Synopsys & Heico Q1 2025

Main takes from Conference Calls and Earnings Report with my Personal Touch

Before next week’s piece on Measuring Capital Efficiency with ROIC, ROIIC, and ROCE, today I’m bringing a 2-in-1 earnings review covering Synopsys and Heico Q1 2025, both of which reported yesterday evening.

Let’s break them down! 👇

💻 Synopsys (SNPS)

Synopsys started FY25 beating revenue guidance midpoints and analyst estimates. While AI and high-performance computing design continue driving semiconductor R&D, management flagged macro softness in industrial, automotive, and consumer electronics, along with slowing growth in China.

Before diving into the earnings and conference call recap, here’s an insightful video breakdown from The Drill Down podcast that I found worth watching: 📎 Drill Down Earnings, Ep. 307: Synopsys Q1 2025 earnings analysis

Q1 2025 Financials and Outlook (Q2 2025 and Full FY25)

Top Line Growth 😐

Q1 Revenue: $1.46B, -4% YoY, reflecting one less work week last year, plus the sale of their software integrity business which represented around 13% of revenue. So, adjusting the numbers, revenue growth would be around +9% YoY.

Design Automation Revenue: $1.02B, +4% YoY, led by advanced node demand.

Design IP Revenue: $435M, -17% YoY, due to tough comps. 🟠

Profitability & Cash Flow 😐

Non-GAAP Operating Margin: 36.5%, in line with expectations.

Free Cash Flow: $(108M) outflow, reflecting higher working capital needs and IP investments. 🟠

Cash & Short-Term Investments: $3.81B at quarter-end.

Stock based compensation as a % of revenues ticked up from 9.3% to 12.2% 🟠

📌 CFO Shelagh Glaser on Outlook for FY25:

"Despite near-term fluctuations, our long-term fundamentals remain strong. We are reaffirming our FY25 revenue target of $6.75B–$6.85B, with 10%+ growth and margin expansion."

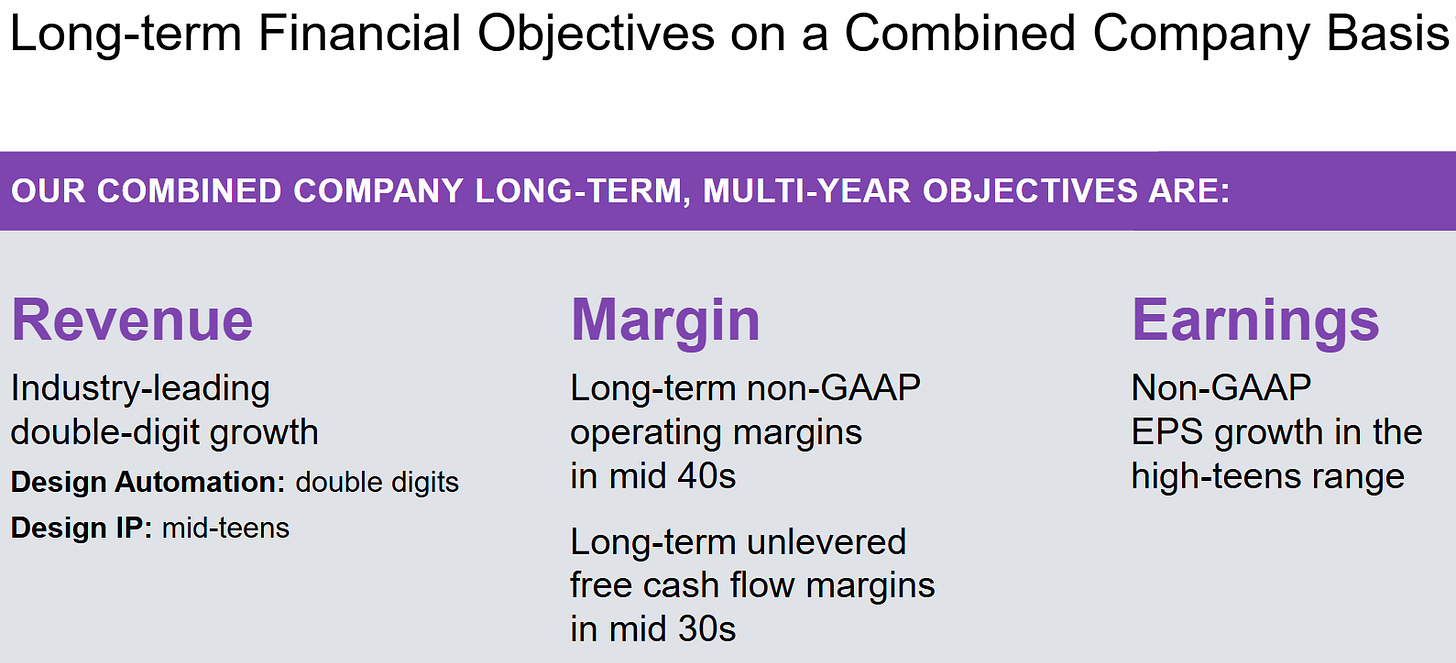

Long-term Outlook (including Ansys) 👀

Strategy & Growth Drivers

AI-Powered EDA & Semiconductor Design Expansion

AI & High-Performance Computing demand (HPC) remains a core growth driver 🟢

Synopsys.ai adoption expanded, with customers reporting 30-35% productivity gains from AI-powered automation tools. 🟢

New hardware-assisted verification (HAV) solutions launched, including HAPS 200 prototyping and ZeBu 200 emulation systems.

📌 CEO Sassine Ghazi on AI’s role in EDA:

"AI is fueling chip innovation, and the AI-driven EDA capabilities we pioneered—from reinforcement learning to generative AI—are delivering significant productivity gains."

Pending Ansys Acquisition: Strengthening Multi-Physics & AI Synergies 👀

EU & UK regulators provisionally approved the deal, while China’s review is ongoing. Synopsys still expects H1 2025 closing

The acquisition expands Synopsys’ footprint in system-level design, simulation, and physics-based modeling.

📌 Ghazi on the strategic rationale:

"Ansys and Synopsys together will redefine what’s possible in AI-driven silicon-to-system design. The opportunities ahead are immense."

Strength in Advanced Node & AI Infrastructure Design 🟢

2nm and 3nm design activity is accelerating across hyperscalers, HPC, and mobile customers.

New Ultra Accelerator Link (UAL) & Ultra Ethernet IP launched to support AI accelerator clusters.

PrimeTime & Fusion Compiler platforms remain the preferred choice for leading-edge chip design.

📌 Ghazi on advanced chip design adoption:

"The AI infrastructure buildout underway is transforming all industries—including our own. We are at the center of this transformation."

Hardware Ramp & Inventory Build-Up

Demand remains high, but Q4 2025 will be more backloaded as production scales.

Inventory increased 15% QoQ, reflecting ramp-up in new hardware production.

📌 Glaser on hardware demand:

"Demand is strong—it’s a matter of us ramping production to fulfill customer orders as fast as possible."

Potential Risks for FY25

China Growth Deceleration 🟠

China revenue fell to $174M in Q1, down from an average $250M per quarter in FY24.

Export restrictions & slowing local investment continue to pressure demand.

Synopsys expects China to grow below corporate average in FY25.

📌 Ghazi on China:

"We anticipated headwinds, but they have strengthened. As a result, we now expect China to grow below our corporate average in FY25."

Mixed End Market Demand 🟠🟢

AI & HPC remain strong, but industrial, automotive, and consumer electronics are still weak.

PC & mobile design activity is rebounding, but auto & industrial segments remain flat.

📌 Ghazi on end-market trends:

"We’re seeing a tale of two markets—AI and HPC are accelerating, while auto and industrial remain stable but not yet recovering."

🧠 Final Take

Not the best quarter by any means. Despite Synopsys beating its own guidance and analysts estimates, top line and bottom line were weak.

1️⃣ China deceleration and macro softness in industrial markets remain risks.

2️⃣ Brightest spot is strength in advanced node & AI infrastructure design

3️⃣ Long-term AI and semiconductor growth drivers remain intact.

A major focus was the $35B Ansys acquisition, which is taking forever, but getting closer now as it’s set to close in H1 2025 pending regulatory approvals form multiple countries. In my opinion, this a big deal for the strategic value of the company as it brings multi-physics design synergies that will enhance EDA and semiconductor modeling capabilities and expand their total addressable market.

Let’s go with Heico now. But first.. let’s take a quick look at What’s New at Expanse Stocks, What’s Coming Soon and What can you get as a Expanse Stock’s Subscriber 🧐

📰 What’s New?

Free Access to 📊 Quarterly Updated Portfolio Composition - by Industry and Geography, plus Valuation Metrics → 📎 Expanse Stocks: Behind-The-Scenes

📰 What’s New?

Free Access to 📊 Quarterly Updated Portfolio Composition - by Industry and Geography, plus Valuation Metrics → 📎 Expanse Stocks: Behind-The-Scenes

📌 Free-to-Read Articles (📎 linked below)

🔎 Deep Dives – ⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista

🛒 Amazon (NEW)

💸 General Investing - Latest: Understanding ROIC, ROIIC, and ROCE

💎 Hidden Gems – Latest: Third Edition

🎅 Christmas Special - Top 5 Picks for 2025

💬 Join my Chat! ( 📎 Learn more)

🔐 Paid Subscriber Exclusives

💎 Hidden Gems - Special Editions + exclusive sections from select articles - Latest: 💎 Hidden Gems - Special Edition II

🎁 Bonus Picks - From the 2025 Christmas Special

📊 DCF & Reverse DCF Models + Capital Efficiency Models– Download the models in the 📎 Portfolio section with multiple practical examples (ASML, GOOG, DHR, MEDP, ANET, AMZN and more)

👀 Coming Soon

📊 Quarterly Update to the Portfolio Composition (31-March) - by Industry and Geography, plus Valuation Metrics → 📎 Expanse Stocks: Behind-The-Scenes

A Leap of Faith with Owner-Operators: Why smart capital allocators deserve a big spot in your portfolio (with some examples)

Expanse Stocks x Finchat.io Partnership!

🎁 Get 20% off + 2 months free on any Finchat plan! →📎 Claim Discount

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 14-Mar-2025)

✈️ Heico (HEI)

Another strong quarter, setting new records for revenue, net income, and cash flow. The company benefits from demand in commercial aerospace, strong aftermarket growth, and increasing defense opportunities. Management also pointed out its strategic acquisitions, disciplined capital allocation, and ongoing efficiency improvements as key drivers of long-term success.

In the risks side, management mentioned macroeconomic uncertainty, supply chain challenges, and evolving defense spending priorities.

Q1 2025 Financials

Record Revenue & Net Income 🟢

Q1 Revenue: $1.03B, +15% YoY, driven by strong commercial aerospace demand.

Net Income (exc. 1 time item gain): $139.7M, +35% YoY, with EPS of $1.2 per diluted share.

Operating Income: $26.8M, +26% YoY

Segment Performance 🟡

Flight Support Group (FSG) Revenue: $691.8M, up 15% YoY, with strong 12% organic growth. 🟢

Electronic Technologies Group (ETG) Revenue: $336.2M, down 2% YoY, due to defense and industrial destocking. 🟠

EBITDA Margin: 25% for FSG, 24.3% for ETG, down from 26% last quarter 🟠

Cash Flow & Dividend Growth 🟢

Operating Cash Flow: $205.6M, up 39% YoY.

Net Debt-to-EBITDA: 2.06x, down from 3.04x a year ago

Dividend: 93rd consecutive dividend declared

Strategy & Growth Drivers

Strong Commercial Aerospace Growth 🟢 👌

Surging aftermarket demand for replacement parts, driven by airlines extending aircraft lifecycles.

The Wencor acquisition continues to outperform, with record aftermarket sales.

MRO (Maintenance, Repair, Overhaul) sales up 11% YoY, indicating strong airline fleet activity.

📌 Eric Mendelson (FSG President) on commercial aerospace momentum:

"The demand for aftermarket parts is stronger than ever. Airlines are looking for cost-effective solutions, and we’re well-positioned to meet that need."

Expanding Defense & Space Business

Defense sales up 25% YoY, with growth in missile systems and military aircraft parts 🟢

DoD cost-cutting initiatives could favor Heico’s lower-cost solutions, creating long-term opportunities 🟢

Increasing focus on space electronics, cybersecurity, and advanced avionics 👀

📌 Mendelson on defense sector opportunities:

"We expect meaningful growth from the defense sector, particularly in missile systems, where demand is exceeding supply."

Aggressive Acquisition Strategy 👀

Five acquisitions completed in 2024, expanding capabilities in aerospace, defense, and industrial markets.

Recent acquisitions include SVM Private Limited, Mid-Continent Controls, and Marwa Power Solutions.

M&A pipeline remains strong, with management actively evaluating new opportunities

📌 Mendelson on M&A strategy:

"We pursue acquisitions with a disciplined approach—focusing on companies that enhance our cash flow and market position."

Potential Risks for FY25

Supply Chain & Manufacturing Constraints 👀

OEM supply chain issues remain a bottleneck, affecting aircraft production rates.

Component lead times are still elevated, but improving slowly.

📌 Mendelson on supply chain conditions:

"We’re seeing gradual improvements, but supply chain constraints are still a challenge, particularly in aerospace."

Margin Pressures & Inflationary Costs

Higher labor and material costs could pressure operating margins, but efficiency gains are offsetting some impacts.

SG&A leverage improvements expected to drive slight margin expansion.

📌 CFO Carlos Macau on margin trends:

"We’re focused on optimizing costs while growing revenue—our strategy is all about efficiency and scalability."

Defense Budget Uncertainty 🟠👀

Potential shifts in U.S. defense spending priorities could impact DoD procurement cycles.

Opportunities in cost-saving initiatives but acknowledges near-term uncertainties.

📌 Mendelson on government contracts:

"We believe our lower-cost solutions align well with evolving defense priorities, but execution timelines remain unpredictable."

🧠 Final Take

Heico continues to capitalize on increasing aerospace aftermarket demand, expand its defense portfolio, and pursue disciplined M&A growth.

Supply chain challenges, inflationary pressures, and defense spending shifts could present some headwinds, but the company’s top financial health, diverse customer base, and focus on efficiency position it well for continued success in FY25.

📌 Mendelson’s closing remarks:

"Our diversified business model and disciplined execution have positioned us for sustained growth. We remain highly confident in Heico’s future."

In my opinion, Heico is one of the most compelling long-term growth story in the aerospace and defense sector with a top “owner-operators” management team.

Ready to dive deeper?

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 14-Mar-2025)