Cloudflare Q4 2024: Momentum for Long-Term Success Continues

Main takes from Conference Calls and Earnings Report with my Personal Touch

Hello readers, welcome once again! 🧑🚀

This week, I’m continuing my earnings reviews with Cloudflare’s Q4 2024 earnings report and conference call transcript.

For those who've been following Expanse Stocks since its launch in September 2024, you know I’ve been closely watching and covering this company:

1️⃣ My very first Deep Dive ⛅ Cloudflare

2️⃣ Multiple earnings reviews, including Q3 2024 👉 here, where I detailed how Cloudflare is positioning itself for long-term success by tackling three key markets: Internet infrastructure at the edge, cybersecurity, and AI inference workloads.

Now, as we enter 2025, that momentum is strengthening with a revamped go-to-market strategy and AI & Edge Computing as the next frontier for the internet.

Let’s dive in!

📰 What’s New?

Free Access to 📊 Quarterly Updated Portfolio Composition - by Industry and Geography, plus Valuation Metrics → 📎 Expanse Stocks: Behind-The-Scenes

📌 Free-to-Read Articles (📎 linked below)

🔎 Deep Dives – ⛅ Cloudflare | 👷♂️ Parsons | 𓇲 MPS | 🥼 Medpace | 🔌 Arista

🛒 Amazon (NEW)

💸 General Investing - Latest: Understanding ROIC, ROIIC, and ROCE

💎 Hidden Gems – Latest: Third Edition

🎅 Christmas Special - Top 5 Picks for 2025

💬 Join my Chat! ( 📎 Learn more)

🔐 Paid Subscriber Exclusives

💎 Hidden Gems - Special Editions + exclusive sections from select articles - Latest: 💎 Hidden Gems - Special Edition II

🎁 Bonus Picks - From the 2025 Christmas Special

📊 DCF & Reverse DCF Models + Capital Efficiency Models– Download the models in the 📎 Portfolio section with multiple practical examples (ASML, GOOG, DHR, MEDP, ANET, AMZN and more)

👀 Coming Soon

📊 Quarterly Update to the Portfolio Composition (31-March) - by Industry and Geography, plus Valuation Metrics → 📎 Expanse Stocks: Behind-The-Scenes

A Leap of Faith with Owner-Operators: Why smart capital allocators deserve a big spot in your portfolio (with some examples)

Expanse Stocks x Finchat.io Partnership!

🎁 Get 20% off + 2 months free on any Finchat plan! →📎 Claim Discount

Q4 2024 Financial Results

Revenue Growth

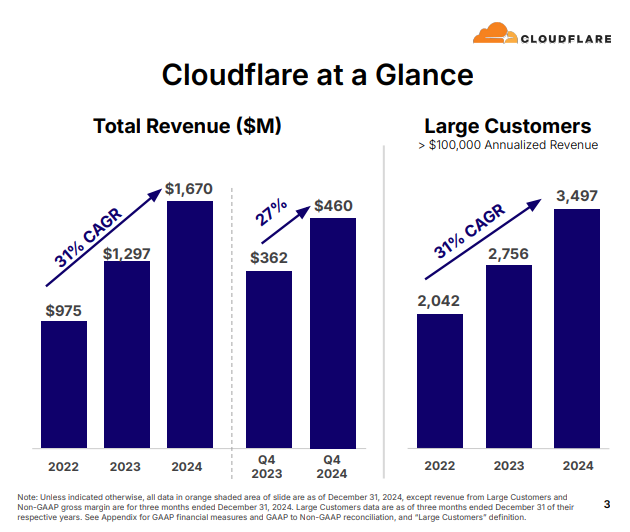

Q4 Revenue: $459.9M (Est. $452.04M), up 27% YoY 🟡

Note 👉 cRPO grew +29.9% (over revenue), strongest sequential growth in 3 years 👀🟢

Enterprise & Large Customer Expansion 🟢

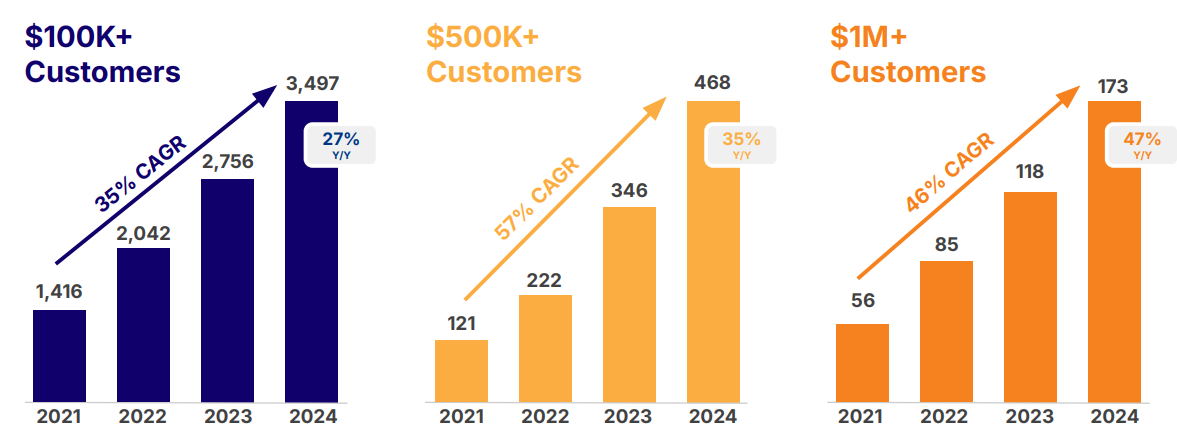

Large Customers ($100K+ ARR): Reached 3497, up 27% YoY.

$1M+ Customers: Ended the year at 173, adding a record 55 new customers in 2024, with more than half signed in Q4.

Dollar-Based Net Retention (DNR): Increased to 111% . Note👉 Q3 showed 110% in DNR so it looks like it has stabilized (and maybe perking up again? Something to watch 👀)

📌 CEO Matthew Prince on customer trends:

"Security, AI, modernization, and efficiency—these are the themes dominating customer conversations. Cloudflare is uniquely positioned to capitalize on these trends."

Profitability & Margins

Gross Margin: 77.6%, remaining above the long-term target range of 75-77% 🟡

Operating Income: $67.2M, up 69% YoY, with operating margin of 14.6% 🟢👌

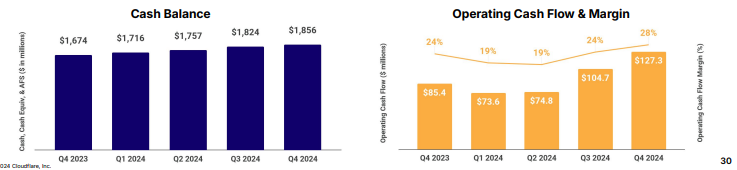

Free Cash Flow: $47.8M (Prev. $50.7M), $166.9M for FY24.

Note👉 YoY decline of -6%, driven by ongoing AI infrastructure investments, reflected in CapEx (13% of total revenue this quarter).

Operating Cash Flows & Margins keep perking up as well as their Cash reserves 👀 👇

Key Enterprise Wins in Q4

$20M, 5-Year Contract: Fortune 100 tech company adopting Cloudflare’s full platform for application security, performance, and Workers AI.

$13.5M AI Deal: Leading AI company signing a pool of funds contract to maximize flexibility for scaling AI workloads.

$10.8M Retail Contract: Global retailer replacing a 20-year incumbent with Cloudflare’s modern application and network security solutions.

$13.6M Financial Services Deal: Banking customer slashing website provisioning time from 14 weeks to 10 minutes using Cloudflare’s Edge Security platform.

📌 Prince on enterprise adoption 👀

"The theme this quarter? Customers aren’t just buying one product—they’re committing to the Cloudflare platform as a whole."

Note👉 This comment by Cloudflare’s CEO is key for long-term success and the investment thesis in Cloudflare. As long as they keep executing…

2025 Outlook: Growth with AI & Enterprise Sales

Guidance & Profitability Focus

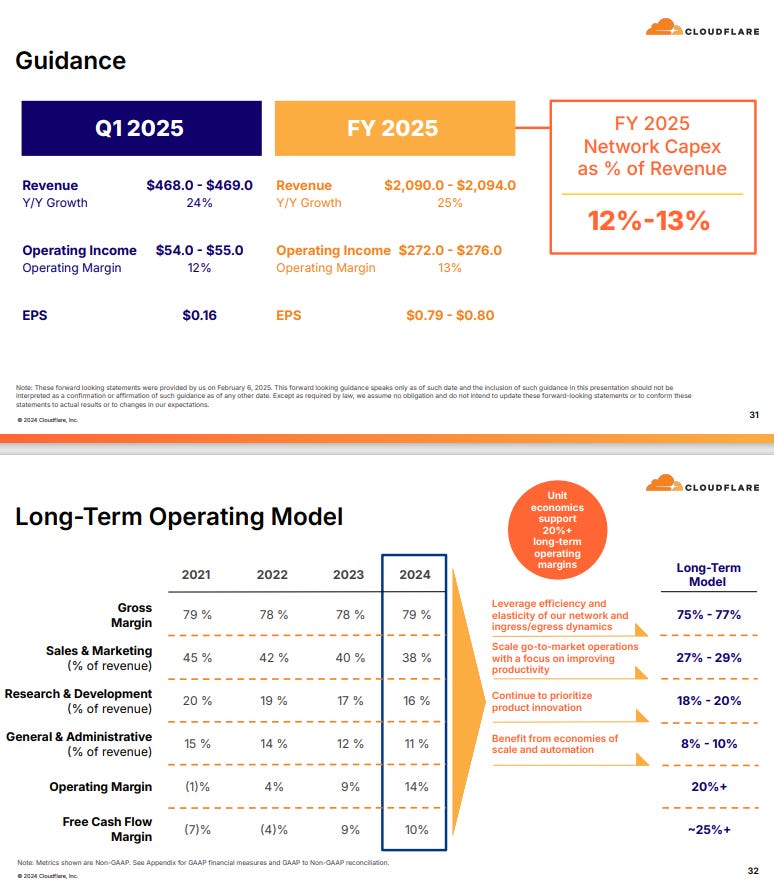

Q1 2025 Revenue: At least $468M–$469M, 24% YoY growth.

FY25 Revenue: At least $2.09B–$2.094B, 25% YoY growth, with continued momentum in large customer deals and AI adoption.

FY25 Operating Income: Projected at $272M–$276M, with continued margin expansion.

Network Capex: Increasing to 12%–13% of revenue, reflecting continued investment in AI infrastructure and GPU capacity.

📌 CFO Thomas Seifert on financial strategy:

"We are balancing growth acceleration with disciplined execution. Every dollar we deploy must drive sustainable, long-term value."

AI & Inference as a Key Growth Driver 👀🟢

Cloudflare Workers AI is gaining traction as a cost-effective, high-performance AI inference platform.

AI companies are choosing Cloudflare over hyperscalers for real-time inference and agentic workflows, benefiting from its serverless, pay-per-use model.

📌 Prince on AI opportunity:

"Inference and AI agents are the biggest opportunities in AI. Workers AI is proving to be the go-to platform for developers looking for the best price performance for inference workloads."

Strengthening Enterprise Sales Execution 🟢

Cloudflare’s sales productivity improved for the fifth consecutive quarter under new leadership.

Enterprise hiring surged, with 80% of Q4 hires focused on enterprise sales.

The company is aggressively targeting “pool of funds” deals (broader commitments to the whole Cloudflare’s platform by customers), where customers pre-commit to Cloudflare’s platform for long-term flexibility.

📌 Prince on sales momentum:

"We’re world-class in product and network stability. 2025 is the year we prove we’re world-class in go-to-market as well."

Security & Zero Trust Expansion

Major wins include a $4M Zero Trust deal with a leading investment firm.

Cloudflare’s SASE (Secure Access Service Edge) offering is gaining traction, with enterprises preferring its single-vendor, unified architecture over fragmented solutions.

📌 Prince on security demand:

"Customers are no longer looking for single-feature solutions. They want a comprehensive, modern security platform that integrates seamlessly. That’s where Cloudflare wins."

AI & Edge Computing: The Next Frontier

Cloudflare sees four major opportunities in AI:

AI-Powered Security & Performance: Cloudflare is embedding AI to improve threat detection and application security.

AI-Optimized Developer Workloads: Workers AI is becoming a top platform for AI inference and agentic workflows.

Efficiency in AI Inference: Cloudflare’s pay-per-inference model delivers 10x price-performance improvements over hyperscalers.

Shaping the Post-Search Web: Cloudflare sits between AI companies and content creators, positioning itself as a key player in AI-driven digital monetization.

📌 Prince on AI disruption:

"AI is shaking up the internet’s economic model. Cloudflare is in a unique position to help shape the business model of the post-search web."

🧠 Final Take

Cloudflare ended 2024 with record revenue, strong enterprise adoption, and a clear AI strategy. The Street seems to be recognizing the company’s sales transformation, AI-driven growth, and expanding enterprise footprint, and while the FY25 outlook seems conservative, the long-term trajectory looks as promising as ever.

With Workers AI, Zero Trust security, and a world-class global network, Cloudflare is well-positioned to capitalize on the next wave of internet and AI transformation.

As Prince pointed out, the key for sustainable growth is that “customers aren’t just buying one product—they’re committing to the Cloudflare platform as a whole."

As long as they keep executing and bringing in more customers with their new “pool of funds” strategy, I believe the market will keep rewarding the Clouflare story as reflected on price action and the (high) premium valuation.

Ready to dive deeper? Here’s what I offer and how I can help you

Free Access to 📊 Quarterly Updated Portfolio Composition - by Industry and Geography, plus Valuation Metrics → 📎 Expanse Stocks: Behind-The-Scenes

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year) with the annual plan!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 28-Feb-2025)

🔎 Stock Picking Methodology – Learn my long-term strategy

💼 Full Portfolio Access – Holdings, Valuation metrics & Performance tracking

📈 Live Trade Updates – My latest trades & watchlist additions

📊 DCF & Reverse-Engineered DCF Models – Proprietary models & valuation guides

🎯 Swing Trading Strategy – My short-term trading approach

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles