Monthly Specials (November 2024) - Part 2

Two new SaaS stock ideas selected through a blend of fundamental analysis and technical setups

Remember that Expanse Stocks and Finchat.io Partnership! Enjoy a 20% discount (+ 2 months free) on any Finchat plan 👉 Claim Your Discount Here

Not a free member yet? Join Expanse Stocks for free if you’d like to receive more content like this and get access to some of my free research (Deep dives, “Monthly Specials” Picks, Hidden Gems Screeners, Stock News and more)

Hello, reader!

Welcome back to the blog, and thanks for joining me for part two of my Monthly Specials for November! (If you missed the first part, you can find it here.)

Each month, I’ll be sharing a list of standout stock ideas—either for swing trades or long-term investments—highlighting growth and quality companies that have caught my eye. These picks come from a mix of qualitative insights, fundamentals, and/or technical setups.

November has delivered plenty of technical breakouts since the U.S. election, and although many stocks are getting a bit frothy, there are still several exciting setups across industries, especially within the SaaS sector.

Software has been lagging behind in the AI boom compared to semiconductors and other parts of the value chain, as AI’s impact on software hasn’t fully shown in their financials—or so the market believes. But with semiconductors likely cooling off, some software leaders may be gearing up to ride the next AI wave as their results start to reflect AI integration.

So, here are two SaaS stocks that really caught my attention this month—not only for their technical setups but also for their strong position to capture this next wave of AI momentum. For one of them, I also go over their Conference call and recent earnings report.

Let’s get to it!

📰 What’s new?

For Free Subscribers, you now have access to:

📊 Quarterly Updated Portfolio Composition by Industry and Geography, plus Valuation Metrics.

👉 Expanse Stocks: Behind-The-Scenes (Last Update: 23-Dec-2024)

Several articles (most are FREE to read):

Brief Deep Dives: ⛅ Cloudflare, 👷♂️ Parsons, 𓇲 MPS, 🥼 Medpace (NEW)

🎅 Christmas Special: TOP 5 Picks for 2025

💸 General Investing Articles

Top article: 📊 Understanding DCF and Reverse-Engineered DCF Models for Investment Decisions (with two examples: GOOG & ASML) 👉 here

👀 Coming up:

Summaries of several earnings and conference calls for Q1 earnings season

The Rareness of Moaty Software Companies: A Selection of 7 Gems

💎 Hidden Gems - Third Edition: Featuring 2 British treasures—one free to read and the second exclusively for paid subscribers.

Articles exclusive for Premium Subscribers:

Bonus picks at the end of the 🎅 Christmas Special

📊 DCF & Reverse DCF Models: Available for download in my Portfolio section

➕ Unlock Full Access to Premium Features:

With access to all my articles, private Community Chat, and the Portfolio section, you’ll get:

🗓️ Biweekly Updates (Last Update: 15-Feb-2025)

🔎 Stock Picking Methodology: Learn my long-term investment strategy.

💼 Full Portfolio Access: View long-term holdings with valuation metrics and performance tracking.

📈 Live Trades: Stay updated on my latest trades and watchlist additions.

📊 DCF & Reverse-Engineered DCF Models: Download proprietary models with calculations and evaluation guides.

🎯 Swing Trading Strategy: Learn my short-term trading technique for quick gains

👉 Access Full Portfolio Content

🎨 Adobe - ADBE

Technical Setup

At first glance, the setup may not look perfect, but with a reliable long-term performer like ADBE, recoveries tend to follow 👇

The stock has consistently rebounded off its rising support line (blue line) since hitting its low in October 2022.

The Moving Average Convergence-Divergence line (MACD) is now attempting to cross above the zero line—a potentially bullish sign.

Selling volume after each ER release has steadily declined, with every dip bought up on volume.

After digesting the COVID-era surge, ADBE has been building a solid multi-year base while its fundamentals steadily improve (more on this in the next section). It. kind of. reminds of the basing process MELI went through before breaking out to all-time highs. As they say: “The longer the base, the higher in space”

Key Valuation metrics

Consistent low-teens to mid-teens Revenue Growth, with 30% net margins and a high ROIC of +20% (and improving Q/Q)

26 P/E (NTM) vs 33 P/E (4Yr Avg)

25 P/FCF (NTM) vs 31 P/FCF (4Yr Avg)

FCF Yield at 4%

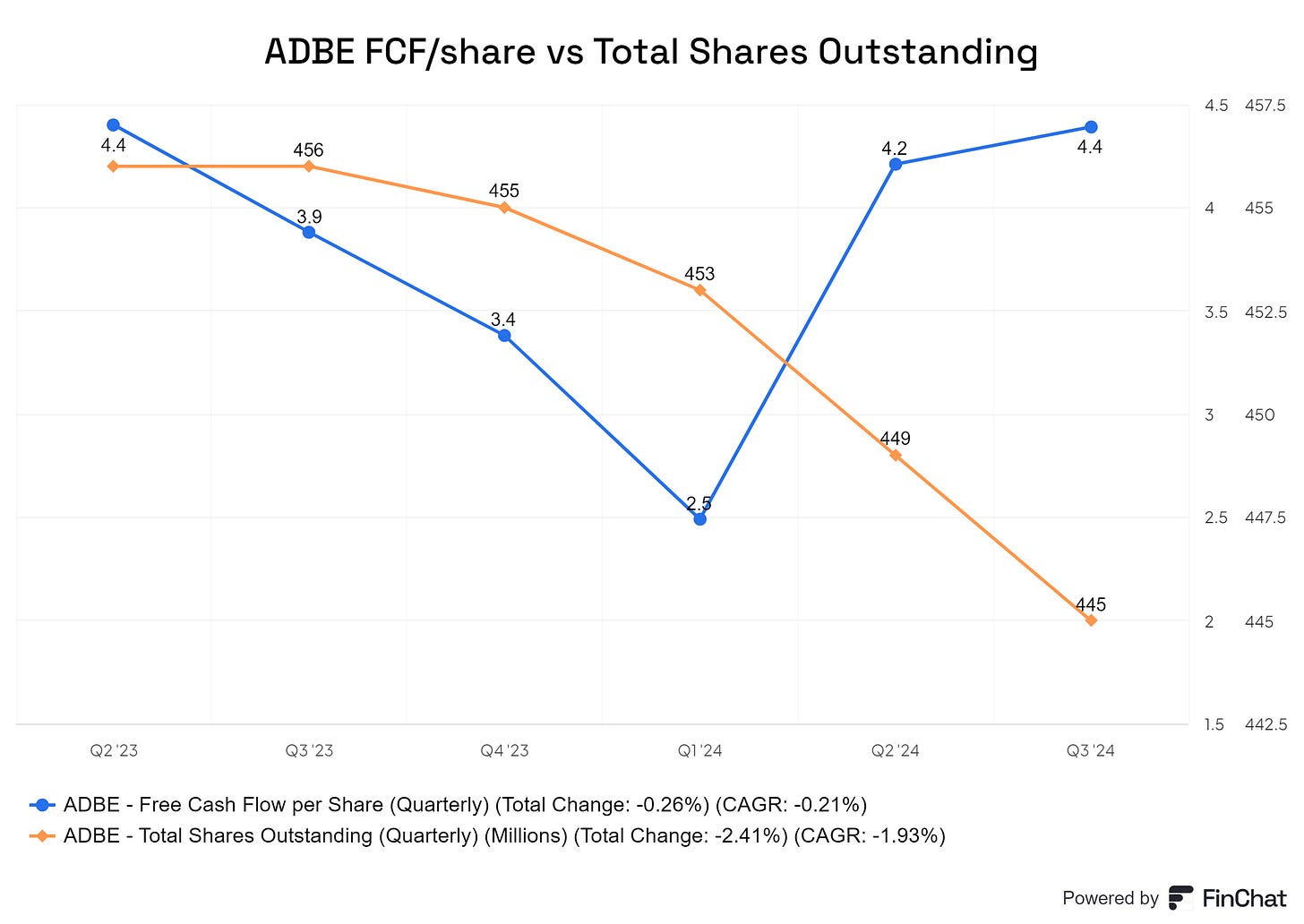

EPS Growth and FCF per Share improving substantially since the beginning of this year while the company has been buying back shares 👇

Commentary

The market has shown some hesitation toward ADBE in recent years, especially with the rapid rise of AI. There are concerns that AI-infused software could disrupt ADBE’s core business, raising questions about how AI-driven growth will ultimately impact software leaders. However, ADBE’s extensive distribution network and strong enterprise partnerships create a substantial moat—one often overlooked by investors. These assets distinguish true software leaders from newer disruptors, many of whom may boast appealing products but struggle to scale or retain market presence.

In fact, ADBE is positioning itself to capitalize on the AI trend, rather than fall behind. The company has steadily rolled out AI-enhanced features across its product suite, and at their MAX investor conference earlier this year, management laid out a clear strategy for driving AI adoption and future monetization. This approach could reaccelerate ADBE’s revenue growth and solidify its standing in the AI landscape. Source: MAX Investors Update

🧠FINAL TAKE:

Adobe, with its wide moat, remains the gold standard in content creation and PDF editing—categories it pioneered and continues to lead. Rather than posing a disruptive threat, AI will likely strengthen Adobe’s competitive edge and drive adoption across its huge customer base.

Solid opportunity for a long-term investment, supported by secular trends and Adobe’s leadership in digital creativity, from content production to marketing services.

Technical setup also looks promising for a swing trade in the coming weeks, with the stock chart primed for a breakout from its multi-year base.

🐶 Datadog - DDOG

Technical Setup

I don’t often share three charts across different timeframes, but DDOG’s setup looks so promising on the daily, weekly, and monthly charts that it’s worth diving into each 👇

On the daily timeframe (first chart), the 50-day MA is close to crossing above the 200-day MA, forming a potential golden cross. This signal coupled with the end of the stock’s Stage 1 base suggests an upward trend could be on the horizon.

On the weekly timeframe (second chart), the MACD has broken out of its consolidation phase and is attempting to stay above the zero line. If upward momentum continues to build, it could give the stock the lift it needs to move higher.

On the monthly timeframe, the 20-day MA (grey line) has already crossed above the newly forming 50-day MA (orange line), completing a bullish golden cross and signaling a potentially uptrend ahead.

Notes from their Q3 2024 results and Conference Call

Revenue growth reaccelerating, up 26% YoY, and operating margins increased by 120 bps to 25.1%

Positive Demand Trends: Seeing positive signs of shifts in customer demand for observability and security solutions. The Q/Q sequential revs acceleration bodes well for 2025.

AI-Driven Demand: Cloud-AI workload adoption expected to increase demand for observability solutions, with AI-native customers’ spending on the platform growing 60% sequentially.

Growth with large customers and upselling: Large customers (ARR>$100K) rose by 12% YoY. And, 26% of customers now use at least 6 modules, up 21% YoY.

Profitability and Operating Leverage: Expecting to expand margins to 30% over the next five years as it moderates research and sales expenses.

More Stats for AI Impact: AI-native customers contributed 6% to ARR, up from 4% last Q, and ARR from these customers has more than tripled year-over-year.

🧠FINAL TAKE:

Solid opportunity for a swing trade and long-term investment on this leader in security and observability, backed by growth reacceleration and rising AI-driven demand in security and observability. The technical charts on every timeframe look great, with the stock about to break out from its late Stage 1 base.

That’s a wrap for this second part and last edition of “Monthly Specials” for November, I hope you enjoyed it, and we’ll keep an eye out for more 🧠 setups and promising opportunities soon.

Ready to dive deeper? Here’s what I can offer you and how I can help you

For Free subscribers, you have access to my quarterly updated Portfolio Composition by Industry and Geography as well as Valuation Metrics — Last Update: 06-Nov-2024

Click here 👉 Expanse Stocks: Behind-The-Scenes

&

For Premium Subscribers, you can dive deeper with full access to all my articles, private Community Chat and the Portfolio section, where you’ll find:

Last Update: 02-Nov-2024

🔎 Stock Picking Methodology: Discover the criteria I use to select long-term investments.

💼 Full Portfolio Access: Explore my ETFs and actively managed long-term holdings (biweekly updates), complete with valuation metrics and performance tracking, regularly updated.

📈 Live Trade Updates: Stay in the loop with biweekly updates on my latest trades, new additions (both swing and long-term), and stocks I’m watching closely.

🎯 Swing Trading Strategy: Get insights into my swing trading approach for short-term gains.

👀 Over the past six weeks, I’ve added to several existing long-term positions, initiated seven new ones and sold three, and opened two additional swing trades. These moves came after selling my passive investments and reallocating the cash into my actively managed portfolio

Click here 👉 Access Full Portfolio Content

Also, available in the “Portfolio” section of the Expanse Stocks blog.