Mercado Libre Q4 2024 & Copart Q2 2025

Main takes from Conference Calls and Earnings Report with my Personal Touch

Welcome back to Expanse Stocks! 🧑🚀

Before releasing next week my Arista Networks (ANET) deep dive brief; today, I’m bringing a 2-in-1 earnings review covering Mercado Libre (MELI) Q4 2024 and Copart (CPRT) Q2 2025. Both reported yesterday evening.

If you’ve been following Expanse Stocks, you know I closely track both stocks and covered their last quarter’s earnings (Q3 2024 and Q1 2025 respectively). While very different in nature, industry and growth stage, both possibly rank among the Top 10 most impressive businesses I follow:

🔹 The Beast (MELI)

🔹 The Steady, Reliable Bull (CPRT)

Let’s break them down! 👇

📦MELI: Beasting

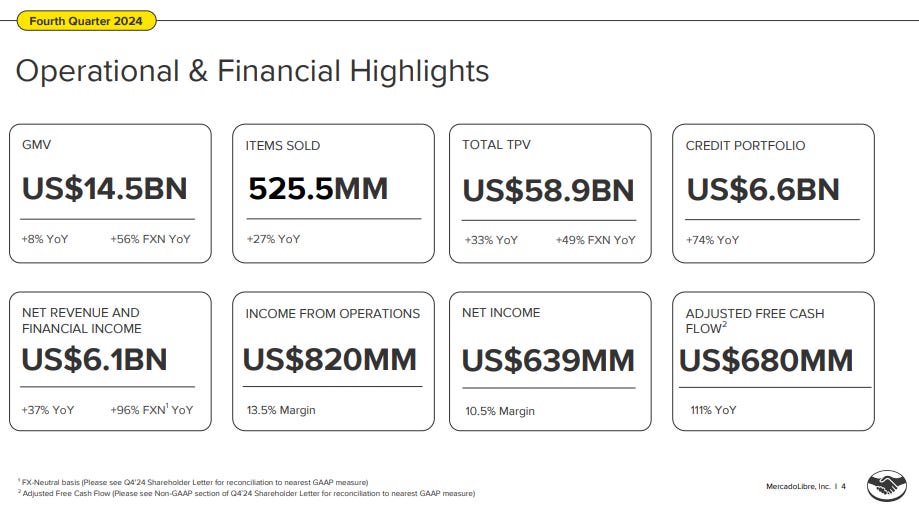

Financial Highlights - Q4 2024 🚀

Record Revenue & User Growth 🟢

Q4 Revenue: $6.1B, up 37% YoY or +96% FX-neutral ($120M beat), with strong growth across all regions. Regional Performance (FX-Neutral Growth):

Brazil: +62% YoY | Mexico: +64% YoY | Argentina: +212% YoY

Full-Year Revenue: $21B

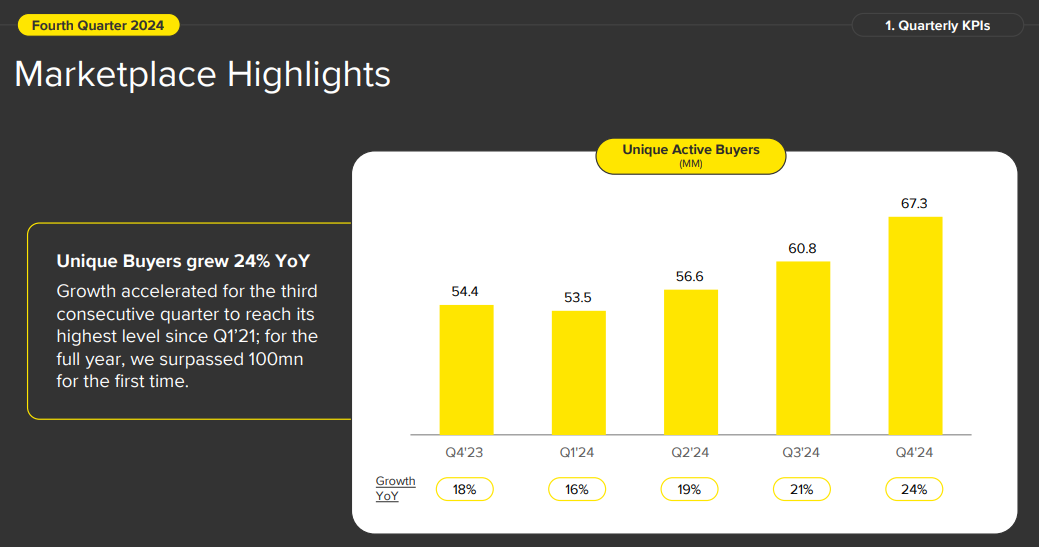

Unique Buyers: Surpassed 100 million for the first time with growth accelerating for the third consecutive quarter.

