Zoetis Q3 2024: A Good Opportunity after their earnings report?

Main takes and thoughts from Zoetis Conference Call, and why I think it may be an opportunity

Not a free member yet? Join Expanse Stocks for free if you’d like to receive more content like this and get access to some of my free research (Deep dives, “Monthly Specials” Picks, Hidden Gems Screeners, Stock News and more)

Hello, reader!

Zoetis released their earnings earlier this week. I listened to their Conference call and noted down some takes and thoughts.

Plus, I’ll also be assessing whether the current technical setup and fundamentals present a good opportunity for long-term investors, especially after the stock's post-earnings reaction. Let’s dive in!

📰 What’s new?

I published several articles recently, all of them are FREE to read:

Deep dive on Monolithic Power Systems (MPS)

My Hidden Gems - Second Edition series where I spotlight two hidden gems: one under-the-radar international mid-cap semiconductor company, with a +20% CAGR over the past five years, plus one promising Norwegian small-cap firm specializing in niche technology solutions with excellent fundamentals and multi-bagger potential.

Measure your Portfolio performance using 3 different methods: Calculating Portfolio Returns & Why Investing is Personal

Also… Feel free to join my Chat! I’ll be launching new threads periodically, so you can join anytime. If you want to know the details, here is a recap of what is this chat about 👉 link

👀 Coming in January for ALL Subscribers

Deep dive on Medpace (MEDP)

The Rareness of Moaty Software Companies: A Selection of 7 Gems, where I’m bringing you an intriguing topic: What is a moat? What are some rare software companies with truly durable moats?

Resources for Investors & Traders - Part 1, my recommendations of tools and digital platforms for Fundamental Analysis, Technical Analysis, and Portfolio Performance Tracking

For PREMIUM SUBSCRIBERS:

👀 Coming right after Year End

Hidden Gems - Special Edition series where I will discover one little known small-mid cap semiconductor equipment company, with a +35% CAGR over the past ten years. I recently started building a position on my long-term portfolio.

And you can dive deeper with full access to all my articles, private Community Chat and the Portfolio section, where you’ll find:

Last Update: 16-Dec-2024 (Biweekly updates)

🔎 Stock Picking Methodology: Discover the criteria I use to select long-term investments.

💼 Full Portfolio Access: Explore my ETFs and actively managed long-term holdings (biweekly updates), complete with valuation metrics and performance tracking, regularly updated.

📈 Live Trade Updates: Stay in the loop with biweekly updates on my latest trades, new additions (both swing and long-term), and stocks I’m watching closely.

🎯 Swing Trading Strategy: Get insights into my swing trading approach for short-term gains.

⚠ Over the past eight weeks, I’ve raised some cash and added to several existing long-term positions, initiated seven new ones and sold four, and opened two additional swing trades. These moves came after selling my passive investments and reallocating the cash into my actively managed portfolio.

Click here 👉 Access Full Portfolio Content

Also, available in the “Portfolio” section of the Expanse Stocks blog.

Conference Call Notes

Positive Highlights and Growth Drivers

Q3 2024 Financial Results 🟢

Revenue up 14% YoY above expectations. Also, raising FY24 guidance for the third time, expecting 10-11% revenue growth and net income growth of 13.5-14.5%.

U.S. and International Performance: U.S. revs and net income grew +15%, with +18% in companion animals and +5% in livestock. International revenue rose +13%.

Key Products Performing Well 🟢

Librela and Solensia: Osteoarthritis treatments have shown exceptional adoption, positioning Librela as a potential billion-dollar franchise. The product’s high penetration rate in the U.S. and increasing global demand support more growth potential. CEO Kristin Peck noted:

“Librela has been our most successful launch in our company’s history. In the U.S., we have an 85% penetration rate...we’ve already got 1 million patients on the product, and we believe we’ve got a significant runway for growth with only 1 million patients and 8 millions still on NSAIDs."

Simparica Trio: Leading parasiticide in the U.S. saw +27% growth, benefiting from being first-to-market in triple-combination parasite protection and strengthening retail partnerships.

Dermatology Franchise: Apoquel and Cytopoint, Zoetis’ flagship dermatology treatments, achieved +16% growth. CEO noted: “continued demand and loyalty within this market”.

Successful expansion into Alternative Channels 🟢

Expanded into retail and online sales, now comprising 15% of the U.S. business. This shift supports growth, enhances product accessibility and improves customer compliance rates.

Strategic Moves 🟢

Completed the sale of its medicated feed additives and certain water-soluble products, aligning with its focus on higher-growth, high-margin products. The livestock business remains strong, with innovations in antibiotic alternatives and genetics, including a collaboration with Danone to support sustainable dairy production.

Cautious Comments and Potential Headwinds

Increased Competition but confident on their moat 🟠

New entrants in dermatology and parasiticide markets could add pressure, despite potentially growing market size overall. Management remains confident in its product differentiation but acknowledges the impact of secondary entrants:

“Competing products entering the market, especially in parasiticides and dermatology, will increase competition. We've seen in the past that secondary entrants can accelerate market expansion, which can benefit us, but we are mindful that it also means more competitive pressure.”

Shifts in Veterinary Channels 🟡

Clinic visits have been softer as consumers increasingly turn to alternative channels like retail and online for wellness needs. While therapeutic visits for key products remain strong, this shift adds complexity in forecasting clinic sales. CEO noted:

"We do see fluctuations in pet visits, particularly with more routine check-ups moving toward alternative channels. While this is a trend that generally benefits our products, it can add complexity in projecting clinic-based product sales.”

Inflation and Pricing 🟠

Pricing has supported growth this year but this could moderate if inflationary pressures ease in 2025.

Challenging Environment in China and Argentina 🟠

Continued headwinds in China but expected to normalize by next year, still this market remains less predictable. Argentina market has been affected by inflation and currency depreciation, which impact profitability.

Overall Outlook 🟢

Long-term growth trajectory remains very promising, thanks to a diverse portfolio, steady demand in core product lines, and expanding alternative sales channels.

Product Growth Potential: Expecting continued momentum in companion animal products, especially in osteoarthritis and dermatology. While overall veterinary visits are down, therapeutic visits are on the rise.

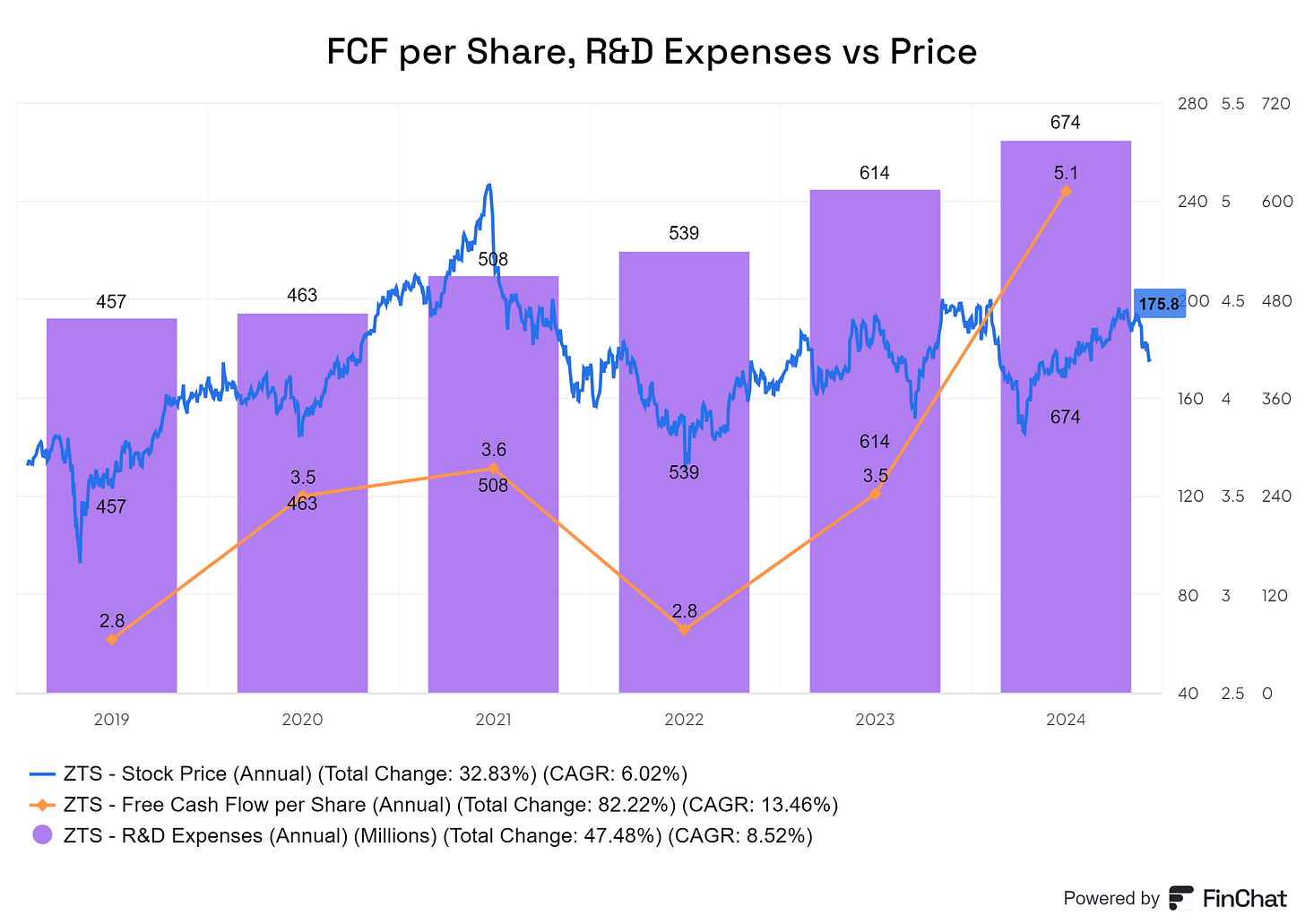

Continued Investment in Innovation: Prioritizing R&D investment in areas such as long-acting injectables and monoclonal antibodies, maintaining its leadership and expanding market presence across therapeutic categories.

The company is also mindful of several factors that could affect its performance: competitive pressures, potential economic volatility, and evolving market dynamics. But they look ready to face these challenges with disciplined investment and strategic focus on high-growth areas:

"As we exit 2024 and move into 2025, we anticipate continued strong growth across our OA pain franchise...alongside our key dermatology and parasiticide franchises, with strong momentum in alternative channels. We also expect to see more normalized headwinds in China next year, which had an approximately 1 percentage unfavorable impact on our growth this year." —CEO comments on FY25 outlook.

Technical setup and Fundamentals

Stock has made several attempts to break a strong resistance level in the $195–$200 range from its base (blue curve), but it hasn’t succeeded yet. Earlier this week, despite what I’d consider a strong earnings report and a positive outlook, the stock surprisingly sold off.

Currently price is at a key level around 175$ supported by the 200-week MA (grey line) while the 50-week MA is flattening and starting to turn up.

MACD showing positive divergence dating back to 2022 and remains above the zero line, trying to rebuild upward momentum.

Key Valuation metrics

8.7 EV/Sales (NTM) vs 10.1 EV/Sales (5Yr Avg)

21.8 EV/EBITDA (NTM) vs 23.5 EV/EBITDA (5Yr Avg)

23.8% ROIC vs 23.3% ROIC (5Yr Avg)

The company is reinvesting in their business with R&D expenses ticking up to support innovation in new products. Despite this, FCF per share has continued to improve significantly since bottoming out in 2022, even as the stock price consolidates. 👇

Commentary

Opportunities ahead (animal health market expected to grow at 5% CAGR for the next 10 years) and new potential multi-billion emerging markets (renal, cardiology, allergies) for this pharmaceutical leader.

Source: Zoetis Investors Presentation (September 2024)

🧠Final Take

High-quality pharma company with pricing power and a moat in intangible assets (Patents, Brand, Scale), trading below its 5-year average valuation, remains in a consolidation phase. Key metrics for future price appreciation, such as FCF per share, along with strategic investments in innovative products with potential to expand their TAM, are showing positive signs.

In my view, recent sell-off following solid earnings and a promising FY25 outlook—despite some cautious sentiment—presents a good opportunity for long-term investment at these levels, supported by both fundamentals and technical setup.

I hope you enjoyed this take on Zoetis!

Ready to dive deeper? Here’s what I can offer you and how I can help you

For Free subscribers, you have access to my updated Portfolio Composition by Industry and Geography as well as Valuation Metrics — Last Update: 06-Nov-2024

Click here 👉 Expanse Stocks: Behind-The-Scenes

&

For Premium Subscribers, you can dive deeper with full access to the Portfolio section, where you’ll find:

Last Update: 21-Nov-2024

🔎 Stock Picking Methodology: Discover the criteria I use to select long-term investments.

💼 Full Portfolio Access: Explore my ETFs and actively managed long-term holdings, complete with valuation metrics and performance tracking, regularly updated.

📈 Live Trade Updates: Stay in the loop with biweekly updates on my latest trades, new additions (both swing and long-term), and stocks I’m watching closely.

🎯 Swing Trading Strategy: Get insights into my swing trading approach for short-term gains.

👀 I recently added to several existing positions and initiated FOUR new ones since 06-Nov-24 after selling my passive investments and reallocating cash into my actively managed portfolio.

Click here 👉 Access Full Portfolio Content

Also, available in the “Portfolio” section of the Expanse Stocks blog.