ASML Q2 2025

Another Report Where the Real Story Lies in the Details & What am I making of it?

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

👀 Recent Releases!

👀 Coming Soon

💎 Hidden Gem - Fifth Edition

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-July-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles

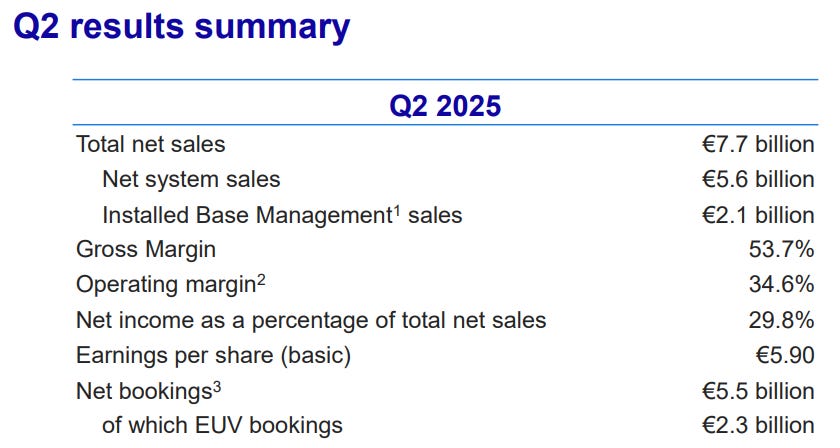

Financial Snapshot: Q2 2025

Key Highlights:

🔹 Net Sales: €7.69B (Est. €7.51B) 🟢 | EPS: €5.90 (Est. €5.22) 🟢

🔹 Gross Margin: 53.7% (Est. 51.9%) 🟢

🔹 Net Bookings: €5.54B (Est. €4.80B) 🟢; -1% YoY and +41% QoQ → For those still focused on QoQ net bookings beats, this Q delivered. But if, like me, you're paying closer attention to total backlog, the real picture is starting to come into focus. I'll dive deeper into that in the Outlook & Guidance section and expand on it in the Final Take below.

🔹 Net Income: €2.29B; UP +45% YoY

CC Breakdown & Management Themes

AI is the Unquestionable Growth Engine

CEO Christophe Fouquet was unequivocal: “Artificial intelligence is currently the main driver for growth for both Logic and Memory.” This theme was the central pillar of the call. Demand from customers adding capacity in the most advanced nodes for AI applications is fueling growth in Logic, while Memory remains robust due to investment in HBM and DDR5. This is directly reflected in the bookings, where Logic accounted for 84% of the €5.5 billion total in Q2.

EUV Business Strength & The Shift from Multi-Patterning to Single Exposure

A core theme was ASML's role in improving its customers' manufacturing economics. As chip features shrink, fabricating a single layer on a wafer can require multiple complex exposure steps (multi-patterning). This process is expensive, time-consuming, and increases the risk of defects.

ASML’s new, more productive tools are key to solving this. CEO Fouquet explained that the higher throughput of the new NXE:3800 Low-NA EUV tool "allows customers to shift more multi-patterning layers to single exposure," which in turn helps them "reduce complexity, reduce yield loss and improve cycle time."

CFO Roger Dassen provided details of the outlook for the Extreme Ultraviolet (EUV) business, projecting "approximately 30% increase of the EUV business" for the full year. This growth is being achieved through higher throughput from the new NXE:3800 tools, allowing customers to meet their “30% extra capacity” needs with a similar number of Low-NA systems as last year.

High-NA Progress & Margin Impact

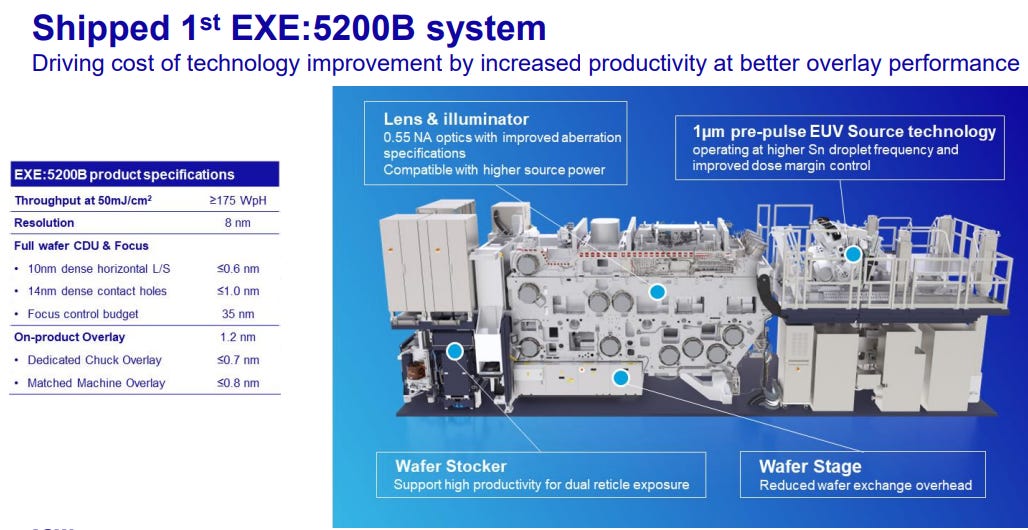

On the technology front, ASML is making steady progress with its next-generation platform, now working with three High-NA customers. The company shipped its first EXE:5200 High-NA system, the tool intended for high-volume manufacturing.

However, management was clear that these early systems are margin dilutive in the short-term. The recognition of more High-NA tools in the second half is a key reason for the guided-down gross margin, which is expected to be around 50% for H2 2025.

On the other hand, according to CEO Fouquet the new EXE:5200 High-NA system that will be used in production will achieve a “60% increase in efficiency compared to the EXE:5000 High-NA currently used by customers’ R&D teams”. This efficiency gain is key to justify the need for this technology and marks a critical milestone in preparing customers for the next generation of chipmaking.

Geopolitical and Macro Uncertainty Remains an Overhang

While the technological demand picture is clear, both executives highlighted growing uncertainty for 2026, coming from “macroeconomic and geopolitical consideration... and that includes, of course, tariffs.” Management claims they are working to mitigate the direct impacts of potential tariffs on systems and parts shipped to the US but acknowledged that the indirect macroeconomic impact remains "very uncertain."

Business & Regional Highlights

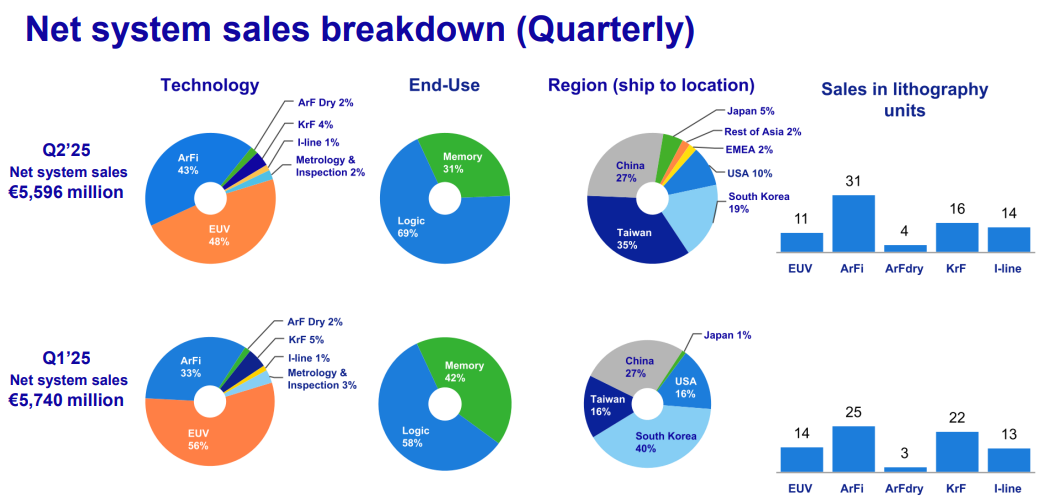

Q2 saw some interesting shifts in the sales mix compared to the prior quarter:

By End-Use: The strength in AI was evident as Logic system sales grew 16% sequentially, accounting for 69% of net system sales, while Memory sales declined 28% after a very strong Q1.

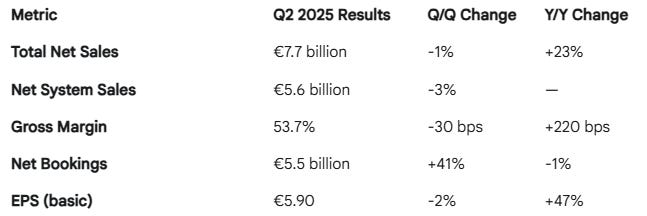

By Technology: In a notable reversal from Q1, DUV system sales grew 19% sequentially, while EUV system sales declined by -16.5%. Despite shipping fewer EUV units (11 in Q2 vs. 14 in Q1), the EUV Average Selling Price (ASP) increased 6% q/q to approximately €244 million, reflecting a richer mix of the new, more productive NXE:3800 tools.

By Region: The geographic mix algo changed substantially. Sales to Taiwan (TSM) more than doubled sequentially, making it the top region at 35% of system sales. In contrast, sales to South Korea (-54%) and the US (-39%) saw sharp declines from a high base in Q1. China remained a stable contributor at 27% of sales.

Outlook & Guidance

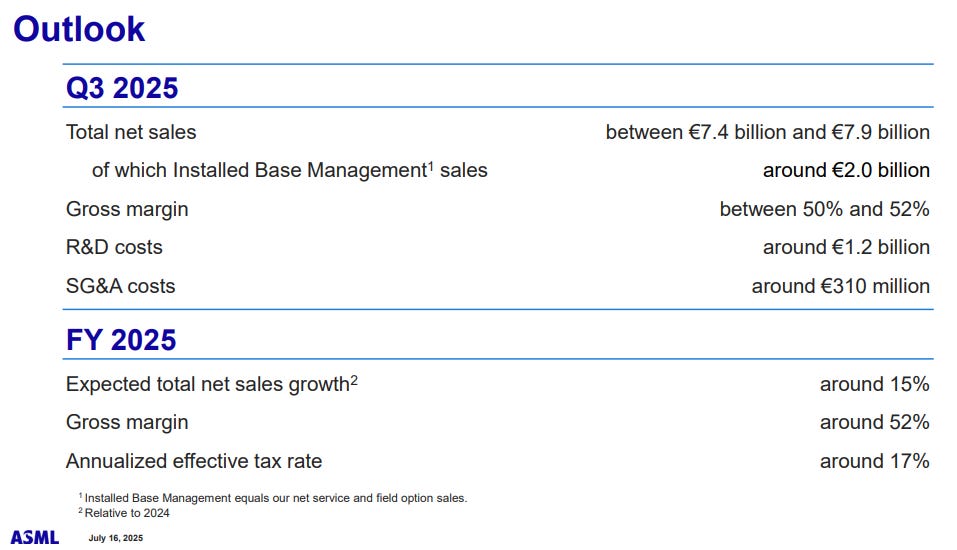

ASML reaffirmed outlook for both the upcoming quarter and the full year, as well as its long-term targets.

Key Highlights:

🔹 FY25 Revenue Growth: ~15% YoY (Prior: €30–35B) → unchanged

🔹 FY25 Gross Margin: ~52% (Prior: 51%–53%) → unchanged

🔹 Q3 Revenue: €7.4B–€7.9B (Est. €8.21B) 🟡

🔹 Q3 Gross Margin: 50%–52% (Est. 51.4%) 🟡

Bookings and Forward Visibility: Bookings and the resulting total backlog now provide approximately 80% coverage for 2026 revenue estimates, suggesting 2026 will be another growth year, though management stopped short of an official commitment.

Long-Term (2030) Outlook: The 2030 targets of €44-€60 billion in revenue and a 56-60% gross margin remain intact.