Monthly Specials (October 2024)

Stock ideas selected through a blend of qualitative analysis, fundamentals, and technical setups

Not a free member yet? Join Expanse Stocks for free if you’d like to receive more content like this and get access to some of my free research (Deep dives, “Monthly Specials” Picks, Hidden Gems Screeners, Stock News and more)

Hello, reader!

Thank you for taking the time to explore my blog. Welcome to my very first "Monthly Specials" post! Each month, I’ll be sharing handpicked stock ideas for swing trades and/or long-term investments, focusing on growth and quality companies that catch my eye. These picks are based on a blend of qualitative insights, fundamentals, and/or technical setups analysis.

I want to highlight three stocks that stand out and may present good opportunities starting October 2024. Let’s dive in!

📰 What’s new?

For Free Subscribers, you now have access to:

📊 Quarterly Updated Portfolio Composition by Industry and Geography, plus Valuation Metrics.

👉 Expanse Stocks: Behind-The-Scenes (Last Update: 23-Dec-2024)

Several articles (most are FREE to read):

Brief Deep Dives: ⛅ Cloudflare, 👷♂️ Parsons, 𓇲 Monolithic Power Systems (MPS)

🎅 Christmas Special: TOP 5 Picks for 2025

💸 General Investing Articles

Most recent: Understanding DCF and Reverse-Engineered DCF Models for Investment Decisions (with two examples: GOOG & ASML) 👉 here

👀 Coming up:

Deep Dive: 🥼 Medpace

The Rareness of Moaty Software Companies: A Selection of 7 Gems

Investor Resources Part 1: Top tools for Fundamental Analysis, Technical Analysis, and Portfolio Tracking.

Monthly Specials - January 2025

Articles for Premium Subscribers:

Bonus picks at the end of the 🎅 Christmas Special

📊 DCF & Reverse DCF Models: Available for download in my Portfolio section

➕ Unlock Full Access to Premium Features:

With full access to all my articles, private Community Chat, and the Portfolio section, you’ll get:

🗓️ Biweekly Updates (Last Update: 01-Jan-2025)

🔎 Stock Picking Methodology: Learn my long-term investment strategy.

💼 Full Portfolio Access: View long-term holdings with valuation metrics and performance tracking.

📈 Live Trades: Stay updated on my latest trades and watchlist additions.

📊 DCF & Reverse-Engineered DCF Models: Download proprietary models with calculations and evaluation guides.

🎯 Swing Trading Strategy: Learn my short-term trading technique for quick gains

👉 Access Full Portfolio Content

Zoetis - ZTS 0.00%↑

Technical setup

50-week MA flattening out and starting to curve up as price push higher

Stock price attempting to break a strong resistance level, 195$-200$, from its base (blue curve) which started to form right after the downfall of the Covid-2021 peak.

MACD with the positive divergence from 2022 and now going above the zero line as it builds upward momentum.

Key Valuation metrics

9 EV/Sales (NTM) vs 10.1 EV/Sales (5Yr Avg)

22.1 EV/EBITDA (NTM) vs 23.5 EV/EBITDA (5Yr Avg)

23.8% ROIC vs 23.3% ROIC (5Yr Avg)

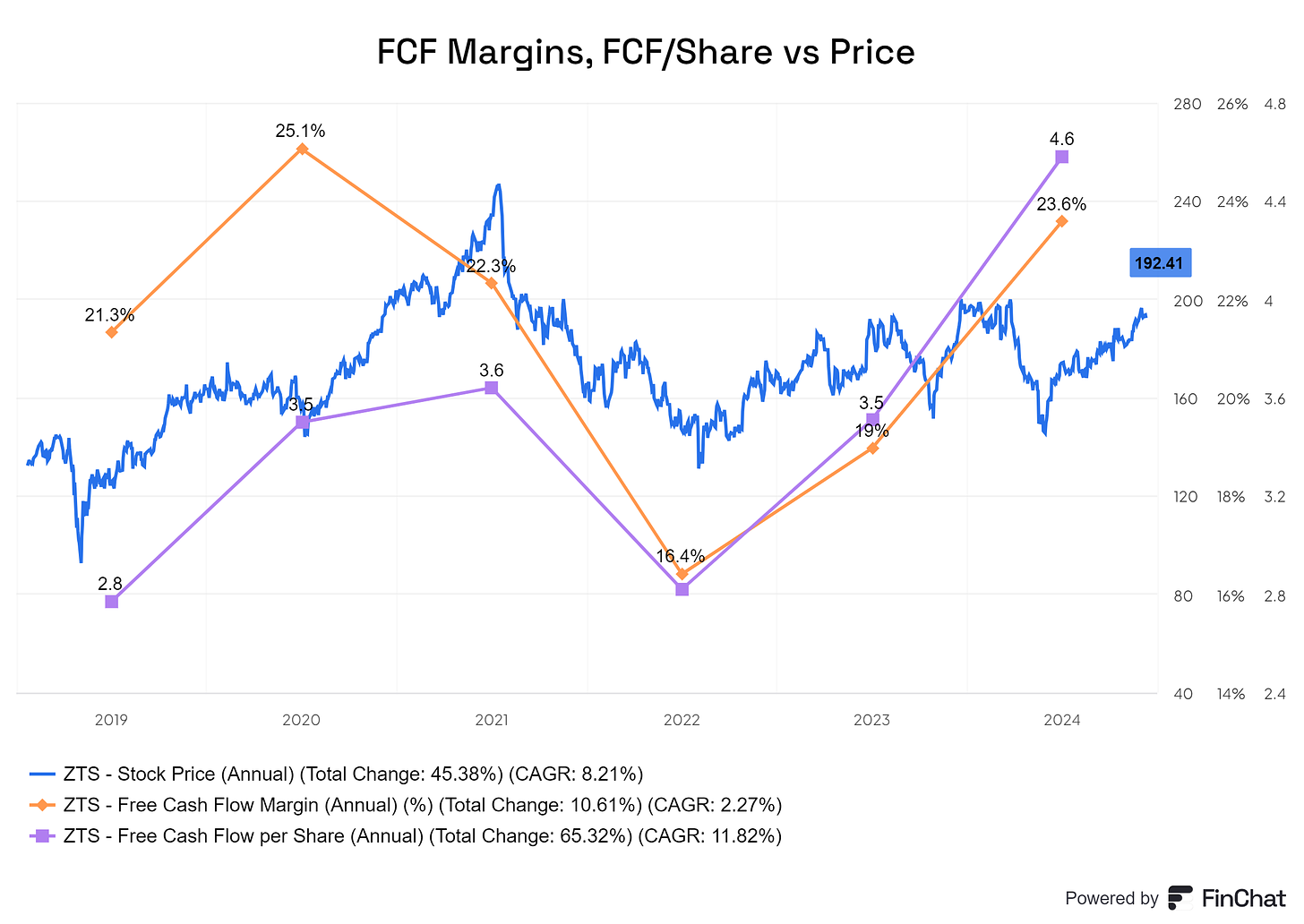

FCF Margins and FCF/Share improving substantially since the 2022 bottom while price consolidates

Commentary

Opportunities ahead (animal health market expected to grow at 5% CAGR for the next 10 years) and new potential multi-billion emerging markets (renal, cardiology, allergies) for this pharmaceutical leader with pricing power and a moat in intangible assets (Patents, Brand, Scale).

Source: Zoetis Investors Presentation (September 2024)

🧠FINAL TAKE:

Quality stock trading below its 5Yr Avg valuation and consolidating, while key metrics for future price appreciation like FCF/share or FCF Margins keep improving.

Good opportunity for both, long investment or swing trade, at these levels based on fundamentals and technical setup.

Otis World - OTIS 0.00%↑

Technical setup

50-week MA in a steady upward trend.

Price above the 50-week MA and the stock is building a new base in the 90$-100$ range within a bigger cup and handle pattern.

MACD starting to curve up and about to cross over after a multi-month consolidation.

Commentary

New policies from China, released earlier this week, could boost housing demand—a key market for them—which bodes well for this "boring" elevator manufacturing leader, especially with its growing recurring revenue from maintenance and related services.

🧠FINAL TAKE:

Quality company, under-the-radar with increasing recurring revenues from maintenance and related services.

Good opportunity for a swing trade, at these levels based on technical setup and new China policies.

Cloudflare - NET 0.00%↑

Technical Setup

50-week MA slowly rising while upward momentum is building, though consolidation continues as it nears resistance.

MACD: Very tight since June 2024, typically signaling an upcoming strong momentum move.

Volume: Steadily declining since the sharp increase during the AI peak.

Stage Analysis: Following Stan Weinstein's Stage Analysis, the stock appears to be in an early Stage 2 phase, which has been playing by the book so far, supported by a rising 50MA, a tightening MACD curve, a retest of the previous mid-$60s resistance level now acting as support, and decreasing volume following the transition from Stage 1 to Stage 2.

Key Valuation Metrics (NTM)

14.9 EV/Sales | 149 EV/FCF | 78 EV/EBITDA

Rule of 40: Revenue Growth + FCF Margin = 43.3%

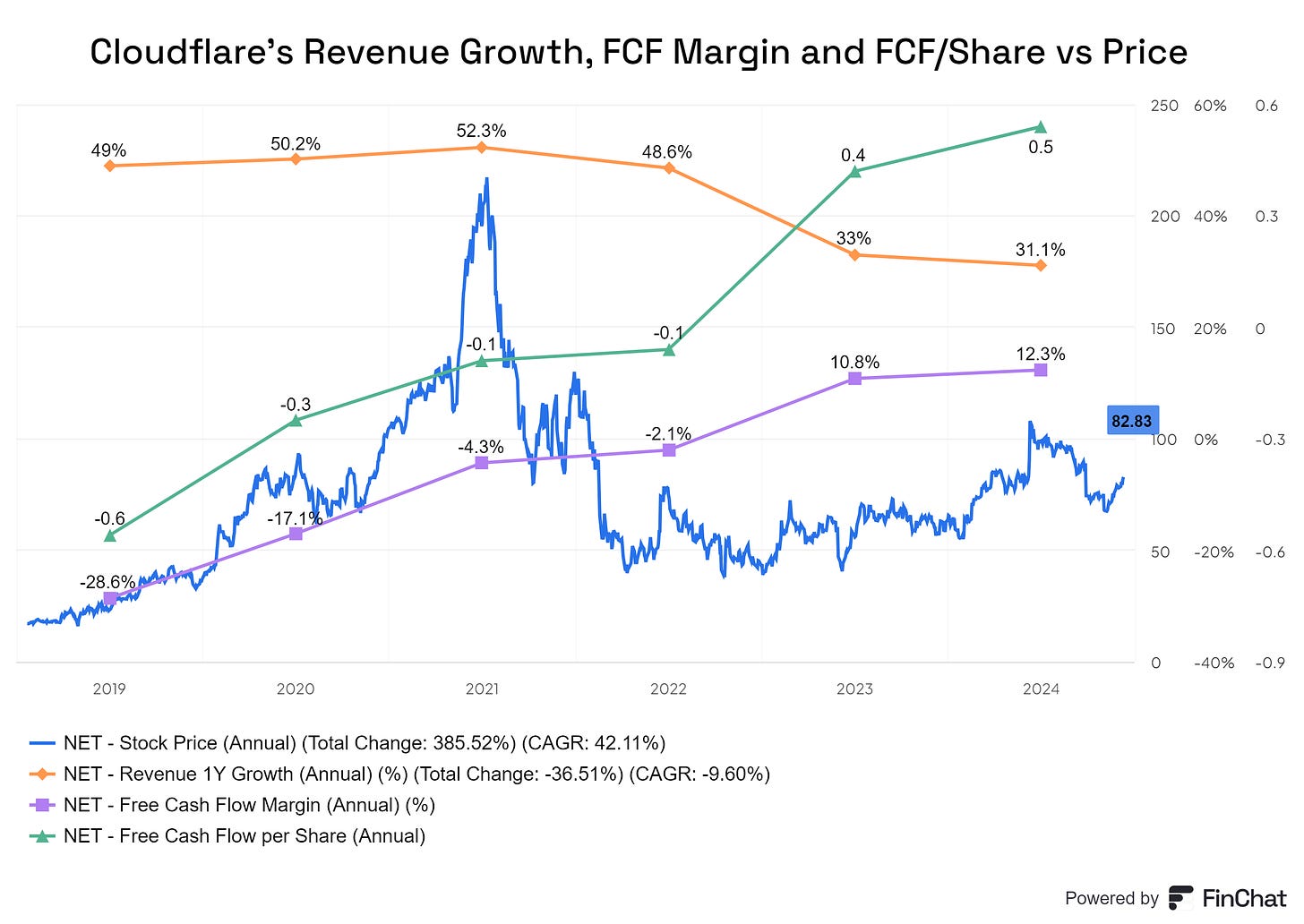

Although revenue growth has slowed down to +30%, a key factor supporting premium valuation at 149 EV/FCF and 78 EV/EBITDA (NTM) is its rapid FCF margin growth recently.

Following the volatility of the Covid era, the relative stability in price trend has allowed FCF per share to improve significantly.

The Rule of 40 (Revenue Growth + FCF Margin) stands out at 43.3%.

🧠FINAL TAKE:

Improving FCF margins at a faster pace than revenue growth slowdown, and FCF/share has seen significant gains, supporting its premium valuation.

As we enter the AI era and anticipate potential Fed rate cuts, I believe the stock presents a renewed opportunity for long-term investors— not without risks.

Stock appears to be in an early Stage 2 phase, which has been playing by the book so far, and presents a potential opportunity for swing traders.

Ready to dive deeper? Here’s what I can offer you and how I can help you

For Free Subscribers, you now have access to:

📊 Quarterly Updated Portfolio Composition by Industry and Geography, plus Valuation Metrics.

👉 Expanse Stocks: Behind-The-Scenes (Last Update: 23-Dec-2024)

➕ Unlock Full Access to Premium Features:

With full access to all my articles, private Community Chat, and the Portfolio section, you’ll get:

🗓️ Biweekly Updates (Last Update: 01-Jan-2025)

🔎 Stock Picking Methodology: Learn my long-term investment strategy.

💼 Full Portfolio Access: View long-term holdings with valuation metrics and performance tracking.

📈 Live Trades: Stay updated on my latest trades and watchlist additions.

📊 DCF & Reverse-Engineered DCF Models: Download proprietary models with calculations and evaluation guides.

🎯 Swing Trading Strategy: Learn my short-term trading technique for quick gains