Arista Q1 2025

Main takes from conference call & earnings report with my comments & thoughts

Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 30-Apr-2025)

Arista Networks Q1 2025 Earnings Call Summary

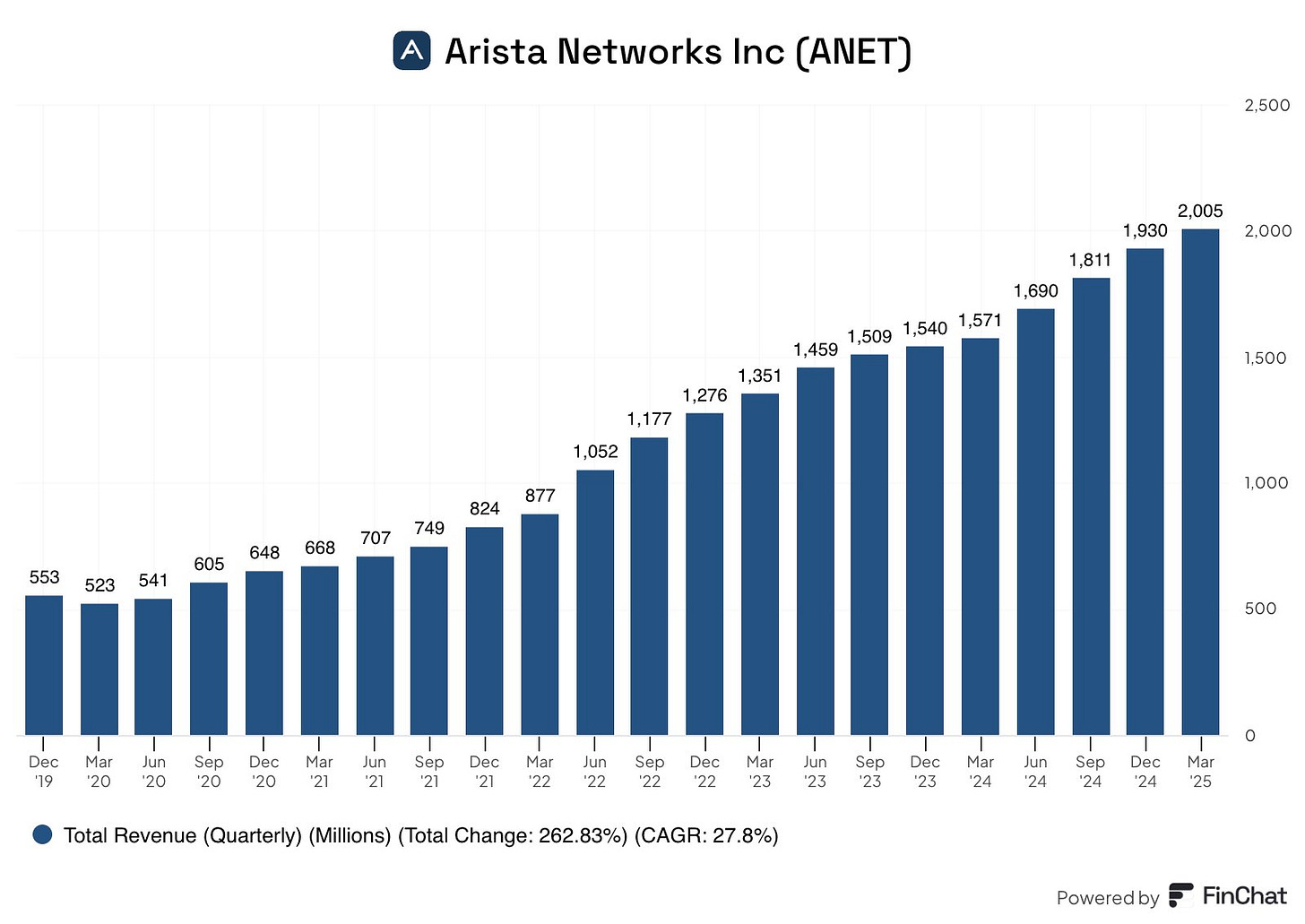

Revenue: $2.04 billion (+27.9% YoY), above their own guide $1.95B and above consensus $1.97B

Source: Finchat.io, Expanse Stocks x Finchat.io Partnership! 🎁 Get 20% off + 2 months free on any Finchat plan! →📎 Claim Discount Revenue Breakdown:

Services: 17.1% of revenues, +28.7% YoY and Products: 82.9% of revenues, +27.3% YoY

North America contribution 80% (very strong), International Contribution 20%

Market, Geographic and Product trends breakdown:

Growing Deferred Revenue: Total deferred revenue (current and non-current) rose to $3.1B—up 10.7% QoQ—showing a healthy backlog and visibility into future revenues.

Gross Margin: 63.7% (GAAP) | Operating Margin: 42.8% (GAAP) vs 42% last year

Adjusted EPS: $0.65, above consensus $0.59

Share Buybacks 👀

Completed shares repurchase of $787M in Q1 (highest ever)

Board authorizes $1.5B stock repurchases in May.

💬 My Commentary:

Classic Arista. The company beat across the board—driven by strong top-line growth, robust profitability, and continued momentum in the U.S. market.

Is this strength a result of customers front-loading orders ahead of potential tariffs? Personally, I don’t think that’s the primary driver.

Company buying back shares like crazy (highest ever) after post-liberation day shenanigans.

Another positive point is their market sector trends; enterprise segment is Arista’s highest revenue growth engine again, leveling up their revenue share vs cloud titans’ (Microsoft and Meta).

Guidance for Q2 2025

Revenue: $2.1 billion, vs consensus $2.03B

Non-GAAP Gross Margin: 63% | Operating Margin: 43%

Guidance for FY25

Top line guide unchanged.

Gross margin range of 60% to 62% a decrease from the 64% level this Q.

Cautious tone as H2 2025 “holds significant ambiguity related to the tariff scenarios.”

AI Revenue Outlook

Analyst Question: How meaningful can AI be in 2025 revenue?

CFO Ita Brennan:

“Too early to break out specifics, but we expect AI-related revenue to ramp meaningfully in the second half of 2025.”

💬 My Commentary: Management keeping their usual cautious tone despite strong underlying metrics. While AI-related visibility continues to improve, Arista is wisely tempering expectations due to ongoing tariff uncertainties.

The biggest concern? Margin contraction. Elevated margins in late FY24 and Q1 2025 were largely driven by a highly efficient, tariff-free supply chain. With potential tariffs and some supply chain disruption on the horizon, that advantage may fade in H2 2025. That said, the company remains confident it can sustain healthy margins “through a mix of supply chain optimization, tariff absorption and potential price increases if required.”

As for AI, no precise revenue target given, but AI is clearly becoming more than just a pilot—indicating potential material impact in H2 and beyond.

AI Networking Momentum

AI Infrastructure and Ethernet vs InfinBand:

AI-driven network architecture is gaining traction; Arista reiterates Ethernet has competitive edge and is the cost-effective alternative to NVDIA’s InfiniBand.

Analyst Question: Will Ethernet truly displace InfiniBand in AI clusters?

CEO Jayshree Ullal:

“We’re not claiming Ethernet will replace InfiniBand in every use case… but for scale-out AI, Ethernet’s economics and openness are more compelling.”

“We believe Ethernet is emerging as the fabric of choice for AI networking… Arista is uniquely positioned with our 800G AI platforms.”

Ita Brennan:

“AI orders contributed meaningfully to bookings this quarter… although still early days for revenue recognition.”

💬 My Commentary:

AI is an emerging tailwind. While not yet a major revenue driver, strong bookings growth shows potential ramp through 2025–2026. Arista is quietly framing itself as an early leader in AI-scale Ethernet networking.

Cloud Titans and Enterprise Demand

Cloud Titans: Showed sequential improvement; spending stabilizing outside AI 👀

Enterprise Segment: Growth of over 20% YoY, driven by demand from financial services, healthcare, and public sector.

Jayshree Ullal:

“We’re starting to see early signs of recovery among Cloud Titans… while enterprise remains broad-based and resilient.”

💬 My Commentary:

The bifurcation between cloud and enterprise spending appears to be easing. Which is pretty good news for shareholders as it reduces the risks of customer concentration and cloud titans’ dependency. Enterprise segment remains a growth engine, while hyperscale customers (like Meta, Microsoft) may re-accelerate in 2H 2025.

Campus and Routing Progress

Cognitive Campus: Driven by Wi-Fi 6E and wired refreshes.

Routing Portfolio: Gains in peering, edge, and AI clusters.

Jayshree Ullal:

“Our campus and routing initiatives continue to deliver, especially in financial and education verticals.”

💬 My Commentary:

Campus builds and routing (historically weak spots) are maturing into complementary revenue contributors. Cross-selling opportunities are growing as Arista broadens its portfolio beyond switching. More revenue streams diversification = more good news if you are a shareholder.

Competitive Landscape

Analyst Question: How do you view competition from Nvidia, Broadcom?

Jayshree Ullal:

“Competition keeps us sharp. We partner and compete with many… what differentiates Arista is our software-first, cloud networking DNA.”

💬 My Commentary:

Arista sees its EOS software and cloud-native architecture as key moats against chip-heavy rivals. The firm’s strength lies in integration, scale, and programmability.

Supply Chain and Lead Times

Improvement in Lead Times: Material lead times coming down, allowing more predictable delivery.

Ita Brennan:

“We’ve seen significant improvements in component availability… helping us return to normalized lead times.”

Commentary:

Better supply chain dynamics (tariffs permitted) should improve revenue linearity, customer satisfaction and support acceleration in AI deployments and enterprise rollouts.

📌 Takeaways

Arista is navigating the macro uncertainty with caution but in a position of strength with more diversified demand across enterprise and hyperscale.

AI represents a key strategic growth area, but management is wisely (IMO) tempering near-term expectations.

The Ethernet for AI narrative is gaining traction, positioning Arista as a long-term beneficiary.

Margins and execution remain top tier, enabling strong profitability even as the company invests in growth.

Ready to dive deeper? Here’s what I offer and how I can help you

➕ Unlock Premium Content – For just $0.39/day ($12/month) or $0.27/day ($100/year)!

📎 Full Portfolio Content - 🗓️ Biweekly Updates (Last Update: 30-Apr-2025)

💼 Full Portfolio Access – Holdings, Valuation metrics & Performance tracking

📈 Live Trade Updates – My latest trades & watchlist additions

📊 Valuation Tools – DCF, Reverse DCF, Capital Efficiency & Growth models

🎧 Podcast Picks of the Week – Handpicked episodes on businesses & investing

🔎 Stock Picking Methodology – Learn my long-term investment strategy

🎯 Swing Trading Strategy – My short-term trading approach

💬 Private Community Chat - 📎 Learn more

🔐 Full access to all my articles