Hello, reader!

Today, Hermès (RMS)—the renowned French luxury brand, famous for its coveted Birkin bags—released its Q3 2024 earnings. After delivering an exceptional performance last quarter, despite concerns about a slowdown in Asia, particularly in China, how did things turn out this time?

In this post, I’ll break down the key takeaways from the earnings report, highlight the positives and negatives, and offer my analysis of the technical chart. Finally, I’ll share my final thoughts on whether now is a good time for long-term investors to consider jumping in.

Not a member yet? Join Expanse Stocks for free if you’d like to receive more content like this and get access to some of my free research (Deep dives, “Monthly Specials” Picks, Hidden Gems, Stock News and more)

Q3 2024 Earnings Recap

Net Sales (ex-FX):

Q3: €3.7B, +11.3% Y/Y | YTD (as of Sep 2024): €11.2B, +14% Y/Y 🟢

👉 Some deceleration from last Q, but showcasing incredible resilience given the tough macro climate. Compared to other luxury brands like LVMH with +2% Y/Y or Kerin -15% Y/Y, Hermès stands out.

Sales by Geography (ex-FX):

Europe: +17.4% 🟢 | Asia: +4.6%, +1% Asia Exc. Japan 🟠 | America: +13.4% 🟢 | Others (Middle-East): +104,4% 🟢

👉 Europe and America continue to deliver solid performance, maintaining similar YoY growth as the previous Q. Middle East, still a smaller market, but expanding rapidly and holds potential. Main concern is China, where demand has slowed.

Performance by Division (ex-FX):

Leather Goods: +14% | Ready-to-Wear: +13.5% | Silk: +4% | Other Hermès: +13.6% | Watches: -18.2% | Perfumes & Beauty: 10.6%

Hermès - $RMS

Technical Setup

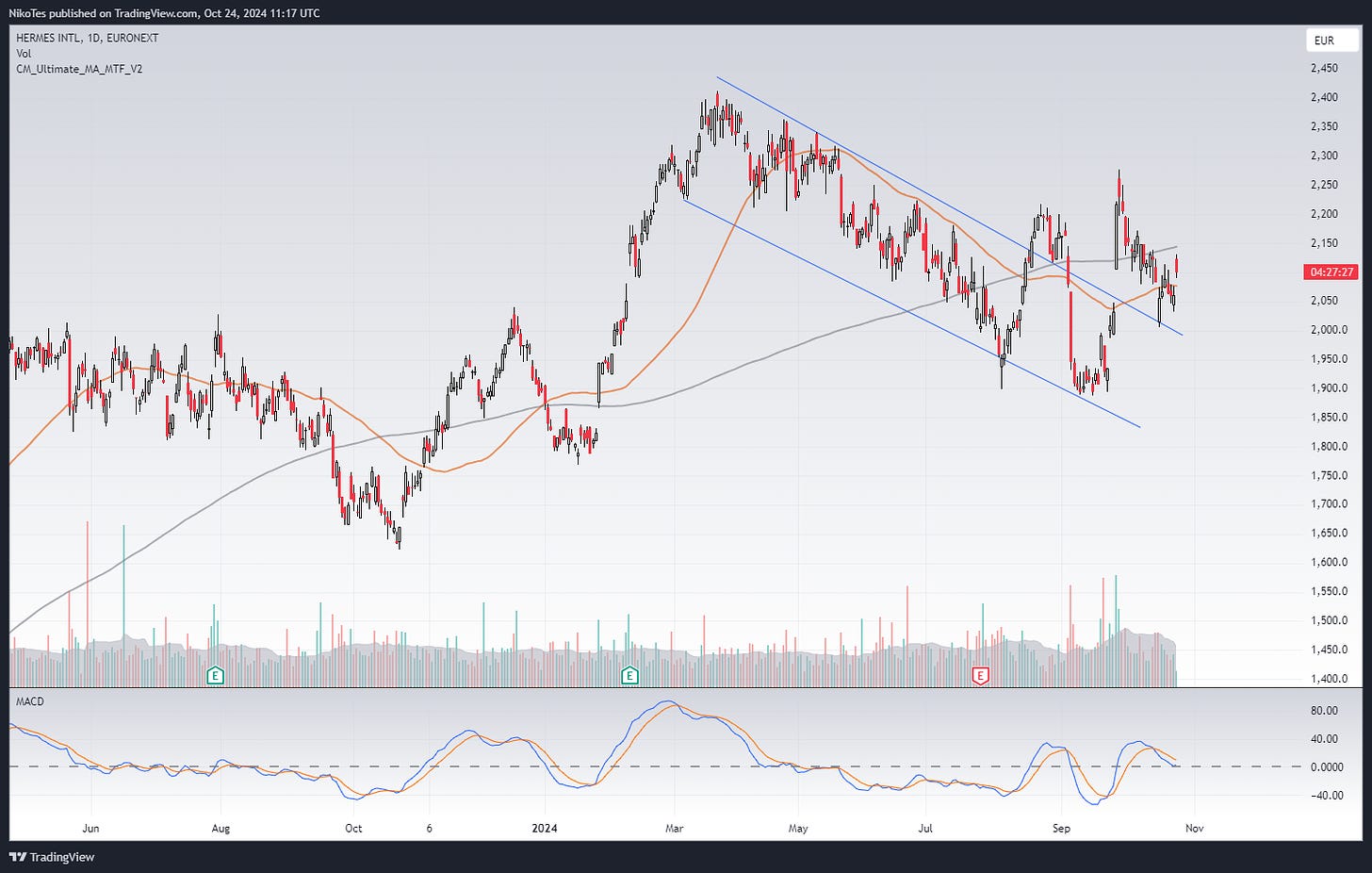

At first glance, chart might look messy, but the stock has actually been consolidating since April 2024 within a descending channel. It finally broke out at the end of September 2024.

Earlier this month, after the breakout, the stock retested the upper side of the descending channel and is now trying to bounce back and reclaim its 50-day MA.

Following today’s earnings report, the price is caught between the 50-day and 200-day MA. The MACD is attempting to perk up again above the zero line, showing some signs of recovery.

Commentary:

Overall, technicals are improving, and the stock looks ready to reclaim both the 50-day and 200-day MAs. With today’s strong earnings results, the stock appears ready to push higher

🧠 Final Take

China Still Looms, but Other Regions Stay Strong

Hermès had weaker demand in China, which Asia-Pacific growth (exc. Japan) at +1% Y/Y. South Korea, Singapore, Australia, and Thailand performed well, reinforcing that China is the black spot. Despite this, they are confident in the region's long-term potential, continuing to invest heavily with moves like the renovated Shenzhen store, the refurbished Lee Gardens store in Hong Kong, and the launch of its 8th High Jewelry collection in Beijing.

Hermès vs Other Luxury brands

Hermès sits at the top of luxury brands, while competitors like LVMH and Kering—though excellent businesses—rank lower. This Q, LVMH saw a 16% Y/Y drop in sales across Asia (excluding Japan) and flat growth in both the U.S. and Europe. In contrast, Hermès maintained steady growth from the previous quarter in both America and Europe, setting it apart as the true leader.

Wrap-up: What sets Hermès apart?

Nearly every sector and region posted solid, sustained growth. The brand’s resilience in a challenging Asian market and its long-term commitment to reinvestment show why Hermès remains on top—even as other players struggle. It's not just about surviving, it's about thriving, and Hermès does that exceptionally well, even in tough macro environments proving again who is the true king of luxury.

As for technicals, the chart is clearly recovering from a multi-month consolidation and some erratic movements triggered by macro-driven volatility and political instability in France. When—not if—the price reclaims both the 50-day and 200-day MAs, and the MACD regains momentum, combined with today’s strong earnings results, the stock appears ready to push higher. In my opinion, for long-term investors, this company remains an absolute must-have.

That’s it for today!

Ready to dive deeper? Here’s what I can offer you and how I can help you

Join the Expanse Stocks Premium Subscription with a 7-Day Free Trial for access to my investment strategies and detailed portfolio insights. You'll be able to dive deeper into the "Portfolio" section of my blog, where you’ll find:

🔎 Stock Picking Methodology: Learn the criteria I use to select long-term investments.

💼 Full Portfolio Access: Explore my ETFs and actively managed long-term holdings, complete with valuation metrics and performance tracking, updated regularly.

🎯 Swing Trading Strategy: Get an inside look at my swing trading approach for short-term gains.

📈 Live Trade Updates: Stay informed with real-time updates on my latest trades, both swing and long-term.

Last Update: 31-Oct-2024

👀 Recently, I added to several existing positions and initiated four new ones after rebalancing a portion of my passive investments into my actively managed portfolio.

👉 Click here to access my PORTFOLIO content

Also, available in the “Portfolio” section of the Expanse Stocks blog.