Monthly Specials (November 2024)

Three new stock ideas selected through a blend of qualitative analysis, fundamentals, and technical setups

Remember that Expanse Stocks and Finchat.io Partnership! Enjoy a 20% discount (+ 2 months free) on any Finchat plan 👉 Claim Your Discount Here

Not a free member yet? Join Expanse Stocks for free if you’d like to receive more content like this and get access to some of my free research (Deep dives, “Monthly Specials” Picks, Hidden Gems, Stock News and more)

Hello, reader!

I’m Diego from Expanse Stocks! Welcome back to the blog, and thanks for joining me for the second edition of "Monthly Specials". Each month, I’ll be sharing handpicked stock ideas for swing trades and/or long-term investments, focusing on growth and quality companies that catch my eye. These picks can be based on a mix of qualitative insights, fundamentals, and/or technical setups analysis.

With November upon us, I’ve found lot of promising technical setups across various industries, making it tough to narrow down the list. After some consideration, here are three stocks that really caught my attention this month and are not only good for a quick swing trend but for (very) long term hold.

Let’s get to it!

📰 What’s new?

For Free Subscribers, you now have access to:

📊 Quarterly Updated Portfolio Composition by Industry and Geography, plus Valuation Metrics.

👉 Expanse Stocks: Behind-The-Scenes (Last Update: 23-Dec-2024)

Several articles (most are FREE to read):

Brief Deep Dives: ⛅ Cloudflare, 👷♂️ Parsons, 𓇲 MPS, 🥼 Medpace (NEW)

🎅 Christmas Special: TOP 5 Picks for 2025

💸 General Investing Articles

Top article: 📊 Understanding DCF and Reverse-Engineered DCF Models for Investment Decisions (with two examples: GOOG & ASML) 👉 here

👀 Coming up:

Summaries of several earnings and conference calls for Q1 earnings season

The Rareness of Moaty Software Companies: A Selection of 7 Gems

💎 Hidden Gems - Third Edition: Featuring 2 British treasures—one free to read and the second exclusively for paid subscribers.

Articles exclusive for Premium Subscribers:

Bonus picks at the end of the 🎅 Christmas Special

📊 DCF & Reverse DCF Models: Available for download in my Portfolio section

➕ Unlock Full Access to Premium Features:

With access to all my articles, private Community Chat, and the Portfolio section, you’ll get:

🗓️ Biweekly Updates (Last Update: 14-Jan-2025)

🔎 Stock Picking Methodology: Learn my long-term investment strategy.

💼 Full Portfolio Access: View long-term holdings with valuation metrics and performance tracking.

📈 Live Trades: Stay updated on my latest trades and watchlist additions.

📊 DCF & Reverse-Engineered DCF Models: Download proprietary models with calculations and evaluation guides.

🎯 Swing Trading Strategy: Learn my short-term trading technique for quick gains

👉 Access Full Portfolio Content

🛒 Amazon - AMZN 0.00%↑

It’s a bold move to include AMZN in this month’s picks, especially on the day they release their Q3 2024 earnings report. But here’s why… 👇

Technical setup

50-week MA is trending upward as the price pushes higher, once again attempting to break through the multi-year “Wall” resistance level.

MACD is gathering steam above the zero line and getting ready to unleash upward momentum.

After years of digesting the COVID-era frenzy, AMZN has been building a lengthy multi-year base, with fundamentals steadily improving (more on that in the next section). As they say: “The longer the base, the higher in space”

Key Valuation metrics

35 P/FCF (NTM) vs 42 P/FCF (3Yr Avg)

36 P/E (NTM) vs 63 P/E (3Yr Avg)

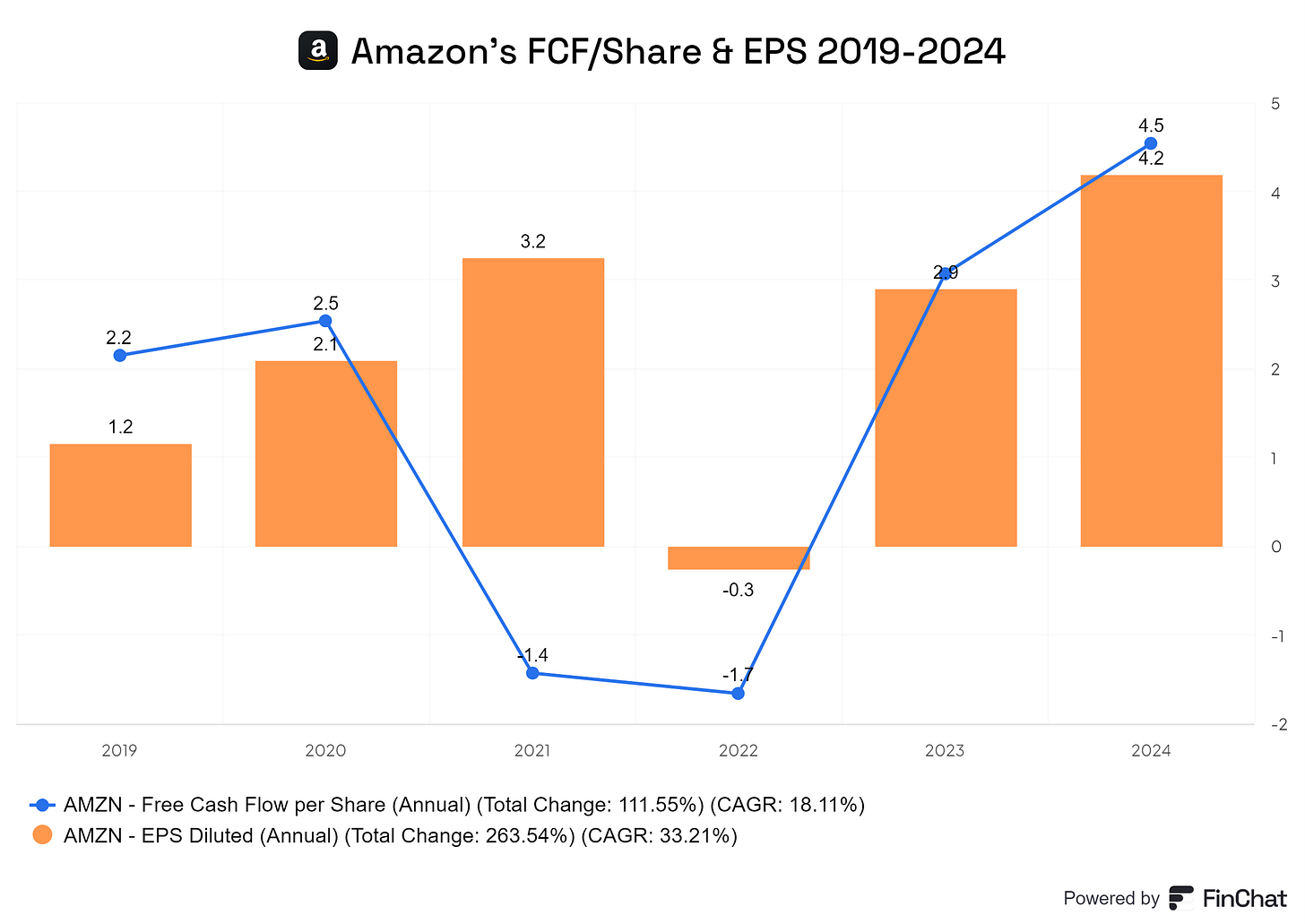

EPS Growth and FCF per Share improving substantially since the 2022 bottom, and now twice the 2019 levels (before the Covid anomaly) 👇

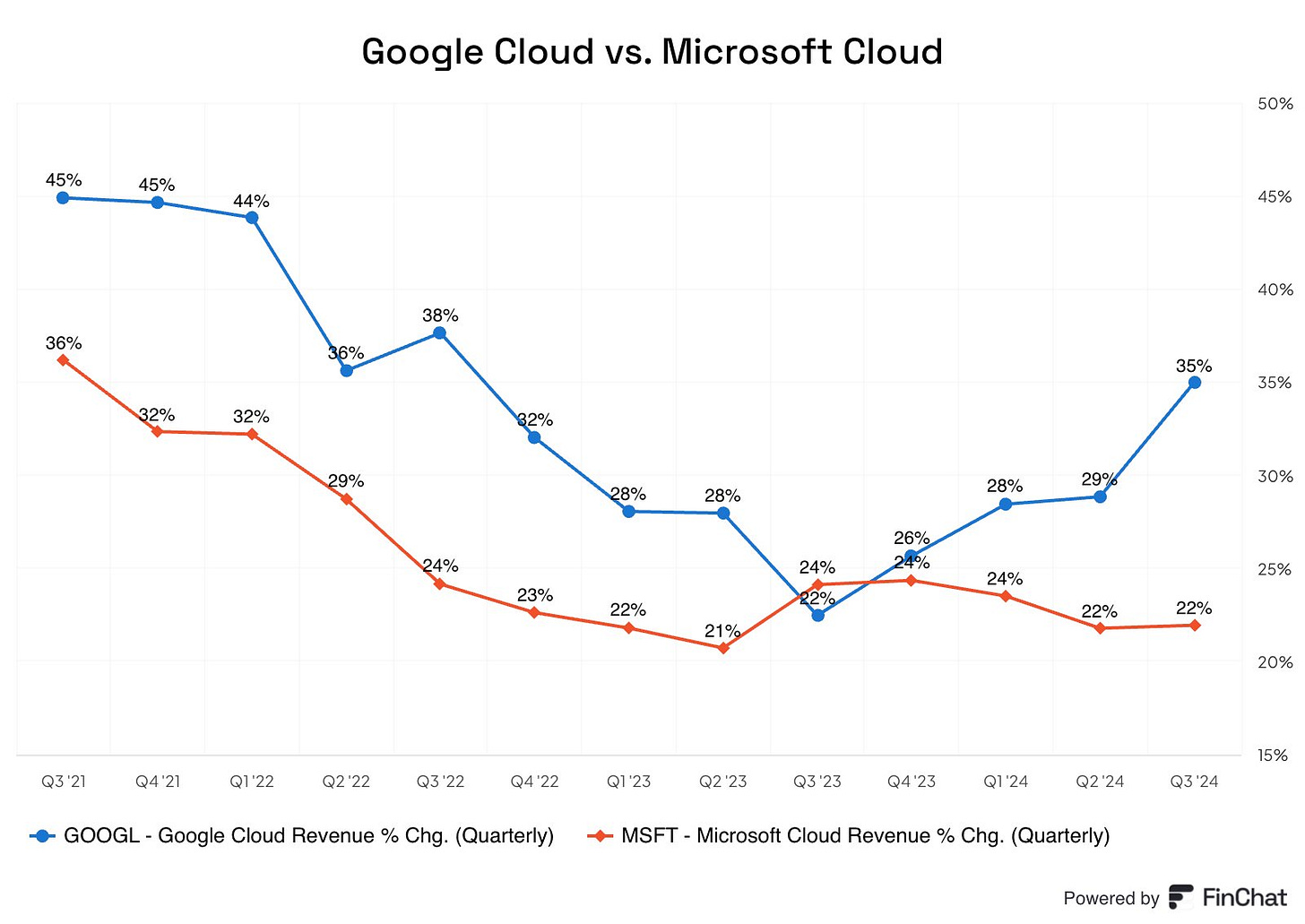

Google and Microsoft reported their earnings earlier this week, and the numbers for their cloud businesses look strong, to say the least. With Amazon’s ER release today, it will be interesting to watch the “battle of the clouds,” especially since AWS—being the largest of the hyperscalers—boasts a higher revenue run rate.

🧠FINAL TAKE:

High-quality, growth company with a massive “economies of scale” advantage, scalable products, and a strong network effects moat, currently trading below its 3y average valuation. It’s about to break out from a multi-year base, while key metrics for future price appreciation, like FCF per share and EPS growth, continue to improve beyond pre-COVID levels.

Solid opportunity for both long-term investment and swing trading, supported by improving fundamentals and a promising technical setup.

🚜 John Deere - DE 0.00%↑

Technical setup

50-month MA is steadily moving up as price consolidates laterally, digesting the post-COVID breakout and now pushing toward the upper edge of the multi-year base.

MACD has been consolidating but holding above the zero line and is nearing an upward cross, a move it hasn’t made in quite some time.

After building a lengthy base following the COVID-era surplus, the stock looks primed for a breakout. With October coming to a close, I’m watching for a monthly hammer candle to make this setup even more bullish as we head into November. Again, as they say: “The longer the base, the higher in space”

Commentary

Industrial activity has been sluggish since the post-COVID downturn, and farmers are feeling the strain of high interest rates. Yet, DE has managed to keep its margins at healthy levels. With the Fed likely to ease its policies and reduce rates, farming and industrial sectors could soon see a boost.

Meanwhile, the company is investing in new technology, and about to launch next-gen, high-productivity farming machinery. They are also transitioning from a cyclical business model to a higher-margin, recurring revenue model, thanks to its focus on maintenance, service offerings, subscription-based connectivity solutions, and the long-term promise of farming automation.

🧠FINAL TAKE:

High-quality company with a durable moat, maintaining margins in check despite the downturn and positioning itself for the next cycle with a more profitable, recurring revenue model.

Stock remains within its multi-year base, but the technical setup is showing signs of improvement. With the Fed’s easing policies, the industrial and farming downturn may be nearing an end. This looks like a solid opportunity with a compelling monthly technical setup for long-term investors who know the value of patience.

𓇲 Synopsys - SNPS 0.00%↑

Technical Setup

At first glance, the setup may not look ideal, but with a reliable compounder that rarely dips below its 50-week MA, recoveries often come quickly. Here’s why 👇

50-week MA has flattened out as the stock price has stayed below it for several months.

MACD, which has been trending downward below the zero line, is now starting to perk up, approaching a potential upward cross.

Selling pressure volume has been declining since the July top.

Looking closer at the stock’s historical patterns (highlighted in violet), when the price dips below the 50-week MA, it doesn’t typically take long to regain support, recover the 50-week MA, and resume upward momentum. This time appears similar, with the stock forming an inverse head-and-shoulder pattern while holding key support around the mid-$400s.

Commentary

Their competitor, Cadence Design Systems, reported earlier this week their earnings report and highlighted some interesting takes on their conference call. Their CEO noted that, “Generational trends such as hyperscale computing, autonomous driving, and 5G, are all accelerated by the AI super cycle, and continue to fuel strong design activity… executing to our intelligent system design strategy that triples our TAM opportunity while significantly expanding our portfolio across core EDA, IP, and system design and analysis. I'm excited about AI's incredible promise and how rapidly it is becoming an integral part of the design workflow, with customers steadily increasing their investments in AI-driven automation.”

🧠FINAL TAKE:

EDA, IP, and system design and analysis are dominated by an oligopoly, with Synopsys as a key player. Their solutions are essential to chip manufacturing, and their market and applications are expanding, accelerated by the AI super cycle and major growth trends in computing, autonomous driving, and 5G.

The potential acquisition of Ansys is Synopsys’ wild card. If approved, it would further expand their moat and TAM, though it can create short-term stock price pressures.

Solid opportunity for a long-term investment, backed by secular trends and a critical role within an oligopoly essential to the semiconductor industry. Technical setup has potential for a swing trade too, showing signs of repair and preparing to gain momentum once again.

That’s a wrap for this edition of “Monthly Specials!” I hope you enjoyed it, and we’ll keep an eye out for more 🧠 setups and promising opportunities soon.

Ready to dive deeper? Here’s what I can offer you and how I can help you

For Free Subscribers, you now have access to:

📊 Quarterly Updated Portfolio Composition by Industry and Geography, plus Valuation Metrics.

👉 Expanse Stocks: Behind-The-Scenes (Last Update: 23-Dec-2024)

➕ Unlock Full Access to Premium Features:

With full access to all my articles, private Community Chat, and the Portfolio section, you’ll get:

🗓️ Biweekly Updates (Last Update: 14-Jan-2025)

🔎 Stock Picking Methodology: Learn my long-term investment strategy.

💼 Full Portfolio Access: View long-term holdings with valuation metrics and performance tracking.

📈 Live Trades: Stay updated on my latest trades and watchlist additions.

📊 DCF & Reverse-Engineered DCF Models: Download proprietary models with calculations and evaluation guides.

🎯 Swing Trading Strategy: Learn my short-term trading technique for quick gains