Calculating Portfolio Returns & Why Investing is Personal

Discussing three methods for calculating returns: Simple Return, Time-Weighted Return (TWR) and Money-Weighted Return (MWR).

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-May-2025)

Welcome back Explorer!

Today, I’m diving into a slightly different topic: how to track your portfolio's performance as an individual investor.

Monitoring your portfolio’s performance is crucial to understanding your financial position and assessing whether your strategies are working. But what’s the best way to measure your returns?

Here are three common methods, each with its unique features, strengths, and ideal use cases:

Simple Return (SR)

Time-Weighted Return (TWR)

Money-Weighted Return (MWR)

Let’s break them down step by step with a focus on what matters most for individual investors.

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 📎 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML | 🦎 Topicus | 💡 Lumine

💸 General Investing

💎 Hidden Gems Series

✨ Annual Specials – Annual Letters, Investing Philosophy & Top Picks of the Year

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

🔐 Paid Subscriber Exclusives

💼 Full Portfolio Content – Positions, valuation, trades, performance and more!

💎 Hidden Gems - Special Editions

🎁 Bonus Picks – From the 2025 Christmas Special

🤫 Exclusive Sections – From select Deep Dive Briefs & Hidden Gems

👀 Coming Soon

✈ Deep Dive Brief: HEICO

💸 A Reflection on my Investing Mistakes

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-May-2025)

💼 Full Portfolio Access – Holdings, Valuation metrics & Performance tracking

📈 Live Trade Updates – My latest trades & watchlist additions

📊 Valuation Tools – DCF, Reverse-Engineered DCF, & Capital Efficiency models

🎧 Podcast Picks of the Week – Handpicked episodes on businesses & investing

🔎 Stock Picking Methodology – Learn my long-term investment strategy

🎯 Swing Trading Strategy – My short-term trading approach

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles

Simple Return (SR): The Straightforward Start

Think of SR as the straightforward method—it’s quick, easy, and gets the job done when your portfolio is simple. SR is calculated by dividing your total profit by your initial investment.

Example

Imagine you invest $2000, and over the course of a year, it grows to $3000. Your SR will be +50%.

But here’s where it gets tricky: suppose you add another $1000 to your portfolio mid-year, and your total grows to $4500. The SR recalculates to 125%, which might feel misleading. Why? Because it doesn’t consider how long the extra $1000 was invested.

Verdict

SR works best for basic book-keeping. If you didn’t make any deposits or withdrawals during the year, SR paints an accurate picture. However, it fails to adjust for cash flows, as it doesn't account for timing or size of contributions/withdrawals, making it less reliable for an ongoing portfolio management.

Personally, I do not use this method for my portfolio performance tracking nor for Benchmark comparisons (vs SPY or QQQ).

Time-Weighted Return (TWR): The Fair Judge of Strategy

If you want to measure your investing skills while ignoring cash flow timing, TWR is the way to go. It divides the investment period into sub-periods, calculates the return for each, and then compounds them. TWR fits perfectly, in this case, because it removes the influence of deposits and withdrawals.

Example

Suppose you started the year with $10000, and midway through, you added $5000 when the portfolio had already grown to $12000. And by year-end, your total portfolio is worth $20000.

So, in the first period your portfolio has grown from $10000 to $12000, which translates to a TWR (r1):

Then, you added $5000, making it $17000 at the start of the second period. And, at year end, the portfolio is worth $20000 which translates to a TWR (r2):

To find the overall TWR for both periods since the start of the year till year end, you use the following equation:

So, as you may notice, TWR doesn’t care about your $5000 deposit and the timing of your deposit—it only focuses on the percentages: 20% growth in the first period and 15.3% in the second.

However, there’s a catch: TWR can sometimes feel disconnected from reality. For instance, if your portfolio value drops after a big deposit, TWR might still show a positive return.

Verdict

TWR is the referee of your investment strategy. If you’re competing/comparing against indexes or evaluating long-term decisions, this method is the gold standard as it sidesteps the impact of when and how much money you added.

Many professional investment managers rely on the TWR methodology since they cannot control client inflows and outflows. It’s ideal for assessing portfolio performance independent of cash movements against the indexes.

However, as a non-professional individual investor, it doesn’t feel like the best method to take full responsibility for my investment decisions. Here’s why.

Money-Weighted Return (MWR): The Investor’s Mirror

MWR, on the other hand, tells a more personal story—it captures the impact of both timing and cash flow size. In a way, it reflects your “gut calls”. Did you add money at the right moment? Did you pull out before a market dip? MWR includes it all.

This method uses the Internal Rate of Return (IRR), which can be thought of as the "interest rate" that balances all your cash flows with the final portfolio value.

Example

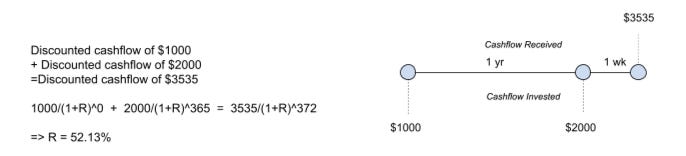

For example, the MWR in the case above is 52.13%, slightly higher than the TWR, as it emphasizes the last week's strong return (67% annualized) due to a larger investment during that period. MWR rewards you for the timing of your contributions, reflecting real-world decision-making and delivering a more satisfying result.

However, this can also backfire. Suppose you invest $5,000, which grows to $6,000, then add $20,000 during a flat market period. MWR heavily weights the $20,000, downplaying your early gains and making overall returns appear lower than they felt.

Verdict

MWR is perfect for understanding how well your portfolio performed in real-life conditions, reflecting how your timing and investment decisions impact returns.

But, let’s not sugarcoat it. MWR can get messy if your contributions are driven by unrelated factors, like depositing your yearly bonus or withdrawing to buy a new car. These actions skew results and might exaggerate or downplay your investment strategy.

Since the MWR equation isn’t the easiest to calculate manually, I typically rely on my broker to provide these returns. However, if your broker doesn’t offer this feature, there are several free tools available:

📎 Portseido Money-Weighted Return Calculator

📎 Money-Weighted Rate of Return Calculator (with Excel Sheet)

Final Thoughts: Which One Should You Use?

In my experience, I find MWR particularly empowering. It’s a bit like having a personal performance review: Did you invest during market dips? Great market timing; Panic-sell during a downturn? A chance to improve.

TWR, on the other hand, feels like an impersonal but fair grade, detached from your individual decisions. If you’re sizing up your portfolio against benchmarks like SPY or QQQ, TWR is the way to go. Why? Because indexes don’t adjust for your deposits and withdrawals. They assume a set-it-and-forget-it approach.

At the end of the day, investing is personal. Portfolio tracking isn’t just about numbers, it’s about understanding your own journey as an investor, Are you making decisions based on strategy or emotion? Are you improving over time?

By using TWR and MWR together, you’ll get a full picture.

That’s all, thank you for reading until the end! I hope you enjoyed it.

Ready to dive deeper?

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 15-May-2025)