Not a free member yet? Join Expanse Stocks for free if you’d like to receive more content like this and get access to some of my free research (Deep dives, “Monthly Specials” Picks, Hidden Gems Screeners, Stock News and more)

Hello, reader!

Earlier this week, ASML, a giant in the semiconductor industry, released its Q3 2024 earnings, causing quite a stir in the markets.

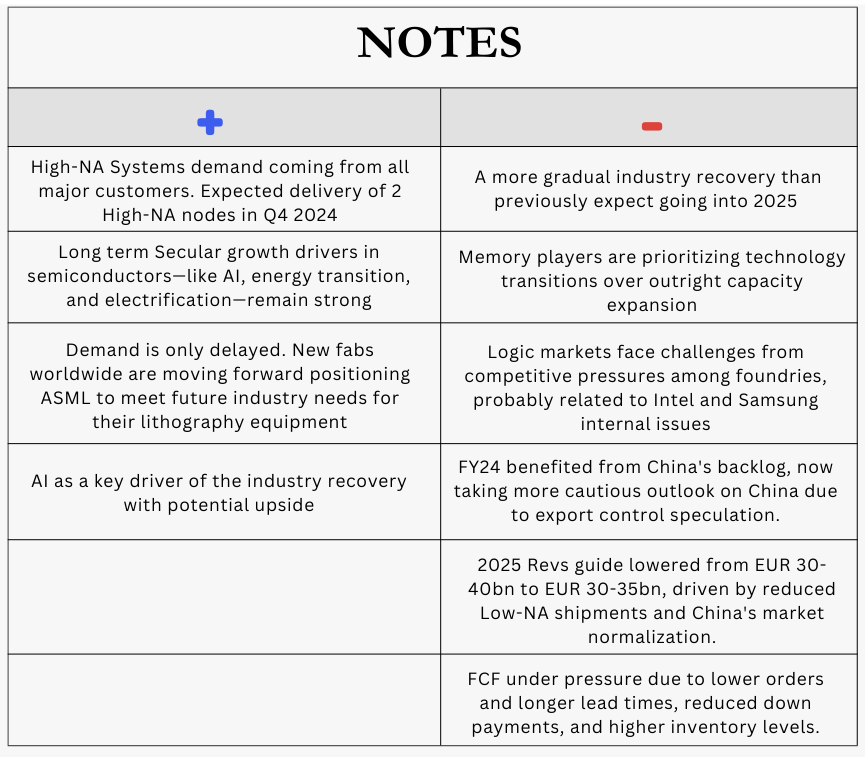

I’ll break down the key takeaways from their earnings report and outlook, highlight the positives and negatives, and share my analysis of their technical chart following the release and final thoughts whether this represent a good opportunity or not to get in for long term investors.

Q3 2024 Earnings Recap

Net Sales: €7.5B, +12% Y/Y | Net Income: €2.1B, +10% Y/Y | FCF: €534m, -14% Y/Y, slightly ahead of guidance but FCF going down as inventories pile up 🟡

Gross Margin: 50.8% | Net Margin: 28%, still solid but ticking down Y/Y 🟡

Q4 2024 Outlook: Sales €8.8B-€9.2B | Margin 49-50%, slightly lower than expected 🟠

2024 Full-Year Forecast: €28B, in line 🟡

Other Business Metrics:

Installed Base Services Sales €1.5B +13% 🟡

Net System Sales €5.9B +12%, with €2.1B EUV and €3.8B non-EUV (64% logic and 36% memory) 🟡

Net bookings €2.6B, with €1.4b EUV and €1.2bn non-EUV (54% memory and 46% logic), way below market expectations 🔴

Total Backlog €36B 🟢

2025 Projections:

Sales: €30B-€35B, +16% vs FY24 at mid-point | Gross Margin: 51-53%, 2-3 pts higher vs FY24 🟠

Revised to the lower range of 2022 Investor Day guidance of €30-€40B sales and 54%-56% gross margin, mainly due to:

New order delays in leading edge node ramps in Logic, particularly for low EUV NA nodes which have been driving gross margins higher in FY24 🔴

Limited capacity expansion in Memory 🔴

Earnings Conference Call

ASML - ASML 0.00%↑

Technical Setup

Panic selling gained momentum with heavy volume following ASML’s pre-announced earnings and continued into the next day. The stock is now retesting a long-term support level and the rising 200-week MA.

Commentary:

It’s unusual to see such a high-quality company like ASML sell off so sharply. However, given the cyclical nature of the industry and the market's high expectations for its 2025 outlook, the reaction isn’t entirely surprising.

What’s notable is the stock’s rare retest of the 200-week MA, aligning with key support in the $680s.

While I don’t expect a quick rebound, the combination of panic-driven selling and the retest of critical support levels might present a compelling opportunity for those with a longer-term perspective.

🧠 FINAL TAKE

High-Quality, monopolistic semiconductor equipment company, going through a low cycle amplified by weakness in the traditional (non-AI) semiconductor sector and unexpected order delays for advanced nodes from two key foundry customers—Intel and Samsung.

I also suspect TSMC is playing hardball, leveraging its dominant position, taking advantage of Intel and Samsung’s struggles, and maybe pressuring ASML on pricing.

These short-term challenges are a blip within a secular growth trend driven by AI, electrification, and energy transition. New fabs across the globe remain on track, and ASML’s lithography equipment—both advanced and mainstream—remains essential to the industry’s technological future.

For long-term investors, I believe the current panic sell-off presents an opportunity, although I am not expecting a V-shape recovery.

Ready to dive deeper? Here’s what I can offer you and how I can help you

Join the Expanse Stocks Premium Subscription with a 7-Day Free Trial for access to my investment strategies and detailed portfolio insights. You'll be able to dive deeper into the "Portfolio" section of my blog, where you’ll find:

🔎 Stock Picking Methodology: Learn the criteria I use to select long-term investments.

💼 Full Portfolio Access: Explore my ETFs and actively managed long-term holdings, complete with valuation metrics and performance tracking, updated regularly.

🎯 Swing Trading Strategy: Get an inside look at my swing trading approach for short-term gains.

📈 Live Trade Updates: Stay informed with real-time updates on my latest trades, both swing and long-term.

👉 Click here to access my PORTFOLIO content

Also, available in the “Portfolio” section of the Expanse Stocks blog.