Fintech Monthly Active Users: Exceeded 60 million across MercadoPago.

Profitability & Margins 👌

Operating Margin: 13.5%, +65bps vs Q4 2024

Net Income: $639M (beat $401.5M ests.), 10.5% Margin (vs 3.7% in Q4 2023)

Q4 Free Cash Flow: 680$ million, +111% YoY

Full-Year Free Cash Flow: $1.3B, even after investing $900M in CapEx and $3B in credit expansion.

GMV & Payments Growth 🟢

GMV Growth: +35%, driven by Mexico (+27%) and Brazil (+34%).

Total Payment Volume (TPV): $241B, up 57% YoY, driven by MercadoPago expansion.

Credit Portfolio: Grew 74% YoY, with 5.9M new credit cards issued.

📌 CEO Marcos Galperin on 2024’s momentum:

"Even after 25 years of growth, we continue to see a massive opportunity ahead of us. Our focus remains on long-term sustainable expansion, even if it brings short-term volatility."

Strategic Growth Drivers

Logistics & Fulfillment Investments 👌

Expanded fulfillment centers, increasing free shipping coverage and delivery speed.

AI-driven route optimization & warehouse automation reduced cost per package.

Record peak season performance, improving user satisfaction.

📌 COO Ariel Szarfsztejn on logistics efficiency:

"There’s no silver bullet for logistics efficiency—it’s about dozens of incremental improvements that compound over time."

Fintech & Credit Expansion

Credit card adoption surged, with higher limits and better underwriting models.

Stable Non-performing loans (NPLs), despite rising interest rates in Brazil, demonstrating risk management improvements. 👌

Launched Meli Dollar stablecoin, new investment products, and tax-free deposits in Brazil 👀

📌 Fintech Head Osvaldo Giménez on credit scaling:

"Older credit card cohorts are turning profitable, proving our risk models are working. We will continue scaling with discipline."

AI-Driven Marketplace Optimization

Improved personalized search, dynamic pricing, and product recommendations.

AI-driven advertising platform scaling, contributing to 50bps GMV growth.

Enhanced fashion & grocery user experience, driving higher conversion rates.

📌 CTO Richard Cathcart on AI adoption:

"AI is embedded across our platform—from logistics to payments to personalization. It’s improving efficiency and engagement at scale."

Outlook for FY25

Expanding Digital Banking Footprint

MercadoPago aims to become Latin America's largest digital bank, leveraging its credit card ecosystem and investment offerings.

Embedded finance for merchants (BNPL, loans) is expected to increase retention and TPV growth. 👀👌

📌 Giménez on digital banking ambitions:

"Our fintech platform isn’t just about payments anymore—it’s becoming a full-fledged financial ecosystem for Latin America."

Further Logistics Enhancements

More automated fulfillment centers to improve last-mile delivery speed.

"Meli Más" loyalty program expansion to increase repeat purchases.

Strengthening cross-border trade (CBT) to enhance product availability.

📌 Szarfsztejn on logistics expansion:

"As demand grows, investing in fulfillment capacity isn’t optional—it’s critical for capturing long-term e-commerce growth in LatAm."

Scaling AI & Advertising

MercadoLibre aims to scale its advertising platform, expanding beyond product ads to display, video, and brand campaigns.

AI-driven dynamic pricing tools will further optimize seller performance.

📌 Cathcart on ad revenue potential:

"We’re still in the early days of ads monetization—there’s no reason MercadoLibre can’t reach the ad penetration levels of global peers."

Challenges & Risks

Brazil’s Interest Rate Environment & Credit Risks

Higher interest rates in Brazil could impact credit portfolio profitability.

Management has tightened credit issuance for riskier segments to mitigate exposure.

📌 Giménez on credit risk in Brazil:

"We’re being more selective in issuing new credit cards while expanding limits for trusted users. Our risk models continue to improve."

Margin Pressures from Investments in Growth 👀 (ST 🟠→ LT 🟢)

Logistics and fintech expansion could weigh on short-term margins, particularly in Brazil.

Management sees long-term scalability benefits outweighing near-term compression.

📌 CFO Martin de los Santos on balancing growth & margins:

"We are playing a long-term game. We will invest where we see opportunity, even if it creates short-term margin volatility."

Competition in Low-ASP Segments

MercadoLibre is seeing competition from discount-focused e-commerce platforms.

Investments in CBT, free shipping, and UI enhancements are helping maintain growth in low-ticket items.

📌 Szarfsztejn on low-ASP competition:

"Our low-ticket sales are growing at or above the marketplace average. We’re focused on providing the best experience, not just the lowest price."

🧠 Final Take

MercadoLibre closed 2024 doing what it does best, beasting: with record-breaking growth in e-commerce, fintech, and credit, further expanding its ecosystem and solidifying its leadership in Latin America.

While macro risks in Brazil, interest rate pressures, and continued investment in logistics & credit may create some short-term margin volatility, the company’s long-term growth drivers remain intact.

📌 Galperin’s closing remarks:

"The opportunity ahead is massive. We will continue investing with discipline to build a business that is even larger and stronger in the years to come."

With a dominant regional presence, expanding fintech ecosystem, and AI-driven efficiencies, MercadoLibre remains one of the most compelling growth stories in global e-commerce and digital banking.

Let’s go with Copart now. But first.. let’s take a quick look at What’s New at Expanse Stocks and what’s coming soon 🧐

Expanse Stocks x Finchat.io Partnership!

🎁 Get 20% off + 2 months free on any Finchat plan! →📎 Claim Discount

Not a member yet? Join Expanse Stocks for free to access Deep Dives, Monthly Specials, Hidden Gems, stock news, and more!

📰 What’s New?

Free Access to 📊 Quarterly Updated Portfolio Composition - by Industry and Geography, plus Valuation Metrics → 📎 Expanse Stocks: Behind-The-Scenes

📌 Free-to-Read Articles (📎 linked below)

🔎 Deep Dives Brief – ⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista Networks

💎 Hidden Gems – Latest: Third Edition (2 British small-cap treasures)

🤏 Monthly Picks + 🎅 Christmas Special: Top 5 Picks for 2025

💸 General Investing - Latest: DCF & Reverse-Engineered DCF (GOOG, ASML examples) + Moaty Software Companies (6 Gems)

💬 Join my Chat! ( 📎 Learn more)

👀 Coming Next

📊 Understanding ROIC, ROIIC, & ROCE - Measuring Investment Efficiency

💎 Hidden Gems - Special Edition II (Paid Subscribers)

🔐 Paid Subscriber Exclusives

💎 Hidden Gems - Special Editions + exclusive sections from recent Hidden Gems articles

🎁 Bonus Picks - From 🎅 Christmas Special

📊 DCF & Reverse DCF Models – Download in 📎 Portfolio Section

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year) with the annual plan!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 28-Feb-2025)

🔎 Stock Picking Methodology – Learn my long-term strategy

💼 Full Portfolio Access – Holdings, Valuation metrics & Performance tracking

📈 Live Trade Updates – My latest trades & watchlist additions

📊 DCF & Reverse-Engineered DCF Models – Proprietary models & valuation guides

🎯 Swing Trading Strategy – My short-term trading approach

💬 Private Community Chat - 📎 Learn more

🚗 CPRT: Steady As It Goes

Financial Highlights

Revenue & Volume Growth 🚂

Q2 Revenue: $1.2B, up 14% YoY, driven by increased total loss volumes and higher service revenue.

Global Unit Sales: Up 8% YoY, with U.S. insurance volume rising 9%.

Non-Insurance Volume: Blue Car (fleet, rental, financial institutions) +27% YoY, while dealer sales remained flat 👀

Margin Expansion & Profitability 👌

Gross Profit: $526M, up 13% YoY, with a 45% gross margin.

Operating Income: $426M, up 12% YoY.

Net Income: $387M, up 19% YoY, benefiting from higher interest income.

EPS: $0.40 (vs $0.33 last year), up 21.2%.

Cash Flow and Investments 🟢

Free Cash Flow: $307m, up 21.8% YoY, Operating Cash Flow: $660.4 millions, up +23% .

CapEx: Rose to $353 million due to land acquisition and technology investments.

📌 CFO Leah Stearns on cash and liquidity:

As of the end of January, we had over $5 billion of liquidity, which is comprised of nearly $3.8 billion in cash and our capacity under our revolving credit facility of over $1.2 billion.

Record Total Loss Frequency 🟢

Q2 U.S. Total Loss Frequency: 23.8%, an all-time high, partially driven by storm-related events.

FY Total Loss Frequency: 22.2%, reinforcing Copart’s central role in insurer decision-making.

📌 Co-CEO Jeffrey Liaw on total loss trends:

"Repair costs keep rising—labor, parts, and rental rates all contribute to making total loss decisions more attractive for insurers. That’s a long-term tailwind for Copart."

Strategic Developments

Expanding Non-Insurance Business 👀

Fleet, rental, and financial institution vehicle sales grew significantly faster than insurance volumes.

📌 Liaw on non-insurance expansion:

"Our non-insurance business is growing fast—fleet, rental, and financial institutions now make up a much larger share of our volume."

AI & Digital Transformation 👌

Title Express adoption surged, with over 1M+ vehicle titles processed annually.

AI-powered image recognition and predictive analytics are accelerating total loss decisions.

Copart’s automated pricing models are helping insurers set reserve prices more efficiently.

📌 Liaw on AI-driven claims processing:

"Our AI tools help insurers make faster, smarter total loss decisions—speeding up the entire claims cycle."

Outlook for FY25

Strengthening Core Insurance Business

AI-driven automation is reducing claim settlement times, helping insurers maximize recovery values.

Storm-related total loss cases are expected to remain above historical levels due to rising repair costs.

📌 Liaw on insurance volume trends:

"Our insurance carriers are trusting us with more of the workflow that they once handled in-house. That’s a testament to our ability to deliver efficiency."

Global Expansion & Buyer Demand

Copart is expanding global buyer participation, particularly in Latin America and Eastern Europe.

📌 Liaw on international growth:

"Even when some regions pull back, others step up. Our global buyer network has proven resilient through economic cycles."

Continued Investments in Technology & Infrastructure

Further expansion of Title Express and AI-driven analytics is planned to improve insurer workflows.

Additional real estate investments to support long-term growth.

📌 Liaw on tech-driven efficiency:

"We’re not just a salvage auction—we’re transforming how insurers and sellers manage vehicles. AI, automation, and expanded services are the future."

Challenges & Risks

Tariff Uncertainty & Possible Retaliation 👀

Incoming U.S. tariffs could drive up repair costs, increasing total loss frequency and potentially benefiting Copart.

However, retaliatory tariffs from key export markets could impact international buyer demand.

📌 Liaw on tariff risks:

"If tariffs raise repair costs, that’s a net positive for total loss frequency. But the real question is whether retaliatory tariffs could impact demand from our key international buyers."

Currency Fluctuations & Strong USD

A strong U.S. dollar makes salvage vehicles more expensive for international buyers, potentially reducing demand in certain regions.

However, Copart’s broad buyer base helps offset fluctuations.

📌 Liaw on currency risk:

"Historically, currency fluctuations haven’t had a major impact—if some countries pull back, others step up."

Macroeconomic Uncertainty & Seller Caution 🟠👀

Some vehicle sellers are taking a wait-and-see approach, delaying transactions amid broader economic uncertainty.

Purple Wave’s GTV growth (8% YoY) was lower than expected, reflecting hesitant sellers in the used equipment market.

📌 CFO Leah Stearns on cautious seller behavior:

"We’re seeing some sellers hold back due to economic uncertainty, but our long-term demand drivers remain intact."

Dealer Services Fluctuation 🟠

Copart Dealer Services down 5% YoY, due to volatility in wholesale dealer sales.

This segment is a focus area, but Copart is prioritizing higher-margin businesses.

📌 Stearns on dealer business challenges:

"Some months, dealer sales outperform; other times, they lag—it’s been unpredictable this year."

🧠 Final Take

Copart’s Q2 2025 results reaffirm its leadership in the insurance salvage market, supported by AI-driven automation, rising total loss frequency, and expanding global buyer demand.

While tariff risks, currency fluctuations, and cautious seller behavior could impact near-term growth, Copart’s strong financials, expanding non-insurance business, and continued investment in efficiency reinforce its long-term upside.

Also, I’d like to remind their 🗝 Long-term Growth Drivers as explained by their CEO during last quarter:

Population Growth: Increasing population leads to higher vehicle ownership and usage.

Vehicle Miles Driven: Rising mileage increases accident probabilities, fueling demand for salvage services.

Rising Loss Frequency:

Insurance companies are more frequently classifying vehicles as total losses due to higher repair costs, rental expenses, and auction returns.

This trend is amplified despite advancements in safety technologies, as the cost and complexity of repairs for modern vehicles (e.g., sensors, cameras) continue to climb.

📌 Liaw’s closing remarks:

"We’re not just a salvage auction—we’re transforming the way insurers and sellers manage vehicles. With AI efficiencies, automation, and expanded services, we’re building the future of total loss management."

Ready to dive deeper? Here’s what I offer and how I can help you

Free Access to 📊 Quarterly Updated Portfolio Composition - by Industry and Geography, plus Valuation Metrics → 📎 Expanse Stocks: Behind-The-Scenes

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year) with the annual plan!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 28-Feb-2025)

🔎 Stock Picking Methodology – Learn my long-term strategy

💼 Full Portfolio Access – Holdings, Valuation metrics & Performance tracking

📈 Live Trade Updates – My latest trades & watchlist additions

📊 DCF & Reverse-Engineered DCF Models – Proprietary models & valuation guides

🎯 Swing Trading Strategy – My short-term trading approach

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles