Mercado Libre Q1 2025

Main takes from conference call & earnings report with my comments & thoughts

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 11-Sep-2025)

Mercado Libre (MELI) Q1 2025 Earnings and Conference Call Highlights

Strong growth in Q1 2025, reporting expansion across both its e-commerce, advertising and fintech businesses. MELI is proving, once again, it can scale profitably while maintaining momentum across the broad in an increasingly competitive Latin American market.

📊 Financial & Operating Highlights

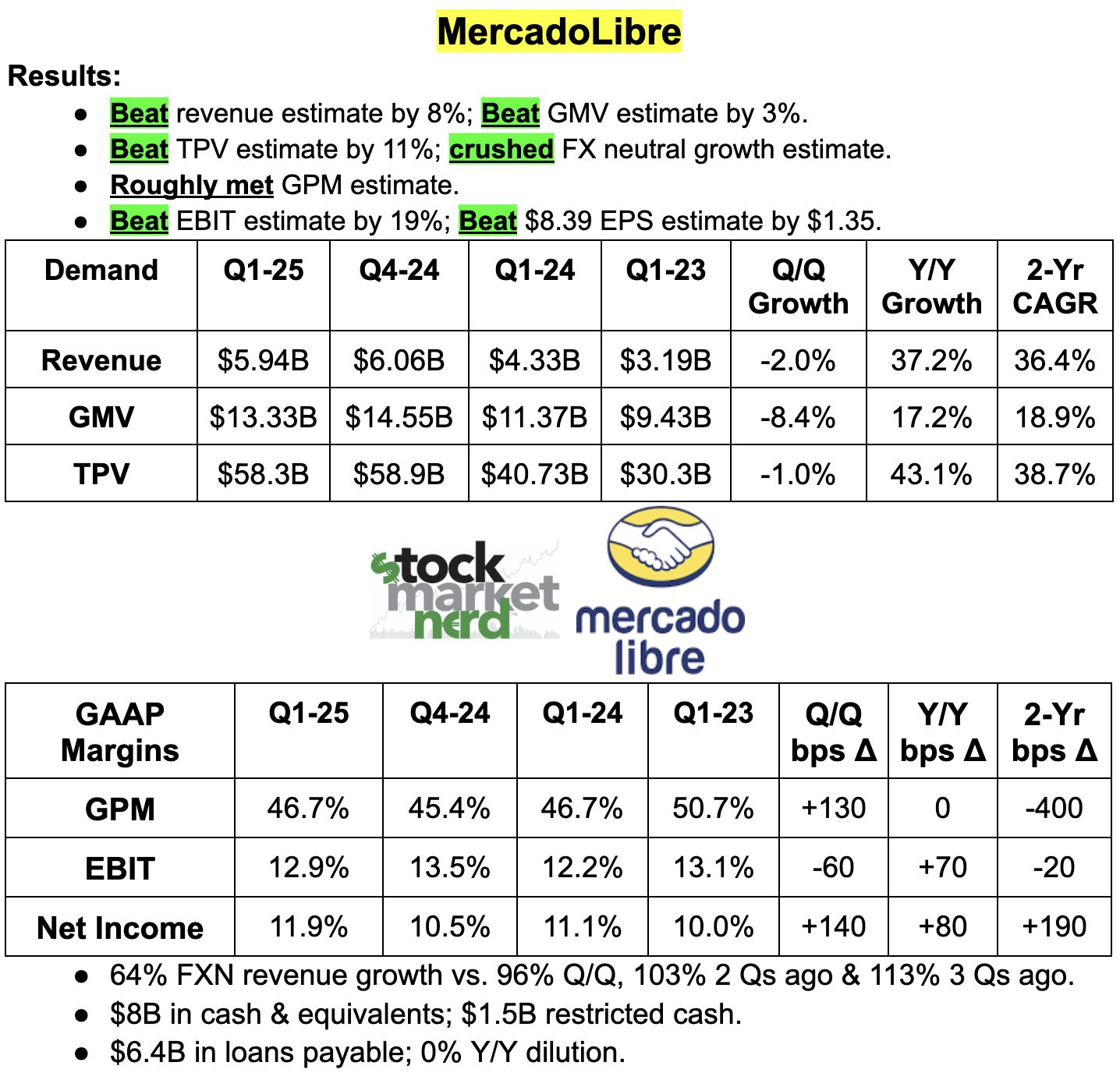

Revenue: $5.94B (+37% YoY, +64% FXN) 🟢

Gross Profit: $2.8B (margin 46.7%), -0 bps YoY 🟡

EBIT: $763M (+45%), margin 12.9%, +67 bps 🟢

Adjusted EBITDA: $935M, margin 16%, +1 bps 🟡

Free Cash Flow: $749M, margin 13% (down 45% YoY due to higher CapEx, i.e. fulfillment centers and fintech investments) 👀 ST 🔴 —> LT 🟢

Operating Cash Flow: $1.02B, margin 17%

Shareholders dilution: 0% Y/Y 👌

📌 CFO De Los Santos:

“We are excited to kick off 2025 with another great quarter at MercadoLibre as we continue to deliver strong growth across both e-commerce and Fintech. In Q1, we maintained the rapid pace of net revenue growth achieved in 2024, while making solid progress on all of our strategic initiatives. This momentum is fueled by continued investments and improvements in the valuable position for us.”

🛒 E-Commerce Segment: Strong Momentum, Especially 1P

All metrics beating market’s expectations:

Commerce Net Revenue: $3.3B (+32%)

GMV: $13.3B (+17%)

Active Buyers: 67M (+26%)

Items Sold: 492M (+28%)

Advertising Revenue: +50% FXN

1P (first party) sales grew +102% YoY, outperforming 3P, particularly in the supermarket segment.

📌 On 1P strategy and margins:

“1P has better unit economics, particularly in supermarkets. We’re operating with greater efficiency and scale through warehouse palletization and master case handling.”

📌 On FMCG opportunity:

“E-commerce penetration in Fast-Moving Consumer Goods (FMCG) remains low, making it a major long-term growth opportunity. We’re seeing a halo effect where buyers end up purchasing more across other categories.”

🌎 Regional Performance

Brazil: Revenue +20% YoY; GMV +10% 🟡

Mexico: Revenue +26% YoY; GMV +2% 🟠

Argentina: Revenue +125% YoY; GMV +77% 🟢

Argentina DC Margin: 47% (+1047 bps YoY), standout profitability contributor

📌 On Argentina’s recovery:

“Argentina had exceptional performance this quarter. Macro stabilization and our leading position helped fuel both top-line and margin growth. Income from operations grew faster than revenue.”

📌 On Argentina’s credit behavior:

“Delinquency rates are the lowest among our markets. Users rely on us as their primary financial platform, which reinforces repayment discipline.”

💳 Fintech: Payments, Credit & Digital Banking Expansion

Highest Growing Segment 🟢

Fintech Net Revenue: $2.6B (+43%)

Total Payment Volume (TPV): $58.3B (+43%)

Credit Portfolio: $7.8B (+75%)

Fintech MAUs: 64M (+31%)

Assets Under Management (AUM): $11.3B (+103%)

NIMAL (Net Interest Margin After Losses): 22.7%, down from low-30% YoY 🟠

—> moving upmarket + increasing the share of credit cards which have lower NIMAL (i.e. revenue generated from lending (interest and fees) after accounting for losses from bad debts and funding costs.)

Mercado Pago continues to gain share with a growing user base (nod to Nubank 😉), successful credit card strategy, and expanding investment product offerings.

📌 On digital banking positioning:

“Offering attractive deposit rates has been a powerful customer acquisition and retention tool. We’re increasingly seen as the go-to digital bank in Brazil.”

📌 On NIMAL & credit strategy:

“We’re moving upmarket with safer portfolios. NIMAL is trending lower, but risk is also down, which is the right trade-off for sustainable profitability.”

“We are increasing the share of credit cards to the overall portfolio, the share of credit card portfolios. Even though, credit cards have a lower NIMAL than other parts of the portfolio the NIMAL of credit card itself has been improving. We never had such a good quarter as this one. So, the asset quality is super good. What is changing is the share there. And also, as we grow our portfolio and all the cohorts mature the percentage of cohorts that are older and therefore, with a positive NIMAL will increase.”

📌 On Argentina credit card rollout:

“We expect to launch our credit card in Argentina in the second half of 2025, building on our experience in Brazil and Mexico.”

Risk Management & Profitability

Provisioning remains high to cover growing credit book:

90 days past due: 18%

Provision coverage: 101% (>15 days), 147% (>90 days)

No deterioration in NPLs, even amid aggressive portfolio growth.

Past-due credit ratios remain within comfort zone, with newer cohorts showing lower defaults.

📌 Management:

“Our recent Brazil cohorts show the lowest first-payment defaults we've ever seen. Asset quality is as strong as it's ever been.”

🚚 Logistics & CapEx

Fulfillment growth remains on track, but fewer new centers opened in Q1 due to seasonal effects.

📌 Management:

“We continue to expand our logistics footprint as needed to support demand. CapEx levels remain consistent with last year.”

👀 Competition & Market Trends

On TikTok Shops’ entrance in Mexico and Brazil:

“Early days. They're targeting low-value goods from local sellers. We’re watching closely, but their playbook seems more aligned with other platforms than ours.”

On U.S. tariff impact:

“So far, we’ve seen no negative effects. We’re importing from the U.S. into Argentina, and we view increased volume as an opportunity.”

On competition in Mexico:

“Yes, we saw aggressive pricing and financing from competitors. In some cases, we lacked the right selection, but we’re already addressing that with pricing, rebates, and selection expansion.”

Final Take

MercadoLibre continues to show why it's Latin America’s most dominant tech platform. Strong top-line growth, disciplined credit management, and rising fintech adoption, MELI is executing exceptionally well, even amid complex macro and competitive conditions.

Definition of a high-growth disruptor, high-quality company with top management.

Ready to dive deeper? Here’s what I offer and how I can help you

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 11-Sep-2025)

💼 Full Portfolio Access – Holdings, Valuation metrics & Performance tracking

📈 Live Trade Updates – My latest trades & watchlist additions

📊 Valuation Tools – DCF, Reverse DCF, Capital Efficiency & Growth models

🎧 Podcast Picks of the Week – Handpicked episodes on businesses & investing

🔎 Stock Picking Methodology – Learn my long-term investment strategy

🎯 Swing Trading Strategy – My short-term trading approach

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles