This was a quarter that separated the signal from the noise. The noise looks like a temporary, cyclical dip in volumes. The signal is the strength of Copart's competitive moat.

Let's unpack the results.

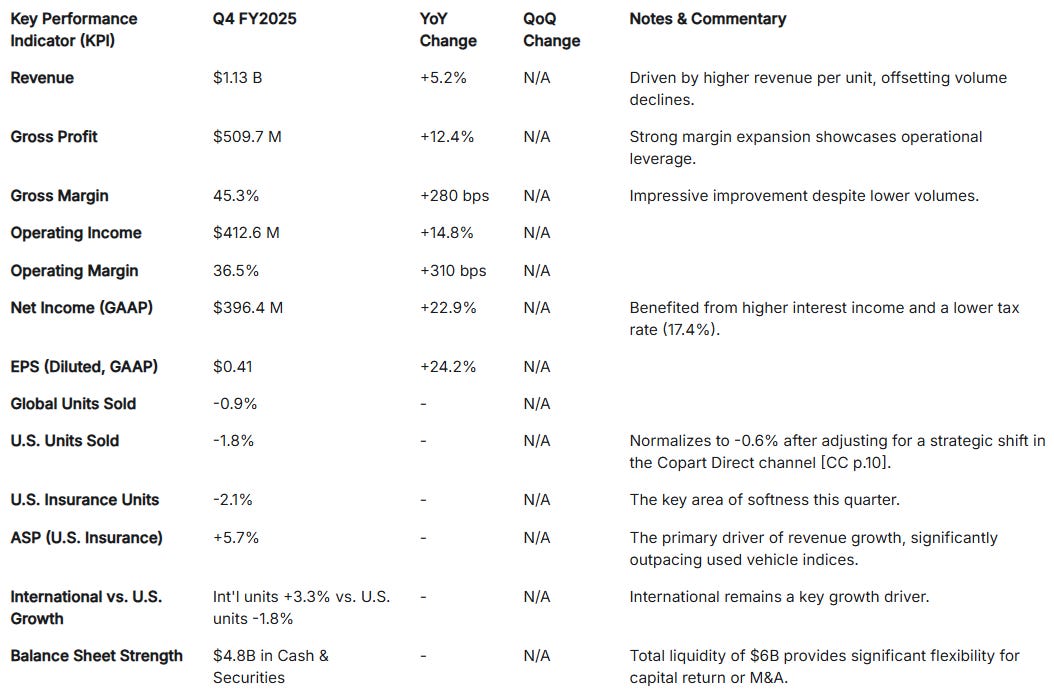

Financial Performance Table

The Headline: Profitability Shines, Volume Softens

A key takeaway from the quarter is that Copart delivered double-digits growth where it matters most: profitability.

Net Income: Up 22.9% YoY to $396.4 million.

Gross Margin: Expanded by 280 basis points to 45.3%.

Operating Margin: Grew by 310 basis points to 36.5%.

This performance was driven by two key factors. First, the company demonstrated excellent operational leverage. Second, and more importantly, they achieved significant growth in Average Selling Prices (ASPs), which rose 5.7% in the U.S. This key metric more than offset a surprising softness in Q4 U.S. insurance unit volumes, which declined by 2.1%.

Deconstructing the Volume Headwind

The decline in U.S. insurance volumes was the primary point of discussion on the earnings call. Management was transparent about the drivers, attributing the weakness to cyclical macro factors rather than a structural issue with the business.

The Underinsurance Trend: A 4.3% decline in "earned car years" (a proxy for insured vehicles) versus only 1.3% growth in the vehicle population. Simply put, consumers are dropping collision coverage due to higher insurance premiums which have been ramping up. When people don't have comprehensive coverage, there are no total loss claims to process.

Insurer Activity: Management also noted the normal "ebbs and flows of business activity among individual auto insurance carriers" as a contributing factor. So, business fluctuations among individual carriers contributed to the softness. This is the kind of quarterly noise that's inherent to any business with concentrated customers.

This still looks like a headwind, but I view the underinsurance trend as cyclical. As insurer profitability improves and premium inflation cools, this pressure should eventually abate.

Management seemed refreshingly transparent about these headwinds. Copart’s CEO did not spin this as anything other than what it looks: a cyclical downturn that doesn't change the fundamental thesis.

The Core Thesis is Intact: All About Auction Liquidity

In my view, the most important part of the earnings release was management’s confident articulation of Copart's core competitive advantage. CEO Jeff Liaw spent some time in the CC highlighting what separates them from the competition: superior "auction liquidity".

He stated, "the critical value we provide sellers... is that our auction platform will find the highest and best use of every vehicle anywhere in the world."

This is the heart of their moat along with their physical network of salvage yards. Copart's global buyer base of 300,000+ members create intense competition for every vehicle, which drives up selling prices. This, in turn, generates higher net returns for their insurance clients.

Management also delivered a “knockout punch” with a direct competitive statement. They noted their ASPs "grew at a rate more than fivefold that of service providers similar to ours."

This is a clear signal to the market and their clients that Copart is a premium partner that delivers superior financial outcomes, creating value for insurance clients. This is how you win and retain business over the long term.

About the Margin Expansion

Another net positive about these results: gross margins expanded 280 basis points to 45.3% and operating margins hit 36.5% up 310 basis points despite lower volumes. This demonstrates the high operating leverage inherent in Copart's business model. Fixed costs get spread over fewer units, yet margins still expanded because of pricing power (higher ASPs) and operational efficiency.

International Growth Offsetting Domestic Weakness

While U.S. volumes declined, international units’ volume grew 3.3% in the quarter and 8.1% for the full year. The shift from purchase contracts to consignment models in markets like Germany is driving higher-margin revenue growth. This geographic diversification provides a partial hedge against cyclical downturns in any single market.

Capital Allocation Flexibility… Maybe Too Much?

With $4.8 billion in cash and securities plus total liquidity of $6 billion, Copart has enormous financial flexibility, maybe too much?...

My guess: management still favors buybacks as the main capital return lever, but they won’t pull the trigger while multiples stay elevated. M&A? Still a wildcard.

What to Watch Going Forward

The key question is whether Q4's volume weakness represents a cyclical trough or the beginning of a more persistent trend. I'm watching three things:

Q1 2026 U.S. insurance volumes: Is this a one-quarter anomaly or something more persistent?

Insurance industry dynamics: With combined ratios improving, there may be more competition for policy growth, which could eventually benefit claims volumes.

ASP sustainability: Can Copart continue outpacing used vehicle indices, or was this quarter's 5.7% growth a one-time thing?

The Bottom Line

This quarter reinforces why Copart is a quality company. The combination of pricing power, margin expansion, and structural industry tailwinds creates a business model that can generate attractive returns even during periods of volume softness.

The reality is that Copart's competitive moat, with their global auction platform and superior liquidity, becomes more valuable during challenging periods, not less. Insurance companies need maximum recovery rates when they're under pressure, which plays directly into Copart's value proposition.

For long-term investors, quarters like this should increase conviction rather than diminish it. Any business can grow when volumes are tailwinds. Only exceptional businesses can expand margins and grow profits when volumes are headwinds.

Thanks for following along,

—Nikotes

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

🔗 Full Portfolio Content - 🗓️ Monthly Updates (Last Update: 11-Sep-2025)