The Rareness of Moaty Software Companies: A Selection of 6 Gems

What is a moat? My take on 6 software companies that, in my opinion, exhibit the traits of competitive moats

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-Jul-2025)

Welcome Explorer!

On this occasion, I’m bringing you an interesting topic:

What is a moat?

What are some rare software companies with truly durable moats?

I will discover 6 gems that, in my opinion, have the traits of moaty software.

Let’s dive in!

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 🔗 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine | ✈ HEICO

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

👀 Recent Releases!

👀 Coming Soon

💎 Hidden Gem - Fifth Edition

💸 Why Equities Win Against Other Assets

Moats: Foundations of Long-term Excellence

When seeking long-term investments, understanding a company’s economic moat—a term popularized by Warren Buffet many years ago—becomes essential. A “moat” represents a sustainable competitive advantage, enabling a business to fend off rivals and maintain profitability. Morningstar defines five primary sources of moats (link for more details):

Network Effects: The value of a product or service increases as more people use it. Think of social networks or payment systems like Visa, where widespread adoption creates a cycle of growth and more relevance.

Intangible Assets: Brands, patents, and proprietary knowledge can provide pricing power or exclusivity. Examples include pharmaceutical patents or software with unique functionality.

Cost Advantages: Companies with lower production costs, achieved through scale or efficiency, can undercut competitors while maintaining healthy margins.

Switching Costs: High switching costs arise when customers face significant expense, disruption, or risk to move to a competitor. Software ecosystems, for instance, often lock users into platforms they’ve invested time and resources to master.

Efficient Scale: Some industries favor a few dominant players due to the high costs of duplicating infrastructure or specialized capabilities, such as pipelines or niche software for regulated industries.

The Challenge of Moats in Software

Despite high growth and attractive margins, the software industry is difficult for establishing durable moats. Technology evolves rapidly, and innovative new players can disrupt incumbents overnight. The main traits that make software attractive—low capital intensity and scalability—also lower entry barriers, inviting competition. Unlike traditional industries with physical infrastructure, software companies must fight to sustain their relevance as competitors constantly improve or imitate their offerings.

Moreover, customer loyalty in software can be fragile. While some applications benefit from high switching costs or network effects, others—particularly in consumer-facing markets—can lose users quickly if a competitor offers a better experience or lower prices. Even moats built on patents or intellectual property may erode as new technologies make older solutions obsolete.

However, moats can still emerge in specific niches where companies align their strengths with unique market needs. In these spaces, enduring moats are often built on a combination of switching costs, network effects, and intangible assets, as we’ll see in the following case studies of “moaty” software companies.

Electronic Design Automation: Cadence Design Systems (CDNS) & Synopsys (SNPS)

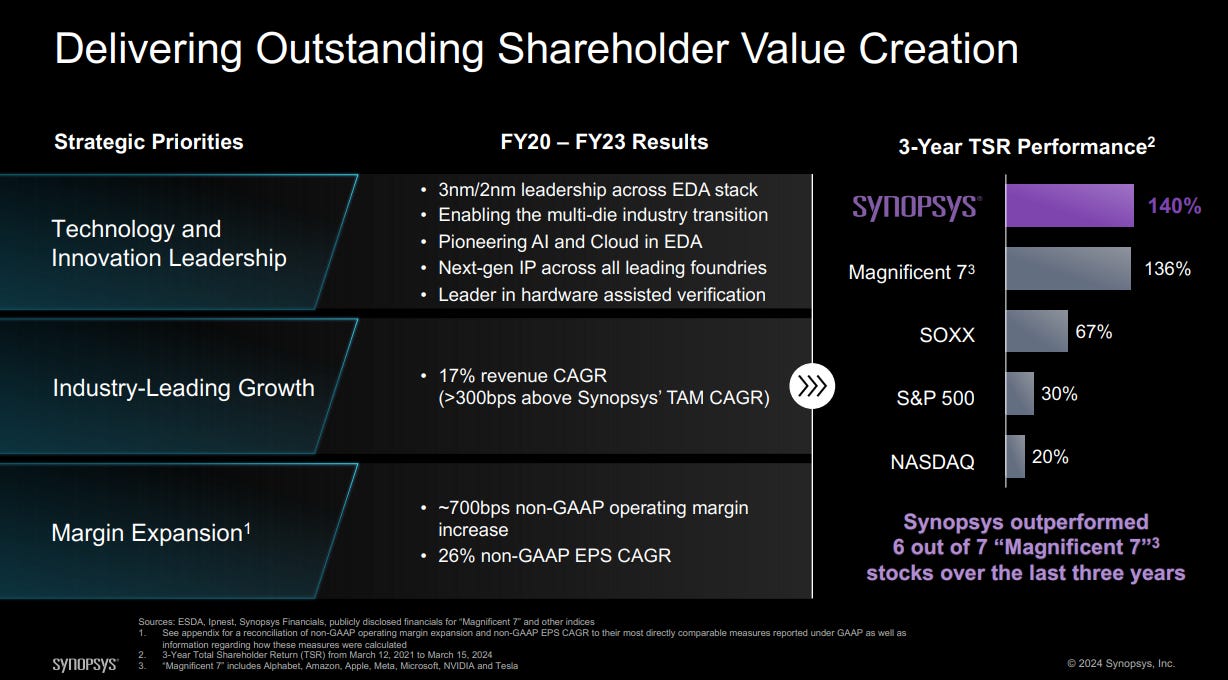

The semiconductor industry relies heavily on Electronic Design Automation (EDA) software for chip planning, design, and implementation. Cadence and Synopsys dominate this space, benefiting from switching costs and a subtle network effect.

Semiconductor companies cannot risk switching to unproven tools. Their engineers often invest years mastering these platforms, embedding years of legacy designs and intellectual property into Cadence and Synopsys systems. The cost and risk of migration deter competitors, creating a sticky customer base.

Moreover, their wide adoption standardizes knowledge, making expertise in these tools a valuable asset for job-seeking engineers.

The moat is amplified by the non-cyclical nature of EDA demand. Unlike hardware, EDA spending continues regardless of economic fluctuations. This paired with a growing need for specialized chips, positions these companies as indispensable partners for leading tech firms.

Cadence and Synopsys are the perfect examples of “moaty” software compounders creating value for their shareholders:

And delivering sustainable growth for decades:

Logistics Optimization: Descartes Systems Group (DSG)

Descartes makes supply chain logistics easier to manage thanks to their modular SaaS solutions covering global trade compliance, routing, and shipment tracking.

Its network effect connects 200,000 parties globally, allowing seamless communication across different transport modes (by air, sea and land) and regulatory boundaries. Switching costs are hard to replicate for competitors, due to data migration risks, retraining, and operational downtime.

Descartes’ neutrality— being unaffiliated with any specific carrier—strengthens its value proposition, cultivating trust among manufacturers, shippers, and suppliers alike. During the pandemic, its adaptability became even more evident, as companies leaned on its platform to navigate supply chain disruptions effectively.

This “quiet” under-the-radar Canadian $10B small-to-mid cap is a prime example of a pure software solutions company with multiple moats. Its ability to deliver exceptional compounded returns to shareholders over the years makes it a “sleep-well” attractive investment:

Retail’s Invisible Orchestrator: Manhattan Associates (MANH)

Manhattan Associates specializes in warehouse and omnichannel management, catering to retailers and manufacturers. Its platform integrates inventory tracking, order fulfillment, and in-store operations, facilitating frictionless customer experience, essential in the “Amazon era”.

High switching costs protect Manhattan’s position. Implementing a new warehouse system can take years, involve significant operational risks, and disrupt productivity.

Moreover, its decades-long relationships and organic product development reinforce customer loyalty. With clients such as Home Depot or UPS, Manhattan consistently proves its value, from optimizing inventory to enabling online-to-store returns.

MANH stock is yet another example of a “quiet” $17B mid-cap compounder that will keep winning as eCommerce continues to expand and supply chain management grows increasingly complex.

Supply Chain Synchronization: SPS Commerce (SPSC)

SPS Commerce simplifies inventory and supplier relationships through electronic data interchange (EDI), a standardized format for business transactions.

Its strength lies in a network effect: retailers like Walmart adopt SPS, requiring their suppliers to do the same, thereby expanding the network’s value.

Switching costs are high. For a retailer to abandon SPS, suppliers must also renew their processes, resulting in a costly, time-consuming task. Integration with enterprise software like Oracle and Microsoft further embeds SPS within client ecosystems, reinforcing its position.

Despite competition from more diversified players like TrueCommerce and Manhattan Associates, SPS leads within this niche with a wide network and integrated capabilities.

Insurance’s Digital Backbone: Guidewire Solutions (GWRE)

Guidewire helps the property and casualty (P&C) insurance sector with its policy, claims, and billing management solutions. This highly regulated, complex industry often uses outdated, deeply integrated systems that are difficult and risky to replace.

Insurance firms are inherently risk-averse, and prioritize reliability over agility, creating high switching costs. Switching away from Guidewire involves reengineering operations, migrating sensitive data, and retraining staff.

Few competitors, such as Sapiens International and Duck Creek, operate in this niche, but Guidewire’s entrenched position is strong enough to “easily” foresee a future dominated by this oligopoly, potentially strengthening its pricing power.

Final Thoughts: Finding Moats in a Dynamic Industry

While software technology evolves rapidly, there are pockets of stability driven by niche markets and indispensable solutions. Companies like Cadence, Synopsys, Guidewire, SPS Commerce, Manhattan Associates and Descartes exemplify how, even in dynamic industries, strong fundamentals and strategic positioning can create lasting advantages.

Whether it’s network effects that enable collaboration across vast ecosystems, or switching costs that discourage disruption, these firms have built defensible positions within their industries.

Investors seeking “sleep well at night” stocks would do well to explore these “moaty” software companies more in-depth. While technology evolves, their strategic advantages ensure they’ll remain ahead of the pack for years to come.

Ready to dive deeper? Here’s what I offer and how I can help you

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-Jul-2025)

📈 Biweekly Report – Portfolio updates, recent moves & watchlist additions

💼 Full Portfolio Access – Holdings, valuation metrics & performance tracking

📊 Valuation Tools – DCF, reverse DCF, capital efficiency & growth models

🎧 Podcast Picks – Biweekly handpicked episodes on business & investing

🔎 Stock Picking Framework – My methodology & investing philosophy

🎯 Swing Trading – Short-term strategy & latest swing trades

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles

Love this analysis, super valuable! I recently did an analysis on Synopsys, so it’s great to see you mention it here.

Gonna be reading a lot more of your analysis!