Monthly Specials (October 2024) - Part 2

Stock ideas selected through a blend of qualitative analysis, fundamentals, and technical setups

Not a free member yet? Join Expanse Stocks for free if you’d like to receive more content like this and get access to some of my free research (Deep dives, “Monthly Specials” Picks, Hidden Gems Screeners, Stock News and more)

Hello, reader!

Thanks for taking the time to explore my blog. Welcome to the second (and final) part of my "Monthly Specials" post for October! If you missed the first part, here is the link.

Each month, I share stock ideas for swing trades or long-term investments, focusing on growth and quality companies that stand out to me, based on a mix of qualitative insights, fundamentals, and technical analysis.

In this second part, I’ll highlight two special stocks that could offer solid opportunities for October 2024 and beyond. Let’s dive in!

📰 What’s new?

For Free Subscribers, you now have access to:

📊 Quarterly Updated Portfolio Composition by Industry and Geography, plus Valuation Metrics.

👉 Expanse Stocks: Behind-The-Scenes (Last Update: 23-Dec-2024)

Several articles (most are FREE to read):

Brief Deep Dives: ⛅ Cloudflare, 👷♂️ Parsons, 𓇲 Monolithic Power Systems (MPS)

🎅 Christmas Special: TOP 5 Picks for 2025

💸 General Investing Articles

Most recent: Understanding DCF and Reverse-Engineered DCF Models for Investment Decisions (with two examples: GOOG & ASML) 👉 here

👀 Coming up:

Deep Dive: 🥼 Medpace

The Rareness of Moaty Software Companies: A Selection of 7 Gems

Investor Resources Part 1: Top tools for Fundamental Analysis, Technical Analysis, and Portfolio Tracking.

Monthly Specials - January 2025

Articles for Premium Subscribers:

Bonus picks at the end of the 🎅 Christmas Special

📊 DCF & Reverse DCF Models: Available for download in my Portfolio section

➕ Unlock Full Access to Premium Features:

With full access to all my articles, private Community Chat, and the Portfolio section, you’ll get:

🗓️ Biweekly Updates (Last Update: 01-Jan-2025)

🔎 Stock Picking Methodology: Learn my long-term investment strategy.

💼 Full Portfolio Access: View long-term holdings with valuation metrics and performance tracking.

📈 Live Trades: Stay updated on my latest trades and watchlist additions.

📊 DCF & Reverse-Engineered DCF Models: Download proprietary models with calculations and evaluation guides.

🎯 Swing Trading Strategy: Learn my short-term trading technique for quick gains

👉 Access Full Portfolio Content

Nintendo - $NTDOY

Key Valuation metrics (LTM)

29% ROIC | 27% Operating Margin | 26.7% FCF Margin | 27.6 OCF/Sales

No debt, with ¥2,163.13B in Cash and a ¥9,415.2B MC

Technical setup

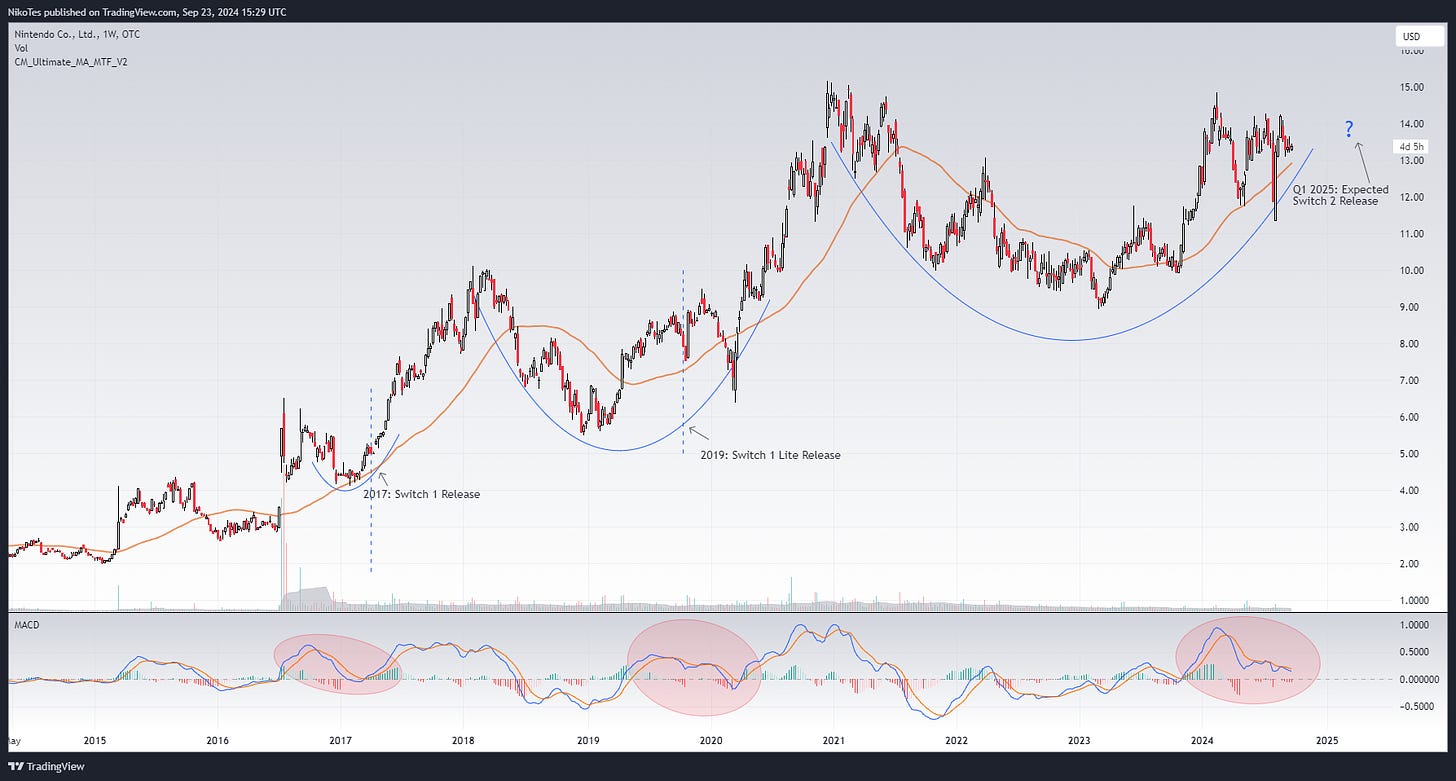

Forming a large Cup & Handle pattern, similar to past setups.

Price above the rising 50-week MA, signaling a potential breakout from its mature base.

MACD is gradually setting up for a momentum boost just like in past cycles, pending upcoming news—which I’ll discuss next.

Commentary

This legendary entertainment firm, boasting one of the strongest "IP franchise" moats alongside Disney, is gearing up to launch its new Switch 2 console in Q1 2025.

Often seen as a cyclical video game/console business with low recurring revenues, leadership has been steadily shifting the model toward more reliable, recurring revenue streams with their Nintendo Account system, supporting cross-platform customers, and subscription-based Nintendo Switch Online service (Source: Medium).

Additionally, leadership has ambitious plans to further capitalize on their IP franchises through new film releases and amusement parks.

🧠 FINAL TAKE:

Quality company, undervalued, with strong margins, high ROIC, and plenty of cash on hand. Their business model is shifting toward increasing recurring revenue from video game franchises and consoles, with some of the strongest IP franchises still under-monetized.

Good opportunity for both swing trading and long term investment, supported by the technical setup, fundamentals and the upcoming console release.

Copart - CPRT 0.00%↑

Technical setup

50-week MA in a steady upward trend and and closing in on the price.

Price just crossed above the 50-week MA, forming a solid weekly bull flag.

MACD is curving up and nearing a crossover above the zero line, signaling upcoming momentum after a multi-month consolidation.

Commentary

Some fear EVs, ADAS, and eventually autonomy will slowly kill them. I believe the opposite — these innovations may unlock more value and help boost their margins. I’ll dive deeper into this company in an upcoming article in the “Beyond Charts” section of my blog.

Steady compounder boasts a high ROIC (+30%) and has room for further growth, driven by increasing miles driven, rising accident rates, and growing salvage rates. Expansion into underpenetrated markets, like Europe, also presents new opportunities.

🧠 FINAL TAKE:

High-quality company, often overlooked, with top-tier leadership and a long-term growth focus, backed by excellent capital allocation.

Solid opportunity for swing trading at current levels supported by the technical setup and long-term investment, based on fundamentals and future opportunities.

Ready to dive deeper? Here’s what I can offer you and how I can help you

For Free Subscribers, you now have access to:

📊 Quarterly Updated Portfolio Composition by Industry and Geography, plus Valuation Metrics.👉 Expanse Stocks: Behind-The-Scenes (Last Update: 23-Dec-2024)

➕ Unlock Full Access to Premium Features:

With full access to all my articles, private Community Chat, and the Portfolio section, you’ll get:

🗓️ Biweekly Updates (Last Update: 01-Jan-2025)

🔎 Stock Picking Methodology: Learn my long-term investment strategy.

💼 Full Portfolio Access: View long-term holdings with valuation metrics and performance tracking.

📈 Live Trades: Stay updated on my latest trades and watchlist additions.

📊 DCF & Reverse-Engineered DCF Models: Download proprietary models with calculations and evaluation guides.

🎯 Swing Trading Strategy: Learn my short-term trading technique for quick gains