Hello Expanse readers,

First off, thank you. Whether you’ve been reading Expanse Stocks from day one or just recently discovered it, I’m grateful that you’ve chosen to spend your time here. Your support has meant a lot to me and has helped shape this publication into what it is today.

Valuation Tools Update

If you’ve been following Expanse Stocks for a while, you’ll know that through the Portfolio Corner and various guidelines, I’ve shared several tools to help us value stocks based on fundamentals.

Some of the models I use include:

Discounted Cash Flow (DCF) & Reverse DCF, with detailed guidance:

🔗 Understanding DCF and Reverse-Engineered DCF Models for Investment DecisionsCapital Efficiency Models (ROIC, ROIIC, ROCE), also with practical use cases:

🔗 Understanding ROIC, ROIIC, and ROCE: Measuring Capital EfficiencyGrowth Models (Reinvestment Rates, Returns on Invested Capital, and resulting Intrinsic Value Growth):

🔗 Understanding Growth & Its Key Drivers

You can read these guidelines for free.

And, as a paying subscriber, you can access and download these models (in Excel format) with practical calculations for some of my holdings and watchlist via the 🔗 Portfolio Corner.

Over the last few weeks, I’ve introduced two new models available for download within the 🔗 Portfolio Corner too.

One focused on Internal Rates of Returns (IRR) to estimate Shareholders return inspired by the legendary Mark Leonard’s preferred method for estimating shareholder returns, which combines profitability and growth:

Shareholder IRR = ROIC + Organic Growth

(Source: Q1 2008 Conference Call & 📎 M. Leonard’s Letters Collection)Note: This formula is most applicable to companies operating under comparable capital allocation models as CSU.

The second one will focus on 🔗 Cash-on-Cash (CoC) returns, a way to estimate returns based on a company’s capital allocation efficiency of their actual cash flows and intrinsic value compounding. This method will complement the current Capital Efficiency and Growth frameworks and will be explained in an upcoming article.

Also, I know I’ve been a bit slow updating models for all holdings. I’ve been working to fill those gaps and published new DCF models for some of my holdings. So, if you’re already subscribed, check them out!

Access to the Article Archive

As Expanse Stocks continues to grow, I want to make sure I’m building something sustainable, both in terms of time and quality. To help with that, I’ll soon be placing part of the article archive behind a paywall. These are previously free research pieces and insights that will soon be available to paying subscribers.

What stays the same:

New free-to-read articles will remain free to read for two weeks after publication.

I’ll continue to publish regular public posts for all readers, alongside subscriber-only pieces as usual.

What changes:

A selection of past articles will become subscriber-only.

Paying subscribers will continue to have full access to the archive, Portfolio corner, and all new content.

If you’ve already subscribed, thank you. Your support allows me to keep improving the depth and quality of this research.

If you haven’t subscribed yet, nothing changes for now. But if you’ve found value in this work, I hope you’ll consider upgrading. The archive includes:

🔗 Deep Dive Briefs—including, in-depth analyses of growth & quality businesses

🔗 Hidden Gems—including, small- & mid-cap companies often overlooked by investors

🔗 General Investing— exploring a diverse range of topics across investing, trading and the financial world. It includes pieces with case studies, e.g. understanding intrinsic value to build DCF models, or articles such as lessons from world-class operators and capital allocators.

🔗 Annual Specials—including, Annual Letters, Investing Philosophy, Top Picks of the Year, Targeted Industry Write-ups & Other Specials.

🔗 Stocks News—including, company specific news & earnings reviews

As the library of research grows and as more readers join, I want to make sure the foundation remains strong. Putting some of that work archive behind a modest paywall is one way to ensure that.

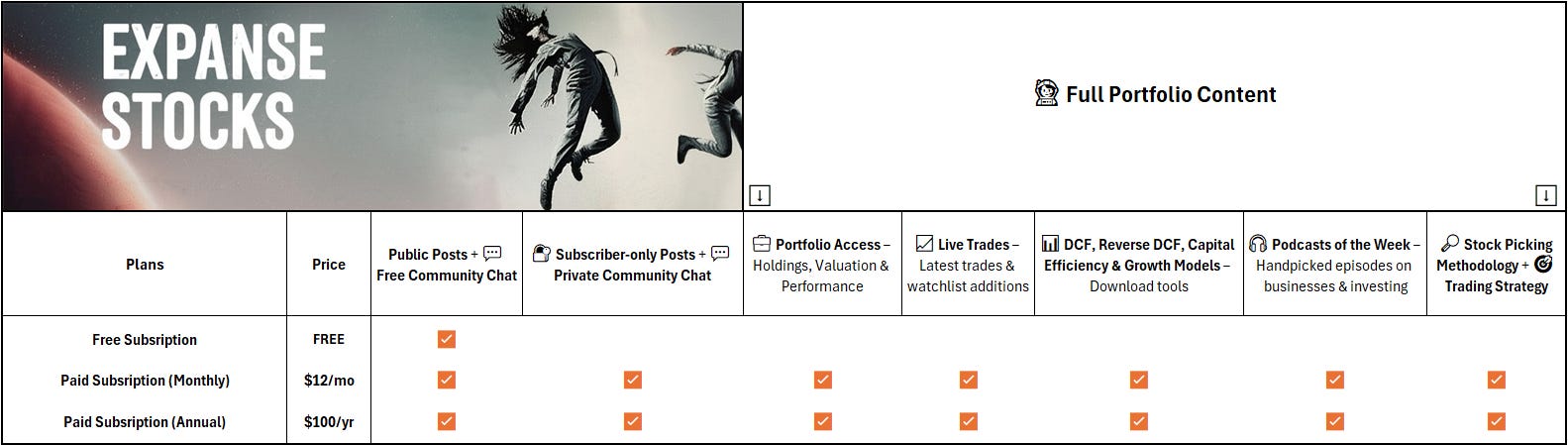

As announced at the beginning of the year, current pricing will remain unchanged for 2025:

$12/month or $0.39/day

$100/year or $0.27/day

As always, thank you for reading and for being part of this community. I’ll keep doing my best to make Expanse Stocks worth your time, inbox, and attention.

Thanks for following along,

Nikotes