ASML Q1 2025

Main takes from video conference & earnings report with my comments & thoughts

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 30-Apr-2025)

Welcome back Explorer!

Q1 2025 earnings season is kicking off and it’s shaping up to be a volatile one 🍃

This time, I’m bringing the earnings breakdown covering ASML (Q1 2025) which reported this morning.

If you’ve been following Expanse Stocks, you already know I keep a close eye on ASML and have reviewed their last two quarters (Q3 & Q4 2024). Here 📎 Stock News

Let’s dig into the numbers, management comments and what they tell us,

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 📎 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML

💸 General Investing

💎 Hidden Gems Series

🎅 Christmas Special - Top 5 Picks for 2025

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

🔐 Paid Subscriber Exclusives

💼 Full Portfolio Content – Positions, valuation, trades, performance [Details below]

💎 Hidden Gems - Special Editions

🎁 Bonus Picks – From the 2025 Christmas Special

🤫 Exclusive Sections – From select Deep Dive Briefs & Hidden Gems

👀 Coming Soon

🔎 A Hidden Gem Deep Dive Brief → Featuring Topicus & a 💎 Hidden Gems – Special Edition III → Featuring Lumine (both, CSU spin-offs)

📘 The Serial Acquirers Playbook: A Primer

📊 Q1 2025 Earnings Reviews + Stock News

ASML Q1 2025 Earnings and Video interview Highlights

ASML delivered a good Q1 2025 despite the noise around macro and ASML’s lumpy quarterly net bookings (more on this below), performing within expectations and reaffirming its FY25 revenue guidance of €30–35 billion. The company continues to benefit from demand for advanced logic driven by AI and high-performance computing, while acknowledging growing macroeconomic uncertainty tied to global tariffs. Technological progress in both Low-NA and High-NA EUV platforms and rising lithography intensity provide long-term tailwinds.

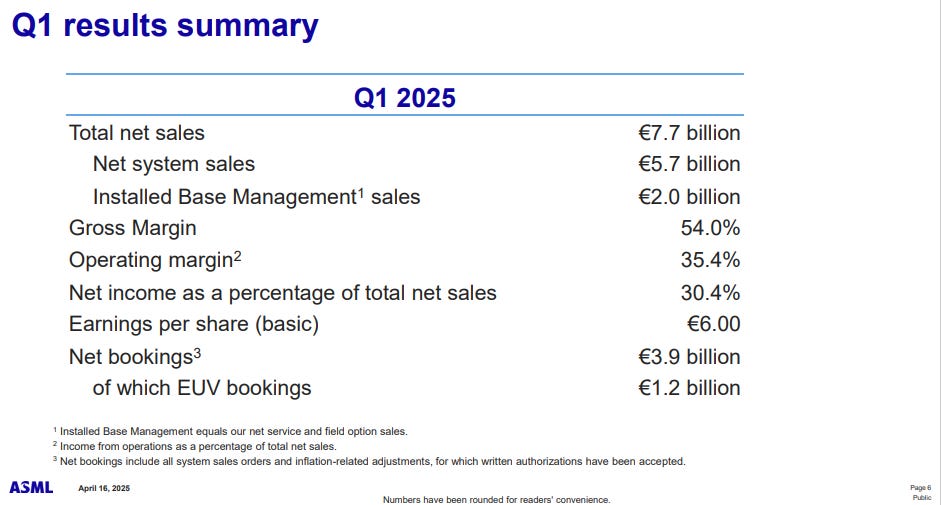

Financial Highlights

Net Sales: €7.7B (in line with guidance), including €2B from Installed Base and €5.7B from Net system sales.

—> 🤔 Comment: Based on shipping by region, it looks like a pick-up in EUV demand from Intel (US) and TSM (Taiwan) has not yet materialized. I’d expect this demand from these two chip manufacturers (particularly TSM) to increase starting H2 2025. Also, worth noting that China made 27% of sales, stronger than anticipated (prior 20% ests.) 👀

Gross Margin: 54%, slightly above guidance due to richer EUV tool mix (more NXE:3800 vs. 3600).

📌 CFO Roger Dassen:

"Margins exceeded expectations thanks to a more advanced mix of EUV systems and performance bonuses. Our capital return remains robust."

Net Income: €2.4B | EPS: €6.00, beating €5.79 estimates.

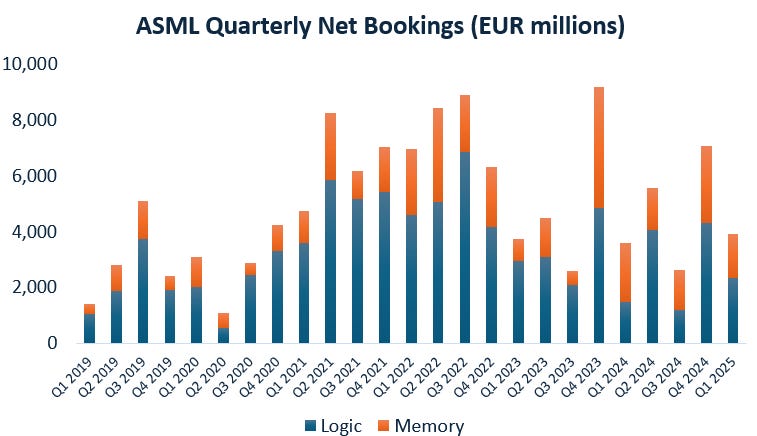

Q1 Net Bookings: €3.9 billion (including €1.2 billion in EUV orders)

ASML’s Quarterly net bookings shared on X by 📎 Tech Fund —> ⚠️ Comment: Net bookings this quarter came in below the €4.5B market expectation—BUT as I’ve emphasized in previous earnings reviews and my latest 📎 ASML Deep Dive Brief, quarterly bookings are highly volatile and not the metric to focus on.

ASML’s own management acknowledged this back in their Q4 2024 call, stating that starting Q1 2026, they will stop reporting quarterly net bookings altogether. Instead, they’ll focus on total net backlog, which offers a far more reliable signal of future revenue and long-term demand.

Bottom line? Don’t get too caught up in this quarter’s booking number—it’s noise, not signal.

Share Buybacks: €2.7 billion in Q1.

—> 👀 Comment: A record high, just this quarter they’ve bought back more shares than in FY24 or any other fiscal year.

Dividend: €1.84 final dividend proposed; total FY24 dividend €6.40 per share.

Outlook for 2025

Full-Year Revenue Guidance: €30B–€35B, unchanged from prior.

Full-Year Gross Margin Forecast: 51%–53%. In line.

Q2 Revenue Guidance: €7.2B–€7.7B, including ~€2B from Installed Base | Q2 Gross Margin: 50%–53%. Both with a wider range from prior ests. due to tariff uncertainty.

H2 2025: Expected to be stronger in revenue, but gross margin will be slightly lower due to High-NA ramp and lower upgrade mix.

📌 CEO Christophe Fouquet:

"If AI demand continues and customers can add capacity, we could reach the upper end of our guidance. But uncertainty—especially around tariffs—could also push us toward the lower end."

Technology & Product Updates

1. Low-NA EUV: NXE:3800 System Becoming the Standard

Upgraded first field system to 220 wafers per hour.

Customers transitioning to NXE:3800 as the dominant Low-NA tool.

Enables shift from multi-patterning to single-exposure lithography.

📌 Fouquet:

"NXE:3800 is becoming the key workhorse for Low-NA EUV. This is a major win for both customer efficiency and our margins."

2. High-NA EUV: Momentum Building

All EXE:5000 systems shipped; installations underway at 3 customers.

📌 Fouquet:

"Customer enthusiasm around High-NA is growing—real results are coming in, and they’re compelling."

Based on feedback from the recent SPIE Advanced Lithography + Patterning event:

Intel exposed 30,000+ wafers, citing major cycle time and process simplification benefits (e.g. 40 process steps reduced to 10).

Samsung reported potential 60% reduction in cycle time using High-NA.

"I think SPIE was a very good event because we saw our customers being very eager to share basically their results on High NA. A few strong examples. I think Intel was explaining that they had exposed more than 30,000 wafers on their tool. They also pointed very strongly to the fact that High NA could help them simplify their process. They mentioned one layer where they could reduce basically the number of process steps from 40 to 10. Which of course helps with cycle time, yield and process complexity. Samsung, also on the same topic said that High NA could reduce their cycle time in fact by 60%. So we start to see basically some of the value of High NA being recognized. Being measured in some way by our customers. Which is very, very encouraging."

Market Segments Breakdown

Logic: Strong growth, driven by advanced 2nm and AI/HPC workloads.

Memory: Stable vs. 2024, with DRAM demand supported by rising litho intensity.

Installed Base: Expanding due to broader EUV penetration, with service and upgrades providing recurring revenue. 👌

📌 Fouquet:

"Advanced logic is scaling fast, and DRAM litho intensity is rising. We’re in a good place across key technologies."

Tariff Impact & Macroeconomic Risk

Multiple categories of potential tariff exposure:

Whole system shipments to the U.S.

Parts and tools for U.S. field operations.

U.S.-based manufacturing imports.

Retaliatory tariffs from other countries.

Indirect risk from tariffs includes global GDP pressure and demand impact.

📌 CFO Dassen on tariffs:

"The financial impact is hard to quantify right now. We're working with the ecosystem to minimize disruption."

—> 🟠 Comment: Arguably the biggest orange flag in this report. The silver lining? It’s not company-specific—it’s a macro/geopolitical overhang (sigh) that ASML will need to navigate alongside its customers, suppliers, and partners. Not ideal, but also not entirely within their control.

Long-Term Vision: 2030 Targets On Track

Reaffirmed 2030 targets of €44B–€60B revenue and 56%–60% gross margin.

High-NA and NXE:3800 performance expected to drive lithography intensity gains.

AI and DRAM applications expected to shift toward single-exposure EUV.

📌 Fouquet:

Now this is very important. We talked a lot about litho intensity, about cost of technology in our Capital Markets Day and the progress on productivity basically allows us to execute with our customers on cost of technology. As a result, we start to see the opportunity to have more EUV single-exposed adoption. Of course, at the expense of multi-patterning. This is great for our customers because it helps with cycle time, simplification, yield, and, of course, for ASML this means that this litho intensity, especially for DRAM now, is continuing to increase.

Final Take

ASML began 2025 delivering in-line results and reaffirming its broad revenue range for the year. While tariffs and global macro factors create uncertainty, the underlying tech roadmap, especially EUV and High-NA, is gaining adoption and driving margin expansion.

With 2030 targets intact, supported by strength in AI demand and ongoing shift towards more advanced technology, a strong customer alignment, and technological leadership, ASML remains one of the most critical enablers in the AI and semiconductor ecosystem.

📌 Fouquet's closing sentiment:

We still see a lot of strength in AI. In fact some of the demand for this year, of course, but also for next year has solidified. So that's very encouraging. Now if we add to that the discussion with our customers it points to 2025 and 2026 to be both a growth year. As we explained in previous discussions.

Now, of course, Roger went into the details. There's this new uncertainty around tariffs. And like many experts, many businesses are explaining this is, of course, something that we don't know how to quantify yet. But this is adding definitely uncertainty on the long term.

Now, if we look at the market itself, we expect a shift towards more advanced technology. This is true for Logic, this is true for DRAM. And as we explained at Capital Markets Day these are basically technologies that will require more advanced lithography. I also explained, it's very, very important that the progress we have made on the NXE:3800 and High NA brings our customers the technology they need to switch more and more from multi-patterning to single-exposure EUV. This is, of course, a good thing when it comes to litho intensity.

With all of that, we feel that we are making a very good step towards our guidance given at the Capital Markets Day in November for 2030. With a range of revenue between €44 and €60 billion and a gross margin range between 56% and 60%.

Thanks for reading Expanse Stocks! That’s all for this very first earnings digest for the Q1 2025 season.

Ready to dive deeper? Here’s what I offer and how I can help you

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 30-Apr-2025)

💼 Full Portfolio Access – Holdings, Valuation metrics & Performance tracking

📈 Live Trade Updates – My latest trades & watchlist additions

📊 Valuation Tools – DCF, Reverse DCF, Capital Efficiency & Growth models

🎧 Podcast Picks of the Week – Handpicked episodes on businesses & investing

🔎 Stock Picking Methodology – Learn my long-term investment strategy

🎯 Swing Trading Strategy – My short-term trading approach

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles