Alphabet Q1 2025

Main takes from conference call & earnings report with my comments & thoughts

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 30-Apr-2025)

First Big Tech report out of the gate this earnings season, Alphabet (GOOG) had its moment yesterday and despite market’s concerns around macro headwinds and fears over existential threats to its Search business, the company showed up with what I believe were better-than-expected results, but not particularly from their Search business. Instead, more interesting trends are beginning to emerge beyond its traditional core in Search.

If you've been following Expanse Stocks, you know I keep a particularly close watch on Big Tech—especially Amazon and Alphabet. If you haven’t already, check out the 📎 Amazon Deep Dive Brief & Alphabet as one of my Top 5 Picks for 2025

Let’s dig into Alphabet’s numbers, management comments and what they tell us 👇

📰 What’s New at Expanse Stocks?

📊 Quarterly Update - Portfolio Composition (by Industry and Geography) + Valuation Metrics → 📎 Behind-The-Scenes [Free access]

📚 Articles

🔎 Deep Dive Briefs

⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista | 🛒 Amazon | 🤖 ASML

💸 General Investing

💎 Hidden Gems Series

🎅 Christmas Special - Top 5 Picks for 2025

📚 Resources for Investors

📢 Latest Stock News

💬 Join My Chat → [📎 Learn more]

🔐 Paid Subscriber Exclusives

💼 Full Portfolio Content – Positions, valuation, trades, performance [Details below]

💎 Hidden Gems - Special Editions

🎁 Bonus Picks – From the 2025 Christmas Special

🤫 Exclusive Sections – From select Deep Dive Briefs & Hidden Gems

👀 Coming Soon

🔎 A Hidden Gem Deep Dive Brief → Featuring Topicus & a 💎 Hidden Gems – Special Edition III → Featuring Lumine (both, CSU spin-offs)

📘 The Serial Acquirers Playbook: A Primer

📊 Q1 2025 Earnings Reviews + Stock News

Alphabet Q1 2025 Earnings & Conference Call Highlights

Financial Highlights

🔹 Revenue: $90.2B (+12% YoY; +14% in constant currency)

Search Ads: $50.7B (+10%)

YouTube Ads: $8.9B (+10%)

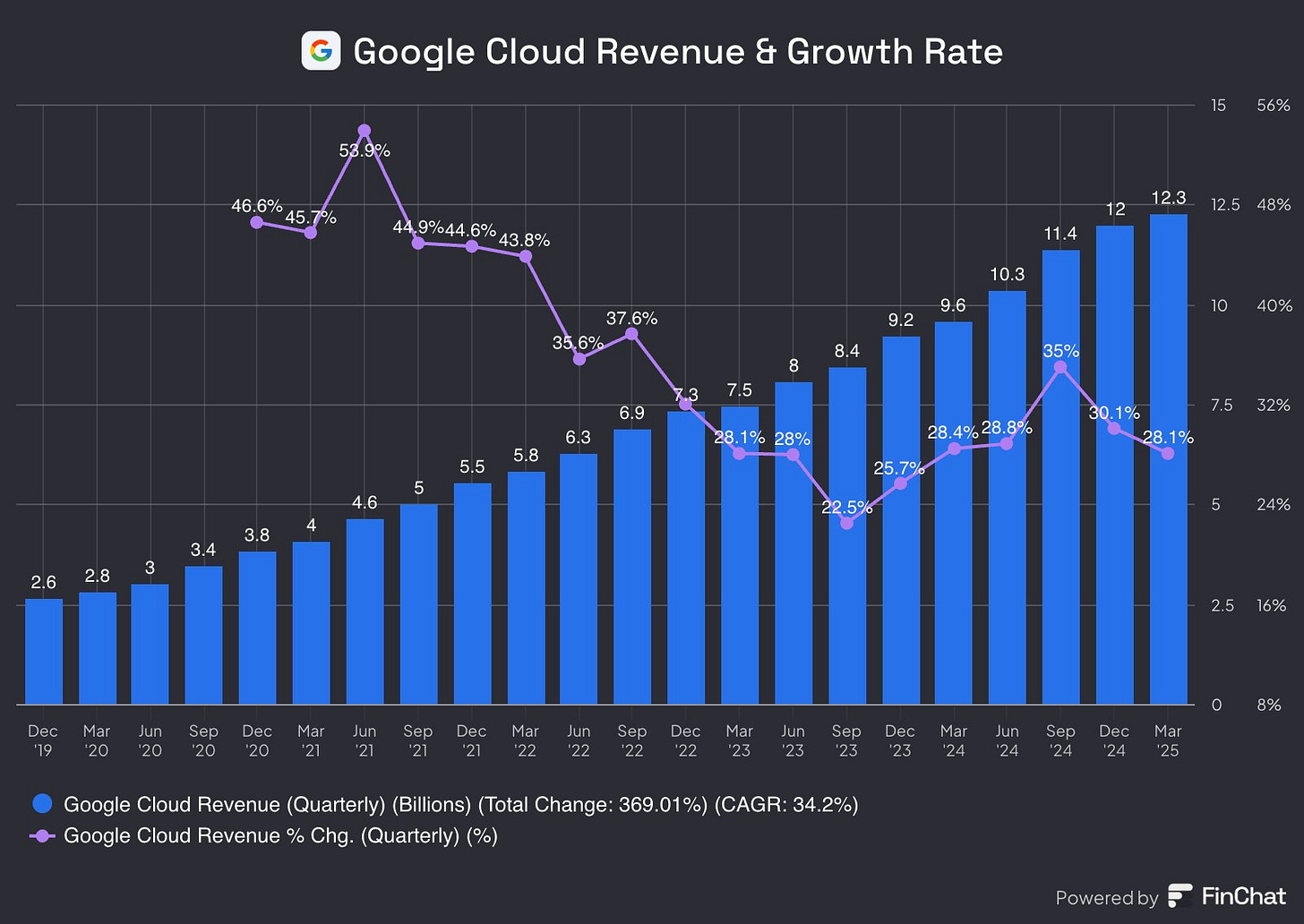

Cloud: $12.3B (+28%)

Subscriptions (YouTube): $10.4B (+19%)

—> 🤔 Comments: Google’s Search business has been under increased scrutiny lately, as fears around existential threats from AI-driven LLMs and alternative platforms continue to grow. Looking at the growth trend over the past year, it’s clear the trajectory is slowing: Q1 24: +14.4%, Q2 24: +13.8%, Q3 24: +12.3%, Q4 24: +12.5% and now +10% (although this Q slowdown was driven to some extent by FX headwinds).

Personally, I expect this deceleration to persist—largely due to scale, business maturity, and rising competition.

That said, the search pie is still big enough, and Google’s moat—built on network effects, default positioning, and billions of active users—should allow the company to keep growing its core business. Just don’t expect reacceleration from here. I believe the future growth story lies elsewhere in the Alphabet ecosystem as we’ll see later.

🔹 Operating Income: $31B (+20%), margin expansion to 33.9% | Net Income: $34.5B (+46% YoY) | EPS: $2.81 (+49%) | Free Cash Flow: $19B

—> 🤔 Comments: $0.62 EPS contribution by one time gain from Google’s SpaceX investment, as the Musk-led space firm was recently valued upwards at $350B in a secondary share sale.

🔹 Shareholder Returns: $15.1B in buybacks + $2.4B in dividends.

🔹 CapEx: $17.2B in Q1; full-year expected: $75B. More comments on this later on.

Google Cloud & Gemini: The New Core Growth Drivers

Scaling & Margin Expansion

Revenue surged 28.1% to $12.3B

—> 🤔 Comments: Slightly below consensus but mainly due to FX headwinds. Otherwise, solid. It would be encouraging to see growth stabilize around these levels at high-twenties next few quarters.

Cloud operating income rose to $2.2B; margin nearly doubled to 17.8% 👀👌

Gemini & AI Ecosystem: New models, all integrated within the Google ecosystem

AI Overviews now reach 1.5B users/month, in 140 countries and 15 languages.

200%+ increase in AI Studio and Gemini API active users since start of the year.

With Gemini 2.5 Pro as top-ranked model in Chatbot arena among developers; major improvements in reasoning, math, and coding.

AI agents now powering Google Workspace, YouTube tools, Ads products, and customer support across industries.

All 15 major Google products now integrate Gemini models.

High demand for AI training, inference, and multi-agent systems.

Vertex AI now supports 200+ foundation models, including Gemini 2.5 Pro, Imagen 3, and Llama 4.

📌 CEO Sundar Pichai:

“We're the leading Cloud for companies building the next generation of AI agents, with Gemini and Vertex driving that innovation.”

“With AI in everything—from Search to Gmail to Pixel—we're putting the best of Google into people’s hands.”

YouTube: The Second Growth Driver on Monetization Success

Subscriptions up +19% with Ad revenue up 10%, supported by Direct Response and Brand campaigns.

Shorts views up 20%, closing monetization gap in the U.S.

More creator partnerships (e.g. Toyota) boosting engagement and ad ROI.

📌 CFO Philipp Schindler:

“YouTube remains a cultural force—our biggest creators now shape conversations and campaigns on a global scale.”

Waymo: A Bet with Lots of Potential by Scaling Self-Driving Commercialization

Exponential Growth: Serving over 250K paid rides weekly, up 5x YoY. 👀

More Expansion: Launching services in Austin and Atlanta in 2025.

Partnerships with Uber, Moove, and others helping scale Waymo operations.

Potential opportunities for personal ownership as well.

📌 Pichai:

“Waymo is building the world’s best driver. We’re not locked into one model, we’re focused on creating value through optionality.”

Cybersecurity & Wiz Acquisition

Announced intent to acquire Wiz, a leading multi-cloud security platform. Synergies with Gemini expected to enhance threat detection, response, and governance.

📌 Pichai:

“With Wiz, we’ll secure enterprises end-to-end, enabling safer, faster multi-cloud adoption.”

Operational Outlook, CapEx & Cost Commentary

Depreciation up 31% YoY, expected to accelerate due to infrastructure investments 🟠

—> 🤔 Comments: This will weight on Alphabet’s margins in the near future.

Costs optimization continues through AI-driven productivity tools, headcount efficiency, and real estate optimization.

$75B CapEx in 2025 to support Gemini, Cloud, and DeepMind growth.

—> 🤔 Comments: CapEx for 2025 was maintained, dissipating some fears of big tech slowing down spending due to waning AI demand.

Furthermore, Pichai explained on the call that they are “operating in a tight supply-demand environment and heavier capacity deployments expected late 2025”

Challenges & Risks

Macro uncertainty may impact ad trends later in 2025, especially APAC retailers (de minimis exemption changes impacting cheap Chinese direct-to-consumer model).

Cloud growth variability tied to infrastructure deployment cadence.

Depreciation pressure from scaled infrastructure buildout.

Final Take

Alphabet enters 2025 stronger than it looked. While headlines may focus on better-than-feared Search results, the real story—at least to me—is Alphabet bracing for the next chapter. Management knows exactly what’s unfolding: Search isn’t falling apart, but the moat is showing cracks. That’s why they’re doubling down on the next wave of potential growth: Google Cloud + AI, AI Agents, YouTube monetization, and bold bets like Waymo and the newly acquired cybersecurity firm, Wiz.

Sure, macro headwinds persist and rising CapEx might put pressure on margins in the short term. But if you consider yourself a long-term investor, that shouldn’t spook you. In fact, I believe this pivot is part of the game plan. Despite the noise, Alphabet continues to deliver a combination of resilient cash flow, margins expansion, a more diversified revenue mix; and all at a current valuation that’s still anchored in Search skepticism.

That, ironically, makes it a compelling value and growth play for the remainder of 2025.

Disclosure: No current position in Alphabet (but it's always on the radar 👀).

Thanks for reading Expanse Stocks! That’s all for the first Big Tech earnings digest of the season.

Ready to dive deeper? Here’s what I offer and how I can help you

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 30-Apr-2025)

💼 Full Portfolio Access – Holdings, Valuation metrics & Performance tracking

📈 Live Trade Updates – My latest trades & watchlist additions

📊 Valuation Tools – DCF, Reverse DCF, Capital Efficiency & Growth models

🎧 Podcast Picks of the Week – Handpicked episodes on businesses & investing

🔎 Stock Picking Methodology – Learn my long-term investment strategy

🎯 Swing Trading Strategy – My short-term trading approach

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles