s remarkable turnaround and has kept it on a steady upward trajectory ever since. If you had become a shareholder back in 2008 at the dawn of the “Great Master Plan”, your investment today would have grown into an incredible 90x bagger 👇

Leadership and Vision: Culture is King

Current CEO Kevin Rountree sums it up nicely: “We hire for attitude, not skills.”

At Games Workshop, passion for the product and the right mindset matter more than a well-dressed CV. Many senior leaders have been with the company for decades, and there’s a clear preference for promoting from within.

The culture is refreshingly no-nonsense: respect, accountability, and a focus on doing what’s best for the company and fans. Mistakes are viewed as part of bold decision-making, and leadership encourages continuous improvement. This pragmatic yet genuine approach is at the heart of their sustained success.

Growth Drivers:

The Warhammer Universe: The company created a deep, sprawling fantasy and sci-fi lore that’s irresistible to fans. The Warhammer IP is not just a product; it’s a lifestyle for fans who collect, paint, and play with its miniatures.

Vertical Integration: From design and manufacturing to retail and marketing, Games Workshop controls every part of its supply chain. This keeps quality high and costs under control.

Licensing Boom: While licensing contributes just 5% of revenues now, it’s a key growing area with tremendous potential. Deals like the rumored Warhammer TV series with Amazon Prime (exciting, right?) and video game success stories (Space Marine 2, anyone?) are planting the Warhammer flag in mainstream media."

Community Magic: Whether through the White Dwarf magazine or its Warhammer+ digital platform, Games Workshop connects with fans on a deeply personal level. This builds loyalty and a sense of belonging.

🧐 Fun Facts and Golden Nuggets

Bedroom Beginnings:

In its first year, Games Workshop operated entirely out of the bedroom of one of his founders, John Peake in Shepherd’s Bush, London; proving again that global giants can start small.

Name Choice:

The company was almost called “Games Garage.” They went with “Games Workshop,” which, in my opinion, sounds not as a cool the alternative. Here is a bit more on their history in their official website, 👉 here

The Magazine:

White Dwarf magazine started in 1977 and is still going strong over 500 issues later. It’s been a must-have for hobbyists, with painting guides, lore, and exclusive content.

Source: Woehammer.com, White Dwarf nº1, the first ever issue, link. Miniatures Mania (featuring my own "golden nugget"):

The early miniatures were sold unpainted, giving fans the chance to unleash their creativity. This Do-it-yourself spirit is still a big part of the hobby today.

Fun fact: here’s one of the miniatures I built and painted at 11 years old—my “golden nugget” from back in the day. It makes me wonder… when did my latent craftsmanship skills slip away? 😅

Licensing Golden Opportunity: The upcoming Warhammer TV series on Amazon Prime could be the company’s ticket to mainstream pop culture.

The already available Secret Level anthology series, featuring Warhammer 40K lore, are expanding its reach—definitely check it out if you haven’t, it’s a fantastic series for sci-fi/fantasy 10-15min short stories! More details on Prime 👉 here

🧠 Final Thoughts

Games Workshop’s competitive advantage lies in its niche focus and the deep loyalty of its fanbase. It’s not chasing trends or trying to be everything to everyone. Instead, it’s doubling down on what it does best: crafting incredible miniatures, creating immersive worlds, and keeping its community engaged.

For investors looking for a company with one-of-a-kind moat, exceptional management, and room to grow from its current £4.4B market cap—specially through its IP licensing optionality— Games Workshop is a rare find.

Now, let’s get into our second hidden 💎 available for Paid subscribers.

The following under-the-radar British small-cap is a true “cash generation machine” focused on acquiring and scaling scientific instrument businesses. The stock has recently give good opportunities for an entry. So, I took advantage and recently added it to my long-term portfolio and plan to gradually build my position throughout 2025.

Ready to dive deeper? Here’s what I offer and how I can help you

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-May-2025)

💼 Full Portfolio Access – Holdings, Valuation metrics & Performance tracking

📈 Live Trade Updates – My latest trades & watchlist additions

📊 Valuation Tools – DCF, Reverse DCF, Capital Efficiency & Growth models

🎧 Podcast Picks of the Week – Handpicked episodes on businesses & investing

🔎 Stock Picking Methodology – Learn my long-term investment strategy

🎯 Swing Trading Strategy – My short-term trading approach

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles